Current Report Filing (8-k)

September 23 2016 - 2:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington

, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 13, 2016

|

PREMIER BIOMEDICAL, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-54563

|

|

27-2635666

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

P.O. Box 31374

El Paso, Texas 79930

(Address of principal executive offices) (zip code)

(814) 786-8849

(Registrant’s telephone number, including area code)

_____________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.01 – Entry into a Material Definitive Agreement

On September 13, 2016, we entered into an operating agreement to form a pain management joint venture company with Advanced Technologies Solutions (ATS), a company based in San Diego, California and owned by Ronald T. LaBorde, a member of our Board of Directors. The joint venture company, Premier Biomedical Pain Management Solutions, LLC, a Nevada limited liability company (PBPMS), will develop and market natural and cannabis-based generalized, neuropathic, and localized pain relief treatment products. We own 50% of PBPMS and ATS owns the other 50%, with 89% of the profits allocated to us and the remaining 11% of profits allocated to ATS. As part of the agreement with ATS, Mr. LaBorde was appointed a member of our Board of Directors.

PBPMS must enter into separate license agreements with us and ATS for the use of technology previously developed by both companies. Intellectual property developed jointly by the parties will be the property of PBPMS. However, ATS and Mr. LaBorde may develop inventions and intellectual property independently from PBPMS, and such inventions and intellectual property will be the sole property of ATS or Mr. LaBorde. Pursuant to the terms of the PBPMS operating agreement, we will tender 1,250,000 warrants, for the purchase of an equal number of shares of our common stock at a strike price of $0.05, at the signing of a license agreement between ATS and PBPMS.

Our initial capital contribution to PBPMS is $25,000. ATS will contribute (i) technical, labor, manufacturing information and know-how required to produce the initial product, an extended duration topical pain relief patch; (ii) $5,000 worth of primary ingredients; and (iii) $5,000 worth of other materials to produce the initial prototype pain relief patches.

PBPMS will be managed by a board of managers (PBPMS Board). Initially, the PBPMS Board will consist of William A. Hartman, our President and Chief Executive Officer and member of our Board of Directors, Ronald T. LaBorde, the Founder of ATS and member of our Board of Directors, Dr. Patricio Reyes, our Chief Technology Officer and member of our Board of Directors, and John Borza, our Vice-President and member of our Board of Directors. Decisions of the PBPMS Board require unanimous approval.

The PBPMS operating agreement is subject to other common terms and ownership transfer restrictions, including a right of first refusal; however, we anticipate signing a more detailed and complete operating agreement to better clarify the terms of the joint venture as summarized above. A press release announcing the joint venture company is attached hereto as Exhibit 99.1 and is incorporated herein by this reference.

Section 9 – Financial Statement and Exhibits

Item 9.01 Financial Statements and Exhibits.

|

99.1

|

Press release of Premier Biomedical, Inc. dated September 15, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Premier Biomedical, Inc.

|

|

|

|

|

|

|

|

Dated: September 23, 2016

|

By:

|

/s/ William Hartman

|

|

|

|

|

William Hartman

|

|

|

|

Its:

|

President and Chief Executive Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release of Premier Biomedical, Inc. dated September 15, 2016

|

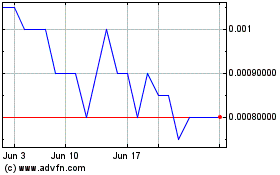

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Apr 2023 to Apr 2024