UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April

2017

GRUPO AEROPORTUARIO DEL PACÍFICO S.A.B. DE C.V.

(PACIFIC AIRPORT GROUP)

|

|

(Translation of

Registrant’s Name Into English)

|

|

|

|

México

|

|

(Jurisdiction

of incorporation or organization)

|

|

|

Avenida Mariano Otero No. 1249-B

Torre Pacifico, Piso 6

Col. Rinconada del Bosque

44530 Guadalajara, Jalisco, México

|

|

(Address of principal

executive offices)

|

|

|

(Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

x

Form 40-F

o

(Indicate by check mark whether the Registrant by furnishing the

information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes

o

No

x

(If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

RESOLUTIONS ADOPTED AT THE

GENERAL ORDINARY SHAREHOLDERS’ MEETING

AND GENERAL EXTRAORDINARY SHAREHOLDERS’

MEETING FOR

GRUPO AEROPORTUARIO DEL PACIFICO, S.A.B. DE C.V.

ON APRIL 25, 2017

Guadalajara, Jalisco, Mexico, April 26, 2017 -

Grupo Aeroportuario del Pacifico, S.A.B. de C.V., (NYSE: PAC; BMV: GAP) (“the Company” or “GAP”) announces

the resolutions adopted at the Annual General Ordinary and Extraordinary Shareholders’ Meeting on April 25, 2017 to be the

following:

ANNUAL GENERAL ORDINARY SHAREHOLDERS’

MEETING

MEETING AGENDA

|

|

I.

|

The following items are approved:

|

|

a.

|

|

The Chief Executive

Officer’s report regarding the results of operations for the fiscal year ended December 31, 2016, in accordance with Article

44, Section XI of the Mexican Securities Market Law and Article 172 of the Mexican General Corporations Law, together with the

external auditor’s report, with respect to the Company on an unconsolidated basis in accordance with Mexican Financial Reporting

Standards (“MFRS”), as well as with respect to the Company and its subsidiaries on a consolidated basis in accordance

with International Financial Reporting Standards (“IFRS”), each based on the Company’s most recent financial

statements under both standards.

|

|

b.

|

|

The Board of

Directors’ comments to the Chief Executive Officer’s report.

|

|

c.

|

|

The Board of

Directors’ report in accordance with Article 172, clause b, of the

Mexican

General Corporations Law, regarding the Company’s main accounting policies and criteria, as well as the information used

to prepare the Company’s financial statements.

|

|

For more information

please visit

www.aeropuertosgap.com.mx

or contact:

|

|

|

|

|

|

|

|

In Mexico

|

|

In the U.S.

|

|

Saúl Villarreal García, Chief Financial Officer

|

|

Maria Barona

|

|

Paulina Sánchez, Investor Relations Officer

|

|

i-advize Corporate Communications Inc.

|

|

Grupo Aeroportuario del Pacífico, S.A.B. de C.V.

|

|

Tel: 212 406 3691

|

|

Tel: 52 (33) 38801100 ext 20151

|

|

gap@i-advize.com

|

|

svillarreal@aeropuertosgap.com.mx

|

|

|

|

psanchez@aeropuertosgap.com.mx

|

|

|

|

d.

|

|

The report on

transactions and activities undertaken by our Board of Directors during the fiscal year ended December 31, 2016, pursuant to the

Mexican Securities Market Law.

|

|

e.

|

|

The annual report

on the activities undertaken by the Audit and Corporate Practices Committee in accordance with Article 43 of the Mexican Securities

Market Law, as well as ratification of the actions of the various committees, and release from further obligations.

|

|

f.

|

|

The report on

the Company’s compliance with tax obligations for the fiscal year ended December 31, 2015, and instruction to Company officials

to comply with tax obligations corresponding to the fiscal year ended December 31, 2016, in accordance with Article 26, Section

III of the Mexican Fiscal Code.

|

|

|

II.

|

Approval for the ratification

of the actions by our Board of Directors and officers and release from further obligations in the fulfillment of their duties as

approved by the governing bodies.

|

|

|

III.

|

Approval of the Company’s

financial statements on an unconsolidated basis in accordance with MFRS for purposes of calculating legal reserves, net income,

fiscal effects related to dividend payments and capital reduction, as applicable, and approval of the financial statements of the

Company and its subsidiaries on a consolidated basis in accordance with IFRS for their publication to the financial markets, with

respect to operations during the fiscal year ended December 31, 2016; and approval of the external auditor’s report regarding

the aforementioned financial statements.

|

|

|

IV.

|

Approval of the Company’s

net income for the fiscal year ended December 31, 2016, reported in its unconsolidated financial statements in accordance with

MFRS presented in agenda item III above, which was Ps. 3,161,718,077.00 (THREE BILLION, ONE HUNDRED AND SIXTY-ONE MILLION, SEVEN

HUNDRED AND EIGHTEEN THOUSAND, AND SEVENTY-SEVEN PESOS AND 00/100 M.N.), the allocation of 5% (FIVE PERCENT) of this amount, or

Ps. 158,085,904.00 (ONE HUNDRED AND FIFTY-EIGHT MILLION, EIGHTY-FIVE THOUSAND, AND NINE HUNDRED AND FOUR PESOS AND 00/100 M.N.),

towards increasing the Company’s legal reserves, with the remaining balance of Ps. 3,003,632,173.00 (THREE BILLION, THREE

MILLION, SIX HUNDRED AND THIRTY-TWO THOUSAND, AND ONE HUNDRED AND SEVENTY-THREE PESOS AND 00/100 M.N.) to be allocated to the account

for net income pending allocation.

|

|

|

V.

|

Approval of the allocation from the account for net income pending

allocation, of an amount equal to Ps. 3,052,111,859.00 (THREE BILLION, FIFTY-TWO MILLION, ONE HUNDRED ELEVEN THOUSAND, EIGHT HUNDRED

AND FIFTY-NINE PESOS AND 00/100 M.N.), for declaring a dividend equal to Ps. 5.72 (FIVE PESOS AND 72/100 M.N.) per share, to be

distributed to each share outstanding as of the payment date, excluding any shares repurchased by the Company as of each payment

date in accordance with Article 56 of the

Mexican Securities Market Law; any amounts of

net income pending allocation

remaining after the payment

of such dividend will remain in t

he account for net income pending allocation. The dividend

will be paid in the following manner:

|

Ps. 2.86 (TWO PESOS AND 86/100 M.N.) per share as of the payment

date, to be distributed before August 31, 2017; and Ps. 2.86 (TWO PESOS AND 86/100 M.N.) per share as of the payment date, to be

distributed before December 31, 2017.

|

|

VI.

|

Approval for the cancellation

of any amounts outstanding under the share repurchase program approved at the Annual General Ordinary Shareholders’ Meeting

that took place on April 26, 2016 for Ps. 950,000,000.00 (NINE HUNDRED AND FIFTY MILLION PESOS AND 00/100 M.N.) and approval of

Ps. 995,000,000.00 (NINE HUNDRED AND NINETY-FIVE MILLION PESOS AND 00/100 M.N.) as the maximum amount to be allocated toward the

repurchase of the Company’s shares or credit instruments that represent such shares for the 12-month period following April

25, 2017, in accordance with Article 56, Section IV of the Mexican Securities Market Law.

|

|

|

VII.

|

The ratification of the four members of the Board of Directors and their respective alternates

named by the Series “BB” shareholders as follows:

|

|

Proprietary

|

|

Alternate

|

|

Laura Díez Barroso Azcárraga

|

|

Carlos Laviada Ocejo

|

|

Juan Gallardo Thurlow

|

|

Eduardo Sánchez Navarro Redo

|

|

Francisco Javier Marín San Andrés

|

|

Carlos Manuel Porrón Suárez

|

|

Rodrigo Marabini Ruiz

|

|

Alejandro Cortina Gallardo

|

|

|

VIII.

|

Nomination by Infraestructura

y Transportes México, S.A. de C.V., of Mr. Alfredo de Jesús Casar Pérez as member to the Board of Directors,

in accordance with the corresponding legal guidelines.

|

|

|

IX.

|

Ratification of Mr. Carlos

Cárdenas Guzmán, Mr. Joaquín Vargas Guajardo, Mr. Ángel Losada Moreno, Mr. Roberto Servitje Achutegui,

Mr. Álvaro Fernández Garza and Mr. Juan Díez-Canedo Ruiz, as members of the Board, designated by the Series

“B” shareholders.

|

As of this date, the Board of Directors

will be comprised of the following:

|

Proprietary

|

|

Alternate

|

|

Laura Díez Barroso Azcárraga

|

|

Carlos Laviada Ocejo

|

|

Juan Gallardo Thurlow

|

|

Eduardo Sánchez Navarro Redo

|

|

Francisco Javier Marín San Andrés

|

|

Carlos Manuel Porrón Suárez

|

|

Rodrigo Marabini Ruiz

|

|

Alejandro Cortina Gallardo

|

|

Carlos Cárdenas Guzmán

|

|

Not applicable

|

|

Joaquín Vargas Guajardo

|

|

Not applicable

|

|

Álvaro Fernández Garza

|

|

Not applicable

|

|

Juan Díez-Canedo Ruiz

|

|

Not applicable

|

|

Ángel Losada Moreno

|

|

Not applicable

|

|

Roberto Servitje Achutegui

|

|

Not applicable

|

|

Alfredo de Jesús Casar Pérez

|

|

Not applicable

|

|

|

X.

|

Ratification of Ms. Laura

Díez Barroso Azcárraga as the Company’s Chairwoman of the Board of Directors, and the ratification of Mr. Carlos

Laviada Ocejo as Alternate, in accordance with Article 16 of the Company’s bylaws.

|

|

|

XI.

|

Approval of the compensation

paid to the members of the Company’s Board of Directors during the 2016 fiscal year and approval of the compensation to be

paid in 2017 as follows: (i) a certain percentage to be paid to Directors for their appointment in a fixed manner (suggesting up

to 20%), and (ii) a second percentage, linked to their respective meeting attendance, to be paid in a variable manner (suggesting

up to 80%), which would be divided by the number of Board sessions held each year and would only be paid to those who actually

attended.

|

|

|

XII.

|

Ratification of Mr. Álvaro

Fernández Garza, as member of the Board of Directors designated by the Series “B” shareholders to serve as a

member of the Company’s Nominations and Compensation Committee, in accordance with Article 28 of the Company’s bylaws.

|

|

|

XIII.

|

Ratification of Carlos Cárdenas Guzmán as President of the Audit and Corporate Practices

Committee.

|

The Audit and Corporate Practices Committee

will be comprised of the following:

CARLOS

CáRDENAS

GUZM

á

N, CHAIRMAN

á

NGEL

LOSADA MORENO, MEMBER

JUAN DÍEZ-CANEDO RUIZ, MEMBER

|

|

XIV.

|

The report concerning compliance

with Article 29 of the Company’s bylaws regarding acquisitions of goods or services or contracting of projects or asset sales

that are equal to or greater than US$ 3,000,000.00 (THREE MILLION U.S. DOLLARS), or its equivalent in Mexican pesos or other legal

tender in circulation outside Mexico, or, if applicable, regarding transactions with relevant shareholders.

|

|

XV.

|

|

Approval

to designate Messrs. Fernando Bosque Mohíno, Sergio Enrique Flores Ochoa, Carlos Efrén Torres Flores and/or Mrs.

Erica Barba Padilla as delegates of this Meeting, so that they may, as needed, present to a notary public the resolutions adopted

at this meeting for formalization, carry out any publications that are required and make any announcements necessary in order

to fulfill the decisions adopted in this Meeting and in relation to the preceding agenda points, before the Mexican National Banking

and Securities Commission, the Mexican Stock Exchange and SD INDEVAL, Institución para el Depósito de Valores. S.A.

de C.V., and/or any other entity or institution, and/or to provide any necessary information to these, and, in general, so that

they may carry out each and every one of the actions deemed necessary so that all Resolutions from this Meeting are fully formalized.

|

EXTRAORDINARY SHAREHOLDERS’ MEETING

APRIL 25, 2017

MEETING AGENDA

|

|

I.

|

Approval to reduce the Company’s

shareholders’ equity by a total amount of Ps. 1,750,166,571.51 (ONE BILLION, SEVEN HUNDRED AND FIFTY MILLION, ONE HUNDRED

SIXTY-SIX THOUSAND, FIVE HUNDRED SEVENTY-ONE PESOS AND 51/100 M.N.) and, consequently, pay Ps. 3.33 (THREE PESOS AND 33/100 M.N.)

per outstanding share.

|

As per the aforementioned, the amendment

of the first paragraph of Article 6 of the Company’s bylaws is approved.

|

|

II.

|

Approval

to designate Messrs. Fernando Bosque Mohíno, Sergio Enrique Flores Ochoa, Carlos Efrén Torres Flores and/or Mrs.

Erica Barba Padilla as delegates of this Meeting, so that they may, as needed, present to a notary public the resolutions adopted

at this meeting for formalization, carry out any publications that are required and make any announcements necessary in order to

fulfill the decisions adopted in this Meeting and in relation to the preceding agenda points, before the Mexican National Banking

and Securities Commission, the Mexican Stock Exchange and SD INDEVAL, Institución para el Depósito de Valores. S.A.

de C.V., and/or any other entity or institution, and/or to provide any necessary information to these, and, in general, so that

they may carry out each and every one of the actions deemed necessary so that all Resolutions from this Meeting are fully formalized.

|

Mr. Sergio Enrique Flores Ochoa

Secretary of the Board of Directors

* * *

Company Description:

Grupo Aeroportuario del Pacífico, S.A.B.

de C.V. (GAP) operates 12 airports throughout Mexico’s Pacific region, including the major cities of Guadalajara and Tijuana,

the four tourist destinations of Puerto Vallarta, Los Cabos, La Paz and Manzanillo, and six other mid-sized cities: Hermosillo,

Guanajuato, Morelia, Aguascalientes, Mexicali and Los Mochis. In February 2006, GAP’s shares were listed on the New York

Stock Exchange under the ticker symbol “PAC” and on the Mexican Stock Exchange under the ticker symbol “GAP”.

In April 2015, GAP acquired 100% of Desarrollo de Concesiones Aeroportuarias, S.L., which owns a majority stake of MBJ Airports

Limited, a company operating the Sangster International Airport in Montego Bay, Jamaica.

This press release may

contain forward-looking statements. These statements are not historical facts, and are based on management’s current view

and estimates of future economic circumstances, industry conditions, company performance and financial results. The words “anticipates,”

“believes,” “estimates,” “expects,” “plans” and similar expressions, as they relate

to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial conditions, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

In accordance with Section 806 of the Sarbanes-Oxley

Act of 2002 and article 42 of the “Ley del Mercado de Valores”, GAP has implemented a “

whistleblower

”

program, which allows complainants to anonymously and confidentially report suspected activities that may involve criminal conduct

or violations. The telephone number in Mexico, facilitated by a third party that is in charge of collecting these complaints,

is 01-800-563-0047. The web site is

http://www.lineadedenuncia.com/gap

. GAP’s Audit

Committee will be notified of all complaints for immediate investigation.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Grupo Aeroportuario del Pacífico, S.A.B. de C.V.

|

|

|

|

|

|

By:

/s/ SAÚL VILLARREAL GARCÍA

Name: Saúl Villarreal García

Title: Chief

Financial Officer

|

Date:

April 26, 2017

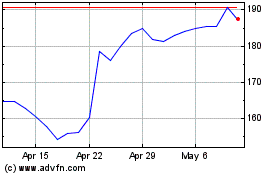

Grupo Aeroportuario Del ... (NYSE:PAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

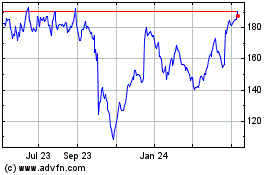

Grupo Aeroportuario Del ... (NYSE:PAC)

Historical Stock Chart

From Apr 2023 to Apr 2024