Abode Properties Announces Stellar Growth

March 20 2017 - 8:00AM

Business Wire

Abode Properties, a Dallas, Texas real estate investment

company, anticipates stellar growth for 2017.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170320005107/en/

Metropolitan - Abode Properties' Class A

asset in Little Rock, Arkansas. (Photo: Business Wire)

Abode Properties’ portfolio consists of top tier, Class A

multifamily assets in emerging markets that correspond with both

sustainable and viable economic growth activity. Enhanced

shareholder value will continue to be generated through investments

in both the acquisition and development of sustainable Class A

multifamily housing in growing markets.

“The US multifamily market continues to outperform every other

property sector,” commented Brad Kyles, EVP-Multifamily Residential

Operations. “We acquired four Class A properties in 2016 and began

construction on four more new developments. Our quality amenities

coupled with the rising demand for high end apartments means

growing our portfolio to meet those demands. We have over 20

additional projects at various stages of development in the

pipeline.”

According to Freddie Mac renter households are poised to grow in

every generational cohort due to a range of economic and

demographic factors. Positive job growth and a stable economy

should help more Millennials form households and enter the

market.

“Abode’s overall occupancy was just over 95% for January 2017.

This is greatly attributed to the quality of our assets, strength

of our property and asset management teams, and the close attention

to managing details as demonstrated throughout all levels of our

organization,” commented President and CEO, Daniel J. Moos.

“Through our expert market research we continue to add assets in

those select markets with the strongest potential.”

Abode Properties is a subsidiary of Transcontinental

Realty Investors Inc., (NYSE: TCI), a Dallas-based real estate

investment company. Abode’s investment and strategic focus is to

acquire, develop, and operate a portfolio of desirable multifamily

residential properties, while capitalizing on our ability to obtain

long term and static debt structures. The portfolio stands to

benefit from historically established, proven, and successful

operational practices, seasoned on-site management, and an

experienced leadership team with forward thinking capabilities in

order to realize maximum cash flows and consistent returns,

while maintaining unequaled resident and customer service. We are

disciplined and prudent allocators of capital and we will continue

growing our geographically diverse portfolio from the Southwest to

the Southeast. These markets are geographically located in areas of

the country that correspond with both sustainable and viable

economic growth activity.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170320005107/en/

for Abode PropertiesChris Childress,

469-522-4275press@pillarincome.com

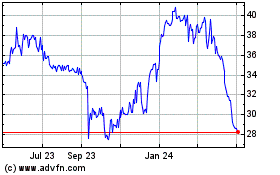

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024