Current Report Filing (8-k)

June 13 2017 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2017

HALLIBURTON COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation

)

|

001-03492

(Commission File Number)

|

No. 75-2677995

(IRS Employer Identification No.)

|

|

3000 North Sam Houston Parkway East, Houston, Texas 77032

|

|

(Address of Principal Executive Offices and zip code)

|

Registrant's Telephone Number, Including Area Code: (281) 871-2699

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

INFORMATION TO BE INCLUDED IN REPORT

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 12, 2017, Halliburton announced that Christopher T. Weber will become its Executive Vice President and Chief Financial Officer effective June 22, 2017. Robb L. Voyles, who has been serving as interim Chief Financial Officer, will continue to serve as the Company's Executive Vice President, Secretary and General Counsel.

Mr. Weber, age 44, was senior vice president and chief financial officer of Parker Drilling Company, May 2013 to June 2017. He was vice president and treasurer of Ensco plc, 2011 to May 2013.

Halliburton entered into an Executive Agreement with Mr. Weber effective June 22, 2017. Pursuant to the Executive Agreement, Mr. Weber will receive an annual base salary of $650,000, a restricted stock award with a grant date value of $483,000 to vest 20% annually over a five (5) year period, nonqualified stock options to purchase shares of Halliburton Company common stock with a grant date value of $207,000 that vest 33 1/3% annually over a three (3) year period, and a restoration grant of Halliburton Company restricted stock with a grant date value of $1,500,000 to vest 100% after a three (3) year period, and will be eligible to participate in the company's performance pay and performance unit incentive plans and to receive grants of restricted stock and stock options under the Halliburton Company Stock and Incentive Plan. The Executive Agreement also restricts Mr. Weber from competing with the company or soliciting company personnel for a period of two years after termination of employment. If Mr. Weber's employment is terminated by Mr. Weber for good reason or by death, disability, or retirement or his employment is terminated by the company for any reason other than cause or Mr. Weber's substantial participation in a breach of fiduciary duty arising from a material violation of a U.S. federal or state law or failure to supervise an employee who substantially participated in such a violation ("significant violation"), all restrictions on restricted stock and units will lapse. In addition, in the case of a termination by Mr. Weber for good reason or termination by the company for any reason other than cause or a significant violation, Mr. Weber will receive a lump sum cash payment equal to two years of his base salary then in effect.

The description of Mr. Weber's Executive Agreement is qualified in its entirety by the provisions of the agreement, which is incorporated by reference to Exhibit 10.1 to this Form 8-K.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

10.1

Executive Agreement (Christopher T. Weber)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HALLIBURTON COMPANY

|

|

|

|

|

|

|

|

|

|

Date: June 13, 2017

|

By:

|

/s/ Bruce A. Metzinger

|

|

|

|

Bruce A. Metzinger

|

|

|

|

Vice President, Public Law and Assistant Secretary

|

EXHIBIT INDEX

EXHIBIT

NUMBER

EXHIBIT DESCRIPTION

10.01

Executive Agreement (Christopher T. Weber)

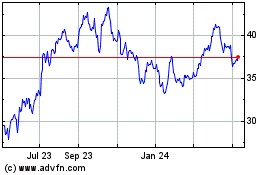

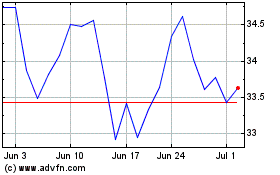

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024