UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

12b-25

|

SEC FILE NUMBER

001 –

15697

|

NOTIFICATION OF LATE FILING

|

(Check One):

|

x

Form 10-K

|

¨

Form 20-F

|

¨

Form 11-K

|

¨

Form

10-Q

|

¨

Form 10-D

|

|

|

|

|

|

|

|

|

|

¨

Form N-SAR

|

¨

Form N-CSR

|

|

|

|

For Period Ended:

March 31, 2016

¨

Transition

Report on Form 10-K

¨

Transition Report on Form 20-F

¨

Transition Report on Form 11-K

¨

Transition Report on Form 10-Q

¨

Transition Report on Form N-SAR

For the Transition Period Ended: _____________________________________________

Read instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked

above, identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

Elite Pharmaceuticals, Inc.

Full name of registrant:

Former name if applicable:

165 Ludlow Avenue

Address of Principal Executive Office (

Street and Number

)

Northvale, New Jersey 07647

City, state and zip code

PART II - RULES 12b-25(b) AND (c)

If the subject report

could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following

should be completed. (Check box if appropriate.)

|

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

x

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, 20-F, 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

|

|

|

|

(c)

|

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III - NARRATIVE

State below in reasonable

detail why Form 10-K, 11-K, 20-F, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within

the prescribed time period.

The

Registrant’s Annual Report on Form 10-K for the period ended March 31, 2016 cannot be filed within the prescribed time period

without unreasonable effort or expense because of

a delay by the Registrant in obtaining and compiling information required

to be included in the Registrant’s Form 10-K

.

PART IV - OTHER INFORMATION

|

|

(1)

|

Name and telephone number of person to contact in regard

to this notification

|

|

Carter Ward

|

|

(201)

|

|

750-2646

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act

of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the

registrant was required to file such report(s) been filed? If answer is no, identify report(s).

|

x

Yes

¨

No

|

|

(3)

|

Is it anticipated that any significant changes in results of operations from the corresponding

period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

x

Yes

¨

No

If so, attach an explanation of the anticipated

change, both narratively and quantitatively, and, if appropriate, reasons why a reasonable estimate of the results cannot be made.

Our revenues for Fiscal

2016 were $12.5 million, an increase of $7.5 million or approximately 149% from revenues for the comparable period of the prior

year, and consisted of $8.0 million in manufacturing fees and $4.5 million in license fees.

Revenues for Fiscal 2015 consisted of $3.9

million in manufacturing fees, $0.005 million in lab and product development fees, and $1.1 million in license fees. Manufacturing

fees increased by approximately 107% as a result of the continued growth in the Company’s generic product sales.

Licensing fees increased by approximately

294% or $3.4 million, from $1.1 million in Fiscal 2015 to $4.5 million in Fiscal 2016. This increase is due to Epic licensing agreements

and increase in profit splits from product sales relating to TAGI and Epic.

Research and development costs for Fiscal

2016 were approximately $12.4 million, a decrease of approximately $2.3 million or approximately 16% from $14.7 million of such

costs for the comparable period of the prior year. The decrease was primarily due to the timing of ongoing clinical trials related

to the development of Elite’s abuse deterrent opioid products. Spending includes equity based payments totaling $0.8 million

made pursuant to the Epic strategic Alliance in relation to FDA’s approval of immediate release oxycodone tablets, a product

included in the Epic Strategic Alliance. Clinical and lab studies includes (such as category 1, category 2 and category 3 testing

as described under the FDA’s draft Guidance for Industry, Abuse-Deterrent Opioids – Evaluation and Labeling, January

2013), process development, analytical development, and regulatory development for products in our pipeline.

General and administrative expenses for

Fiscal 2016 were $2.9 million no increase from $2.9 million of general and administrative expenses for the comparable period of

the prior year. Please note that these levels of overhead costs are expected to continue or increase in subsequent periods.

Depreciation and amortization for Fiscal

2016 was $0.67 million, an increase of $0.05 million or approximately 8%, from $0.62 million for the comparable period of the prior

year. The increase was primarily due to the expansion and upgrading of the Northvale Facility, which has required substantial investments

in property, plant and equipment.

Non-cash compensation through the issuance

of stock options and warrants for Fiscal 2016 was approximately $0.33 million, an increase of $0.07 million, or approximately 28%

from $0.26 million for the comparable period of the prior year. The increase was due to the issuance of options to purchase an

aggregate of 4,334,000 shares of Common Stock to various employees during Fiscal 2016, primarily pursuant to employment agreements,

and the timing of the amortization schedule established at the time of issuance of the related stock options

As a result of the foregoing, our loss

from operations for Fiscal 2016 was $8.3 million, compared to a loss from operations of $16.5 million for Fiscal 2015.

Other income for Fiscal 2016 totaled a

net income of $7.1 million, a decrease in net other income of $14.6 million from the net other income of $21.7 million for the

comparable period of the prior year. The decrease in other income was due to proceeds from the sale of New Jersey State tax losses

totaling $0.5 million and derivative income relating to changes in the fair value of derivative liabilities during Fiscal 2016

totaling $7.4 million, as compared to a net derivative income of $20.3 million and gain on sale of investment totaling $1.7 for

the comparable period of the prior year, a $14.6 million overall decrease in other income. Please note that derivative income/(expenses)

are most significantly determined by the closing price of the Company’s Common Stock as of the end of each annual or quarterly

reporting period, and also as of the date on which shares of the Company’s convertible preferred stock are converted into

common stock, with incomes being generated by decreases in such closing prices and expenses being incurred by increases in such

closing prices. The closing price of the Company’s Common Stock as of March 31, 2016 was $0.31, as compared to a closing

price of $0.25 as of March 31, 2015. These variances in the closing price of the Company’s Common Stock as compared with

the closing price at the end of the immediately preceding fiscal year end were significant factors in the derivative income recorded

during the year ended March 31, 2016.

As a result of the foregoing, our net loss

for Fiscal 2016, including credits for income taxes totaling $0.5 million was $0.7 million, compared to a net income of $5.2 million,

inclusive of credit for income taxes totaling $0.003 million for Fiscal 2015.

Changes in maximum redemption

value in our convertible preferred mezzanine equity, which is included in the calculation of net loss attributable to common shareholders

resulted in the net loss being increased by $9.3 million for fiscal year 2016, as compared to an increase in net income attributable

to common shareholders of $23.7 million for the comparable period of the prior year. Accordingly, net income (loss) attributable

to common shareholders for fiscal year 2016 was net loss of $10.0 million, compared to net income attributable to common shareholders

of $28.9 million for the comparable period of the prior year.

Please also see the Registrant’s

Consolidated Statements of Operations for each of the three fiscal years ended March 31, 2016 (which will be included in the Registrant’s

Annual Report on Form 10-K for the fiscal year ended March 31, 2016 to be filed later today), attached hereto as Exhibit 1 to this

Notification of Late Filing on Form 12b-25 for further details on the Company’s results of operations.

Elite Pharmaceuticals, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Dated:

|

June 15, 2016

|

|

By:

|

/s/ Carter Ward

|

|

|

|

|

|

|

Name:

|

Carter Ward

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

INSTRUCTION: The form

may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the

person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant

by an authorized representative (other than an executive officer), evidence of the representative's authority to sign on behalf

of the registrant shall be filed with the form.

|

ATTENTION

Intentional misstatements or omissions of

fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

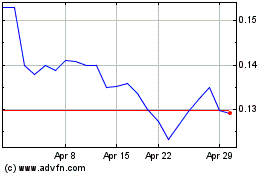

Elite Pharmaceuticals (QB) (USOTC:ELTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

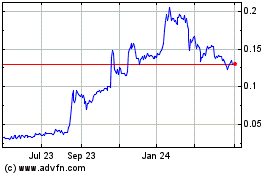

Elite Pharmaceuticals (QB) (USOTC:ELTP)

Historical Stock Chart

From Apr 2023 to Apr 2024