___________________________________________________________________

___________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE,

SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission file number 001-13836

Full title of the plan and the address of the plan, if different from the issuer named below:

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

JOHNSON CONTROLS, INC

5757 North Green Bay Avenue

Milwaukee, Wisconsin 53209

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

JOHNSON CONTROLS INTERNATIONAL PLC

One Albert Quay,

Cork, Ireland

JOHNSON CONTROLS, INC

(Former name, if changed since last report)

___________________________________________________________________

___________________________________________________________________

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

YEARS ENDED DECEMBER 31, 2016 AND 2015

|

|

|

|

|

|

|

|

|

Contents

|

Page

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2016 and 2015

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits for the year ended

December 31, 2016

|

|

|

|

|

|

Notes to the Financial Statements

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, Line 4i* - Schedule of Assets (Held at End of Year)

as of December 31, 2016**

|

|

|

|

|

|

Signature

|

|

|

|

|

|

Index to Exhibits

|

|

*Note: Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income and Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and Administrator of the

Johnson Controls Savings and Investment 401(k) Plan:

We have audited the accompanying Statement of Net Assets Available for Benefits of Johnson Controls Savings and Investment 401(k) Plan (the “Plan”) as of December 31, 2016 and 2015, and the related Statement of Changes in Net Assets Available for Benefits for the year ended December 31, 2016, and the related notes to the financial statements. Johnson Controls’ management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of Johnson Controls Savings and Investment 401(k) Plan as of December 31, 2016 and 2015, and the results of its changes in net assets available for benefits for the year ended December 31, 2016 in conformity with accounting principles generally accepted in the United States of America.

Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The supplemental schedule is presented for purposes of additional analysis and is not a required part of the financial statements but is supplementary information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. Such information is the responsibility of the Plan's management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. The information has been subjected to the auditing procedures applied in the audit of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying and other accounting records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the information is fairly stated in all material respects in relation to the financial statements as a whole.

/s/

Coleman & Williams, Ltd.

Milwaukee, Wisconsin

June 28, 2017

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

Investments

|

|

|

|

|

Investment in Master Trust at fair value

|

$

|

2,742,269,529

|

|

|

$

|

3,116,716,063

|

|

|

Investment in Master Trust at contract value

|

333,022,299

|

|

|

378,639,201

|

|

|

Total investments in Master Trust

|

3,075,291,828

|

|

|

3,495,355,264

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

Employer contributions

|

118,508,321

|

|

|

158,197,623

|

|

|

Participant contributions

|

494,823

|

|

|

511,132

|

|

|

Notes receivable from participants

|

42,188,332

|

|

|

63,401,248

|

|

|

|

161,191,476

|

|

|

222,110,003

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

3,236,483,304

|

|

|

$

|

3,717,465,267

|

|

See the notes to the financial statements

2

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

December 31, 2016

|

|

|

|

|

Additions

|

|

|

Additions to net assets attributed to:

|

|

|

Investment income:

|

|

|

Net appreciation in fair value of investments

|

$

|

201,240,641

|

|

|

Other investment income

|

99,041,349

|

|

|

Interest on notes receivable from participants

|

1,694,851

|

|

|

|

301,976,841

|

|

|

|

|

|

Contributions:

|

|

|

Participants

|

135,524,926

|

|

|

Employer

|

119,633,612

|

|

|

|

255,158,538

|

|

|

|

|

|

Total additions

|

557,135,379

|

|

|

|

|

|

Deductions

|

|

|

Deductions from net assets attributed to:

|

|

|

Distributions and withdrawals

|

350,121,484

|

|

|

Administrative expenses

|

3,914,961

|

|

|

|

|

|

Total deductions

|

354,036,445

|

|

|

|

|

|

Transfers to other plans, net

|

(684,080,897

|

)

|

|

|

|

|

Net decrease in net assets available for benefits

|

(480,981,963

|

)

|

|

|

|

|

Net assets available for benefits, beginning of year

|

3,717,465,267

|

|

|

Net assets available for benefits, end of year

|

$

|

3,236,483,304

|

|

See the notes to the financial statements

3

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NOTE 1 - DESCRIPTION OF THE PLAN

The following description of the Johnson Controls Savings and Investment 401(k) Plan (the "Plan") provides only general information. Participants should refer to the Summary Plan Description provided to all participants for a more complete description of the Plan's provisions.

GENERAL

The Plan is a defined contribution plan adopted effective August 1, 1974 for participation by eligible employees of Johnson Controls, Inc. ("JCI Inc.") and selected subsidiaries, as designated by the Board of Directors. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). On September 2, 2016, Johnson Controls, Inc. and Tyco International plc ("Tyco") completed a merger, with JCI Inc. being the surviving corporation in the merger and a wholly owned indirect subsidiary of Tyco (the "Merger"). Following the Merger, Tyco changed its name to "Johnson Controls International plc (the "Company")."

The Plan is administered by the Employee Benefits Policy Committee appointed by the Company.

CONTRIBUTIONS

Participants can designate an amount up to twenty-five percent (25%) of their gross annual compensation as contributions. Since July 1, 2006, the Plan has provided multiple company contribution schedules based on specific eligibility rules. A full listing of the schedules can be found in the Plan document.

Participant contributions are deposited in the investment funds of their choice. Participants may reallocate their account balances among the available investment funds at any time in increments of one percent (1%). However, participants can reallocate deposits out of the Fixed Income Fund no more than once each calendar quarter in order to maximize the rate of return for that fund.

Participants are immediately vested in their contributions plus actual earnings (losses) thereon. Since July 1, 2006, a participant's interest in employer contributions plus actual earnings (losses) thereon, vests based on eligibility rules specific to certain groups of employees.

If employment terminates other than by reason of retirement, death or total and permanent disability and the participant is not reemployed by the Company or its affiliates within 72 months of that date, the participant's interest in the non-vested portion of the employer contributions is forfeited. The Company may apply any forfeited amounts to reduce future employer contributions to the Plan.

PAYMENT OF BENEFITS

On termination of service due to death, disability or retirement, a participant may elect to receive a lump-sum amount equal to the value of the participant's interest in his or her account. For termination of service for other reasons, a participant may receive the value of the vested interest in his or her account as a lump-sum distribution. Benefits are recorded when paid.

PARTICIPANT ACCOUNTS

Participant recordkeeping is performed by Fidelity Investments Institutional Retirement Services Company ("Fidelity").

As of December 31, 2016 and 2015, Plan assets of $1,048,700,559 and $1,047,502,818, respectively, have been allocated to the accounts of persons who are no longer active participants of the Plan, but who have not yet received distributions as of that date.

NOTES RECEIVABLE FROM PARTICIPANTS

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum of $50,000 or fifty percent (50%) of their account balance, whichever is less. Loans are subject to certain limitations based on the Plan document. Only two loans per participant may be outstanding at any time. Each loan may be for a term up to five years. Regular payroll deductions are required

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

to repay a loan. Each loan's interest rate is fixed at the prime rate at the beginning of the calendar quarter in which it is issued. Interest rates range between 3.25% and 7.75%. At termination, participants may continue to make monthly loan payments until the balances of any loans are paid off.

The notes receivable from participants are measured at their unpaid principal balances plus accrued but unpaid interest. At the time of borrowing, the assets of the participant are sold proportionally to finance the loan. The loan is collateralized by the participant's assets in the Plan.

Should a participant fail to make a loan payment when due (including retirement or termination), the participant is given a grace period to cure the delinquency through the end of the calendar quarter following the calendar quarter in which the default arose. If the participant fails to cure the delinquency, a deemed distribution occurs in accordance with the provisions of the Plan document. The Plan has not made a provision for uncollectible loans as there are none.

There is no impact on the Johnson Controls Savings and Investment Master Trust (the "Master Trust") (see Note 2) if a participant defaults on the loan.

ADMINISTRATIVE EXPENSES

Administrative expenses are paid by the Plan, as allowed by Plan provisions, with all remaining expenses paid by the Company.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The financial statements of the Plan are prepared on the accrual basis of accounting.

USE OF ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

SAVINGS AND INVESTMENT MASTER TRUST

All investments and participant loans of the Plan are included under a master trust arrangement, the Master Trust, which is trusteed by Fidelity. All investments of the Master Trust, except the Fixed Income Fund, are stated at market value based on quoted market prices. The Fixed Income Fund, a stable value fund, contains wrap contracts which are stated at contract value. Contract value, as reported to the Plan by Fidelity, represents contributions made under the contract, plus interest at the contract rate, less participant withdrawals and administrative expenses.

The wrap contracts are designed to allow a stable value fund, such as the Fixed Income Fund, to maintain a constant net asset value (NAV) and to protect the fund in extreme circumstances. The wrap issuer agrees to pay the fund the difference between the contract value and the market value of the covered assets once the market value has been totally exhausted. Though relatively unlikely, this could happen if the fund experiences significant redemptions (redemption of most of the fund's shares) during a time when the market value of the fund's covered assets is below their contract value, and market value is ultimately reduced to zero. If that occurs, the wrap issuer agrees to pay the fund an amount sufficient to cover shareholder redemptions and certain other payments (such as fund expenses), provided that all of the terms of the wrap contract have been met. Purchasing wrap contracts is similar to buying insurance, in that the fund pays a relatively small amount to protect against a relatively unlikely event (the redemption of most of the shares of the fund). Fees the fund pays for wrap contracts are a component of the fund's expenses.

Wrap contracts accrue interest using a formula called the "crediting rate" which minimizes the difference between the market value and contract value of the covered assets over time. Using the crediting rate formula, an estimated future market value is calculated by compounding the fund's current market value at the fund's current yield to maturity for a period equal to the fund's duration. Crediting rates are reset quarterly. Although the crediting rate may be affected by many factors, including purchases and redemptions by shareholders, the wrap contracts provide a guarantee that the crediting rate will not fall below zero percent (0%).

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The fund and the wrap contracts purchased by the fund are designed to pay all participant-initiated transactions at contract value. However, the wrap contracts limit the ability of the fund to transact at contract value upon the occurrence of certain events, which include, but are not limited to, the Plan's failure to qualify under Section 401(a) or Section 401(k) of the Internal Revenue Code (IRC), any substantive modification of the Plan or the administration of the Plan that is not consented to by the wrap issuer, complete or partial termination of the Plan, or any early retirement program, group termination, group layoff, facility closing or similar program. At this time, the occurrence of such an event is not probable.

A wrap issuer may terminate a wrap contract at any time. In the event that the market value of the fund's covered assets is below their contract value at the time of such termination, Fidelity may elect to keep the wrap contract in place until such time as the market value of the fund's covered assets is equal to their contract value. A wrap issuer may also terminate a wrap contract if Fidelity investment management authority over the fund is limited or terminated as well as if all of the terms of the wrap contract fail to be met. In the event that the market value of the fund's covered assets is below their contract value at the time of such termination, the terminating wrap provider would not be required to make a payment to the fund.

Investment income or loss of the Master Trust is allocated among the participants plans daily based on the plans' relative equity interests in each of the Master Trust's investment programs as of the beginning of the applicable day. Interest income and share price appreciation or depreciation are recorded daily by each of the applicable investment programs. Dividend income is recorded either quarterly or semi-annually, depending on the investment program.

The statements of financial position as of December 31, 2016 and 2015 and the statement of operations and changes in participating plans' equity for the year ended December 31, 2016 for the Master Trust are presented in Note 8.

The Plan had approximately a ninety-four percent (94%) and eighty-seven percent (87%) interest in the assets of the Master Trust at December 31, 2016 and 2015, respectively.

At December 31, 2016 and 2015, participant forfeitures of non-vested employer contributions of $3,323,432 and $4,351,762, respectively, related to the Plan, were in the Master Trust.

RECLASSIFICATION

Certain prior year amounts have been reclassified to conform to the current year’s presentation.

NEW ACCOUNTING PRONOUNCEMENTS

Recently Adopted Accounting Pronouncements

In July 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-12 "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient." Only Parts I and II of ASU 2015-12 are applicable to the Plan. Part I of ASU 2015-12 eliminates the requirements to measure the fair value of fully benefit-responsive investment contracts (FBRICs) and provide certain disclosures. Part II of ASU 2015-12 eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. It also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics, and risks. ASU 2015-12 was effective retrospectively for fiscal years beginning after December 15, 2015. The Plan adopted Parts I and II of this guidance effective January 1, 2016 and applied the change retrospectively to all periods presented. The adoption of this guidance did impact disclosures in the notes to the financial statements, but did not impact the net assets available for benefits.

In May 2015, the FASB issued ASU No. 2015-07, "Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)." ASU No. 2015-07 removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. Such investments should be disclosed separate from the fair value hierarchy. The Plan adopted this guidance January 1, 2016 and applied the change

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

retrospectively to all periods presented. The adoption of this guidance only impacts disclosures in the notes to the financial statements.

Recently Issued Accounting Pronouncements

In February 2017, the FASB issued Accounting Standards Update ASU No. 2017-06, "Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting." ASU No. 2017-06 clarifies the presentation requirements by a plan's interest in a master trust and requires disclosure of the dollar amount of the plan's interest in each investment type held by a master trust, as well as disclosure of the master trust's other assets and liabilities, and the dollar amount of the plan's interest in each of those balances. ASU No. 2017-06 is effective for fiscal years beginning after December 15, 2018 with early adoption permitted, and will be applied retrospectively to all periods presented. The Company is currently evaluating the impact the adoption of the guidance will have on the Plan’s financial statements.

NOTE 3 - FAIR AND CONTRACT VALUE MEASUREMENTS

ASC 820, "Fair Value Measurement," defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also establishes a three-level fair value hierarchy that prioritizes information used in developing assumptions when pricing an asset or liability as follows:

|

|

|

|

|

|

Level 1:

|

Observable inputs such as quoted prices in active markets;

|

|

Level 2:

|

Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

|

|

Level 3:

|

Unobservable inputs where there is little or no market data, which requires the reporting entity to develop its own assumptions.

|

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurement.

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The following table sets forth by level, within the fair value hierarchy, the Plan's investment assets at fair value and the contract value of FBRICs held in the plan's Fixed Income Fund as of December 31, 2016 and 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2016

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual Funds

|

|

$

|

523,792,525

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

523,792,525

|

|

|

Common Stock Funds

|

|

454,867,977

|

|

|

—

|

|

|

—

|

|

|

454,867,977

|

|

|

Total investments at fair value

|

|

$

|

978,660,502

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

978,660,502

|

|

|

Investments Measured at Net Asset

Value, as Practical Expedient:

|

|

|

|

|

|

|

|

|

|

Mutual Funds*

|

|

|

|

|

|

|

|

1,576,979,202

|

|

|

Other Separate Accounts *

|

|

|

|

|

|

|

|

186,629,825

|

|

|

Fixed Income Fund at contract value

|

|

|

|

|

|

|

|

333,022,299

|

|

|

Total investments

|

|

|

|

|

|

|

|

$

|

3,075,291,828

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of

|

|

|

|

December 31, 2015

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mutual Funds

|

|

$

|

618,334,275

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

618,334,275

|

|

|

Common Stock Fund

|

|

567,231,017

|

|

|

—

|

|

|

—

|

|

|

567,231,017

|

|

|

Total investments at fair value

|

|

$

|

1,185,565,292

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

1,185,565,292

|

|

|

Investments Measured at Net Asset

Value, as Practical Expedient:

|

|

|

|

|

|

|

|

|

|

Mutual Funds*

|

|

|

|

|

|

|

|

1,682,676,436

|

|

|

Other Separate Accounts *

|

|

|

|

|

|

|

|

248,474,335

|

|

|

Fixed Income Fund at contract value

|

|

|

|

|

|

|

|

378,639,201

|

|

|

Total investments

|

|

|

|

|

|

|

|

$

|

3,495,355,264

|

|

* As discussed in Note 2, "Summary of Significant Accounting Policies" of the notes to the financial statements, ASU No. 2015-07 allows investments measured at NAV as a practical expedient to be excluded from the fair value hierarchy. The fair value amounts presented herein are intended to permit reconciliation of total investments to the statement of net assets available for benefits. For certain mutual funds and other separate accounts where a NAV is not publicly quoted, the NAV per share is used as a practical expedient and is based on the quoted market prices of the underlying net assets of the fund as reported daily by the fund managers.

Following is a description of the valuation methodologies used for assets measured at fair value:

Mutual Funds:

The fair value for Mutual Funds is determined by direct quoted market prices. Mutual funds are open-ended investments that obtained proper registration from the Securities and Exchange Commission. The funds publish daily their NAV after the close of trading on regulated financial exchanges. The NAV represents the current market value of the fund's holdings after deducting the fund's liabilities. In the event a direct quoted market price is not available, the fair value of the fund holdings are determined by using pricing inputs that are either directly or indirectly observable and therefore classified as Level 2 assets.

Common Stock Funds:

The fair value for the Johnson Controls International plc Stock Fund ("JCI plc Stock Fund"), formerly known as the Johnson Controls Common Stock Fund ("JCI Stock Fund"), and the Adient Stock Fund is determined by indirect quoted market prices. The value of the funds are not published, but the investment manager reports daily the underlying holdings. The underlying holdings are direct quoted market prices on liquid and regulated financial exchanges.

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The fair value of the investments reflect a unit value computed daily based on the share price and the value of the fund's short-term investments. At December 31, 2016, the Plan held 45,815,384 units of the Johnson Controls plc Stock Fund at a unit value of $8.73. At December 31, 2016, the Plan held 4,423,459 units of the Adient Stock Fund at a unit value of $12.46. At December 31, 2015, the Plan held 48,941,416 units of the JCI Stock Fund at a unit value of $11.59.

Other Separate Accounts:

The fair value for Other Separate Accounts is determined by indirect quoted market prices. These investments are generally held in a commingled trust. The value of the trust is not published, but the investment manager reports daily the underlying holdings. The underlying holdings are direct quoted market prices on liquid and regulated financial exchanges.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. The fair values of receivables approximate their carrying values.

The Fixed Income Fund is stated at contract value. The underlying investments/holdings are direct quoted market prices on regulated financial exchanges and their value is insured through a contract. Contract value, as reported to the Plan by Fidelity, represents contributions made under the contract, plus interest at the contract rate, less participant withdrawals and administrative expenses. Refer to Note 2 for further information regarding the Fixed Income Fund

.

NOTE 4 - TAX STATUS

The Internal Revenue Service (IRS) has determined and informed the Company by a letter dated May 5, 2014, that the Plan is designed in accordance with applicable sections of the IRC. The Plan has been amended since receiving the determination letter. However, the Plan administrator and the Plan's tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a liability if the organization has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS or Department of Labor. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded as of December 31, 2016 and 2015, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE 5 - PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

NOTE 6 - PARTY-IN-INTEREST TRANSACTIONS

As discussed in Note 1, "Description of the Plan," of the notes to the financial statements, JCI Inc. and Tyco completed a Merger on September 2, 2016. Prior to the Merger, the underlying investments of the Master Trust included a unitized stock fund, the JCI Stock Fund. The merger was structured as a reverse merger, in which JCI Inc. merged with an indirect wholly owned subsidiary of Tyco, with JCI Inc. being the surviving corporation in the Merger and a wholly owned, indirect subsidiary of Tyco. Following the Merger, Tyco changed its name to “Johnson Controls International plc.” In the Merger, each share of JCI Inc. common stock issued and outstanding immediately prior to the Merger, including shares held in the Plan, was converted into the right to receive, at the election of its holder, either one ordinary share of JCI plc or $34.88 in cash, without interest. Following the Merger, JCI Inc. common stock was delisted from the New York Stock Exchange (“NYSE”) and ceased to be publicly traded, and the ordinary shares of the JCI plc began to be traded on the NYSE under the existing JCI Inc.’s ticker symbol “JCI”. As a result of the Merger, all shares of JCI Inc. in the Common Stock Fund of the Plan were exchanged for ordinary shares of JCI plc or cash in accordance with the Merger agreement and shareholder elections. As a result, JCI Stock Fund was renamed JCI plc Stock Fund.

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

The total value of the Plan’s investment in the JCI Stock Fund was approximately $567.2 million at December 31, 2015. For the period from January 1, 2016 to September 2, 2016, the Plan purchased units in the JCI Stock Fund of approximately $61.9 million, sold units of approximately $228.3 million and had net appreciation in the fair value of investments of approximately $93.9 million. On the Merger Date, the units of the JCI Stock Fund of approximately $494.7 million were exchanged into the JCI plc Stock Fund as described above, and the JCI Stock Fund ceased to exist.

On October 31, 2016, Johnson Controls International plc completed the spin-off of its Automotive Experience business by way of transfer to Adient plc and the issuance of ordinary shares of Adient directly to holders of Johnson Controls ordinary shares on a pro rata basis. Each participant received one unit of the new Adient Stock Fund for every ten units of JCI plc Stock fund that they held in the Plan immediately preceding the spin-off. A new Adient Stock Fund was established in the Plan in order to hold distributed shares. The Adient Stock Fund is a closed investment in the Plan, which means balances can be taken out of the Adient Stock Fund but no new contributions or exchanges can be made into this Fund.

The units of JCI plc Stock Fund of approximately $48.0 million were distributed into the Adient Stock Fund units at the date of the spin-off. For the period from October 31, 2016 to December 31, 2016, the Plan sold units in the Adient Stock Fund of approximately $3.6 million and had net appreciation in the fair value of investments of approximately $10.7 million. The total value of the Plan’s investment in the Adient Stock Fund was approximately $55.1 million at December 31, 2016.

For the period from September 2, 2016 to December 31, 2016, the Plan purchased units in the JCI plc Stock Fund of approximately $4.5 million, sold units of approximately $39.8 million and had net depreciation in the fair value of investments of approximately $11.6 million. The total value of the Plan’s investment in the JCI Plc Stock Fund was approximately $399.8 million at December 31, 2016.

The unit values of the JCI Stock Fund, JCI plc Stock Fund and Adient Stock Fund are recorded and maintained by Fidelity and the Plan. Plan participants may direct up to 25% of their employee and employer contributions to the JCI plc Stock Fund. In addition, participants may exchange a portion of their account balance into the JCI plc Stock Fund, provided the transaction does not cause the portion of their account balance invested in the JCI plc Stock Fund to exceed 25%.

Certain of the assets of the Master Trust are invested in registered investment companies managed by Fidelity Investments, for which Fidelity Management & Research Company (“FMR Co.”) provides investment advisory services. FMR Co. is an affiliate of both Fidelity, and Fidelity Workplace Services, LLC, record keeper of the Plan. Expenses paid to FMR Co. and/or its affiliates by the Plan during the year ended December 31, 2016 were $1,084,216. These transactions and investments, as well as participant loans, qualify as exempt “party-in-interest” transactions, as “party-in-interest” is defined under Department of Labor regulations as any fiduciary of the Plan, any party rendering services to the Plan, the Company and certain others.

NOTE 7 - RISKS AND UNCERTAINTIES

The Plan's investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investments and the level of uncertainty related to changes in the values of investments, it is at least reasonably possible that changes in risks in the near term would materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits and the statement of changes in net assets available for benefits.

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

NOTE 8 - JOHNSON CONTROLS, INC. SAVINGS AND INVESTMENT MASTER TRUST

The statements of financial position as of December 31, 2016 and 2015 and the statement of operations and changes in participating plans' equity for the year ended December 31, 2016 for the Master Trust are presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

JOHNSON CONTROLS, INC.

|

|

SAVINGS AND INVESTMENT MASTER TRUST

|

|

STATEMENTS OF FINANCIAL POSITION

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (direct):

|

|

|

|

|

|

Mutual Funds

|

|

$

|

568,031,899

|

|

|

$

|

722,464,532

|

|

|

|

|

|

|

|

|

Investments at fair value as determined by quoted market price (indirect):

|

|

|

|

|

|

Common Stock Funds

|

|

483,424,032

|

|

|

630,972,865

|

|

|

|

|

|

|

|

|

Investments Measured at Net Asset Value, as Practical Expedient:

|

|

|

|

|

|

Mutual Funds

|

|

1,686,231,038

|

|

|

1,933,891,945

|

|

|

Other Separate Accounts

|

|

200,415,408

|

|

|

297,236,923

|

|

|

|

|

1,886,646,446

|

|

|

2,231,128,868

|

|

|

Investments at contract value:

|

|

|

|

|

|

Fixed Income Fund:

|

|

|

|

|

|

At contract value

|

|

351,894,337

|

|

|

423,559,308

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

44,315,168

|

|

|

76,071,247

|

|

|

Net assets available for benefits

|

|

$

|

3,334,311,882

|

|

|

$

|

4,084,196,820

|

|

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2016 AND 2015

|

|

|

|

|

|

|

|

JOHNSON CONTROLS, INC.

|

|

SAVINGS AND INVESTMENT MASTER TRUST

|

|

STATEMENT OF OPERATIONS AND CHANGES IN PARTICIPATING PLANS' EQUITY

|

|

|

|

|

|

Year Ended

|

|

|

December 31, 2016

|

|

|

|

|

Additions

|

|

|

Additions to net assets attributed to:

|

|

|

Investment income:

|

|

|

Mutual Funds

|

$

|

179,834,858

|

|

|

Common Stock Funds

|

34,515,652

|

|

|

Other Separate Accounts

|

8,923,635

|

|

|

|

223,274,145

|

|

|

|

|

|

Contributions:

|

|

|

Participants

|

149,614,716

|

|

|

Employer

|

176,672,315

|

|

|

|

326,287,031

|

|

|

|

|

|

Other investment income

|

106,314,713

|

|

|

Interest on notes receivable from participants

|

1,918,307

|

|

|

Total additions

|

657,794,196

|

|

|

|

|

|

Deductions

|

|

|

Deductions from net assets attributed to:

|

|

|

Participant withdrawals

|

433,995,856

|

|

|

Administrative fees

|

4,622,858

|

|

|

Total deductions

|

438,618,714

|

|

|

|

|

|

Net increase prior to transfers to other plans

|

219,175,482

|

|

|

|

|

|

Transfers to other plans, net **

|

(969,060,420

|

)

|

|

Net decrease in assets available for benefits

|

(749,884,938

|

)

|

|

|

|

|

Net assets available for benefits, beginning of year

|

4,084,196,820

|

|

|

Net assets available for benefits, end of year

|

$

|

3,334,311,882

|

|

** On October 31, 2016, Johnson Controls International plc completed the spin-off of its Automotive Experience business by way of transfer to Adient plc. Under the terms of the spin-off, defined contribution plans related to the Automotive Experience business were transfered into a master trust managed by Adient plc on July 1, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

|

|

SCHEDULE H, 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

PLAN #011, EIN: 39-0380010

|

|

DECEMBER 31, 2016

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

*

|

|

Participant Loans

|

|

3.25% - 7.75%

|

|

|

|

$

|

42,188,332

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the members of the Johnson Controls International plc Employee Benefit Policy Committee have duly caused this annual report to be signed by the undersigned thereunto duly authorized.

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

By:

/s/

Brian J. Stief

Brian J. Stief

Executive Vice President and Chief Financial Officer

JOHNSON CONTROLS INTERNATIONAL PLC

June 28, 2017

JOHNSON CONTROLS SAVINGS AND INVESTMENT 401(k) PLAN

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

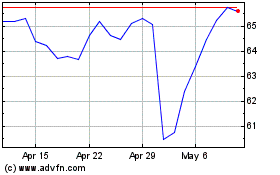

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024