UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under §240.14a-12

|

Saker Aviation Services, Inc.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

SAKER AVIATION SERVICES, INC.

Downtown Manhattan Heliport

20 South Street

Pier 6 East

River

New York, New York 10004

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD AUGUST 17, 2017

To the Stockholders of

Saker Aviation Services, Inc.:

The Annual Meeting of Stockholders of Saker Aviation Services Inc. (the “Company”) will be held at its operating facility, located at 2117 S. Air Service Road, Garden City Regional Airport, Garden City, KS 67846, on Thursday, August 17, 2017, at 10:00 a.m., Eastern Daylight Time, for the following purposes:

1. To elect five directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified;

2. To approve a possible reverse stock split of the Company’s Common Stock, $.001 par value, in an amount which the Board of Directors deems appropriate, to be not less than one-for-ten and not more than one-for-one hundred, and the timing of its effectiveness to be at such time as the Board determines to file an Amendment to the Company’s Articles of Incorporation effectuating this reverse stock split, but not later than August 17, 2020.

3. To ratify the selection of Kronick Kalada Berdy & Co. as the Company’s independent registered public accounting firm for the year ended December 31, 2017;

4. To approve, on an advisory basis, the compensation of our named executive officers;

5. To provide an advisory vote on the frequency of stockholder advisory votes on the compensation of our named executive officers; and

6. To transact such other business as may properly be brought before the annual meeting or any adjournment thereof.

The Company’s Board of Directors has fixed the close of business on June 30, 2017 as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting and any adjournment thereof. Only stockholders of record at the close of business on Friday, June 30, 2017, are entitled to notice of, and to vote at, the annual meeting or any adjournment thereof. To vote at the annual meeting, a stockholder of record, or his, her or its proxy, must be physically present at the annual meeting. If your shares of record are held by a broker, bank or other nominee and you wish to vote at the annual meeting, you must bring to the annual meeting a letter from the broker, bank or other nominee confirming both (1) your beneficial ownership of the shares, and (2) that the broker, bank or other nominee is not voting the shares at the annual meeting.

If you own your shares through a broker, we encourage you to follow the instructions provided by your broker regarding how to vote. Your broker may not vote your shares for director nominees, on the reverse stock split, on the advisory vote on executive compensation, or on the advisory vote on the frequency of the advisory vote on executive compensation unless you provide your broker with your voting instructions.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

Ronald J. Ricciardi

|

|

|

|

President

|

|

July 7, 2017

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE ANNUAL MEETING, PLEASE DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE. THE PROXY MAY BE REVOKED IN WRITING PRIOR TO THE MEETING OR, IF YOU ATTEND THE MEETING, YOU MAY REVOKE THE PROXY AND VOTE YOUR SHARES IN PERSON.

SAKER AVIATION SERVICES, INC.

PROXY STATEMENT

201

7

ANNUAL MEETING OF STOCKHOLDERS

The enclosed proxy is solicited on behalf of the Board of Directors of Saker Aviation Services, Inc., a Nevada corporation, for use at the annual meeting of stockholders to be held on Thursday, August 17, 2017, at 10:00 Eastern Daylight Time, or at any adjournment or postponement thereof, for the purposes set forth in this proxy statement and in the accompanying Notice of Annual Meeting of Stockholders.

Location of Annual Meeting

The annual meeting will be held at our operating facility located at 2117 S. Air Service Road, Garden City Regional Airport, Garden City, KS 67846.

Mailing Date

This proxy statement, accompanying form of proxy, notice of annual meeting, and 2017 annual report to stockholders are first being mailed by us on or about July 7, 2017 to all stockholders entitled to vote at the annual meeting.

Record Date and Outstanding Shares

Stockholders of record at the close of business on June 30, 2017, the record date for the annual meeting, are entitled to notice of and to vote at the annual meeting. We have one class of shares outstanding, designated as common stock, $0.001 par value per share. As of the record date, 33,422,995 shares of our common stock were issued and outstanding.

Solicitation of Proxies

We are making this solicitation of proxies, and we will bear all related costs. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to beneficial owners. Proxies may also be solicited on our behalf, in person or by telephone or facsimile, by our directors, officers and employees, none of whom will receive additional compensation for doing so.

Revocability of Proxies

You may revoke any proxy given pursuant to this solicitation, at any time before it is voted, by either:

|

▸

|

delivering a written notice of revocation or a duly executed proxy bearing a later date; or

|

|

▸

|

attending the annual meeting and voting in person.

|

Quorum

A quorum is required for stockholders to conduct business at the annual meeting. Our bylaws provide that a quorum will exist at the annual meeting if the holders of a majority of the shares of our common stock entitled to vote are present, in person or by proxy, at the annual meeting.

Voting

Each stockholder is entitled to one vote for each share held as of the record date. A stockholder may vote at the annual meeting by attending the meeting and voting in person or by submitting a proxy. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions on such proxies.

If no specific instructions are given, all shares represented by proxies will be voted:

|

|

●

|

FOR the election of each of the five nominees for directors named in this proxy statement

; and

|

|

|

●

|

FOR the approval of a reverse stock split of

not less than one-for-ten and not more than one-for-one hundred

shares, with the timing of such effectiveness to be determined by the Board of Directors, but not later than August 17, 2020; and

|

|

|

●

|

FOR the

ratification of the

selection of Kronick Kalada Berdy & Co. as our

independent registered public accounting firm for the year ended December 31, 201

7

;

and

|

|

|

●

|

FOR

approval

, on an advisory basis,

of

the compensation of our named executive officer

s

; and

|

|

|

●

|

FOR THREE YEARS, for

the frequency of

stockholder

advisory votes on the compensation of our named executive officers.

|

The shares may also be voted by the named proxies on such other business that may properly come before the annual meeting or any adjournment of postponement of the annual meeting.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must bring to the annual meeting a letter from the broker, bank or other nominee confirming both (1) your beneficial ownership of the shares and (2) that the broker, bank or other nominee is not voting the shares at the annual meeting.

Vote Required

The table below shows the vote required to approve the proposal described in this proxy statement, assuming the presence of a quorum at the annual meeting.

|

Proposal

|

|

Vote Required

|

|

|

|

|

|

|

|

|

1.

|

Election of five directors

|

|

Plurality of votes duly cast at the annual meeting

|

|

|

|

|

|

|

|

|

2.

|

Approval of reverse stock split

|

|

Majority of votes duly cast at the annual meeting

|

|

|

|

|

|

|

|

|

3.

|

Ratification of auditor

|

|

Majority of votes duly cast at the annual meeting

|

|

|

|

|

|

|

|

|

4.

|

Approval, on an advisory basis, of the compensation of our named executive officers

|

|

Majority of votes duly cast at the annual meeting

|

|

|

|

|

|

|

|

|

5.

|

Advisory vote regarding the frequency

of stockholder advisory votes on the

compensation of our named executive

officers

|

|

Plurality of the votes duly cast at the annual meeting

|

|

A

bstentions

Shares that abstain from voting on one or more proposals to be acted on at the annual meeting are considered to be present for the purpose of determining whether a quorum exists and are entitled to vote on all proposals properly brought before the annual meeting.

Abstentions will have the same effect as a vote against the reverse stock split, the ratification of auditor and the approval, on an advisory basis, of the compensation of our named executive officer, and will have no effect on the election of directors or the advisory vote on the frequency of stockholder advisory votes on the executive compensation of our named executive officers.

Broker Non-Votes

Under the rules governing brokers who have record ownership of shares that they hold in “street name” for their clients who are the beneficial owners of such shares, brokers have the discretion to vote such shares on routine matters, such as the ratification of the selection of an independent registered public accounting firm, but not on non-routine matters, such as the election of directors. A “broker non-vote” occurs when shares held by a broker are not voted on a non-routine proposal because the broker has not received voting instructions from the beneficial owner and the broker lacks discretionary authority to vote the shares in the absence of such instructions.

If you own your shares through a broker, we encourage you to follow the instructions provided by your broker regarding how to vote.

Your broker may not vote your shares for director nominees, on the reverse stock split, on the advisory vote on executive compensation, or on the advisory vote on the frequency of the advisory vote on executive compensation unless you provide your broker with your voting instructions.

Shares subject to broker non-votes are counted for the purpose of determining the presence of a quorum but are not counted for the purpose of determining the number of shares voting on the reverse stock split or the advisory vote on the compensation of our named executive officers. Thus, broker non-votes will have the same effect as a vote against the reverse stock split and the approval, on an advisory basis, of the compensation of our named executive officers. Broker non-votes will have no effect on the election of directors or the advisory vote regarding the frequency of stockholder advisory votes on the compensation of our named executives.

Annual Report to Stockholders and Annual Report on Form 10-K

We have enclosed our 2017 annual report to stockholders with this proxy statement. Our annual report on Form 10-K for the fiscal year ended December 31, 2016, as filed with the Securities and Exchange Commission, is included in the 2017 annual report. The 2017 annual report includes our audited consolidated financial statements, along with other information about us, which we encourage you to read.

You can obtain, free of charge, an additional copy of our annual report on Form 10-K for the fiscal year ended December 31, 2016 by:

|

•

|

writing to us at Downtown Manhattan Heliport, 20 South Street, Pier 6 East River, New York, New York 10004, Attention: Corporate Secretary;

|

|

|

|

|

•

|

telephoning us at (212) 776-4046; or

|

|

•

|

visiting our website at www.sakeraviation.com where you can access our reports under the heading “Investor Relations.”

|

You can also obtain a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2016 and all other reports and information that we file with, or furnish to, the Securities and Exchange Commission from the Securities and Exchange Commission’s EDGAR database at www.sec.gov.

Any information contained on our website is not a part of this proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON

AUGUST 17, 2017

As required by the rules adopted by the Securities and Exchange Commission, we are making this proxy statement and our annual report to stockholders available on the Internet.

The proxy statement and annual report to security holders are available at

http://sakeraviation.com/investor-relations/

For directions on how to attend the annual meeting and vote in person, please review the “Voting” section on page 2 of this proxy statement.

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees Proposed for Election as Directors

Our articles of incorporation and bylaws provide for a Board of Directors consisting of no less than one and no more than eleven directors. The number of directors is currently fixed at five. If elected, the five directors will hold office for a one-year term expiring on the date of the next annual meeting of stockholders and until his or her successor is duly elected and qualified.

Based on the recommendation of the Nominating Committee, we have nominated William B. Wachtel, Alvin S. Trenk, Ronald J. Ricciardi, Marc Chodock, and Roy P. Moskowitz, all of whom currently serve on the Board of Directors.

We recommend the election of the five nominees named in this proxy statement, and unless authority to vote for one or more of the nominees is specifically withheld according to the instructions on your proxy card, proxies in the enclosed form will be voted

FOR

the election of Messrs. Wachtel, Trenk, Ricciardi, Chodock, and Moskowitz.

Proxies received in response to this solicitation, unless specified otherwise, will be voted in favor of the five nominees named below, all of whom are currently serving as directors. We do not contemplate that any of the nominees will be unable to serve as a director, but if a nominee should not be available for election as contemplated, the proxy holders will vote for such lesser number of directors as are available to serve or will vote for a substitute appointed by the Board of Directors. In no event will proxies be voted for more than five nominees.

The following table sets forth certain information, as of the record date, concerning the nominees for election as directors. The information as to age has been furnished to us by each director nominee. For information as to the shares of our common stock beneficially owned by each nominee, please review the table under the caption “Security Ownership of Certain Beneficial Holders and Management” in this proxy statement.

|

Name of Nominee

|

Age

|

Director Since

|

Position / Offices

|

|

William B. Wachtel

|

62

|

2005

|

Chairman of the Board of Directors

|

|

Alvin S. Trenk

|

88

|

2004

|

Director, Chief Executive Officer

|

|

Ronald J. Ricciardi

|

56

|

2004

|

Director, President

|

|

Marc Chodock

|

38

|

2015

|

Director

|

|

Roy P. Moskowitz

|

62

|

2015

|

Director

|

Business History of Director Nominees

:

William B. Wachtel – Chairman of the Board

Mr. Wachtel was elected as a director and our Chairman of the Board on March 31, 2005. Mr. Wachtel served as our Chairman until April 8, 2009, when he resigned from such capacity but remained a member of the Board. On October 27, 2011, Mr. Wachtel was re-elected as our Chairman of the Board. If elected, Mr. Wachtel shall serve as Chairman of the Board of Directors effective upon the 2017 Annual Meeting of Stockholders.

Mr. Wachtel has been a managing partner of Wachtel Missry LLP (previously Wachtel & Missry, LLP), and before that, its predecessor law firm Gold & Wachtel, LLP, since its founding in August 1984. Such firm has provided certain legal services to the Company in the past. He is a co-founder of the Drum Major Institute, an organization carrying forth the legacy of the late Reverend Martin Luther King, Jr.

Mr. Wachtel has been nominated for re-election to our Board of Directors because of his extensive experience advising companies regarding legal issues, which provides him with a depth and breadth of experience that enhances our ability to navigate legal and strategic issues, and because of his extensive experience working with us.

Alvin S. Trenk – Director, Chief Executive Officer

Mr. Trenk was first elected as a director and our Chairman of the Board effective August 20, 2004, in connection with the reverse merger transaction pursuant to which we became a public company. He resigned as the Chairman of the Board on March 31, 2005, but continued to serve as a director. On November 6, 2013, Mr. Trenk was appointed to the position of Chief Executive Officer of the Company.

Mr. Trenk has served as Chairman and Chief Executive Officer of Air Pegasus since 1981 and, from 1997 to 2003, as Chairman, President and Chief Executive Officer of Sightseeing Tours of America, Inc. and Liberty Helicopters, Inc., privately held corporations operating public use heliports in New York, and providing helicopter air tours and charter and air services. Mr. Trenk has also been Chairman and Chief Executive Officer of TechTron, Inc. since 1980. TechTron is a privately owned holding company with investment emphasis on emerging global market opportunities. From 1976 to 1980, Mr. Trenk was Vice Chairman of Kenton Corporation, a diversified publicly-traded corporation, where he also served as President and Chief Executive Officer of Charles Town Turf Club, owner and operator of thoroughbred race tracks in West Virginia, and Chairman and Chief Executive Officer of International Health Company, which owned and operated a national chain of artificial kidney centers.

Mr. Trenk has been nominated for re-election to our Board of Directors because of his deep knowledge of the aviation industry gained from his more than thirty year career as an executive officer in the aviation industry.

Ronald J. Ricciardi – Director, President

Mr. Ricciardi had served as the President and a director of Arizona FBO Air, Inc. since its inception in 2003 and was designated as its Chief Executive Officer on January 2, 2004. He was appointed our President and a director of the Company and designated as our Chief Executive Officer on August 20, 2004 effective with the reverse merger transaction pursuant to which we became a public company. On December 12, 2006, he was elected as our Vice Chairman of the Board. On March 2, 2009, he was re-appointed as our President and continues to serve in that capacity, and designated as our Chief Executive Officer. On April 8, 2009, Mr. Ricciardi was elected as our Chairman of the Board. On October 27, 2011, Mr. Ricciardi was elected as our Vice Chairman of the Board. He continued to serve as our Chief Executive Officer until November 6, 2013.

Mr. Ricciardi is a senior executive with extensive general management experience in entrepreneurial and large companies. Before joining Arizona FBO Air and from 2000 to 2003, Mr. Ricciardi was President and Chief Executive Officer of P&A Capital Partners, Inc., an entertainment finance company established to fund the distribution of independent films. From 1999 to 2000, Mr. Ricciardi was also co-founder, Chairman and Chief Executive Officer of eTurn, Inc., a high technology service provider, for which he developed a consolidation strategy, negotiated potential merger and acquisition candidates, prepared private placement materials and executed numerous private, institutional and venture capital presentations. After a management career at Pepsi-Cola Company and the Perrier Group of America, Mr. Ricciardi was President and Chief Executive Officer of Clearidge, Inc., a leading regional consumer product company, where he provided strategic and organizational development, and led a consolidation effort that included 14 transactions, which more than tripled company revenue over four years.

Mr. Ricciardi has been nominated for re-election to our Board of Directors because of his fourteen years of experience working in a variety of roles with us, including his service on our Board of Directors, combined with his knowledge of the aviation industry and his extensive management experience, demonstrate his strong commitment to us and make him a valued member of our Board of Directors.

Marc Chodock - Director

Mr. Chodock was appointed as a director on June 25, 2015. Mr. Chodock has been acting as a private investor since February 2013. Previously, he was a consultant in the New York office of McKinsey & Company and a Principal at MatlinPatterson Global Advisors, where he served on the Board of Directors of four companies. He holds a Bachelor of Science in Economics from the University of Pennsylvania’s Wharton School of Business and a Bachelor of Applied Science in Biomedical Science from the School of Engineering and Applied Science of the University of Pennsylvania.

Mr. Chodock has been nominated for re-election to our Board of Directors because of his extensive experience in advising companies by serving on Boards as well as his knowledge in depth and breadth of the aviation industry.

Roy P. Moskowitz - Director

Mr. Moskowitz was appointed as a director on June 25, 2015. Mr. Moskowitz has been the Chief Legal Officer of The New School since September 2006. From 1988 – 2004, Mr. Moskowitz held senior positions of legal oversight for New York educational institutions, including the New York State Education Department, City University of New York, Community School District #2, and the Regional Superintendent of Region 9.

Mr. Moskowitz has been nominated for re-election to our Board of Directors because his extensive experience analyzing legal issues enables Mr. Moskowitz to advise the Company on potential courses of action, particularly when legal topics are involved.

The Board of Directors recommends that stockholders vote FOR the election of each of the five director nominees.

PROPOSAL TWO: AUTHORITY TO BOARD TO IMPLEMENT

A POSSIBLE REVERSE STOCK SPLIT

General

As a result of the Company’s cash flow from operations and working capital surplus, the Board of Directors does not believe that there is foreseeable need for working capital or capital for other corporate purposes in the foreseeable future. The Board, however, has long disclosed that additional capital may be necessary for the Company to make further acquisitions in the aviation services segments in which the Company operates.

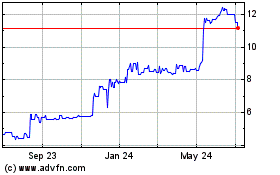

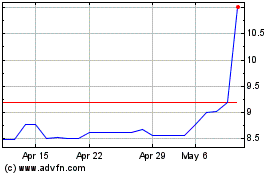

The Board believes that a higher market price for the Company’s Common Stock would create a more favorable marketplace for such additional financing. Further, the Board believes that a higher price for the Common Stock would make inclusion of the stock as a currency in potential acquisitions much more likely. The Board therefore believes it is prudent to consider decreasing the number of outstanding shares on a fully diluted basis through the implementation of a reverse stock split. As an example, if a one-for-ten reverse stock split was implemented and the market price was $.20 per share, then, after such a split, a stockholder holding ten shares of the Common Stock valued at $2.00 in the aggregate would now own one share at a market price of $2.00 per share, at least initially. In such event, the 35,322,995 fully diluted shares as of the Record Date would become 3,532,300 shares after a one-for-ten reverse stock split, subject to the Company issuing a full share for any fractional share.

Investment bankers consulted by the Company have advised that a listing of the Common Stock on either the Nasdaq Capital Market or NYSE MKT exchanges would further facilitate the Company’s ability to obtain financing on a more favorable basis, as well as being beneficial in other ways to existing stockholders. See the immediately following section ‘‘Reasons for the Reverse Stock Split’’ under this caption ‘‘Proposal Two: Authority to Board to Implement a Possible Reverse Stock Split.’’

Based on its analysis of the entry criteria for listing the Common Stock on either Nasdaq or NYSE MKT, the Board has concluded that a major impediment to any such listing is that the current bid price of the Common Stock is far less than the per share requirement of either exchange, respectively. Depending on the size and success of implementation, the Board believes a reverse stock split could enable the Company to overcome this impediment.

However, assuming that stockholders approve Proposal Two and the directors subsequently implement a reverse stock split, no assurance can be given that the market price of the Common Stock will remain at the proportionately increased price. For example, if the Company were to effect a one-for-ten reverse stock split of the Common Stock, there is no assurance that the new market price would remain at ten times the prior market price. Nor can there be any assurance as to precisely what effect the proposed reverse split would have on the long-term market price of the Common Stock. In addition, at the time it may make an application to Nasdaq or NYSE MKT, the Company may not meet the other requirements for listing on those exchanges. Finally, even if the market price of the Common Stock retains the level of the reverse stock split and the Common Stock is listed on Nasdaq or NYSE MK, there can be no assurance that the Company will obtain financing on more favorable terms, if at all.

The Board also recognizes that the timing of a reverse stock split is a key element in determining whether the desired goal of a higher market price for the Common Stock is likely to be achieved. The Board is cognizant that general market conditions unrelated to the Company or its securities specifically can affect the result. The Board has not made a determination as to the timing, if any, for the reverse split, however, the Board prefers to avoid the delay and the expense of calling a Special Meeting of Stockholders at a later date when they deem the time appropriate for taking such action.

Accordingly, instead of asking the stockholders to authorize a reverse stock split in a specified amount, and for the Company to implement the change at the current time, the Board is seeking stockholder approval to authorize a reverse stock split in an amount which the Board deems appropriate, if and when required. Such amount would not be less than one-for-ten nor more than one-for-one hundred. In addition, the timing of its effectiveness would be at such time as the Board determines, but not later than August 17, 2020. If the reverse stock split is not implemented by August 17, 2020, then the Board believes that a potential reverse stock split should be the subject of consideration at the Annual Meeting of Stockholders in 2020, if at all.

The reverse stock split, were it to be authorized by the stockholders and implemented by the Board, would require an Amendment to Article Four of the Company’s Articles of Incorporation relating to capitalization. For example, if a one-for-ten reverse stock split was implemented, the authorized shares of the Common Stock would be changed from 100,000,000 shares with a par value of $.001 per share to 10,000,000 shares with a par value of $.010 per share. The 33,422,995 shares outstanding on the Record Date in such an example would become 3,342,300 shares, with any fractional share being increased to a full share. Your attention is directed to the section ‘‘Stock Certificates’’ later under this caption ‘‘Proposal Two: Authority to Board to Implement a Reverse Stock Split’’ in this Proxy Statement.

Reasons for Reverse Stock Split

As indicated above in the section ‘‘General’’ under this caption ‘‘Proposal Two: Authority to Board to Implement a Reverse Stock Split,’’ the Board of Directors believes that a successful reverse stock split may have the following benefits, among others, for the Company:

|

|

•

|

facilitate any necessary financing because a higher market price may be a prerequisite to doing financing on more favorable terms,

|

|

|

|

|

|

|

•

|

facilitate use of the Common Stock as a currency or component of total consideration offered to a prospective target of acquisition,

|

|

|

|

|

|

|

•

|

a higher market price may enable the Company to qualify the Common Stock for listing on a Nasdaq or NYSE MKT exchange.

|

The Board believes that a higher market price for the Common Stock should result if the Company continues to operate on a profitable basis, even without a reverse stock split. There can be no assurance, however, that the Company will continue to operate on a profitable basis or that the market price will rise as the Board anticipates. Finally, although there can be no assurance that any of the results described in this paragraph will be achieved, the Board believes that a reverse stock split may be the best method to realize these objectives.

Additionally, because the Common Stock is not on a Nasdaq or NYSE MKT exchange, and because its bid price has been below $5.00 per share, the Common Stock is subject to Rule 15g-9 of the Exchange Act. This Rule imposes additional sales practices requirements on a broker-dealer which sells Rule 15g-9 securities to persons other than the broker-dealer’s established customers and institutional accredited investors (as such term is defined in Rule 501(a) under the Securities Act). For transactions covered under Rule 15g-9, the broker-dealer must make a suitability determination of the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. In addition, broker-dealers, particularly if they are market makers in the Common Stock, have to comply with the disclosure requirements of Rule 15g-2, 15g-3, 15g-4, 15g-5 and 15g-6 under the Exchange Act unless the transaction is exempt under Rule 15g-1. Consequently, Rule 15g-9 and these other Rules may adversely affect the ability of broker-dealers to sell or to make markets in the Common Stock and, accordingly, make it more difficult for stockholders to sell their shares whenever they desire to take such action. If the Common Stock were listed on Nasdaq or NYSE MKT, or if the bid price of the Common Stock were above $5.00 per share, these ‘‘penny stock’’ rules would no longer be applicable to the Company.

In addition, institutional investors which generally do not purchase stocks traded on the OTCQB Marketplace would more likely consider the Common Stock as a possible investment if it were traded on Nasdaq or NYSE MKT. A listing on one of these exchanges also exempts that security from compliance with the ‘‘blue sky’’ laws of all 50 states and the District of Columbia and, accordingly, would reduce the Company’s expenses in any future public or private offering under the Securities Act.

In addition to these benefits, the Board believes that the reverse stock split may result in certain additional benefits to stockholders, such as:

|

|

•

|

creating the ability for them to execute purchase or sale orders with certain brokerage firms which restrict or discourage execution or orders for low-priced stocks,

|

|

|

|

|

|

|

•

|

the ability for them to purchase shares of the Common Stock on margin (assuming approval by the Federal Reserve Board) with those firms which do not allow margin purchases of very low-priced stocks and

|

|

|

|

|

|

|

•

|

the ability for them to have purchases or sales executed at a lower commission rate per dollar of investment.

|

However, as indicated above in the section ‘‘General’’ under this caption ‘‘Proposal Two: Authority to Board to Implement a Reverse Stock Split,’’ the Board cannot assure a stockholder as to what effect the proposed reverse stock split will have on the market price of the Common Stock. Accordingly, there can be no assurance that any or all of the objectives set forth in this subsection would be achieved.

Effect on Stockholders

Holders of the Common Stock have no preemptive, subscription or conversion rights and are entitled to dividends on a

pro

rata

basis when and if declared by the Board of Directors. The proposed reverse stock split will not affect any of these rights. However, because of the management’s desire to use cash flow to grow the business, the likelihood of dividends being paid on the Common Stock in the foreseeable future is remote.

Each holder of the Common Stock has one vote per share on all matters submitted to stockholders for a vote. A reverse stock split will not affect such right.

Upon liquidation of the Company, each holder of the Common Stock is entitled to share ratably any assets available for distribution after payment of all debts and distribution in respect of any then outstanding shares of the Company’s Preferred Stock, $.001 par value (of which no shares are currently outstanding). The reverse stock split, if implemented, will not affect the liquidation rights of the holders of the Common Stock.

Accordingly, except for the increase in the par value of a share of the Common Stock and the concurrent decrease in the number of shares held by each holder of the Common Stock as a result of an implemented reverse stock split, the Board is of the opinion that the proposed Amendment to the Articles of Incorporation would create no material differences between the shares of the Common Stock prior to the Amendment and the shares of the Common Stock after the Amendment.

Stock Certificates

If the proposed Amendment to the Articles of Incorporation of the Company permitting the Board of Directors to effect a proposed reverse stock split is adopted by the stockholders at the Meeting and thereafter the Amendment is filed in the State of Nevada as required by the Nevada General Corporation Law to become effective, each stockholder must turn in his, her or its stock certificate to Continental Stock Transfer and Trust Company, the Transfer Agent for the Common Stock, for exchange for a new stock certificate evidencing the post-reverse-stock-split Common Stock and the new CUSIP number assigned to the Company.

The Company will give notice to each stockholder, and will make a form available for such purpose, at the appropriate time. If, upon making the exchange for the new certificates evidencing the Common Stock, a fractional share would otherwise be issued, no fractional share will be issued and the stockholder making the exchange will receive instead a full share.

The Board of Directors recommends that stockholders vote FOR the

authorization of a reverse split of the Common Stock in an amount (not less than one-for-ten nor more than one-for-one hundred) and a time to be determined by the Directors (but not later than August 17, 2020)

.

Fees Paid to Independent Registered Public Accounting Firm

Kronick Kalada Berdy & Co. (“

KKB

”) served as our independent registered public accounting firm for our fiscal years ended December 31, 2016 and 2015.

Audit Fees

.

The aggregate fees billed for professional services rendered by KKB for the audits of our annual financial statements for the fiscal years ended December 31, 2016 and 2015, and the reviews of the financial statements included in the Company’s Quarterly Reports on Forms 10-Q for those fiscal years were approximately $92,000 and $90,000 by for 2016 and 2015, respectively,.

Audit-Related Fees

.

There were no fees billed for for assurance and related services by KKB that are reasonably related to the performance of the audit or review of our financial statements and not reported under “Audit Fees” above for the fiscal years ended December 31, 2016 and 2015.

Tax Fees

. There were no fees billed for professional services rendered by KKB for tax compliance, tax advice, and tax planning for the years ended December 31, 2016 and 2015. The aggregate fees billed by a firm other than the principal accountant for services categorized as Tax Fees were $19,000 and $19,000, respectively.

All Other Fees

. There were no fees billed by KKB for any products and services other than the foregoing for the fiscal years ended December 31, 2016 and 2015.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm. As part of this responsibility, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent registered public accounting firm to help assure that they do not impair the registered public accounting firm’s independence from us. The Audit Committee may either approve the engagement of the independent registered public accounting firm to provide services or pre-approve services to be provided on a case by case basis. All audit and non-audit services provided in the fiscal years ended December 31, 2016 and December 31, 2015 have been discussed and pre-approved by the Audit Committee in accordance with these policies and procedures.

PROPOSAL T

HREE

RATIFICATION OF THE SELECTION OF

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected KKB as our independent registered public accounting firm for the year ending December 31, 2017, subject to ratification by stockholders at the annual meeting. KKB has served as our independent registered public accountants since December 18, 2009.

We have been advised by KKB that a representative will be present at the annual meeting and that such representative will be available to respond to appropriate questions. Such representative will be given an opportunity to make a statement if he or she so desires.

The Board of Directors recommends that stockholders vote FOR the ratification of the appointment of KKB as our independent registered public accounting firm for

the year ended December 31, 2017

.

PROPOSAL

FOUR

TO APPROVE, ON AN ADVISORY BASIS, THE COMPENSATION OF OUR

NAMED EXECUTIVE OFFICER

S

As required by Section 14A of the Securities Exchange Act of 1934, as amended, our stockholders are entitled this year to a non-binding vote on the compensation of our named executive officer (referred to as a “Say-on-Pay”).

The compensation program for our named executive officers, as described in the “Compensation of Named Executive Officers and Directors” and “Corporate Governance” sections of this proxy statement, is developed and recommended for approval by our compensation committee, which is comprised exclusively of independent directors. The primary goal of the compensation program is to further the intent and purpose of our fundamental compensation philosophy and objectives, by aligning the interests of our executive officer and stockholders.

Our objectives with respect to executive compensation are to: attract, motivate, and retain talented executive officers, promote the achievement of key business objectives by linking our executive officer’s base salary determination with the Company’s performance in the prior calendar year, our executive officer’s individual performance during the prior calendar year, and evaluating information on current compensation trends.

We are asking our stockholders to indicate their support and approval, on an advisory basis, for our named executive officers’ compensation as described in the “Compensation of Named Executive Officers and Directors”, accompanying compensation tables and related narrative discussions contained in this proxy statement. We believe that our compensation program for our named executive officer is designed to create value for our stockholders over the long term, and provides for appropriate pay-for-performance alignment.

For the reasons summarized above, and as discussed in this proxy statement, our Board of Directors is asking our stockholders to vote for the following advisory resolution:

The say-on-pay vote is advisory, and therefore not binding on our compensation committee or our Board of Directors. Nevertheless, our Board of Directors and our compensation committee value the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote in deciding whether to take any action as a result of the vote and when making future compensation decisions for our named executive officers.

The

B

oard of

D

irectors recommends that you vote FOR the

following advisory resolution:

RESOLVED, that the compensation paid to

our

named executive officer

s

, as disclosed

pursuant to

the Securities and Exchange Commission’s compensation disclosure rules, including the

Compensation

of Named Executive Officers and Directors

,

accompanying

compensation tables and

related narrative discussion

s contained in this proxy statement,

is hereby approved.

PROPOSAL F

IVE

ADVISORY VOTE

REGARDING

THE FREQUENCY OF

STOCKHOLDER

ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

As described in Proposal Four, our stockholders are being asked to vote to approve the compensation of our named executive officers as described in the “Compensation of Named Executive Officers and Directors”, accompanying compensation tables and the related narrative discussions contained in this proxy statement. As required by Section 14A of the Securities Exchange Act of 1934, as amended, our stockholders are also entitled to vote on whether future advisory votes on named executive officer compensation should occur every year, every two years or every three years. Stockholders may also abstain from voting. Stockholders will have an opportunity to cast an advisory vote on the frequency of future advisory votes on executive compensation at least every six years. After careful consideration, the Board of Directors

recommends that future advisory votes on named executive officer compensation occur every three years.

Stockholders can specify one of four choices when voting on this proposal: holding the advisory vote every year, every two years, every three years or abstaining. The advisory vote regarding the frequency of future advisory votes described in this proposal will be determined by a plurality of the votes cast. The frequency - “Every Year,” “Two Years” or “Three Years” - receiving the highest number of votes will be determined to be the preferred frequency of holding future advisory votes on the compensation of our named executive officers.

Stockholders are not voting to approve or disapprove the board’s recommendation. As an advisory vote, this proposal is not binding on our compensation committee or our Board of Directors. Notwithstanding the board’s recommendation and the outcome of this advisory vote, the board may, in the future, decide to conduct stockholder advisory votes on a less or more frequent basis and may vary its practice based on factors such as discussions with stockholders and the adoption of material changes to compensation programs.

The

B

oard of

D

irectors recommends that

stockholders submit an

advisory vote

for a THREE YEAR

frequency

for

future

stockholder

advisory votes on the compensation of our named executive officers.

REPORT OF THE AUDIT COMMITTEE

1

The Audit Committee of the Board of Directors is currently comprised of two members of the Board of Directors, both of which the Board of Directors has determined are independent under the independence standards of NASDAQ Stock Market and applicable Securities and Exchange Commission rules. The Audit Committee assists the Board of Directors in overseeing our accounting and financial reporting processes and financial statement audits. The specific duties and responsibilities of the Audit Committee are set forth in the Audit Committee charter, a copy of which is available on our website at http://sakeraviation.com/investor-relations/

The Audit Committee has:

|

|

●

|

reviewed and discussed our audited consolidated financial statements for the fiscal year ended December 31, 2016 with our management and our independent registered public accounting firm;

|

|

|

●

|

discussed with KKB, our independent registered public accounting firm, the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard 1301, Communications with Audit Committees; and

|

|

|

●

|

received and discussed the written disclosures and the letter from KKB required by applicable requirements of the Public Company Oversight Board regarding KKB’s communications with the audit committee concerning independence, and discussed with KKB its independence.

|

Based on these reviews and discussions with management and our independent registered public accounting firm, and the report of the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, that the audited consolidated financial statements for the fiscal year ended December 31, 2016 be included in our annual report on Form 10-K for the fiscal year ended December 31, 2016 for filing with the Securities and Exchange Commission.

The Audit Committee selects our independent registered public accounting firm annually and has submitted the selection of KKB for ratification by stockholders at our annual meeting.

|

|

Respectfully submitted,

|

|

|

|

|

|

|

|

/s/ Marc Chodock, Chairman

|

|

|

|

/s/ Roy P. Moskowitz

|

|

|

|

|

|

|

|

Audit Committee

|

|

1

The material in this report is not deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filings.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

During the fiscal year ended December 31, 2016, all of our directors and executive officers complied in a timely manner with the filing requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, except for Messrs. Chodock, Moskowitz, Trenk and Wachtel who each filed one late report disclosing a single transaction. In making this statement, we have relied solely on the written representations of our directors and executive officers.

CORPORATE GOVERNANCE

Meetings of the Board of Directors

Members of our Board of Directors are expected to attend all regular and special meetings of the board and of the committees on which they serve. The Board of Directors held one meeting during 2016. Each director then in office attended at least 75% of the total of such board meetings and meetings of board committees on which he served. In addition, all directors, absent special circumstances, are expected to attend our annual meeting. All directors who were serving as directors at the time attended the 2013 annual meeting of stockholders.

Director Independence

The Board of Directors uses the independence standards of the NASDAQ Stock Market and applicable Securities and Exchange Commission rules to determine which directors are deemed independent. The Board of Directors has determined that Marc Chodock and Roy P. Moskowitz qualify as independent pursuant to these standards.

Committees of the Board of Directors

The Board of Directors has established, among other committees, an Audit Committee, a Nominating Committee and a Compensation Committee. The Audit Committee acts pursuant to a written charter adopted by the Board of Directors. The current Audit Committee charter is available on our website, http://sakeraviation.com/investor-relations/. In addition, a stockholder may receive a written copy of the Audit Committee’s charter by sending a written request to Saker Aviation Services, Inc., Downtown Manhattan Heliport, 20 South Street, Pier 6 East River, New York, New York 10004, Attention: Corporate Secretary or by telephone at (212) 776-4046. The Compensation Committee and Nominating Committee do not have written charters.

Audit Committee

The current members of the Audit Committee are Messrs. Chodock and Moskowitz. As discussed above, the Board of Directors has determined that both are independent pursuant to the independence standards of the NASDAQ Stock Market and applicable Securities and Exchange Commission rules. The Board of Directors has determined that Messrs. Chodock and Moskowitz have sufficient knowledge in financial and auditing matters to serve as members of the audit committee. The Board of Directors has designated Mr. Chodock as an “audit committee financial expert” in accordance with applicable Securities and Exchange Commission rules.

The Audit Committee serves as an independent and objective party to monitor our financial reporting process and internal control system; retains, pre-approves audit and permitted non-audit services to be performed by, and directly consults with, our independent registered public accounting firm; reviews and appraises the services of our independent registered public accounting firm; and provides an open avenue of communication with our independent registered public accounting firm, management and the Board of Directors. Our Audit Committee charter more specifically sets forth the duties and responsibilities of the Audit Committee.

The Audit Committee is also responsible for preparing the Audit Committee Report that the Securities and Exchange Commission rules require us to include in our annual proxy statement, and performing such other tasks that are consistent with its charter.

The Audit Committee held four meetings during 2016. The Audit Committee’s report relating to fiscal year ended December 31, 2016 appears on page 10 of this proxy statement.

Nominating Committee

The current members of the Nominating Committee are Messrs. Wachtel, Ricciardi, and Trenk. The Nominating Committee does not have a formal written charter, however, the Board of Directors, by resolution, granted authority to the Nominating Committee to act on certain matters described herein.

The Nominating Committee is charged with identifying qualified candidates, consistent with criteria approved by the committee, to become directors and recommending that the Board of Directors nominate such qualified candidates for election as directors. The process followed by the Nominating Committee to identify and evaluate candidates includes requests to our directors, our chief executive officer, and others for recommendations, the evaluation of biographical information and background material relating to potential candidates and their qualifications, and interviews of selected candidates.

In addition to its authority to recommend nominees for election or re-election as directors, the Board of Directors granted the Nominating Committee the authority to make recommendations to the Board of Directors as follows: (i) the criteria regarding the composition of the committees of the Board Directors, such as size, employee and non-employee director membership thereon and the periodic rotation of committee assignments; (ii) the criteria relating to tenure as a director, such as retirement age, limitations on the number of times a director may stand for re-election and the continuation of directors in an honorary or similar capacity; (iii) the criteria for retention of directors, such as attendance at Board of Director and committee meetings, health or the assumption of responsibilities which are incompatible with effective board membership; (iv) the specific amounts of directors’ retainers and meeting fees; (v) the removal of a director under unusual circumstances; (vi) the selection of committee chairpersons, and committee assignments; (vii) the types and functions of the committees of the Board of Directors; and (viii) the procedures, frequency and location of meetings of the Board of Directors.

The Nominating Committee also considers recommendations for nomination to the Board of Directors submitted by stockholders and applies the same standards in evaluating stockholder recommendations that it applies in evaluating recommendations from other sources. Such recommendations for nomination, together with relevant biographical information, should be sent to the following address: Saker Aviation Services, Inc., Downtown Manhattan Heliport, 20 South Street, Pier 6 East River, New York, New York 10004, Attention: Chairman of the Nominating Committee. The qualifications of recommended candidates will be reviewed by the Nominating Committee.

If the stockholder desires that a candidate be considered for election at an annual meeting, such recommendation must be made before April 1

st

of the year so that adequate consideration can be given to such recommendation. Nominations to fill a vacancy other than at an annual meeting will be considered by the Nominating Committee at any time.

In evaluating the suitability of candidates (other than our executive officers) to serve on the Board of Directors, including stockholder nominees, the Nominating Committee generally seeks candidates who are independent and meet other selection criteria established by the Nominating Committee from time to time. The Nominating Committee also considers an individual’s skills, character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, national and international experience, and other relevant criteria that may contribute to our success. This evaluation is performed in light of the skill set and other characteristics that would most complement those of the current directors, including the diversity, maturity, skills and experience of the board as a whole.

The Nominating Committee approved the nominees for director.

Compensation Committee

The current members of the Compensation Committee are Messrs. Moskowitz and Chodock. As discussed above, the Board of Directors has determined that both are independent pursuant to the independence standards of the NASDAQ Stock Market and applicable Securities and Exchange Commission rules.

The Compensation Committee does not have a formal written charter, however, the Board of Directors, by resolution, granted authority to the Compensation Committee to act on certain matters described herein.

The Board of Directors has delegated the following authority to the Compensation Committee: (i) review and, where appropriate, formulate or recommend changes to our stock benefit and executive, managerial or employee compensatory and benefit plans or programs, provided that the authority to adopt or change any compensatory or benefit plan or program will rest with our Board of Directors (unless specifically delegated to the Compensation Committee); (ii) administer, and act as the designated committee under, any stock option, restricted stock, stock purchase or similar plan; and (iii) approve the base salary, bonus or other compensation arrangements of our existing or prospective officers.

The Compensation Committee is responsible for establishing and implementing compensation programs for our executives and directors that further the intent and purpose of our fundamental compensation philosophy and objectives, and performing such other tasks that are within the delegation of authority from the Board of Directors to the Compensation Committee that is described above.

Because of our small size and the limited number of executive officers, the Compensation Committee has reviewed and considered recommendations from our chief executive officer to determine the amount and form of executive and director compensation. The Compensation Committee has not used compensation consultants to determine or recommend the amount or form of executive and director compensation.

The Compensation Committee held no meetings during 2016.

Board Leadership Structure

Like many publicly traded companies, we have chosen to separate the chief executive officer and board chairman positions. We chose this structure because we believe it results in the most effective leadership for our board to help it discharge its duties given the small size of our operations. We believe our chairman is best positioned to provide board leadership that is aligned to our stockholders' interests. Our chief executive officer is well situated to assess our needs, business model and industry position, identify the key risks facing us and ensure that these are brought to the attention of the board. Finally, our chairman and chief executive officer are able to act as conduits between the board and management to plan and execute board meetings, to provide updates between meetings when necessary and to efficiently implement board directives. We believe that this structure reduces the likelihood of confusion about leadership roles and duplication of efforts. Due to our small size we have not found it necessary to formally create the role of lead independent director. Instead, our independent directors have the ability to meet together in executive session without management being present.

Board of Director’s Role in Risk Oversight

Our Board of Directors is primarily responsible for oversight and monitoring of management’s risk assessment and risk management functions. Due to our small size we do not have formal mechanisms in place to monitor risk, but our board does consider risk in evaluating management’s recommended business plans and strategies.

Code of Ethics and Policy and Procedure Governing Related Party Transactions

The Board of Directors adopted a Code of Ethics on May 19, 2006, that is applicable to all of our directors, officers and employees, and includes directors, officers and employees at our operating facilities. In addition, the Board of Directors adopted a Policy and Procedure Governing Related Party Transactions on April 26, 2007. Pursuant to these procedures, the Audit Committee reviews and approves: (i) all related party transactions when and if required to do so by applicable rules and regulations, (ii) all transactions between the Company or any of its subsidiaries and any of the Company’s executive officers, directors, director nominees or any of their immediate family members and (iii) all transactions between the Company or any of its subsidiaries and any security holder who is known by the Company to own of record or beneficially more than five percent of any class of the Company’s voting securities, other than transactions that (a) have an aggregate dollar amount or value of less than $120,000 (either individually or in combination with a series of related transactions) and (b) are made in the ordinary course of business of the Company or its subsidiary, as applicable, and such related party.

During 2016, all of the transactions that were subject to the Audit Committee’s policies and procedures described above were reviewed and approved or ratified by the Audit Committee or the Board of Directors.

Both the Code of Ethics and the Policy and Procedure Governing Related Party Transactions delegate certain functions to the Audit Committee and the Compensation Committee. The Code of Ethics is available on our website, http://sakeraviation.com/investor-relations/. A stockholder may receive a written copy of the Code of Ethics or the Related Party Policy and Procedure by forwarding a written request to Saker Aviation Services, Inc., Downtown Manhattan Heliport, 20 South Street, Pier 6 East River, New York, New York 10004, Attention: Corporate Secretary or by telephone at (212) 776-4046.

Stockholder Communications

Stockholders may send correspondence by mail to the full Board of Directors or to individual directors. Stockholders should address any such correspondence to the Board of Directors or to the attention of the relevant board members in care of Saker Aviation Services, Inc., Downtown Manhattan Heliport, 20 South Street, Pier 6 East River, New York, New York 10004, Attention: Corporate Secretary.

All stockholder correspondence will be compiled and forwarded as appropriate. In general, correspondence relating to corporate governance issues, long-term corporate strategy or similar substantive matters will be forwarded to the Board of Directors, one of the aforementioned committees of the Board of Directors, or a member thereof for review. Correspondence relating to the ordinary course of business affairs, personal grievances, and matters as to which we tend to receive repetitive or duplicative communications are usually more appropriately addressed by our executive officer or his designees and will be forwarded to such persons accordingly.

EXECUTIVE OFFICERS

Current Executive Officers

Our current executive officers are Alvin S. Trenk, who serves as a Director as well as our Chief Executive Officer, and Ronald J. Ricciardi, who serves as a Director as well as our President. Messrs. Trenk and Ricciardi serve at the discretion of the board. Messrs. Trenk and Ricciardi’s business experience are outlined in the section entitled “Business History of Director Nominees” under the caption “Proposal One: Election of Directors” on page 5 of this Proxy Statement.

COMPENSATION OF NAMED EXECUTIVE OFFICERS AND DIRECTORS

Compensation Overview

We are currently considered a “smaller reporting company” for purposes of the SEC’s executive compensation and other disclosure rules. In accordance with the SEC’s executive compensation disclosure rules, a smaller reporting company must provide a Summary Compensation Table (reporting compensation for the prior two years) and an Outstanding Equity Awards at Fiscal Year-End Table, as well as certain limited narrative disclosures.

Because we are a smaller company, our compensation philosophy and objectives are to provide compensation that is fair and reasonable and is at a competitive level that will allow us to attract and retain qualified personnel necessary to operate at the most efficient level possible. In this context, we seek to offer total compensation packages at levels we consider to be competitive in the marketplace in which we compete for talent.

We believe that the skill and dedication of our executive officers are critical factors that affect our long-term success. Accordingly, the Compensation Committee has designed our compensation program to motivate and retain our Chief Executive Officer and President to align executive compensation with the attainment of strategic business objectives that are intended to increase stockholder returns.

The compensation program that we provide for our executive officers generally consists of three major components: (1) base salary, which is reviewed annually by the Compensation Committee; (2) an opportunity to earn annual cash bonuses; and (3) long-term equity-based incentive awards (historically delivered in the form of stock options). Our President also receives health and welfare benefits, and is eligible to participate in our 401(k) plan.

Summary Compensation Table for Fiscal Year 201

6

The following table sets forth the annual and long-term compensation paid by us during the fiscal years ended December 31, 2016 and 2015 for services performed on our behalf with respect to the persons who served as our named executive officers as of December 31, 2016. Alvin S. Trenk, our Chief Executive Officer, and Ronald J. Ricciardi, our President, are the only persons who served as our principal operating or principal financial officers in fiscal 2016. We have no other executive officers. Mr. Trenk has taken no compensation for either of the fiscal years ended 2016 or 2015, except as it relates to his status as a director of the Company.

SUMMARY COMPENSATION TABLE

|

Name and Principal Position

|

Year

|

Salary

($)(1)

|

Bonus

($)

|

Option

Awards

($)

|

All Other

Compensation

($)(2)

|

Total

($)

|

|

|

|

|

|

|

|

|

|

Ronald J. Ricciardi, President

|

2016

|

150,000

|

—

|

—

|

16,236

|

166,236

|

|

|

2015

|

150,000

|

—

|

—

|

18,132

|

168,132

|

|

1.

|

Mr. Ricciardi received a base salary of $150,000 in 2016 and 2015.

|

|

|

|

|

2.

|

Mr. Ricciardi receives health insurance coverage estimated at a value of approximately $978 per month in 2016 and approximately $1,136 in 2015. Mr. Ricciardi received a match to his 401K contributions from us amounting to approximately $4,500 in both 2016 and 2015.

|

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2016

|

Name

|

Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#)(1)

|

Option

Exercise

Price

($)

|

Option

Expiration

Date

|

|

|

|

|

|

|

Ronald J. Ricciardi

|

300,000

|

0.03

|

10/21/2018

|

|

|

|

|

|

|

Alvin S. Trenk

|

500,000

|

0.08

|

Various(2)

|

|

1.

|

Mr. Ricciardi received on October 21, 2010 an option for 300,000 shares at $0.03 per share, the closing price of the common stock on October 20, 2010, which option vested on October 21, 2013 and is exercisable until October 21, 2018. On April 18, 2017, Mr. Ricciardi exercised this option on a cashless basis and was issued 265,385 shares.

|

|

|

|

|

2.

|

Mr. Trenk received: 1) on December 1, 2016 an option for 100,000 at $0.075 per share, the closing price of the common stock on that date, which option vests on December 1, 2017 and is exercisable until December 1, 2021; 2) on December 1, 2015 an option for 100,000 at $0.080 per share, the closing price of the common stock on that date, which option vested on December 1, 2016 and is exercisable until December 1, 2020; 3) on December 1, 2014 an option for 100,000 at $0.085 per share, the closing price of the common stock on that date, which option vested on December 1, 2015 and is exercisable until December 1, 2019; 4) on December 1, 2013 an option for 100,000 at $0.077 per share, the closing price of the common stock on that date, which option vested on December 1, 2014 and is exercisable until December 1, 2018; and 5) on December 1, 2012 an option for 100,000 at $0.084 per share, the closing price of the common stock on that date, which option vested on December 1, 2015 and is exercisable until December 1, 2017.

|

Employment Agreements

We do not have any current employment agreements.

Additional Narrative Disclosure Regarding Compensation

We do not offer a defined benefit retirement or pension plan. Our 401k Plan (the “401K Plan”) covers all of our employees. The 401K Plan contains an option for us to match each participant's contribution. Any contributions by us vest over a five-year period on a 20% per year basis. In January 2011, we set our match of participant contributions at a rate of 50% of the first 6% of participant deferrals. Our contributions to the 401K Plan totaled approximately $28,000 and $41,000 for the years ended December 31, 2016 and 2015, respectively.

2016 DIRECTOR COMPENSATION TABLE

|

Name

|

Fees

Earned in

Cash

($)(1)

|

Option

Awards

($)(2)

|

Total

($)

|

|

|

|

|

|

|

Alvin S. Trenk

|

1,000

|

7,500

|

8,500

|

|

|

|

|

|

|

William B. Wachtel

|

1,000

|

7,500

|

8,500

|

|

|

|

|

|

|

Marc Chodock

|

1,500

|

7,500

|

9,000

|

|

|

|

|

|

|

Roy P. Moskowitz

|

1,500

|

7,500

|

9,000

|

|

1.

|

Each non-employee director and our Chief Executive Officer, Alvin S. Trenk, are entitled to a fee of $1,000 per board meeting and $750 and $500 per committee meeting for committee chairman and committee members, respectively. Each director is also entitled to reimbursement for expenses incurred in connection with attendance at meetings of the Board of Directors.

|

|

|

|

|

2.

|

Each non-employee director and our Chief Executive Officer, Alvin S. Trenk, are eligible to be granted an annual option to purchase shares of our common stock. On December 1, 2016, the Board of Directors granted each non-employee director and our Chief Executive Officer, Alvin S. Trenk, an option for their service in 2016. Each option was for 100,000 shares and was priced at $0.075 per share, which was the closing sales price of our common stock on December 1, 2016. The options vest on December 1, 2017 and may be exercised until December 1, 2021.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information as of June 30, 2017 regarding the beneficial ownership of our common stock by:

|

●

|

each of our current executive officer and directors; and

|

|

|

|

|

●

|

all of our current directors and executive officer as a group; and

|

|

|

|

|

●

|

each other person or entity known by us to own beneficially 5% or more of our issued and outstanding common stock;

|

|

Name of Beneficial Owner

|

|

Number of Shares of Common Stock

Beneficially

Owned

|

|

|

Common Stock

Beneficially

Owned (1)

P

ercentage of

|

|

|

|

|

|

|

|

|

|

|

|

|

William B. Wachtel (2)

|

|

|

5,584,407

|

(3)

|

|

|

16.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Ronald J. Ricciardi (4)

|

|

|

1,308,960

|

|

|

|

3.9

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Alvin S. Trenk (5)

|

|

|

1,285,444

|

(6)

|

|

|

3.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Marc Chodock (7)

|

|

|

3,100,000

|

(8)

|

|

|

9.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Roy P. Moskowitz (9)

|

|

|

170,000

|

(10)

|

|

|

0.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All directors and officers as a group (5 in number)

|

|

|

11,483,426

|

|

|

|

33.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Ronald I. Heller

(11)

|

|

|

1,922,545

|

(12)

|

|

|

5.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

All Beneficial Holders

as a group (6 in number)

|

|

|

13,405,971

|

|

|

|

38.8

|

%

|

|

(1)

|

The percentages computed in the table are based upon 33,422,995 shares of our common stock, which were outstanding on June 30, 2017. Effect is given, pursuant to Rule 13-d(1)(i) under the Exchange Act, to shares of our common stock issuable upon the exercise of options or warrants currently exercisable or exercisable within 60 days of June 30, 2017.

|

|

|

|

|

(2)

|

William B. Wachtel is our Chairman of the Board and a director. Mr. Wachtel’s address is 20 South Street, Pier 6 East River, New York, New York 10004.

|

|

|

|

|

(3)

|

The shares of our common stock reported in the table include: (a) 100,000 shares issuable upon the exercise of an option expiring December 1, 2017, which option is currently exercisable; (b) 100,000 shares issuable upon the exercise of an option expiring December 1, 2018, which option is currently exercisable; (c) 100,000 shares issuable upon the exercise of an option expiring December 1, 2019, which option is currently exercisable; and (d) 100,000 shares issuable upon the exercise of an option expiring December 1, 2020, which option is currently exercisable. The shares of our common stock reported in the table do not reflect (x) 100,000 shares issuable upon the exercise of an option granted on December 1, 2016, which shall become exercisable on December 1, 2017; and (y) 333,400 shares of our common stock acquired by Wachtel Missry, LLP, which has provided certain legal services for us. Mr. Wachtel is a managing partner of such firm, but does not have sole dispositive or voting power with respect to such firm’s securities.

|

|

|

|

|

(4)

|

Ronald J. Ricciardi is our President and a director. Mr. Ricciardi’s address is 20 South Street, Pier 6 East River, New York, New York 10004.

|

|

|

|

|

(5)

|

Alvin S. Trenk is our Chief Executive Off

icer and a director. Mr. T

renk’s address is 20 South Street, Pier 6 East River, New York, New York 10004.

|

|

(6)

|

The shares of our common stock reported in the table include: (a) 100,000 shares issuable upon the exercise of an option expiring December 1, 2017, which option is currently exercisable; (b) 100,000 shares issuable upon the exercise of an option expiring Decem

b