Report of Foreign Issuer (6-k)

May 17 2017 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2017

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ [National Register of Legal Entities] nº 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

MATERIAL FACT NOTICE

Ambev S.A.

(“Company”) informs its shareholders and the public that the Company’s Board of Directors, in a meeting held on May 16, 2017, according to the minutes made available on the SEC and Investor Relations Department’s websites, approved the execution, by and between the Company, or a controlled entity, and financial institutions to be approved by the Board of Officers, of equity swaps, having as underlying asset the shares issued by the Company or American Depositary Receipts representing these shares (“ADRs”). Additional information is attached to the minutes of the Board of Directors’ meeting.

The settlement of the equity swap will take place within a maximum period of 18 months from this date, and the agreements may result in an exposure of up to 80 million common shares (of which all or part may be through ADRs), with a limit value of up to R$ 1.5 billion.

The equity swap will allow the Company or its controlled entities to receive the price variation related to its shares traded on the stock exchange or ADRs and pay CDI or LIBOR plus a fee, during the term of the agreement, as applicable.

The purpose of the transaction is to neutralize the possible effects of the stock prices’ oscillation in view of the future delivery of shares or ADRs by the Company within the scope of its share-based payment programs.

São Paulo, May 16, 2017.

Ambev S.A.

Ricardo Rittes de Oliveira Silva

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 16, 2017

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Ricardo Rittes de Oliveira Silva

|

|

|

Ricardo Rittes de Oliveira Silva

Chief Financial and Investor Relations Officer

|

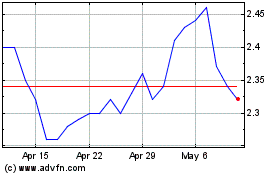

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

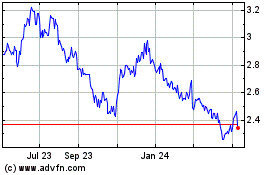

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024