Registration of Additional Securities (up to 20%) (s-3mef)

April 21 2017 - 1:35PM

Edgar (US Regulatory)

As

filed with the Securities and Exchange Commission on April 21, 2017

Registration

No. 333-

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

Under

The

Securities Act of 1933

ADAMIS

PHARMACEUTICALS CORPORATION

(Exact

name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

|

|

82-0429727

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

|

|

(I.R.S.

Employer

Identification

Number)

|

11682

El Camino Real, Suite 300

San

Diego, CA 92130

(858)

997- 2400

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Dennis

J. Carlo, Ph.D.

Chief Executive Officer

11682 El Camino Real, Suite 300

San Diego, CA 92130

(858)

997-2400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

C.

Kevin Kelso, Esq.

Weintraub

Tobin Chediak Coleman Grodin, Law Corporation

400

Capitol Mall, Suite 1100

Sacramento,

CA 95814

(916)

558-6000

(916)

446-1611 - Facsimile

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☒ (Registration No. 333-196976)

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the SEC pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer”, “emerging

growth company”, “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do

not check if a smaller reporting company)

|

|

Small reporting company

|

|

☒

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

|

☐

|

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with

any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

|

|

Title

of each class of

securities

to be registered

|

|

Proposed

Maximum

Aggregate Offering

Price(1)(2)

|

|

Amount

of

Registration Fee(3)

|

|

Common

Stock, par value $0.0001 per share

|

|

$457,526

|

|

$ 54

|

|

|

|

(1)

|

The Registrant

previously registered an aggregate principal amount of $50,000,000 of Common Stock, Preferred Stock, Warrants and Units

on the Registration Statement on Form S-3 (Registration No. 333- 196976) (the “Related Registration

Statement”) and paid a fee of $6,440. In accordance with Rule 462(b) under the Securities Act of 1933, as amended

(the “Securities Act”), an additional amount of securities having a proposed maximum aggregate offering price

of no more than 20% of the maximum aggregate offering price of the remaining securities eligible to be sold under the

Related Registration Statement on Form S-3 (Registration No. 333-196976) is hereby registered. Includes the

aggregate offering price of shares that the underwriters have the option to purchase.

|

|

|

|

|

(2)

(3)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) promulgated under the Securities Act.

Amount

calculated pursuant to Section 6(b) under the Securities Act.

|

The

Registration Statement shall become effective upon filing in accordance with Rule 462(b) promulgated under the Securities Act

of 1933, as amended.

EXPLANATORY

NOTE AND INCORPORATION BY REFERENCE

This

Registration Statement is being filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 462(b)

promulgated under the Securities Act of 1933, as amended. This Registration Statement incorporates by reference the contents of,

including all amendments and exhibits thereto and all information incorporated by reference therein, the Registration Statement

on Form S-3 (Registration No. 333-196976), which was declared effective by the Commission on July 2, 2014, and is being

filed solely for the purpose of registering an additional $457,526 amount of securities of the Registrant. The required

opinion and consents are listed on the Exhibit Index attached hereto and filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on

its behalf by the undersigned, thereunto duly authorized in the City of San Diego, State of California, on April 21,

2017.

|

|

ADAMIS

PHARMACEUTICALS CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

Dennis J. Carlo

|

|

|

|

Dennis

J. Carlo

|

|

|

|

Chief

Executive Officer

|

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities and on the dates indicated:

|

Signature

|

|

Title

|

|

Date

|

|

/s/ Dennis J. Carlo

|

|

|

|

|

|

Dennis J. Carlo

|

|

Chief Executive Officer and Director

|

|

April 21, 2017

|

|

|

|

|

|

|

|

/s/ Robert O. Hopkins

|

|

Vice President, Finance, Chief Financial

|

|

|

|

Robert O. Hopkins

|

|

Officer and Secretary

|

|

April 21, 2017

|

|

|

|

|

|

|

|

/s/ David J. Marguglio

|

|

|

|

|

|

David J. Marguglio

|

|

Director

|

|

April 21, 2017

|

|

|

|

|

|

|

|

/s/ *

|

|

|

|

|

|

William C. Denby, III

|

|

Director

|

|

April 21, 2017

|

|

|

|

|

|

|

|

/s/ *

|

|

|

|

|

|

Robert B. Rothermel

|

|

Director

|

|

April 21, 2017

|

|

|

|

|

|

|

|

/s/

*

|

|

|

|

|

|

Richard C. Williams

|

|

Director

|

|

April 21, 2017

|

|

|

|

|

|

|

*By: /s/

ROBERT O. HOPKINS

Robert O. Hopkins

attorney-in-fact

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT

INDEX

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

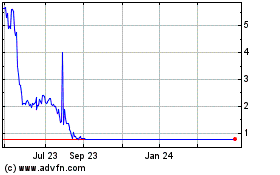

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024