Current Report Filing (8-k)

May 02 2016 - 5:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): April 26, 2016

ORIGINCLEAR, INC.

(Name of registrant as specified in

its charter)

|

Nevada

(State or other jurisdiction of

Incorporation or organization)

525 S. Hewitt Street,

Los Angeles, California

(Address of principal executive offices)

|

333-147980

(Commission File Number)

|

26-0287664

(I.R.S. Employer

Identification Number)

90013

(Zip Code)

|

Registrant’s telephone

number, including area code:

(323) 939-6645

5645 W. Adams Blvd.

Los Angeles, CA 90016

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

3.02 Unregistered Sales of Equity Securities

Private Placement

As of April 26, 2016, OriginClear,

Inc. (the “Company”) sold, in a private placement, 17,500,000 shares of its common stock to accredited investors for

an aggregate consideration of $175,000 (the “Offering”). The shares issued in this Offering are subject to price protection

such that, if on the one year anniversary of the date of sale of the common stock sold in the private placement (the “Anniversary

Date”), the product of the Price Per Share ($.01) multiplied by 300% (the “Adjusted Price Per Share”) is greater

than the Market Price (as defined below), then the Company shall promptly issue additional shares of common stock to the investor

for no additional consideration, in an amount equal to (i) the quotient of the Adjusted Aggregate Purchase Price (as defined below)

divided by the Market Price, minus (ii) the total number of shares of Common Stock initially issued to the investor.

For the purposes

hereof, (i) the “Adjusted Aggregate Purchase Price” means the product of the number of shares of Common Stock initially

issued to the investor multiplied by the Adjusted Price Per Share, and (ii) the “Market Price” is defined as the average

closing price of the Company’s Common Stock for the twenty (20) consecutive trading days immediately prior to the Anniversary

Date (which 20-day period shall end on a day not later than the last trading day of the Anniversary Date), but not less than $.01

per share.

The securities referenced above were

offered and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act of 1933,

as amended (the “Securities Act”) and Rule 506 of Regulation D promulgated thereunder since, among other things, the

transactions did not involve a public offering and the securities were acquired for investment purposes only and not with a view

to or for sale in connection with any distribution thereof.

Consultant Issuances

On

April 29, 2016, the Company issued to consultants an aggregate of 1,572,581 shares of the Company’s common stock in lieu

of cash consideration.

The securities referenced above were offered

and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act.

Conversion of Notes

On April 28,

2016,

holders of convertible promissory notes converted an aggregate principal and interest

amount of $71,211 into an aggregate of 8,377,760 shares of the Company’s common stock.

The securities referenced above were offered

and sold pursuant to an exemption from the registration requirements under Section 4(a)(2) of the Securities Act since, among other

things, the transactions did not involve a public offering.

Item 8.01 Other Events

The Company’s principal executive offices

are now located at 525 S. Hewitt Street, Los Angeles, California 90113.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

ORIGINCLEAR, INC.

|

|

|

|

|

May 2, 2016

|

By:

|

/s/ T. Riggs Eckelberry

|

|

|

|

Name: T. Riggs Eckelberry

Title: Chief Executive Officer

|

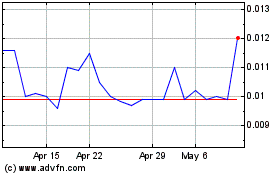

Originclear (PK) (USOTC:OCLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

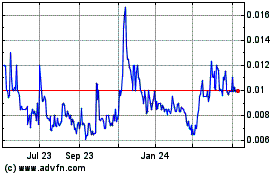

Originclear (PK) (USOTC:OCLN)

Historical Stock Chart

From Apr 2023 to Apr 2024