Current Report Filing (8-k)

April 12 2017 - 4:56PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________

FORM

8-K

_______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 11, 2017

_______________________________

PEREGRINE

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-32839

|

|

95-3698422

|

(State of other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

14282 Franklin Avenue, Tustin, California 92780

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

(714) 508-6000

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

_______________________________

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

o

Soliciting material pursuant to Rule 14A-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of

Listing.

|

On April 11,

2017, Peregrine Pharmaceuticals, Inc. (the “Company”) received a letter from the Listing Qualifications

Department (the “Staff”) of The NASDAQ Stock Market LLC (“NASDAQ”) stating that the Company has not

regained compliance with the $1.00 minimum closing bid price requirement set forth in the NASDAQ Listing Rule 5550(a)(2)

(the

“Minimum Bid Price Requirement”)

. The letter further states that the Staff has determined to delist the

Company’s securities, both common and preferred stock, from the NASDAQ Capital Market on April 20, 2017, unless the

Company requests a hearing before the NASDAQ Hearings Panel (the “Panel”) by April 18, 2017 to appeal the

Staff’s determination to delist its securities.

The

Company intends to timely request such a hearing before the Panel, and such request will stay any delisting action by the Staff

pending the issuance of a written Panel decision.

The Panel will typically hold a hearing to consider an appeal within 45

days after the request for a hearing is made.

At the hearing, the Company

will present its plan to regain compliance with the requirements for continued listing on The NASDAQ Capital Market. The Company

is considering several paths to regain compliance with the Minimum Bid Price Requirement, including, among other things, a reverse

stock split. As previously disclosed, the Company’s stockholders approved a reverse stock split of the Company’s common

stock at a ratio of up to 1-for-7, to be determined by the Company’s Board of Directors in its sole discretion and effected,

if at all, at any time until the Company’s 2017 annual meeting of stockholders.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: April 12, 2017

|

PEREGRINE PHARMACEUTICALS, INC.

|

|

|

|

|

|

By:

|

/s/ Paul J. Lytle

|

|

|

|

Paul J. Lytle

Chief Financial Officer

|

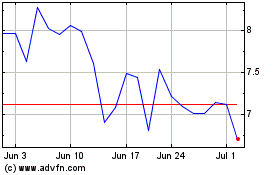

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

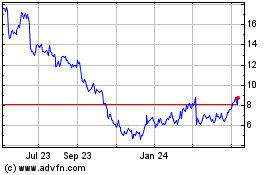

Avid Bioservices (NASDAQ:CDMO)

Historical Stock Chart

From Apr 2023 to Apr 2024