Canadian Dollar Weakens After Core Retail Sales Fall Unexpectedly

May 19 2017 - 5:45AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the European session on Friday, after data showed that the nation's

consumer price inflation matched forecasts, while core retail sales

fell unexpectedly.

Data from Statistics Canada showed that the consumer price index

rose a seasonally adjusted 0.5 percent on month in April, matching

expectations.

This follows a 0.2 percent drop in March.

Core inflation, excluding food and energy, ticked up 0.1 percent

month-on-month in April, after a 0.1 percent decline a month

ago.

Separate data showed that Canadian retail sales rose 0.7 percent

on a monthly basis in March, surpassing forecasts for a 0.3 percent

uptick. The February reading was revised to a 0.4 percent fall,

whose reading was previously reported as 0.6 percent decline.

Core retail sales fell 0.2 percent month-over-month in March,

slightly steeper than previous month's 0.1 percent slide.

Economists were looking for a gain of 0.2 percent.

The currency was higher before the release of data, buoyed by

higher oil prices. Oil prices rallied on optimism that oil

producing nations will agree on an extension of output deal at a

meeting next week.

The loonie spiked up against its major rivals in the Asian

session.

The loonie fell to 81.74 against the yen, from a 2-day high of

82.33 hit at 4:45 am ET. The loonie-yen pair is likely to find

support around the 80.00 area.

The loonie, having advanced to a 2-day high of 1.0077 against

the aussie at 9:00 pm ET, reversed direction and edged down to

1.0135. The loonie is seen finding support around the 1.02

level.

The loonie weakened to 1.5204 against the European currency, off

its previous 2-day high of 1.5089. Continuation of the loonie's

downtrend may see it challenging support around the 1.53 mark.

Figures from the European Central Bank showed that the euro area

current account surplus declined in March largely due to widening

shortfall on secondary income.

The current account surplus fell to a seasonally adjusted EUR

34.1 billion in March from a record EUR 37.8 billion in

February.

Following a 3-week high of 1.3554 hit at 8:15 am ET against the

greenback, the loonie eased off to 1.3598 after the data. If the

loonie extends fall, 1.37 is likely seen as its next support level.

Looking ahead, Eurozone preliminary consumer sentiment index for

May is due shortly.

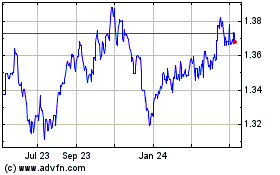

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

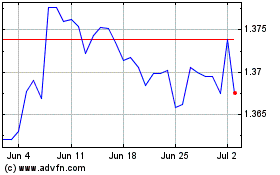

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024