Filed by Nivalis Therapeutics, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

And deemed filed pursuant to Rule 14a-12

Of the Securities Exchange Act of 1934, as amended

Subject Company: Nivalis Therapeutics, Inc.

Commission File No.: 001-37449

On April 18, 2017, Nivalis Therapeutics, Inc. (“Nivalis”) and Alpine Immune Sciences, Inc. (“Alpine”) hosted an investor conference call at 4:30 p.m. Eastern Time to discuss the entering into a definitive merger agreement under which Alpine will merge with a wholly-owned subsidiary of Nivalis in an all-stock transaction. The conference call related to such proposed merger is set forth below:

* * * * *

C O R P O R A T E P A R T I C I P A N T S

Matt Clawson,

Investor Relations, Pure Communications

Michael Carruthers,

Interim President and Chief Financial Officer, Nivalis Therapeutics

Dr. Mitchell Gold,

Executive Chairman and Chief Executive Officer, Alpine Immune Sciences

Dr. Jay Venkatesan,

President and Director, Alpine Immune Sciences

C O N F E R E N C E C A L L P A R T I C I P A N T S

Tom Shrader,

Stifel Nicolaus

Phil Nadeau,

Cowen & Company

Wangzhi Li,

Ladenburg Thalmann

P R E S E N T A T I O N

Operator:

Greetings and welcome to the Nivalis Therapeutics and Alpine Immune Sciences conference call. At this time all participants are in a listen-only mode. A brief question and answer session will follow the formal presentation. If anyone should require operator assistance during the conference, please press star, zero on your telephone keypad. As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Mr. Matt Clawson from Pure Communications. Thank you, Mr. Clawson. You may begin.

Matt Clawson:

Thank you, Michelle and good afternoon everyone. Joining for the call from Nivalis are Mike Carruthers, Interim President and Chief Financial Officer, and Janice Troha, Chief Operating Officer. Joining from Alpine Immune Systems are Dr. Mitchell Gold, Executive Chairman and Chief Executive Officer, and Dr. Jay Venkatesan, President and Director.

Before we begin I’d like to remind everyone that our call today will include remarks about future expectations, plans and prospects for Nivalis and Alpine, which constitute forward-looking statements for the purpose of the Safe Harbor provisions under applicable federal securities laws. These forward-looking statements include, without limitation, statements regarding the completion of the transaction, the combined company’s expected cash position, Nivalis and Alpine’s expectations with respect for future performance; the nature, strategy, and focus of the combined company, and the safety, efficacy, and projected development timeline and commercial potential of any product candidates. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expected, including the risk that the conditions to the closing of the transaction are not satisfied and uncertainties as to the timing of the consummation of the transaction, and the ability of each of Nivalis and Alpine to consummate the transaction. Information regarding factors that could cause results to differ are described more fully in Nivalis periodic reports filed with the SEC.

All forward-looking statements are made as of the date of this call and Nivalis and Alpine disclaim any duty to update such statements.

You are advised to read when available Nivalis filings with the SEC, including a registration statement that will contain a proxy statement to be used in connection with solicitation of proxies for the special meeting of shareholders to approve the transaction, because these documents will contain important information about the transaction and the participants’ interest in such transaction. These documents can be obtained without charge at the SEC’s Internet website, www.sec.gov.

Now I’ll turn the call over to Mike Carruthers, Interim President and CFO of Nivalis Therapeutics. Good afternoon, Mike, and congratulations.

Michael Carruthers:

Thank you, Matt. Good afternoon and thank you all for joining the call.

Let’s talk about the transaction and why we’re extremely pleased with this transformative event. Today, we issued a news release announcing Nivalis and Alpine Immune Sciences have agreed to merge. I’ll provide details about the structure and the terms of the transaction and then Dr. Gold will provide an overview of Alpine’s unique technology platform and pipeline products as well as upcoming milestones. Then we’ll open the call to questions.

As Nivalis announced in early January, we formed a Special Committee to explore and evaluate a range of strategic alternatives focused on maximizing shareholder value. A thorough process was conducted which generated formal proposals from over 80 companies. From this, ten companies were selected to participate in the final diligence process. After conducting an extensive and thorough review of each of our strategic alternatives, Nivalis decided to enter into a definitive merger agreement with Alpine Immune Sciences a well-funded, privately-held biotechnology company with a robust discovery platform designed to identify multi-specific molecules capable of directly modulating the immune system. Alpine is using its proprietary

platform technology to develop innovative potential new therapies for people living with cancer and autoimmune disorders. Dr. Gold will go into more detail on Alpine’s technology in just a bit.

Under the terms of the definitive merger agreement, and subject to the satisfaction or waiver of customary closing conditions, including approval of the transaction by each party’s shareholders, Alpine will merge into Nivalis, with Alpine surviving. The transaction is intended to qualify as a tax-free reorganization.

Unlike many companies that indicated interest in pursuing a strategic transaction with Nivalis, Alpine is already very well capitalized. Alpine’s existing investors include: Frazier Healthcare Partners, Alpine BioVentures, and OrbiMed Advisors. Immediately prior to the close, these investors will invest an additional $17 million into Alpine. As a result, we currently anticipate the combined company will have approximately $90 million in cash and equivalents at closing, and we believe is sufficient to achieve a number of important development milestones.

This transaction has been unanimously approved by the boards of directors of both companies and is expected to close in the third quarter of 2017. At the closing of the merger, each outstanding share of Alpine common stock will be converted into the right to receive shares of Nivalis common stock. Immediately following the effective time of the merger, current shareholders of Nivalis are expected to own approximately 26% of the outstanding capital stock of the combined company on a fully diluted basis, and current Alpine shareholders are expected to own approximately 74% of the outstanding capital stock of the combined company on a fully diluted basis. The exchange ratio for the transaction is based on a valuation of Nivalis of $50 million, which includes approximately $44 million in cash expected to be held by Nivalis at the time of closing. Once the transaction closes, the name of the combined company will become Alpine Immune Sciences and will trade on the NASDAQ Global Market with a new ticker symbol to be announced at a later date.

Regarding management of the combined company, Dr. Gold will become the Chairman and Chief Executive Officer, and the corporate headquarters will be located in Seattle. Following the closing of the transaction, the board of directors of the combined company will expand to seven seats. The board will be comprised of two representatives designated by Nivalis, and four current Alpine board members, and one independent nominee.

This transaction represents an optimal path forward for both companies and we expect the transaction to advance important new potential therapies for patients and to create significant value for shareholders. For Nivalis shareholders, this transaction will provide a significant equity stake in a promising new biotechnology company. Alpine is led by a talented and experienced management team that has successfully brought immunotherapies to market and possesses a next-generation platform capable of developing multiple, potentially transformative immune therapies for very sick patients.

I’m looking forward to working with the Alpine team, which has a great track record and has already received strong validation of its technology and approach through a collaboration with Kite Pharma, a leading cancer immunotherapy company.

With that, I would like to turn the call over to Mitch.

Dr. Mitchell Gold:

Thank you, Mike and good afternoon everyone. The Alpine team believes the potential of this transaction represents a unique opportunity to accelerate the development of a novel immunotherapy platform focused on both inflammation and immuno-oncology. By bringing together the substantial resources of both Nivalis and Alpine, we are creating a unique, publicly-traded company with sufficient capital to achieve meaningful value-creating milestones without the near-term need to raise additional capital. We expect the combined balance sheet has sufficient, is sufficient, to fund operations for approximately 3 years.

Our goal is to become a clinical-stage company in the second half of 2018 with our lead dual ICOS/CD28 antagonist program. I’ll talk more about that program in just a bit. With the additional capital on our balance sheet as a result of this combination, we expect we will be filing an IND for two additional programs in either Immuno-Oncology or Inflammation after our lead is filed.

While difficult to predict, we believe Alpine’s platform provides a highly productive opportunity for partnering with potential access to more than 400 targets. Of these, we have prioritized more than a dozen for further active development. We believe these partnering opportunities are potentially value creating as they allow us to advance the platform into disease areas we might not pursue on our own.

Now let me now take you through the history of Alpine, our technology platform, and our programs, before I turn to upcoming value-driving milestones.

We built Alpine with a team of experts in the field of recombinant protein immunotherapies. Having participated in the approval of the world’s first immunotherapy, we have a deep appreciation and understanding of the power and complexity of the immune system. Our objective in starting Alpine was to design truly novel, protein-based therapeutics capable of interfacing with a multitude of ligands simultaneously and be able to have applicability for not only oncology applications but also inflammatory diseases as we see these as two opposite sides of the same coin.

Alpine received its seed funding from Alpine BioVentures and based on promising pre-clinical data, we signed a significant collaboration with Kite Pharma, a leader in the field of immuno-oncology, to enhance

their CAR-T and TCR products with our unique molecules. The collaboration with Kite provides for up to $535 million in upfront and potential milestone payments, plus royalties on marketed products.

The uniqueness of our platform allowed us to attract some of the best scientists from the Seattle biotech community, including proven leaders like Dr. Stanford Peng, the former Chief Medical Officer at Stemcentrx. I am fortunate to be able to say this is the best scientific team I’ve had the privilege to work with.

In June of last year, we attracted two new blue-chip investors Peter Thompson from OrbiMed Advisors and Jamie Topper from Frazier Healthcare Partners who joined Jay and me in closing a $48 million Series A financing. Now in our third year, we are well positioned to take multiple programs into the clinic. We believe our combination with Nivalis is the next logical step.

We all know great value can be created when talented scientists come together with complimentary skill sets to create game changing therapies. Alpine was established with the goal of capitalizing on our deep understanding of immunology and protein engineering to create a robust discovery platform, which we call Variant Ig Domains or vIgDs.

vIgDs are created using our process of directed evolution to exploit the native interactions commonly occurring as a natural way to regulate the immune system. We have generated a large library of vIgDs exhibiting exhibit favorable biology. Our lead program is a first-in-class, dual ICOS/CD28 inhibitor which blocks multiple co-stimulatory signals simultaneously for use in inflammatory and auto-immune diseases. Multiple in vivo studies from this program suggest it may potentially be superior to current forms of existing treatment options. Its ability to block two principle co-stimulatory signals may open up new disease areas of interest that have been recalcitrant to current forms of treatment. We expect to begin Phase I studies of this program in the second half of next year.

In addition to our vIgD technology as our standalone protein therapeutics, we can use these same proteins to help companies focused on engineered cell therapies, or ECTs such as CAR-Ts or TCRs. Researchers in the ECT space seek to engineer immune system cells to attack diseased cells. Early data here have shown great promise, particularly in hematologic cancers. Our proprietary Transmembrane Immunomodulatory Protein, or TIP, program potentially enhances ECTs and may possibly increase the specificity, persistence, and efficacy of engineered cell therapies.

In support of this approach, in October 2015, we entered into a research and collaboration and license agreement with Kite Pharma. Under this agreement, Kite exclusively licensed two programs from our TIP technology, which it has rights to further engineer into CAR-T’s and TCR product candidates.

With this merger, we expect we will have sufficient financial resources to move three of our programs into the clinic, the first being our dual ICOS/CD28 inhibitor in the second half of 2018. We also have two active programs in Oncology.

In oncology, the immune system can be suppressed by the tumor microenvironment and multiple inhibitory signals known as checkpoints. While blocking single checkpoints has yielded impressive clinical data, approximately 70-80% of patients still don’t respond to checkpoint therapy alone. We have designed a unique multi checkpoint inhibitor that can potentially block multiple check point pathways and perhaps expand the responder population. The potential ability of vIgDs to attack multiple checkpoints with a single molecule in the tight confines of the immune synapse and in a way that mimics the native interactions of the ligands of a particular pathway is a powerful and unique attribute of our platform.

Our third product candidate comes out of our V-mAb platform where we link our co-stimulatory vIgDs to a well-known therapeutic antibody to achieve localized delivery of our co-stimulatory domains to assist in priming the immune system and driving a robust, localized T-cell infiltrate.

Our IP rests on our process of directed evolution of Immunoglobulin Super-Family or “IgSF” proteins toward multiple counter structures simultaneously. Many of the most common immune system modulators are IgSF proteins. IgSF proteins comprise a vast list of proteins responsible for cell-cell communication. Some well-known members of the IgSF family include proteins that are the principal focus of current immunologic therapeutics. These include, CD28, CTLA-4, PD-1, TIGIT, ICOS and more than 400 other targets.

Turning to operations, as we approach the expected closing of the merger we will update you on clinical, operational, and financial guidance for the combined company. We currently anticipate the cash on hand from the combined company, along with the additional capital infusion from OrbiMed, Frazier, and Alpine BioVentures, will be sufficient to fund 3 programs into the clinic and will provide us with approximately three years of operating capital. With that I will hand it over to Mike for closing remarks.

Michael Carruthers:

Thanks Mitch. In summary, we believe this combination represents an excellent opportunity for Nivalis shareholders and new shareholders to capture the value of Alpine’s transformative platform technology. The combined company has a strong cash position, allowing us to drive multiple programs into the clinic and a steady stream of scientific milestones that will continue to support the value of Alpine’s platform. We look forward to speaking with you in more detail as we work to close this transaction.

We’ll now open the call to questions. Michelle, please open the line.

Operator:

Thank you. We’ll now be conducting a question and answer session. If you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue. You may press star, two if you would like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys. One moment, please, while we poll for questions.

Our first question comes from the line of Tom Shrader with Stifel. Please proceed with your question.

Tom Shrader:

Good afternoon. To the Nivalis people, I mean sorry to see you go but congratulations for getting it done so quickly and maybe for making $44 million worth $50 million. I guess anything else about Nivalis, Mike? Is this it for everything? Will anything continue? Will you try to license assets or do you think there’s nothing pursuable here? There was some talk of signs of efficacy, just to wrap up.

Michael Carruthers:

Sure. Thank you for the question, Tom. The GSNOR platform will roll into the merged company and together we’ll seek to be able to potentially out-license or carry on any potential development that makes sense. I think one of the things you referred to is the weight gain potential [inaudible] which was shown in multiple back-to-back studies. That could have some legs in the long term, but the real focus here is Alpine’s unique science and the fantastic progress that they’ve made today.

Tom Shrader:

Okay. Maybe a couple of quick ones for Mitch. The ICOS/CD28 program, it’s certainly intriguing. It sounds like you’re on the TH1 side where—any indication of what you will pursue? Things like RA or psoriasis, is that what we should be thinking about or are there other diseases that make more sense? Can you tell us anything about where you’re thinking?

Dr. Mitchell Gold:

Sure, Tom. As we continue to get information out on the combined company we’ll be sharing more and more of that detail with you, but certainly as we start to bring the dual ICOS/CD28 program forward in the clinic we’ll look for signals for where we think this is going to have the most efficacious type of response, and there’s certainly a number of gene signatures that when you block both ICOS and CD28 are indicative of certain disease patterns and that’s information that we’re going to present at upcoming scientific meetings throughout the course of the year.

Tom Shrader:

Okay, perfect. Then finally, on the Kite deal, as far as I know, exactly what you’re binding is not public yet. Do you expect to make that public now that you’re public, or will that remain somewhat of a stealth program.

Dr. Mitchell Gold:

You know, we have a very close relationship with Kite and as of now we anticipate that that will continue to remain confidential.

Tom Shrader:

Okay. Well, congratulations. It all certainly seems interesting so good luck. We’ll keep watching.

Operator:

Thank you. Our next question comes from the line of Phil Nadeau with Cowen & Company. Please proceed with your question.

Phil Nadeau:

Good afternoon. Thanks for taking my questions, and let me add my congratulations for getting the deal done so quickly. Mitch and Jay, a couple of questions for you. On your pipeline, you mentioned one IND in the second half of 2018 for the dual antagonist and then two to follow. It wasn’t entirely clear to me whether those two were coming from the oncology programs or maybe two from a single oncology program. Where were those other two INDs going to come from? Is it one each from the oncology programs or is that still undecided?

Dr. Mitchell Gold:

We left that open-ended, Phil. The first IND is going to come from our dual ICOS-CD28 inhibitor. We have the most data on that to date, and then we’ll move two of the programs forward in the clinic, either from the two different oncology platforms that we have or from an inflammation compound.

Phil Nadeau:

Okay. On the dual antagonist, do you have a lead candidate today that’s going through preclinical tox studies and IND enabling studies, or are you still in the process of identifying a lead candidate?

Dr. Mitchell Gold:

We have several potential lead candidates that we’re moving forward, and again, we’ll talk about that in more detail as we present more scientific data on that program at scientific meetings throughout the course of this year. I’d ask Jay if you have anything to add to that?

Dr. Jay Venkatesan:

No. We have initiated a multi-prong strategy on manufacturing with these multiple lead programs so that we will be able to select from those three programs or these three compounds so that we can initiate the IND enabling studies in the next few months.

Phil Nadeau:

Got it. Thanks for taking my questions and congratulations again on getting the deal done.

Dr. Mitchell Gold:

Thanks, Phil.

Operator:

Thank you. Once again, if you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys.

Our next question comes from the line of Wangzhi Li with Ladenburg Thalmann. Please proceed with your question.

Wangzhi Li:

Thanks for taking my question and congratulations on the announcement on the merger. Great stuff. Maybe a question for Mitch and to try to understand more about your technology platform. It looks like a lot of potential there. Can you maybe elaborate a little bit more on what the key kind of advantages or differentiation of your platform versus let’s say bispecific antibodies or other similar technologies existing right now?

Dr. Mitchell Gold:

Yes, good question. So, Wangzhi, I think what we’re really seeing in immunotherapy today, whether you’re trying to dampen an immune response or amplify an immune response for oncology is that it’s the multitude of interactions that are occurring within the tight confines of the way cells communicate, known as the immune synapse. The most common way that cells do that are through these proteins called IgSF proteins and the basic platform IP for Alpine is the ability to drive new biology through a process known as directed evolution. So, we’ll take a native interaction, for example CTLA-4 and the way it interacts with CD28, and then we’ll affinity mature and through directed evolution new types of biology that we want to drive, either to amplify an immune response or to tamp it down, and because that mimics what’s occurring naturally, the biology that we are able to extract from that is much more powerful than just using, for example, bispecifics or monoclonal antibodies on their own.

Wangzhi Li:

Got you. I think I’ll take a look at your website and the information, so it looks like you can have both antagonists and agonists in the same molecule just for one engineered protein. Also, I think you can also have both agonists and antagonists in the same molecule. Is that correct?

Dr. Mitchell Gold:

Yes, it’s exactly right. One of the most powerful elements of this platform is there is more than 400 IgSF family members that are really actionable that we could go after, and when you put these through our process of affinity maturation and directed evolution, the biology that you get out of them is unique depending on the clones that are generated from that and how they’re formatted. So off of a single directed evolution campaign, we could generate protein structures that could be relevant for autoimmune diseases and another set of them that are relevant for immuno-oncology. Because of that, we kind of open up this broad platform of molecules that are very actionable from a partnering perspective.

Wangzhi Li:

Got you. Just maybe a follow on the potential application of the platform. Of course you said you can dial up the immune response for oncology and dial down the immune response for autoimmune disease. So especially in the immuno-oncology field, I mean it may be a little bit early to talk about it but what’s the position of your molecules with the existing landscape? For example, are you targeting more the patient currently not responding to PD-1 inhibitors or - any color on this type of thinking - or are you expecting to use a biomarker to select patients or the indication? Any kind of—I know it’s a bit early but any color on that?

Dr. Mitchell Gold:

Good question. I think those are probably questions that are more general in their approach but what I can say is the field of immuno-oncology is going to a more directed approach whether you’re going after a very specific cell type, for example T-reg depletion, or you’re going after trying to localize this within the tumor microenvironment itself. The beauty of the vIgD platform is that you can accomplish both of those. So you could be targeting multiple different checkpoint inhibitors simultaneously with a certain type of approach that causes that to occur mostly in the tumor microenvironment, and that’s the type of data that we’re going to continue to share as we roll out the scientific platform at scientific meetings throughout the course of the year. Or you could target a very specific cell type with unique biology based on the vIgDs that are generated out of our directed evolution campaign.

Wangzhi Li:

Okay. I see. Maybe last question, can you also talk a little bit about your IP? Where is the technology from and what is the IP situation?

Dr. Mitchell Gold:

Yes. The IP for the company is based on a couple of things. One is we take a very much a kind of a picket fence approach to our IP portfolio. So we have broad platform IP that we filed on that any IgSF protein that’s affinity matured against two different counterstructures would rest within our IP domain. Then we have obviously species-specific IP along that. Then we have ways that we format that, whether that’s in our V-mAb platform or as part of our TIP or ECT technology. So, you know, that really starts at the top. You work down in the species and then the formatting of those.

Wangzhi Li:

Okay, great. Thank you very much. Congratulations again.

Dr. Mitchell Gold:

Sure.

Operator:

Thank you. There are no further questions at this time. This does conclude today’s teleconference. You may disconnect your lines at this time. Thank you for your participation and have a wonderful day.

Michael Carruthers:

Thank you everyone.

Matt Clawson:

Thank you.

* * * *

Forward-Looking Statements

This communication contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Nivalis, Alpine Immune Sciences, Inc. (“Alpine”), the proposed transaction and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of Nivalis, as well as assumptions made by, and information currently available to, management. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the risk that the conditions to the closing of the transaction are not satisfied, including the failure to timely or at all obtain stockholder approval for the transaction; uncertainties as to the timing of the consummation of the transaction and the ability of each of Nivalis and Alpine to consummate the transaction; risks related to Nivalis’ ability to

correctly estimate its operating expenses and its expenses associated with the transaction

; risks related to the market price of Nivalis’ common stock relative to the exchange ratio; the ability of Nivalis or Alpine to protect their respective intellectual property rights; competitive responses to the transaction; unexpected costs, charges or expenses resulting from the transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; and legislative, regulatory, political and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Nivalis’ most recent Annual Report on Form 10-K, and Nivalis’ recent Quarterly Report on Form 10-Q and Current Reports on Form 8-K filed with the SEC. Nivalis can give no assurance that the conditions to the transaction will be satisfied. Except as required by applicable law, Nivalis undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the United States Securities Act of 1933, as amended. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Important Additional Information Will be Filed with the SEC

In connection with the proposed transaction between Nivalis and Alpine, Nivalis intends to file relevant materials with the SEC, including a registration statement that will contain a proxy statement and prospectus.

NIVALIS URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NIVALIS, THE PROPOSED TRANSACTION AND RELATED MATTERS

. Investors and shareholders will be able to obtain free copies of the proxy statement, prospectus and other documents filed by Nivalis with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement, prospectus and other documents filed by Nivalis with the SEC by contacting Investor Relations by mail at Attn: Investor Relations, 3122 Sterling Circle, Boulder, Colorado, 80301. Investors and stockholders are urged to read the proxy statement, prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction.

Participants in the Solicitation

Nivalis and Alpine, and each of their respective directors and executive officers and certain of their other members of management and employees, may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Nivalis’ directors and executive officers is included in Nivalis’ Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on February 13, 2017, and the proxy statement for Nivalis’ 2017 annual meeting of stockholders, filed with the SEC on April 6, 2017. Additional information regarding these persons and their interests in the transaction will be included in the proxy statement relating to the transaction when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated below.

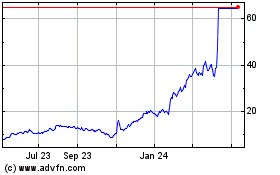

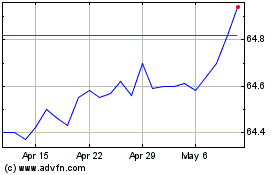

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Apr 2023 to Apr 2024