UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Amendment No. 1

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

¨

|

Preliminary Information Statement

|

|

|

|

|

¨

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

x

|

Definitive Information Statement

|

|

NATE’S FOOD CO.

|

|

(Name of Registrant As Specified In Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

THIS INFORMATION STATEMENT IS BEING PROVIDED TO

YOU BY THE BOARD OF DIRECTORS OF NATE’S FOOD CO.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

NATE’S FOOD CO.

15151 Springdale Street

Huntington Beach, California 92649

(949) 381-1834

INFORMATION STATEMENT

(Definitive)

Amendment No. 1

June 28, 2017

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

GENERAL INFORMATION

To the Holders of Common Stock of Nate’s Food Co.:

This Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), to the holders (the “

Stockholders

”) of common stock, par value $0.0001 per share (the “

Common Stock

”), of Nate’s Food Co., a Colorado corporation (the “

Company

”), to notify the Stockholders that on April 6, 2017, the Company received the written consent in lieu of a meeting of the holders of a majority of the total voting power of all issued and outstanding voting capital of the Company (the “

Majority Stockholders

”) authorizing the following:

|

|

·

|

Amending the Company’s Articles of Incorporation, as amended, to increase the total number of authorized shares of Common Stock from 500,000,000 to 1,500,000,000(the “

Authorized Shares Increase

” or the “

Action

”)

|

On the same date, the Board of Directors of the Company (the “

Board

”) approved, and recommended to the Majority Stockholders that they approve the Authorized Shares Increase. On April 6, 2017, the Majority Stockholders approved the Actions by written consent in lieu of a meeting, in accordance with Colorado law. Accordingly, your consent is not required and is not being solicited in connection with the approval of the Actions.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

This Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), to the holders (the “

Stockholders

”) of common stock, par value $0.0001 per share (the “

Common Stock

”), of the Company to notify the Stockholders of the Authorized Shares Increase. Stockholders of record at the close of business on May 22, 2017, are entitled to notice of this stockholder action by written consent. Because this action has been approved by the holders of the required majority of the voting power of our voting stock, no proxies were or are being solicited. The Actions will not be effected until at least 20 calendar days after the mailing of the Information Statement accompanying this Notice. We will mail the Notice of Stockholder Action by Written Consent to the Stockholders on or about June 29, 2017. We anticipate that the Actions will become effective on or about July 20, 2017, at such time as a certificate of amendment to our Articles is filed with the Secretary of State of Colorado.

Attached hereto for your review is an Information Statement relating to the above-described action. Please read this Information Statement carefully. It describes the essential terms of the action to be taken. Additional information about the Company is contained in its reports filed with or furnished to the Securities and Exchange Commission (the “SEC”). These reports, their accompanying exhibits and other documents filed with the SEC may be inspected without charge at the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Copies of such material may also be obtained from the SEC at prescribed rates. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of these reports may be obtained on the SEC’s website at www.sec.gov.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

By:

|

/s/ Nate Steck

|

|

|

|

|

Chief Executive Officer

|

|

|

June 28, 2017

|

|

|

|

I

NTRODUCTION

Colorado law provides that the written consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted can approve an action in lieu of conducting a special stockholders’ meeting convened for the specific purpose of such action. Colorado law, however, requires that in the event an action is approved by written consent, a company must provide prompt notice of the taking of any corporate action without a meeting to the stockholders of record who have not consented in writing to such action and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for such meeting had been the date that written consents signed by a sufficient number of holders to take the action were delivered to a company.

In accordance with the foregoing, we will mail the Notice of Stockholder Action by Written Consent on or about June 29, 2017.

This Information Statement contains a brief summary of the material aspects of the Actions approved by the Board of Nate’s Food Co., (the “

Company

,” “

we

,” “

our

,” or “

us

”) and the Majority Stockholders.

ACTION TO BE TAKEN

The Action will become effective on the date that we file the Certificate of Amendment to the Articles of Incorporation of the Company (the “

Amendment

”) with the Secretary of State of the State of Colorado. We intend to file the Amendment with the Secretary of State of the State of Colorado promptly after the twentieth (20th) day following the date on which this Information Statement is mailed to the Stockholders.

Notwithstanding the foregoing, we must first notify FINRA of the intended Actions by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to the anticipated record date of such action. Our failure to provide such notice may constitute fraud under Section 10 of the Exchange Act.

We currently expect to file the Amendment on or about July 20, 2017.

AUTHORIZED SHARES INCREASE

GENERAL

The Board of Directors of the Company has adopted a resolution to amend the Articles of Incorporation so as to increase the number of shares of common stock authorized for issuance by the Board of Directors from 500,000,000 to 1,500,000,000. The Majority Shareholders have given their written consent to the resolution.

Under Colorado corporation law, the consent of the holders of a majority of the voting power is effective as shareholders’ approval. We will file the Amendment with the Secretary of State of Colorado on or July 20, 2017, and it will become effective on the date of such filing. The Amendment to the Articles of Incorporation will provide that the authorized shares of capital stock of the Company will consist of 1,500,000,000 shares of common stock with a par value of $0.0001 per share.

REASONS

The Board of Directors and the Majority Shareholders have approved the amendment to the Articles of Incorporation in order to provide the Company with flexibility in pursuing its long-term business objectives. The primary reasons for the amendment are:

|

|

●

|

Management may in the future pursue opportunities to obtain capital in order to fully implement the Company’s business plan. A reserve of common shares available for issuance from time-to-time will enable the Company to entertain a broad variety of financing proposals.

|

|

|

●

|

Management may utilize the additional shares in connection with corporate acquisitions, joint venture arrangements, or for other corporate purposes, including the solicitation and compensation of key personnel.

|

Management has not entered into any commitment to issue any shares, and is not engaged in any negotiations with respect to any transaction of the sort listed above. There are no outstanding options or warrants to purchase shares of the Company’s common stock, nor is there any derivative security outstanding that may be converted by the holder into shares of the Company’s common stock either with or without the payment of additional consideration.

As a result of the increase in authorized common stock, there will be 1,500,000,000 common shares available for issuance. The Board of Directors will be authorized to issue the additional common shares without having to obtain the approval of the Company’s shareholders. Colorado law requires that the Board use its reasonable business judgment to assure that the Company obtains “fair value” when it issues shares. Nevertheless, the issuance of the additional shares would dilute the proportionate interest of current shareholders in the Company. The issuance of the additional shares could also result in the dilution of the value of shares now outstanding, if the terms on which the shares were issued were less favorable than the contemporaneous market value of the Company’s common stock.

The increase in the number of common shares available for issuance is not being done for the purpose of impeding any takeover attempt. Nevertheless, the power of the Board of Directors to provide for the issuance of shares of common stock without shareholder approval has potential utility as a device to discourage or impede a takeover of the Company. In the event that a non-negotiated takeover were attempted, the private placement of stock into “friendly” hands, for example, could make the Company unattractive to the party seeking control of the Company. This would have a detrimental effect on the interests of any stockholder who wanted to tender his or her shares to the party seeking control or who would favor a change in control.

NO APPRAISAL RIGHTS

Under Colorado law, our Stockholders are not entitled to appraisal rights in connection with the Authorized Shares Increase.

WHEN THE INCREASE WILL GO INTO EFFECT

Upon filing of the Amendment with the Secretary of State of Colorado on or about July 20, 2017.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The voting power of the Company is vested in its common stock, with one vote per share. At the Record Date, 363,399,856 shares of common stock were outstanding.

Set forth below is information concerning the ownership as of the Record Date of the common stock of the Company by the persons who were the sole shareholders to sign the shareholders’ written consent.

The following table sets forth the name of the Series A Stockholder, the number of shares of Series A Preferred held by the Series A Stockholder, the total number of votes that the Series A Stockholders voted in favor of the Authorized Shares Increase and the percentage of the issued and outstanding voting equity of the Company that voted in favor thereof.

|

Name of Series A Stockholder

|

|

Number of Shares of Series A Preferred Held

|

|

|

Number of Votes Held by Such Series A Stockholder

|

|

|

Number of Votes that Voted in Favor of the Actions

|

|

|

Percentage of the Total Capital Voting Equity that Voted in Favor of the Actions

|

|

|

Nate Steck

|

|

|

970,052

|

|

|

|

970,052,000

|

|

|

|

970,052,000

|

|

|

|

41

|

%

|

|

Marc Kassoff

|

|

|

970,051

|

|

|

|

970,051,000

|

|

|

|

970,051,000

|

|

|

|

41

|

%

|

|

Total Votes in Favor

|

|

|

1,940,103

|

|

|

|

194,103,000

|

|

|

|

1,940,102,000

|

|

|

|

82

|

%

|

______________

|

(1)

|

The Company is authorized to issue 2,000,000 shares of Series A Preferred Stock, par value $0.0001. As of June 8, 2017, there were 1,940,102 shares of our company’s Series A Preferred Stock issued and outstanding. Each share of Series A Preferred Stock has no conversion rights and is equal to 1,000 votes.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth certain information regarding the beneficial ownership of our Common Stock as of June 8, 2017, of (i) each person known to us to beneficially own more than 5% of Common Stock, (ii) our directors, (iii) each named executive officer and (iv) all directors and named executive officers as a group. As of June 8, 2017, there were a total of 363,399,856 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote on matters on which holders of voting stock of the Company are eligible to vote. The column entitled “Percentage of Outstanding Common Stock” shows the percentage of voting common stock beneficially owned by each listed party.

The number of shares beneficially owned is determined under the rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under those rules, beneficial ownership includes any shares as to which a person or entity has sole or shared voting power or investment power

plus

any shares which such person or entity has the right to acquire within sixty (60) days of June 8, 2017, through the exercise or conversion of any stock option, convertible security, warrant or other right. Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power (or shares such power with that person’s spouse) with respect to all shares of capital stock listed as owned by that person or entity.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

Percentage of Class

(1)(2)(3)(4)(5)(6)

|

|

Nate Steck 15151 Springdale St,

Huntington Beach, CA 92649

|

|

6.974.000 Common Stock

970,052 Series A Preferred

20,872 Series B Preferred

1,000,000 Series D Preferred

|

|

1.919%

50.00%

14.072%

15.748%

|

|

|

|

|

|

|

|

Marc Kassoff 15151 Springdale St,

Huntington Beach, CA 92649

|

|

5,296,000 Common Stock

970,051 Series A Preferred

52,550 Series B Preferred

1,000,000 Series D Preferred

10,000 Series E Preferred

|

|

1.457%

49.99%

35.40%

15.748%

*

|

|

|

|

|

|

|

|

Timothy Denton 15151 Springdale St,

Huntington Beach, CA 92649

|

|

5,063,600 Common Stock

25 Series A Preferred

20,000 Series B Preferred

1,000,000 Series D Preferred

7,240 Series E Preferred

|

|

1.376%

.001%

13.484%

15.748%

*

|

|

|

|

|

|

|

|

Jeremy Kaplan 15151 Springdale St,

Huntington Beach, CA 92649

|

|

5,000,000

25 Series A Preferred

20,050 Series B Preferred

1,000,000 Series D Preferred

|

|

1.376%

.001%

13.518%

15.748%

|

|

|

|

|

|

|

|

Directors and Executive Officers as a Group

|

|

22,333,600 Common Stock

1,940,153 Series A Preferred

113,472 Series B Preferred

4,000,000 Series D Preferred

17,240 Series E Preferred

|

|

6.12%

99.2%

76.4%

62.9%

0.17%

|

______________

|

*

|

Represents an amount less than 1%

|

|

(1)

|

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on June 8, 2017. As of June 8, 2017, there were 363,399,856 shares of the Company’s common stock issued and outstanding.

|

|

(2)

|

The Company is authorized to issue 2,000,000 shares of Series A Preferred Stock, par value $0.0001. As of June 8, 2017, there were 1,940,102 shares of our company’s Series A Preferred Stock issued and outstanding. Each share of Series A Preferred Stock has no conversion rights and is equal to 1,000 votes.

|

|

(3)

|

The Company is authorized to issue 150,000 shares of Series B Preferred Stock, par value $0.0001. As of June 8, 2017, there were 130,500 shares of our company’s Series B Preferred Stock issued and outstanding. Each 1 share of Series B Preferred Stock converts into 1,000 shares of common stock of the Company. The Series B Preferred Stock has no voting rights.

|

|

|

|

|

(4)

|

The Company is authorized to issue 250,000 shares of Series C Preferred Stock, par value $1.00. As of June 8, 2017, there were 58,774 shares of our company’s Series C Preferred Stock issued and outstanding. Each one share of Series C Preferred Stock converts into 66 shares of common stock of the Company. The Series C Preferred Stock has no voting rights.

|

|

(5)

|

The Company is authorized to issue 10,000,000 shares of Series D Preferred Stock, par value $0.0001. The Series D Preferred Stock is convertible into shares of our common stock. As of June 8, 2017, there were 6,350,000 shares of our company’s Series D Preferred Stock issued and outstanding. Of the Series D Preferred Stock outstanding, 4,000,000 shares are held by our directors or officers and upon conversion, no current holder of the Series D Preferred Stock would be a beneficial owner of 5% or more of our common stock. The Series C Preferred Stock has no voting rights.

|

|

|

|

|

(6)

|

The Company is authorized to issue 15,000,000 shares of Series E Preferred Stock, par value $0.0001. As of June 8, 2017, there were 10,225,000 shares of our company’s Series E Preferred Stock issued and outstanding. Of the Series E Preferred Stock outstanding, 17,240 are held by our directors and officers. Upon conversion no current holder of the Series E Preferred stock would be a beneficial owner of 5% or more of our common stock. The Series C Preferred Stock has no voting rights.

|

ADDITIONAL INFORMATION

We are subject to the disclosure requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, file reports, information statements and other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained by the SEC at Room 1024, 450 Fifth Street, N.W., Washington, DC 20549. Copies of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549 at prescribed rates. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

The following documents, as filed with the Commission by the Company, is incorporated herein by reference:

|

|

●

|

The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended February 28, 2017, as filed with the SEC on May 17, 2017;

|

|

|

|

|

|

|

●

|

The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2016, as filed with the SEC on January 23, 2017;

|

|

|

|

|

|

|

●

|

The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2016, as filed with the SEC on October 24, 2016;

|

|

|

|

|

|

|

●

|

The Company’s Annual Report on Form 10-K for the fiscal quarter ended May 31, 2016, as filed with the SEC on October 6, 2016;

|

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company at 15151 Springdale Street, Huntington Beach, California 92649; telephone (949) 381-1834.

If multiple Stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at, its principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

This Information Statement is provided to the holders of Common Stock of the Company only for information purposes in connection with the Actions, pursuant to and in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information Statement.

By Order of the Board of Directors

Dated: June 28, 2017

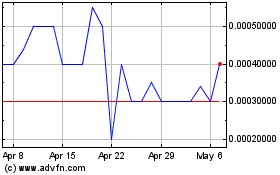

Nates Food (PK) (USOTC:NHMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nates Food (PK) (USOTC:NHMD)

Historical Stock Chart

From Apr 2023 to Apr 2024