Abode Properties CEO Daniel Moos Attends Patriots Ceremony at the White House

May 03 2017 - 8:00AM

Business Wire

President Donald J. Trump recently welcomed the New England

Patriots to the White House to celebrate their Super Bowl victory

win over the Atlanta Falcons. In attendance was Abode Properties

and Pillar Income Asset Management CEO and President, Daniel J.

Moos.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170503005226/en/

Abode Properties and Pillar Income Asset

Management CEO and President, Daniel J. Moos attends Patriots

ceremony at the White House on Wednesday, April 19th 2017. (Photo:

Business Wire)

“Though I’m not necessarily a New England Patriot fan, I am

indeed a Patriot,” commented Daniel Moos. “It was both exciting and

an honor to visit the White House and experience such a time

honored tradition.”

Patriots owner Robert Kraft and head coach Bill Belichick joined

the team on the South Lawn to present President Trump with a

Patriots jersey sporting the number 45.

Pillar Income Asset Management, Inc. is a Dallas-based real

estate management company, which develops and manages in excess of

$2.5 billion of real estate for public and private real estate

entities. Affiliated companies under management or advisement by

Pillar include American Realty Investors, Inc. (NYSE: ARL);

Transcontinental Realty Investors, Inc. (NYSE: TCI); Income

Opportunity Realty Investors, Inc. (NYSE MKT: IOT); and Abode

Properties Inc.

Abode Properties, a subsidiary of Transcontinental Realty

Investors Inc., (NYSE: TCI), a Dallas-based real estate investment

company, represents a premium class of unparalleled multifamily

residential properties. Abode’s investment and strategic focus is

to acquire, develop, and maintain a portfolio of top tier Class-A

quality multifamily residential properties in emerging markets that

correspond with both sustainable and viable economic growth

activity. Our ability to identify investment opportunities,

establish proven and successful operational practices, implement

efficient on-site management, and obtain optimal debt structures

sets us apart to realize maximum cash flows and consistent

risk-adjusted returns. Enhanced shareholder value will continue to

be generated through investments in both acquisition and

development of sustainable Class-A multifamily housing in focused

secondary and tertiary markets. These markets, generally, represent

high-growth suburban areas, where an increasing population and

strong economic conditions signal long-term and resilient demand.

An exceptional and forward thinking leadership team further

complements our continued efforts to deliver a quality living

experience for our residents, while diversifying our holdings

through the Southwest and Southeast United States. Accordingly,

Abode’s seasoned executive leadership team and expertise will

continue to strategically manage cash flow, revenue, capital, and

reserves, while focusing on increasing the overall equity base,

optimizing leverage, and ensuring market diversification.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170503005226/en/

for Abode PropertiesChris Childress,

469-522-4275press@pillarincome.com

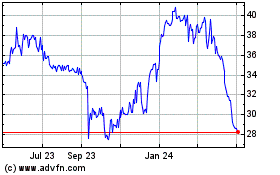

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024