Aurora Behavioral Health Auction Attracts Interest from Acadia Healthcare

May 13 2016 - 3:10PM

Dow Jones News

Behavioral hospital operator Signature Healthcare Services LLC

is attracting interest from prospective bidders, including one of

the industry's largest operators.

Acadia Healthcare Co.—backed by private equity firms Bain

Capital and Waud Capital Partners—has engaged investment bank

Jefferies LLC in the auction for the Corona, Calif.-based

Signature, which does business as Aurora Behavioral Health Care,

according to people with knowledge of the process.

One of these people said private equity firm Welsh Carson

Anderson & Stowe also is interested in Aurora and would merge

it with portfolio company Springstone Inc., which operates

hospitals treating mental illness and substance abuse.

Universal Health Services Inc., of King of Prussia, Pa., also is

said to be a potential bidder in the process, the people said.

First round bids for the process, run by investment bank Goldman

Sachs Group Inc., were due Wednesday, they added.

The auction for Aurora presents a rare chance for behavioral

health operators to acquire a sizable asset in a highly fragmented

industry.

Last month, Dow Jones reported that Aurora recorded $130 million

in earnings before interest, taxes, depreciation and amortization

last year. Based on the average purchase price multiples behavioral

health companies typically command in the current market, Aurora

could potentially be valued at well over $1 billion.

However, the people added that Aurora's Ebitda number was the

sum of the earnings of Aurora's 14 facilities and was heavily

adjusted. The Ebitda figure that private equity would likely use as

a basis for bids, which would include the costs of corporate

overhead, was closer to $50 million, the people said.

The people said the fact that Aurora uses the adjusted Ebitda in

its pitch to prospective investors could suggest that the seller

prefers strategic buyers over private-equity investors that don't

already have an existing company into which they would merge

Aurora. Strategic investors often have greater bidding power than

private equity buyers, because they can factor in cost savings they

would achieve by combining operations, such as marketing and sales

or back office accounting.

Founded in 2000 by retired psychiatrist Dr. Soon Kim, Aurora

operates 14 facilities. The Press-Enterprise, a Southern California

newspaper, reported in May 2015 that Aurora acquired seven acres in

Riverside County to build and operate a 150-bed treatment center,

expected to open in the spring of 2018.

UHS and Acadia have both been active acquirers in recent years

and, together, accounted for a combined 8.3% share of the $17.2

billion mental health and substance abuse clinics industry in 2015,

according to industry tracker IBISWorld.

Last year, UHS bought Foundations Recovery Network LLC, an

operator with four facilities and eight outpatient centers and

backed by Nick Pritzker Capital Management, for about $350 million.

That same year, it also acquired English psychiatric-care provider

Alpha Hospitals from London firm C&C Alpha Group Ltd. for £ 95

million.

Acadia, meanwhile, acquired U.K. provider Priory Group earlier

this year, adding onto a slew of deals it did over the past two

years. Those deals also include the acquisitions of Bain

Capital-backed CRC Health Group Inc. for $1.18 billion,

Philadelphia inpatient behavioral health-care provider Belmont

Behavioral Health and a 15-bed Southampton, U.K., rehabilitation

facility called The Manor Clinic.

Welsh Carson's Louisville, Ky.-based Springstone, which

currently runs 14 hospitals in seven states, is much smaller than

UHS and Acadia. Welsh Carson has backed the company since 2010,

when it committed $100 million to develop the behavioral

health-care and psychiatric hospital platform.

Write to Amy Or at amy.or@wsj.com

(END) Dow Jones Newswires

May 13, 2016 14:55 ET (18:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

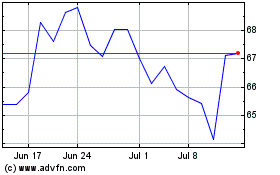

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

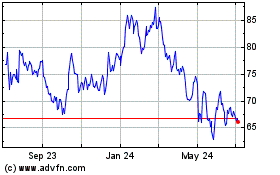

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Apr 2023 to Apr 2024