Current Report Filing (8-k)

May 17 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________

FORM 8-K

______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2017

______________________________________________

Markel Corporation

(Exact name of registrant as specified in its charter)

______________________________________________

|

|

|

|

|

|

|

|

|

Virginia

|

|

001-15811

|

|

54-1959284

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4521 Highwoods Parkway

Glen Allen, Virginia 23060-6148

(804) 747-0136

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Not Applicable

(Former name or former address, if changed since last report.)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

[ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On May 15, 2017, the Board of Directors of Markel Corporation (the Company), upon the recommendation of the Board’s Compensation Committee, approved a change to the form of award agreement used for performance-based restricted stock units (RSUs) for executive officers, including the Company’s named executive officers. These awards are made under the Company's 2016 Stock Incentive Compensation Plan (the Plan). Subject to specific exceptions, unvested performance-based RSUs are forfeited upon a separation of service that occurs prior to the applicable vesting date. The Board approved an additional vesting exception, which provides that upon Early Retirement (as defined in the Plan) by an employee with 25 years of continual service unvested performance-based RSUs will become fully vested and shares will be issued on the otherwise applicable vesting date.

A copy of the new form of award agreement for performance-based RSUs is filed as Exhibit 10.1 to this report and is incorporated herein by reference in response to this item.

|

|

|

|

|

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Annual Meeting of Shareholders of Markel Corporation was held on May 15, 2017. At the annual meeting, shareholders (i) elected directors to serve until the 2018 Annual Meeting of Shareholders, (ii) approved an advisory vote on executive compensation and (iii) ratified the selection of KPMG LLP by the Audit Committee of the Board of Directors as the Company’s independent registered public accounting firm for the year ending December 31, 2017. With respect to the advisory vote on the frequency of shareholder advisory votes approving executive compensation, shareholders were in favor of holding an advisory vote on executive compensation every year.

The results of the meeting were as follows:

Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors

|

|

For

|

|

|

|

Against

|

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. Alfred Broaddus, Jr.

|

|

|

10,354,782

|

|

|

|

|

|

321,660

|

|

|

|

|

7,387

|

|

|

|

|

1,909,127

|

|

|

|

K. Bruce Connell

|

|

|

10,592,738

|

|

|

|

|

|

83,637

|

|

|

|

|

7,454

|

|

|

|

|

1,909,127

|

|

|

|

Douglas C. Eby

|

|

|

10,361,631

|

|

|

|

|

|

314,549

|

|

|

|

|

7,649

|

|

|

|

|

1,909,127

|

|

|

|

Thomas S. Gayner

|

|

|

10,386,663

|

|

|

|

|

|

291,178

|

|

|

|

|

5,988

|

|

|

|

|

1,909,127

|

|

|

|

Stewart M. Kasen

|

|

|

10,131,658

|

|

|

|

|

|

544,602

|

|

|

|

|

7,569

|

|

|

|

|

1,909,127

|

|

|

|

Alan I. Kirshner

|

|

|

10,252,486

|

|

|

|

|

|

424,520

|

|

|

|

|

6,823

|

|

|

|

|

1,909,127

|

|

|

|

Lemuel E. Lewis

|

|

|

10,508,287

|

|

|

|

|

|

168,362

|

|

|

|

|

7,180

|

|

|

|

|

1,909,127

|

|

|

|

Anthony F. Markel

|

|

|

10,270,749

|

|

|

|

|

|

406,217

|

|

|

|

|

6,863

|

|

|

|

|

1,909,127

|

|

|

|

Steven A. Markel

|

|

|

10,271,836

|

|

|

|

|

|

405,946

|

|

|

|

|

6,047

|

|

|

|

|

1,909,127

|

|

|

|

Darrell D. Martin

|

|

|

10,040,974

|

|

|

|

|

|

635,753

|

|

|

|

|

7,102

|

|

|

|

|

1,909,127

|

|

|

|

Michael O’Reilly

|

|

|

10,571,253

|

|

|

|

|

|

105,000

|

|

|

|

|

7,576

|

|

|

|

|

1,909,127

|

|

|

|

Michael J. Schewel

|

|

|

10,249,222

|

|

|

|

|

|

426,836

|

|

|

|

|

7,771

|

|

|

|

|

1,909,127

|

|

|

|

Jay M. Weinberg

|

|

|

10,425,048

|

|

|

|

|

|

251,754

|

|

|

|

|

7,027

|

|

|

|

|

1,909,127

|

|

|

|

Richard R. Whitt, III

|

|

|

10,542,306

|

|

|

|

|

|

134,014

|

|

|

|

|

7,509

|

|

|

|

|

1,909,127

|

|

|

|

Debora J. Wilson

|

|

|

10,600,936

|

|

|

|

|

|

75,918

|

|

|

|

|

6,975

|

|

|

|

|

1,909,127

|

|

|

Advisory Vote on Approval of Executive Compensation

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

10,550,192

|

|

116,115

|

|

17,522

|

|

1,909,127

|

Advisory Vote on the Frequency of Shareholder Advisory Votes Approving Executive Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

One Year

|

|

Two Years

|

|

Three Years

|

|

Abstain

|

|

Broker Non-Votes

|

|

9,513,156

|

|

196,990

|

|

958,713

|

|

14,970

|

|

1,909,127

|

Ratification of Selection of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

12,459,219

|

|

123,011

|

|

10,726

|

|

Not applicable

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

10.1

|

Form of Performance-Based Restricted Stock Unit Award Agreement for Executive Officers for the 2016 Equity Incentive Compensation Plan (revised May 15, 2017)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARKEL CORPORATION

|

|

|

|

|

|

|

Date: May 17, 2017

|

|

|

|

By:

|

|

/s/ Richard R. Grinnan

|

|

|

|

|

|

Name:

|

|

Richard R. Grinnan

|

|

|

|

|

|

Title:

|

|

General Counsel and Secretary

|

Exhibit Index

|

|

|

|

|

|

Exhibit

|

Description

|

|

|

|

|

10.1

|

Form of Performance-Based Restricted Stock Unit Award Agreement for Executive Officers for the 2016 Equity Incentive Compensation Plan (revised May 15, 2017)

|

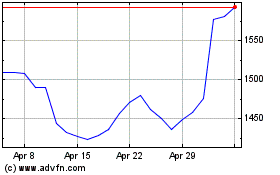

Markel (NYSE:MKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

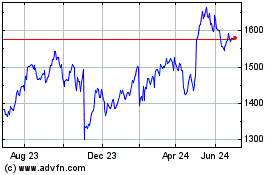

Markel (NYSE:MKL)

Historical Stock Chart

From Apr 2023 to Apr 2024