Bank Of England's Cunliffe Says Not Right Time To Raise Rates

June 28 2017 - 3:57AM

RTTF2

Bank of England Deputy Governor Jon Cunliffe said Wednesday that

this is not the right time to adjust interest rates, a stance in

accordance with the views of Governor Mark Carney, but different

from the bank's chief economist Andrew Haldane.

In an interview with BBC Radio, Cunliffe said he would wish to

see how inflation evolves, adding that inflation above the 2

percent target is "not a comfortable place" for any member of the

monetary policy committee.

For Cunliffe, it was important to consider how much of the

overshoot was generated domestically, and how much caused by the

fall in the sterling exchange rate.

UK inflation accelerated to a four-year high of 2.9 percent in

May. The central bank has forecast 2.7 percent inflation for this

year.

Further, Cunliffe said he wanted to see whether business

investment and exports could compensate for a consumer

slowdown.

Consumer spending is slowing as households' real income are

squeezed by higher inflation.

"We do have to look at what's happening with domestic inflation

pressures and on the data we have at the moment, gives us a bit of

time to see how this evolves," he added.

Last week, fellow policymaker Haldane signaled favor for a rate

hike. His comment came after Carney said the time is not right to

begin raising interest rates as wage growth remains anaemic.

At the June meeting, the MPC voted 5-3 to keep the record low

interest rate unchanged.

Kristin Forbes, Ian McCafferty and Michael Saunders sought a

quarter point rate hike at the June meeting. They said partial

withdrawal of stimulus will help to moderate inflation

overshoot.

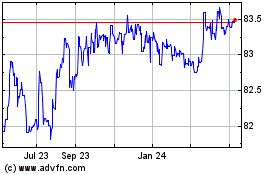

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

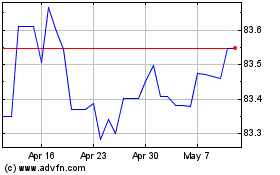

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024