Current Report Filing (8-k)

April 27 2017 - 1:27PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Act of 1934

April 26, 2017

(Date of earliest event Reported)

NEXT GROUP HOLDINGS, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1111 Brickell Avenue, Suite 2200, Miami,

FL, 33131

(Address of principal executive offices)

Registrant's telephone number, including area

code: (800) 611-3622

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

NOTE ABOUT FORWARD

LOOKING STATEMENTS

Most of the matters discussed within this report

include forward-looking statements on our current expectations and projections about future events. In some cases you can identify

forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,”

“expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,”

and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a

number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual

results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and

uncertainties include the risks noted under “Item 1A Risk Factors.” We undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 1.01. Entry into a Definitive Material

Agreement.

On April 26, 2017 Next Group Holdings, Inc, ("NXGH" or

the "Company") signed a Purchase and Sale Agreement with Dean Keatin Marketing, LLC ("DKM") and related parties

to sell back AIM (Accent Intermedia, LLC) to DKM. This Agreement will release NXGH from approximately $1.9 million in debt and

other obligations. NXGH acquired AIM from DKM when it signed the previous “Purchase and Sale Agreement” on July 22,

2016.

As per the Agreement, NXGH shall sell, transfer

and deliver to DKM, 100% of the capital stock of Transaction Processing Products, Inc. (“TPP”) and all AIM venture

debt, for $1. DKM will indemnify and hold harmless NXGH for any and all liabilities or costs incurred by NXGH arising from AIM

prior to July 7, 2016 including the approximate $2 million in payables currently being carried by AIM. Upon execution, this $2

million in payables will be removed from the consolidated financial statements of NXGH. NXGH is responsible for any and all costs

associated with the termination of any employee of AIM that occurred after July 7, 2016 to the date of this Agreement.

As per the Agreement, NXGH shall be entitled to 45% of the gross

proceeds of any settlement or judgment obtained by AIM, DKM, TPP or any of their assignees or successors in interest from its litigation

against ComData, Inc./FleetCor (the “FleetCor Litigation).

The parties have agreed to use their best efforts to complete all

pre-closing due diligence and enter into a definitive agreement.

Item 9.01 Exhibit

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Dated: April 27, 2017

|

NEXT GROUP HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Arik Maimon

|

|

|

|

Arik Maimon

|

|

|

|

Chief Executive Officer

|

3

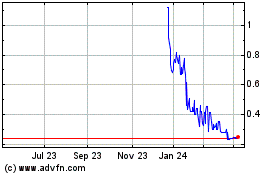

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

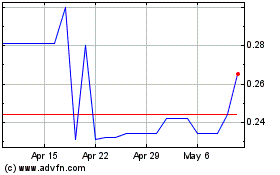

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024