Third Point Calls for Honeywell to Spin Off Aerospace Unit

April 27 2017 - 6:42PM

Dow Jones News

By David Benoit and Thomas Gryta

Activist investor Third Point LLC disclosed it has taken a stake

in Honeywell International Inc. and called on the conglomerate's

newly appointed chief executive to spin off its aerospace

business.

The aerospace unit has been a drag on the company's performance

and separating it "would result in a sustained increase in

shareholder value in excess of $20 billion," Daniel Loeb's Third

Point wrote in a letter to its investors Thursday. The activist

argued organic growth at the unit has lagged behind that of its

peers.

Honeywell said it would conduct a review of the potential

separation of its aerospace business. "Honeywell's management and

Board regularly conduct portfolio assessments and have a

demonstrated track record of effective portfolio realignment and

capital deployment actions," the company said.

Honeywell, which has a market value of about $100 billion, makes

everything from aircraft landing gears to home thermostats. The

aerospace business accounts for about 37.5%, or $39.3 billion, of

its annual sales. The segment's revenue declined 3% in 2016.

Shares of Honeywell jumped 4.7% to $136.00 on the news in

after-hours trading Thursday.

Third Point's approach comes a few weeks after Darius Adamczyk

took over as Honeywell's CEO from longtime leader David Cote, who

remains the company's chairman.

Write to David Benoit at david.benoit@wsj.com and Thomas Gryta

at thomas.gryta@wsj.com

(END) Dow Jones Newswires

April 27, 2017 18:27 ET (22:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

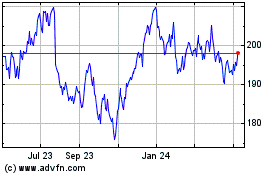

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

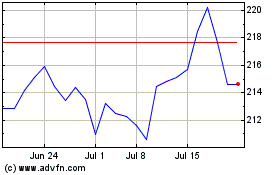

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024