By Annie Gasparro and Heather Haddon

Whole Foods Market Inc. lost its edge, and now it's losing its

independence.

With a sale to Amazon.com Inc. announced Friday, Whole Foods is

entering a new frontier, joining the mass retailers from which it

has long striven to differentiate itself.

For decades, the natural and organic food retailer grew faster

than the rest of the grocery industry by tapping into an emerging

population of affluent urbanites interested in a new way of eating

and grocery shopping. It had a certain cachet, with a distinct

offering of organic foods and specially trained salespeople

promoting an experience for which customers were willing to pay

more.

But in recent years, as mainstream grocers from Kroger Co. to

Wal-Mart Stores Inc. began stocking more natural and organic food

at cheaper prices, Whole Foods began to lose its advantage.

"They didn't do enough to continue to command the higher

prices," said Gaurav Gupta, a corporate-strategy consultant at

Kotter International. "Their competitive advantage has eroded

slowly over the last five years."

For nearly two years, Whole Foods, which has about 460 stores,

has faced its longest stretch of quarterly same-store sales

declines since it began trading on the stock market in 1992. Its

share price had been cut in half leading up to Friday's

announcement.

Amazon said it has agreed to acquire Whole Foods for $42 a share

in a deal valued at $13.7 billion, including debt.

Pressure on Whole Foods, and its co-founder and Chief Executive

John Mackey, mounted this year, when activist investor Jana

Partners, with several allies, unveiled a stake in Whole Foods and

publicly pushed the company to explore a sale. The new dynamic

added to shareholder tension that had been more quietly bubbling,

turning attention to the sliding results after years of being a

highflying stock.

Since it opened its first store in 1980, Whole Foods has prided

itself on its independence. Mr. Mackey, a strict vegan, aimed to

bring organic and natural food to the world. During the 1990s and

2000s, Whole Foods expanded rapidly, buying 11 regional health-food

chains and opening more stores. As recently as last year, he spoke

of expanding the chain to 1,200 stores in the U.S.

Whole Foods' problem with how customers perceived its prices

worsened in the summer of 2015, when the New York Department of

Consumer Affairs accused it of overcharging customers in nine

stores by putting incorrect weights on some items.

"That was when these other competitors were really starting to

ramp up, so that was when they needed to reverse that perception,

not reinforce the negative perception," said Sonia Lapinsky,

managing director in the retail practice at AlixPartners. Whole

Foods' sales and stock never came back from that, she said.

Whole Foods put its efforts toward lowering its prices compared

with rivals like Kroger. It expanded its private-label brand,

called 365, to more foods and opened a new line of smaller stores

called 365 by Whole Foods, aimed at offering overall lower

prices.

But it was too little too late, Wall Street analysts say.

Despite its efforts, Whole Foods' prices are still 20% to 30%

higher than mainstream grocers', according to consulting firm

OC&C Strategy Group. Earlier this year, Whole Foods said it was

closing several underperforming stores and no longer aiming for

1,200 locations in the U.S.

In November, Whole Foods said its longtime co-chief Walter Robb

would step down, leaving Mr. Mackey to make swifter decisions to

turn around the lagging business. Last year, Whole Foods' profit

declined by more than 5% and its comparable-store sales fell

2.5%.

Mr. Mackey moved more purchasing decisions to its Austin

headquarters and made other organizational changes to operate more

like a national grocer than a startup.

But Jana Partners said it wasn't enough. The activists pushed

for board changes and a slew of operational changes if the company

was going to prove it could stand alone. Neuberger Berman, a mutual

fund that doesn't typically speak publicly, and other investors

were calling for change as well.

In May, Whole Foods moved to shake up its board, naming five new

directors and planning to remove two others by the next annual

meeting. Jana, though, balked at a settlement offer that would have

given the hedge fund only a few seats. That kept the public

pressure on the company.

Whole Foods and Jana declined to comment on Friday. Neuberger

Berman portfolio manager Charles Kantor applauded the strategic

move of uniting with Amazon, but also speculated the bid could be

topped.

The unique problems facing Whole Foods came as the grocery

sector more broadly continued to grapple with a host of pressures.

In recent years, consumers have been buying more of groceries

through online merchants, with discounters and meal-kit delivery

services all grabbing market share. A glut in commodities from

grains to meat has brought down prices for many staple foods over

the past 18 months, putting pressure on many retailers to lower

their prices.

Amazon brings an innovative, technology-driven perspective to

Whole Foods that could help it improve, analysts say. Mr. Mackey

will remain chief executive of Whole Foods and the stores will

continue to operate under the Whole Foods brand and maintain its

suppliers.

Richard Gerber, a former Whole Foods regional president whose

Florida-based health-food chain was acquired by the grocer in 1997,

welcomed the Amazon bid. He said Mr. Mackey was an innovator in

their sector for a period, but that things in the industry have

since changed.

"We are granola people but it's about profitability. It's for

your shareholders," said Mr. Gerber, who consults in grocery and is

a Whole Foods shareholder. "Whole Foods has been unable to find

their way. They've been lost in the forest for a long time and they

haven't been able to reinvent themselves fast enough."

-- David Benoit contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com and Heather

Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

June 16, 2017 15:47 ET (19:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

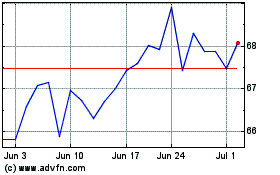

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

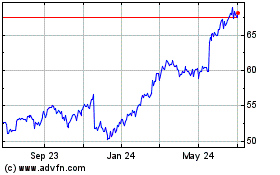

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024