Ahead of the Tape: Wal-Mart Deserves Credit for Web Effort -- WSJ

May 18 2017 - 3:03AM

Dow Jones News

By Steven Russolillo

It has been an earnings season to forget for retailers. Wal-Mart

Stores Inc., the biggest of all, at least appears better-positioned

than most.

The world's largest retailer's fiscal first-quarter earnings,

out Thursday, should show steady progress at a time when

brick-and-mortar competitors are stumbling. Even with Wal-Mart's

shares trading near a two-year high, results should be good enough

to support more gains.

Analysts polled by FactSet forecast quarterly earnings of 96

cents a share, down two cents from a year earlier. Wal-Mart has

exceeded analysts' estimates for six straight quarters. Revenue for

the period that ended in April is expected to have increased 1.6%

to $117.8 billion. Importantly, sales in stores open at least 12

months are expected to increase for an 11th straight quarter.

Wal-Mart has been raising wages, cutting prices and growing

online sales, particularly in the U.S. These are necessary

investments that have weighed on earnings. But more people have

been going to Wal-Mart's stores and actually buying stuff --

something few retailers can brag about these days.

As a result, Wal-Mart's U.S. business has taken on added

importance. Domestic sales accounted for 63.4% of its overall total

in its most-recently completed fiscal year that ended in January,

the highest in seven years and up from a low of 58.5% four years

ago. For the first quarter, analysts estimate U.S. sales increased

2.5%, higher than overall expected top-line growth.

Investors also are giving Wal-Mart the benefit of the doubt as

it bulks up its e-commerce operations. The strategic shift started

last year when Wal-Mart bought Jet.com for $3.3 billion and

installed the site's founder, Marc Lore, as the company's head of

U.S. online operations. Wal-Mart has since made several smaller

e-commerce purchases, such as ModCloth, Shoebuy and Moosejaw.

The Jet purchase helped juice online sales in the U.S., which

rose 29% in the fourth quarter from a year ago. Now Wal-Mart is

pushing in-store pickup of online orders as a way to get people to

keep going to their physical locations. Wal-Mart is charging online

buyers less if they go to stores and pick up their orders, a

strategy aimed at competing with rival Amazon.com Inc.

Shares have jumped 9% over the past three months while the Dow

Jones Industrial Average has been roughly flat. That has pushed

Wal-Mart's valuation to a rich 17 times projected earnings over the

next 12 months. But in this turbulent retail environment, paying up

for steady performance is a fair trade-off.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

May 18, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

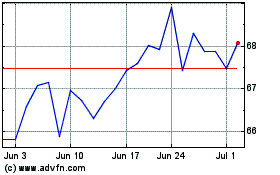

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

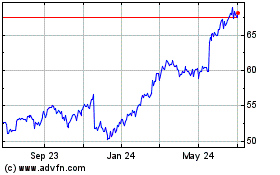

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024