Additional Proxy Soliciting Materials (definitive) (defa14a)

May 23 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[ ]

|

|

Preliminary Proxy Statement

|

|

|

|

|

|

[ ]

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

[ ]

|

|

Definitive Proxy Statement

|

|

|

|

|

|

[ ]

|

|

Definitive Additional Materials

|

|

|

|

|

|

[X]

|

|

Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12

|

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

(Name of Registrant as Specified in Its Chart)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

|

No fee required.

|

|

|

|

|

|

[ ]

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

1.

|

|

Title of each class of securities to which transactions applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ]

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

[ ]

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identity the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

6.

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.

|

|

Date Filed:

|

|

Q.

|

WHY IS THE ANNUAL MEETING OF STOCKHOLDERS BEING POSTPONED?

|

|

A.

|

Institutional Shareholder Services Inc. (“ISS”) is a proxy advisory firm that offers proxy voting recommendations to institutional investors. The other major proxy advisory firm is Glass, Lewis & Co., LLC. (“Glass Lewis”).

|

On May 3, 2017, Glass Lewis issued a report recommending that stockholders vote in line with the recommendation of the Board of Directors (the “Board”) of Firsthand Technology Value Fund, Inc. (the “Company”) and vote AGAINST the non-binding stockholder proposal requesting that the Board take action to replace the current investment advisor of the Company (“Proposal 3”). On May 10, 2017, ISS issued a report recommending that stockholders vote FOR Proposal 3.

We believe ISS’s analysis in support of its recommendation is significantly flawed.

First

, ISS compared the performance of the Company with funds that we believe do not belong in its peer group. Specifically, ISS considers Gladstone Capital Corp. and Capital Southwest Corp. to be in the Company’s peer group, despite the fact that both are credit-focused BDCs that invest primarily in debt securities – an investment approach that is completely distinct from the Company’s.

Second

, ISS compared the Company’s performance to that of the S&P BDC Index, which is composed almost exclusively of credit-focused BDCs. We believe this is akin to comparing the performance of an equity mutual fund to that of a bond mutual fund or an index of bond funds.

The Board believes strongly that ISS made its recommendation in error and wants additional time to discuss the issue with ISS.

|

Q.

|

WHAT AM I BEING ASKED TO CONSIDER AND VOTE ON AT THE POSTPONED ANNUAL MEETING?

|

|

A.

|

The matters to be considered and voted upon at the postponed 2017 Annual Meeting of Stockholders (the “Annual Meeting”) are the same that were to be considered at the previously scheduled May 23, 2017 Annual Meeting:

|

|

|

•

|

Proposal 1: The election of two Class III Directors to serve until the Company’s 2020 Annual Meeting of Stockholders and until their successors are duly elected and qualify. The directors currently serving in Class III are Kevin Landis and Kimun Lee.

|

|

|

•

|

Proposal 2: The ratification of the selection of Tait, Weller & Baker LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017.

|

In addition, if properly presented at the Annual Meeting, stockholders will consider and vote on the following non-binding stockholder proposal:

|

|

•

|

Proposal 3: That the Board of Directors take action to replace the current investment advisor of Firsthand Technology Value Fund, Inc.

|

|

Q.

|

WHEN WILL THE POSTPONED ANNUAL MEETING BE HELD?

|

|

A.

|

The new Annual Meeting date is Tuesday, July 11, 2017, at 2:00 p.m., Pacific Time. The Annual Meeting will be held at the Hilton San Jose Hotel, 300 Almaden Boulevard, San Jose, CA 95110.

|

|

Q.

|

WHAT IF I ALREADY SUBMITTED MY PROXY?

|

|

A.

|

If you have already submitted your proxy with voting instructions, there is no need to submit another proxy; your vote will be counted. If you wish to change your vote, you may do so by:

|

|

|

•

|

sending a letter revoking your proxy to the Secretary of the Company at our offices located at 150 Almaden Boulevard, Suite 1250, San Jose, CA 95113;

|

|

|

•

|

re-submitting your vote via Internet or telephone by following the instructions on the proxy card you received;

|

|

|

•

|

properly executing and sending a later-dated proxy; or

|

|

|

•

|

attending the Annual Meeting, requesting return of any previously delivered proxy, and voting in person. Attendance at the Annual Meeting alone will not revoke your proxy.

|

Firsthand Technology Value (NASDAQ:SVVC)

Historical Stock Chart

From Mar 2024 to Apr 2024

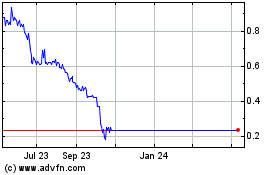

Firsthand Technology Value (NASDAQ:SVVC)

Historical Stock Chart

From Apr 2023 to Apr 2024