UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

FORM S-1/A

(AMENDMENT NO. 1)

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

EUROSPORT

ACTIVE WORLD CORPORATION

(Exact

name of registrant as specified in its charter)

Registration No. 333-207333

| Florida |

|

3585 |

|

65-0913886 |

| (State

or other jurisdiction |

|

(Primary

Standard Industrial |

|

(I.R.S.

Employer |

| of incorporation) |

|

Classification

Code Number) |

|

Identification

No.) |

2000

Ponce de Leon Blvd, 6th Floor

Miami,

Florida 33134

Tel.

No.: 305 517 7330

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Copies

to:

Clifford

J. Hunt, Esquire

Law

Office Of Clifford J. Hunt, P.A.

8200

Seminole Boulevard

Seminole,

Florida 33772

Tel. No.: (727) 471-0444

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box: þ

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following

box and list the Securities Act registration number of the earlier effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

þ |

CALCULATION

OF REGISTRATION FEE

Title of Each

Class of

Securities to be Registered | |

Amount

to be Registered | | |

Proposed Maximum Offering

Price Per

Share (2) | | |

Proposed Maximum Aggregate Offering

Price (2) | | |

Amount

of Registration Fee | |

| Common stock, par value $0.001 par value per share (the

“Common Stock”)(1) | |

| 21,747,348 | | |

$ | 1.00

| | |

$ | 21,747,348 | | |

$ | 220.05 | |

(1) This

registration statement covers the resale by our selling shareholders of up to 21,747,348 shares of Common Stock previously issued

to such selling shareholders.

(2) The

offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule

457(c) and Rule 457(o) of the Securities Act.

THE REGISTRANT HEREBY AMENDS

THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE

A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE

WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION,

ACTING PURSUANT TO SUCH SECTION 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to

sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

Subject

to completion, dated ________________ |

EUROSPORT

ACTIVE WORLD CORPORATION

PROSPECTUS

21,747,348 Shares of Common Stock

The

selling security holders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The

common stock to be sold by the selling shareholders as provided in the “Selling Security Holders” section is

common stock that are shares that have already been issued and are currently outstanding. We will not receive any proceeds from

the sale of the common stock covered by this prospectus. We have agreed to bear the expenses relating

to the registration of the shares for the selling security holders.

The

selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The

common stock to be sold by the selling shareholders as provided in the “Selling Shareholders” section is shares

of our common stock, par value $0.001 per share (the “Common Stock”), that have already been issued and are currently

outstanding. We will not receive any proceeds from the sale of the Common Stock covered by this prospectus.

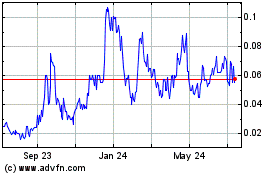

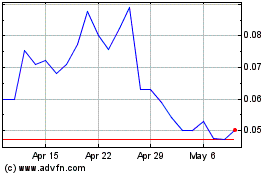

Our

common stock is currently quoted on the OTC Pink Market maintained by OTC Markets Group, Inc. under the symbol “EAWD”;

however, our securities are currently highly illiquid, and subject to large swings in trading price, and are only traded on a

sporadic and limited basis. As a result, you should not expect to be able to resell your common stock regardless of how we perform

and, if you are able to sell your common stock, you may receive less than your purchase price.

Common Stock being registered

in this registration statement may be sold by Selling Security Holders at the fixed price of one dollar ($1.00) per share through

the duration of the offering or privately negotiated prices or in transactions that are not in the public market. Selling shareholders

may be deemed underwriters as defined under the Securities Act of 1933. The Company has no present plans to be acquired or to

merge with another company nor does the Company, or any of its shareholders, have plans to enter into a change of control or similar

transaction. On February 11, 2016, the closing price of our Common Stock was $1.38 per share as reported on the OTC Pink Marketplace.

We

are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”)

and are subject to reduced public company reporting requirements.

Investing

in our Common Stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of

material risks of investing in our Common Stock in “Risk Factors” beginning on page 4 of this

prospectus.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is

February 11, 2016

TABLE

OF CONTENTS

Please

read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared

this prospectus so that you will have the information necessary to make an informed investment decision.

You

should rely only on information contained in this prospectus. We have not authorized any other person to provide you with different

information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the

offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover,

but the information may have changed since that date.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the

information that you should consider before investing in the Common Stock. You should carefully read the entire prospectus,

including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and the Financial Statements, before making an investment decision. In this Prospectus, the terms “EAWC,”

“EAWC Technologies,” “Eurosport Active,” “Eurosport” “Company,” “we,”

“us” and “our” refer to Eurosport Active World Corporation or any of its subsidiaries.

Overview

The

Company focuses on green sustainable solutions to generate and purify water, as well as the production and reproduction of energy.

EAWC is already engaged in the promotion, development and commercialization of green technologies, mainly in Mexico & the

State of California. The strong increased demand for water and energy around the world, the Company and its partners develop,

manufacture, distribute and operate water generation, water purification, and green energy production (Waste to Energy) technologies.

http://www.eawctechnologies.com

.

Company

History

Eurosport

Active World Corporation (the “Company”) (formerly Eagle International Holdings Group Inc. or “EIH”),

was incorporated under the laws of the State of Florida on August 23, 2000. EIH was a shell entity that was in the market to merge

with an operating company.

On

March 17, 2008, EIH entered into an Agreement and Plan of Acquisition (the “Merger Agreement”) with Inko Sport America,

LLC (“ISA”), a Florida privately-held limited liability company. In connection with the closing of the Merger Agreement,

ISA merged with and into EIH effective May 7, 2008, with the filing of the Merger Agreement with the Florida Secretary of State.

Pursuant

to the terms and conditions of the Merger Agreement:

| ● | As

a precondition of the consummation of the merger transaction, a reverse stock split of

EIH common stock was consummated on a one for 1,000 basis pursuant to which each 1,000

outstanding shares of EIH common stock was converted into one share of Eurosport Active

World Corp. common stock. After giving effect to the reverse stock split, the authorized

capital stock of EIH immediately prior to the closing of the Merger Agreement consisted

of one billion shares of EIH common stock, of which 106,214 shares (as a result of the

reverse stock split) was issued and outstanding. |

| | | |

| ● | After

the reverse stock split, ISA agreed to acquire 100% of the ownership interest in EIH,

in exchange for the issuance of 20,500,000 (approximately 99% of the issued and outstanding

common stock of the Company). |

| | | |

| ● | Concurrent

with the closing of the Merger Agreement, 4,394,044 shares of common stock were issued

to EIH’s majority shareholder and officer, Michael Farkas, for the satisfaction

of obligations payable to him; and |

| | | |

| ● | Immediately

after the closing of the Merger Agreement, ISA merged with EIH, and adopted EAWC’s

business plan and changed its name to Eurosport Active World Corp (“EAWC”).

Further, upon completion of the merger, the prior officers and directors of EIH resigned

and the current officers and directors of the Company were appointed to their positions. |

This

transaction was accounted for as a recapitalization effected by a share exchange, wherein ISA was considered the acquirer for

accounting and financial reporting purposes.

ISA

was a development stage company, incorporated on February 24, 2005. Through December 31, 2012, the Company had been primarily

engaged in the promotion, development and commercialization of green technologies. In view of the increased demand of water and

energy, the Company began to focus on water generation, water purification, and green energy production (Waste to Energy); acquiring

and licensing the rights to sell and produce related technologies and securing through collaboration with Green Tech research

and developments centers in Europe, the research and development, technical maintenance, education and training related to the

technology.

Where

You Can Find Us

Our

principal executive offices are located at 2000 Ponce de Leon Blvd., 6th Floor, Miami, Florida 33134. Our telephone

number is 305-517-7330.

Implications

of Being an Emerging Growth Company

We

qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified

reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| |

● |

A

requirement to have only two years of audited financial statements and only two years of related MD&A; |

| |

|

|

| |

● |

Exemption

from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial

reporting under Section 404 of the Sarbanes-Oxley Act of 2002; |

| |

|

|

| |

● |

Reduced

disclosure about the emerging growth company’s executive compensation arrangements; and |

| |

|

|

| |

● |

No

non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller

reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In

addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying

with new or revised accounting standards. We have elected to use the extended transition period provided above and therefore our

financial statements may not be comparable to companies that comply with public company effective dates.

We

could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year

in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as

defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates

exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which

we have issued more than $1 billion in non-convertible debt during the preceding three year period.

For

more details regarding this exemption, see “Management’s Discussion and Analysis of Financial Condition and Results

of Operations – Critical Accounting Policies.”

THE

OFFERING

| Securities

Offered (1) |

|

21,747,348 shares

of the Company’s Common Stock

|

| |

|

|

| Common

Stock Outstanding Before the Offering (2): |

|

87,201,863

|

| |

|

|

| Common

Stock Outstanding After the Offering (2): |

|

87,201,863

|

| |

|

|

| Quotation

of Common Stock |

|

Our

common stock is listed for quotation on the OTC Pink market under the symbol “EAWD” |

| |

|

|

Terms

of the Offering:

|

|

The

selling shareholders will determine when and how they will sell the Common Stock offered

in this prospectus.

|

| |

|

|

| Termination

of the Offering: |

|

The

offering will conclude upon the earliest of: (i) such time as all of the Common Stock has been sold pursuant to the registration

statement of which this prospectus forms a part (the “Registration Statement”); or (ii) such time as all of the

Common Stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any

other rule of similar effect. |

| |

|

|

| Use

of proceeds: |

|

We

are not selling any shares of the Common Stock covered by this prospectus. As such, we will not receive any of the offering

proceeds from the registration of the shares of Common Stock covered by this prospectus. |

| |

|

|

| Risk

Factors: |

|

The

Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the

loss of their entire investment. See “Risk Factors” beginning on page 4. |

(1) Based on 87,201,863 shares of Common Stock outstanding

as of February 10, 2016.

(2) Does not include Common Stock underlying

2,200,000 options granted pursuant to stock plan that can be dilutive.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this prospectus, including in the documents incorporated by reference into this prospectus, includes

some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements

include, but are not limited to, statements regarding our Company and management’s expectations, hopes, beliefs, intentions

or strategies regarding the future, including our financial condition, results of operations, and the expected impact of the offering

on the parties’ individual and combined financial performance. In addition, any statements that refer to projections, forecasts

or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipates,” “believes,” “continue,” “could,” “estimates,”

“expects,” “intends,” “may,” “might,” “plans,” “possible,”

“potential,” “predicts,” “projects,” “seeks,” “should,” “will,”

“would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the

absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments

and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting

us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond

the parties’ control) or other assumptions that may cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements.

RISK

FACTORS

The

shares of our Common Stock being offered are highly speculative in nature, involve a high degree of risk and should be purchased

only by persons who can afford to lose the entire amount invested in the Common Stock. Before purchasing any of the shares of

Common Stock, you should carefully consider the following factors relating to our business and prospects. If any of the following

risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such

case, you may lose all or part of your investment. You should carefully consider the risks described below and the

other information in this process before investing in our Common Stock.

Ricks

Related to Our Business

OUR

ABILITY TO CONTINUE, AS A GOING CONCERN, IS IN SUBSTANTIAL DOUBT ABSENT OBTAINING ADEQUATE NEW DEBT OR EQUITY FINANCINGS.

Our

continued existence is dependent upon us obtaining adequate working capital to fund all of our operations. Working

capital limitations continue to impinge on our day-to-day operations, thus contributing to continued operating losses. Thus,

if we are unable to raise funds to fund the research and development of our products, we may not be able to continue as a going

concern and you will lose your investment. We have incurred accumulated operating losses since inception, have incurred operating

losses in 2014 and 2013 and have working capital deficits at the end of 2014 and 2013, respectively. Our independent accounting

firm has included in its report the qualification that these conditions raise a substantial doubt about the Company's ability

to continue as a going concern. The report also states that the consolidated financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

IF

WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO

LIMIT THE SCOPE OF OUR OPERATIONS.

The

severe recession, freezing of the global credit markets may adversely affect our ability to raise capital in the future. If adequate

additional financing is not available on reasonable terms or at all, we may not be able to undertake expansion, we may have to

modify our business plans accordingly.

Even

if we do find a source of additional capital, we may not be able to negotiate favorably terms and conditions for receiving the

additional capital. Any future capital investments will dilute or otherwise materially and adversely affect the holdings or rights

of our existing shareholders. In addition, new equity or debt securities issued by us to obtain financing could have rights, preferences

and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to

us, or if available, will be on terms favorable to us.

OUR

FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICES OF RALPH HOFMEIER AND IRMA VELAZQUEZ. WITHOUT

THEIR CONTINUED SERVICE, WE MAY BE FORCED TO INTERRUPT OR EVENTUALLY CEASE OUR OPERATIONS.

We

are presently dependent to a great extent upon the experience, abilities and continued services of Ralph Hofmeier, our President

and Chief Executive Officer Irma Velazquez, our COO.

WE

EXPECT SIGNIFICANT COMPETITION FOR OUR PRODUCTS AND SERVICES.

Many

of our competitors and potential competitors are well established and have substantially greater financial, research and development,

technical, manufacturing and marketing resources than we have today. If these larger competitors decide to focus on the development

of distributed power or cogeneration, they have the manufacturing, marketing and sales capabilities to complete research, development

and commercialization of these products more quickly and effectively than we can. There can also be no assurance that current

and future competitors will not develop new or enhanced technologies or more cost-effective systems, and therefore, there can

be no assurance that we will be successful in this competitive environment.

INTERNATIONAL

REGULATION MAY ADVERSELY AFFECT OUR PLANNED PRODUCT SALES.

As

a part of our marketing strategy, we plan to market and sell our products internationally. In addition to regulation by the U.S.

government, those products will be subject to environmental and safety regulations in each country in which we market and sell.

While we have already received regulatory approval in some countries including Mexico and India, we anticipate that regulations

will vary from country to country and will vary from those of the United States. The difference in regulations and the laws of

foreign countries may be significant and, in order to comply with the laws of these foreign countries, we may have to implement

manufacturing changes or alter product design or marketing efforts. Any changes in our business practices or products will require

response to the laws of foreign countries and will result in additional expense to the Company and either reduce or delay product

sales.

IN

THE CONDUCT OF OUR business, we sometimes rely upon the use of patents OWNED by other

entities or which are not exclusively owned by our company.

Our business

utilizes various technologies that are the subject of patents owned by other entities or for which we do not have exclusive ownership.

The use of such patented technologies is dependent upon the cooperation of such companies and our agreements with them. There

can be no assurances that any of our agreements will be extended beyond their current term or that such cooperation with entities

that control the patents will continue in the foreseeable future. Our success depends on our ability to continue to use the patented

technology identified in this prospectus and the ability of our business colleagues to maintain patent protection for their products

in the United States and in other countries and to enforce such patents. There can be no assurance that any of the patents relating

to the technology that we use will be deemed valid and enforceable against third-party infringement or that our products will

not infringe any third-party patent or intellectual property. Moreover, any patent claims relating to our technologies may not

be sufficiently broad to protect our products. In addition, issued patent claims may be challenged, potentially invalidated or

potentially circumvented. Our patent claims may not afford us protection against competitors with similar technology or permit

the commercialization of our products without infringing third-party patents or other intellectual property rights.

THE

OFFERING PRICE OF THE SHARES WAS ARBITRARILY DETERMINED, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET

PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO THE ACTUAL VALUE OF THE COMPANY, AND MAY MAKE

OUR SHARES DIFFICULT TO SELL.

Since

our shares are thinly traded on the OTC Pink Markets, the offering price of $1.00 per share for the shares of common stock was

arbitrarily determined. The facts considered in determining the offering price were our financial condition and prospects, our

limited operating history and the general condition of the securities market. The offering price bears no relationship to the

book value; assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded

as an indicator of the future market price of the securities.

Risks

Related to Our Common Stock

WE

WILL BE SUBJECT TO THE “PENNY STOCK” RULES WHICH WILL ADVERSELY AFFECT THE LIQUIDITY OF OUR COMMON STOCK.

The

Securities and Exchange Commission, or the SEC, has adopted regulations which generally define “penny stock” to be

an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. We expect the market

price of our common stock will be less than $5.00 per share and therefore we will be considered a “penny stock” according

to SEC rules. This designation requires any broker-dealer selling these securities to disclose certain information concerning

the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase

the securities. These rules limit the ability of broker-dealers to solicit purchases of our common stock and therefore reduce

the liquidity of the public market for our shares should one develop.

BECAUSE

DIRECTORS AND OFFICERS CURRENTLY AND FOR THE FORESEEABLE FUTURE WILL CONTINUE TO CONTROL EAWC, IT IS NOT LIKELY THAT YOU WILL

BE ABLE TO ELECT DIRECTORS OR HAVE ANY SAY IN THE POLICIES OF EAWC.

Our

shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring

shareholder approval will be decided by majority vote. The directors and officers of EAWC beneficially own approximately 57.34%

of our outstanding common stock. Due to such significant ownership position held by our insiders, new investors may

not be able to effect a change in our business or management, and therefore, shareholders would have no recourse as a result of

decisions made by management.

In

addition, sales of significant amounts of shares held by our officer and directors, or the prospect of these sales, could adversely

affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making

a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our shareholders

from realizing a premium over our stock price.

SINCE

WE INTEND TO RETAIN ANY EARNINGS FOR DEVELOPMENT OF OUR BUSINESS FOR THE FORESEEABLE FUTURE, YOU WILL LIKELY NOT RECEIVE ANY DIVIDENDS

FOR THE FORESEEABLE FUTURE.

We

have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future

earnings to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common

stock in the foreseeable future.

A

SIGNIFICANT NUMBER OF OUR SHARES WILL BE ELIGIBLE FOR SALE AND THEIR SALE OR POTENTIAL SALE MAY DEPRESS THE MARKET PRICE OF OUR

COMMON STOCK.

Sales of a

significant number of shares of our common stock in the public market could harm the market price of our common stock. This prospectus

relates to 21,747,348 shares of our common stock, which represents approximately [25%] of our current issued and outstanding shares

of our common stock. As additional shares of our common stock become available for resale in the public market pursuant to this

offering, and otherwise, the supply of our common stock will increase, which could decrease its price.

WE

MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING

REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We

may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable

corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by

the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our

legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable

rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance

and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or

similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board

of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable

rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition,

we may not be able to absorb these costs of being a public company, which will negatively affect our business operations.

THE

LACK OF PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM COULD ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS

OF U.S. SECURITIES LAWS.

Our management

team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as

those imposed by Sarbanes-Oxley Act of 2002. Our senior management has never had responsibility for managing a publicly traded

company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis.

Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond

to such increased legal, regulatory compliance and reporting requirements, including the establishing and maintaining internal

controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially

adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934, which is necessary

to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public

company would be in jeopardy in which event you could lose your entire investment in our company.

WE

ARE NOT REQUIRED TO FILE PROXY STATEMENTS PURSUANT TO THE SECURITIES EXCHANGE ACT OF 1934, WHICH MAY IMPEDE YOUR ABILITY TO OBTAIN

INFORMATION ABOUT OUR BUSINESS AND OPERATIONS.

Upon

effectiveness of this registration statement we will be subject to Section 15(d) of the Exchange Act unless we file a Form 8A

to register our common stock under Section 12 of the Securities Exchange Act of 1934. Pursuant to section 15(d) we are not required

to file proxy statements. Proxy statements may be useful to investors in assessing corporate business decisions such as how

management is paid and potential conflict-of-interest issues with auditors. Proxy statements may include but are not limited to:

| |

● |

Voting

procedure and information; |

| |

|

|

| |

● |

Background

information about the company's nominated directors including relevant history in the company or industry, positions on other

corporate boards, and potential conflicts of interest; |

| |

|

|

| |

● |

Board

compensation; |

| |

|

|

| |

● |

Executive

compensation, including salary, bonus, non-equity compensation, stock awards, options, and deferred compensation. Also, information

is included about perks such as personal use of company transportation, travel, and tax gross-ups. Many companies will also

include pre-determined payout packages if an executive leaves the company; and |

| |

|

|

| |

● |

Who

is on the audit committee, as well as a breakdown of audit and non-audit fees paid to the auditor; |

We

are subject to section 15(d) of the Exchange Act. We may never file a Form 8A to register our common stock under Section

12 of the Securities Exchange Act of 1934. If we do not file a Form 8A, we are not required to file proxy statements

and it may impede your ability to obtain information about our business and operations which may have a negative effect on your

investment.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of Common Stock by the selling shareholders. All of the net proceeds from the sale

of our Common Stock will go to the selling shareholders as described below in the sections entitled “Selling Security Holders”

and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the Common

Stock for the selling shareholders.

DETERMINATION

OF OFFERING PRICE

The

offering price of the shares of our Common Stock does not necessarily bear any relationship to our book value, assets, past operating

results, financial condition or any other established criteria of value. The facts considered in determining the offering price

were our financial condition and prospects, our limited operating history and the general condition of the securities market.

The

selling stockholders will offer common stock at the prevailing market prices or privately negotiated price. The offering price

of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition

or any other established criteria of value. Our common stock may not trade at market prices in excess of the offering price as

prices for common stock in any public market will be determined in the marketplace and may be influenced by many factors, including

the depth and liquidity.

DILUTION

The

shares of Common Stock to be sold by the selling shareholders as provided in the “Selling Security Holders” section

are shares of Common Stock that are currently issued. Accordingly, there will be no dilution to our existing shareholders.

SELLING

SHAREHOLDERS

The shares of Common Stock being offered for resale by the

selling shareholders consist of 21,747,348 shares.

The following table sets forth the

names of the selling shareholders, the number of shares of Common Stock beneficially owned by each of the selling shareholders

as of October 7, 2015 and the number of shares of Common Stock being offered by the selling shareholders. The selling shareholders

received their shares of common stock from the Company by purchasing such shares at various times or such shares were issued in

exchange for assets acquired by the Company or services rendered to the Company. The issuance of all shares of common stock identified

in the registration statement occurred pursuant to Section 4(a)(2) of the Securities Act of 1933. All shareholders were deemed

by Company principals to be “sophisticated investors” or “qualified institutional investors” at the time

such shares of common stock were issued. The shares being offered hereby are being registered to permit public secondary trading,

and the selling shareholders may offer all or part of the shares for resale from time to time. However, the selling shareholders

are under no obligation to sell all or any portion of such shares nor are the selling shareholders obligated to sell any shares

immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling

shareholders.

| NAME | |

SHARES

BENEFICIALLY OWNED PRIOR TO OFFERING | | |

SHARES

TO BE OFFERED | | |

AMOUNT

BENEFICIALLY OWNED AFTER OFFERING | | |

PERCENT

BENEFICIALLY OWNED AFTER OFFERING | | |

POSITION

OFFICE

OR OTHER MATERIAL RELATIONSHIP TO THE COMPANY WITHIN LAST THREE YEARS |

| Linda Anderson | |

| 187,857 | | |

| 187,857 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Archstone Capital (1) | |

| 2,500,000 | | |

| 2,500,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Adam Brinckman | |

| 8,000 | | |

| 8,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Philip Carson | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| David Chambovey | |

| 76,924 | | |

| 76,924 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Ashley Chipman | |

| 30,000 | | |

| 30,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Tiffany Chipman | |

| 30,000 | | |

| 30,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Joseph Dedek | |

| 12,500 | | |

| 12,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Albert Dossa | |

| 4,975 | | |

| 4,975 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Roland Feger | |

| 268,246 | | |

| 268,246 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Douglas Flaute | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Kathleen Forrester | |

| 1,334 | | |

| 1,334 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Rick Fuerstenau | |

| 4,000 | | |

| 4,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Mark George | |

| 232,500 | | |

| 232,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Hans V. Glattli | |

| 240,000 | | |

| 240,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Green Dimension Ltd. (2) | |

| 221,667 | | |

| 221,667 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Julian Hamburger | |

| 1,500 | | |

| 1,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Qaiser Hassan | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| David Hawkins | |

| 30,683 | | |

| 30,683 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Thomas Hewitt | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Eugene Hunt | |

| 16,000 | | |

| 16,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Mark Johnson | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| George Jordan | |

| 8,000 | | |

| 8,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Avi Keinan | |

| 50,000 | | |

| 50,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Keystone Ventures (3) | |

| 466,783 | | |

| 466,783 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Jeffrey Lagrew | |

| 10,000 | | |

| 10,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Christian Lherisson | |

| 1,236,669 | | |

| 1,236,669 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Timothy Meisner | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Mayan Metzler Leicht | |

| 23,333 | | |

| 23,333 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Guy Merezky | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Dominique Morand | |

| 42,345 | | |

| 42,345 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Ilona Muenzer | |

| 23,530 | | |

| 23,530 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Li San Ong | |

| 366,782 | | |

| 366,782 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Ana Beatrice Oregano | |

| 19,141 | | |

| 19,141 | | |

| 0 | | |

| 0 | % | |

Service Provider |

| Clyde Parks | |

| 300,000 | | |

| 300,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Frank Petrusnek | |

| 7,500 | | |

| 7,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Jaqueline Richardson | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Laurent Roten | |

| 60,000 | | |

| 60,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Frederieke Shoute | |

| 15,000 | | |

| 15,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| William Schrader | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Lloyd Telfort | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Michael Thieren | |

| 11,000 | | |

| 11,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Jean Luis Toffel | |

| 80,000 | | |

| 80,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| John Vandenberghe | |

| 300,000 | | |

| 300,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Yaron Weinberg | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Paul Westhof | |

| 50,000 | | |

| 50,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Tigertail Real Estate (4) | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Lherisson Viridiana/ AGI Funding | |

| 5,084,468 | | |

| 5,084,468 | | |

| 0 | | |

| 0 | % | |

Outsider investor |

| Andrea Hofmeier | |

| 8,000,000 | | |

| 8,000,000 | | |

| 0 | | |

| 0 | % | |

Ralph Hofmeier’s Divorced Wife |

| Patricia Elias | |

| 20,000 | | |

| 20,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Pierre Alain Frey | |

| 14,050 | | |

| 14,050 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Ana Beatrice Dominguez | |

| 18,561 | | |

| 18,561 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Corey Hoffman | |

| 415,000 | | |

| 415,000 | | |

| 0 | | |

| 0 | % | |

Corporate Legal Counsel |

| Chris Jessenberger | |

| 108,000 | | |

| 108,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Diego Andres Lherisson | |

| 10,000 | | |

| 10,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Leticia V. de Meerettig | |

| 50,000 | | |

| 50,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Mike & Leticia Meerettig | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| ORMA, S.A. Switzerland (6) | |

| 150,000 | | |

| 150,000 | | |

| 0 | | |

| 0 | % | |

Equipment Supplier |

| Pillow Hog Ventures (7) | |

| 510,000 | | |

| 510,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Andreas Rassmussen | |

| 76,000 | | |

| 76,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Tina Reine | |

| 60,000 | | |

| 60,000 | | |

| 0 | | |

| 0 | % | |

Service Supplier |

| Svein Viland | |

| 100,000 | | |

| 100,000 | | |

| 0 | | |

| 0 | % | |

License Vendor |

| |

(1) |

Ibrahim Almagarby has voting and dispositive power over Archstone Capital. |

| |

(2) |

Jaqueline Yung] has voting and dispositive power over Keystone Ventures |

| |

(3) |

Sagi Green has voting and dispositive power over Green Dimension Ltd. |

| |

(4) |

Tony Scarnavacca as voting and dispositive power over Tigertail Real Estate |

| |

(5) |

Benjamin Leuenberger has voting and dispositive power over ORMA, S.A. |

| |

(6) |

Matthew Chipman has voting and dispositive power over Pillow Hog Ventures. |

| |

(7) |

Based

on 87,201,863 shares of Common Stock issued and outstanding as of February 11, 2016. |

PLAN

OF DISTRIBUTION

This

prospectus is to be used by the Selling Security Holders in connection with a potential resale by certain Seller Security Holders

of up to an aggregate of 21,747,348 shares of the registrant’s Common Stock.

The

common stock held by the selling stockholders may be sold or distributed from time to time by the selling stockholders directly

to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing

at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be

changed on any stock exchange, market or trading facility on which the shares are traded or in private transactions. The sale

of the selling stockholders’ common stock offered by this prospectus may be affected in one or more of the following

methods:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales entered into after the effective date of the Registration Statement of which this prospectus is a part; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the selling shareholders to sell a specified number of such shares at

a stipulated price per share; |

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling shareholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

In

addition, the selling shareholders may enter into hedging transactions with broker-dealers who may engage in short sales, if short

sales were permitted, of shares in the course of hedging the positions they assume with the selling shareholders. The selling

shareholders may also enter into option or other transactions with broker-dealers that require the delivery by such broker-dealers

of the shares, which shares may be resold thereafter pursuant to this prospectus. None of the selling shareholders are broker-dealers

or affiliates of broker dealers. We will advise the selling shareholders that the anti-manipulation rules of Regulation M under

the Exchange Act may apply to sales of shares in the market and to the activities of the selling shareholders and their affiliates.

In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the

selling shareholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act

The

selling shareholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against

certain liabilities, including liabilities arising under the Securities Act.

Brokers,

dealers, or agents participating in the distribution of the shares may receive compensation in the form of discounts, concessions

or commissions from the selling shareholders and/or the purchasers of shares for whom such broker-dealers may act as agent or

to whom they may sell as principal, or both (which compensation as to a particular broker-dealer may be in excess of customary

commissions). Neither the selling shareholders nor we can presently estimate the amount of such compensation. We know of no existing

arrangements between the selling shareholders and any other stockholder, broker, dealer or agent relating to the sale or distribution

of the shares. We will not receive any proceeds from the sale of the shares of the selling shareholders pursuant to this prospectus.

We have agreed to bear the expenses of the registration of the shares, including legal and accounting fees, and such expenses

are estimated to be approximately $50,000.

Notwithstanding

anything set forth herein, no FINRA member will charge commissions that exceed 8% of the total proceeds of the offering.

DESCRIPTION

OF SECURITIES

Authorized

Capital and Preferred Stock

Our authorized capital stock consists

of 1,000,000,000 shares of common stock, par value $0.001 per share and 500,000,000 shares preferred stock, par value $0.001 per

share. As of February 11, 2016, there were 87,201,863 shares of common stock outstanding.

Common

Stock

The

following is a summary of the material rights and restrictions associated with our common stock.

Each

share of Common Stock shall have one (1) vote per share for all purposes. Our Common Stock does not provide preemptive, subscription

or conversion rights and there are no redemption or sinking fund provisions or rights. Holders of shares of Common Stock are not

entitled cumulative voting for electing members of the Board. Please refer to the Company’s Articles of Incorporation, Bylaws

and the applicable statutes of the State of Florida for a more complete description of the rights and liabilities of holders of

the Company’s securities.

Preferred

Stock

Of

the 500,000,000 shares of preferred stock authorized, there are no shares issued or outstanding.

Dividends

We

have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our

Board and depends upon our earnings, if any, our capital requirements and financial position, and general economic conditions.

It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any,

in our business operations.

Warrants

The

Company does not currently have any warrants issued or outstanding.

Options

On

January 2, 2012, the Company’s Board of Directors approved the creation of the 2012 Non-Qualified Stock Option Plan (the

“2012 Plan”). The 2012 Plan provides for the issuance of incentive stock options to designated employees,

certain key advisors and non-employees members of the Board of Directors with the opportunity to receive grant awards to acquire,

in the aggregate, up to 5,000,000 shares of the Company’s common stock.

A

summary of information regarding the Company’s common stock options outstanding is as follows:

| | |

Number

of

Shares | | |

Weighted

Average

Exercise

Price | | |

Weighted

Average

Remaining Contractual

Term (Years) | |

| Outstanding

at December 31, 2012 | |

| 2,200,000 | | |

$ | 0.10 | | |

| 8 | |

| Issued | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Outstanding

at December 31, 2013 | |

| 2,200,000 | | |

| 0.10 | | |

| 7 | |

| Issued | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Outstanding

at December 31, 2014 | |

| 2,200,000 | | |

$ | 0.10 | | |

| 6 | |

| Issued | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | |

Outstanding at September 30,

2015

| |

| 2,200,000 | | |

$ | 0.10 | | |

| 5.3 | |

The above outstanding options were

granted to a former Company executive. Of these options, 1,240,000 shares were vested and exercisable at December 31, 2012. During

the years ended December 31, 2014 and 2013 and the nine months ended September 30, 2015, the Company recognized stock-based

compensation expense of approximately $12,000, $12,000 and $9,000, respectively, related to stock options. The weighted-average

grant date fair value of each option was estimated to approximate $.05 using the Black Scholes valuation methodology. As of December

31, 2014 and September 30, 2015, there was approximately $24,000 and $15,000, of total unrecognized compensation costs related

to non-vested stock options, which is to be recognized over the next 1.5 years.

The

fair value of stock options granted of $0.05 per share was calculated using the Black-Scholes option pricing model based on the

following assumptions; risk free interest rate of 1.89%, expected volatility of 317.38%, expected option terms of 9.08 years and

no expected dividend yield.

Expected

volatility is based on historical volatility of the Company and other comparable companies. Short Term U.S. Treasury rates were

utilized. The expected term of the options was calculated using the alternative simplified method permitted by SAB 107, which

defines the expected life as the average of the contractual term of the options and the weighted average vesting period for all

option tranches.

The following table summarizes the activity

of non-vested employee stock options:

| | |

Number

of

Non-Vested

Shares | | |

Weighted-

Average

Grant Date

Fair Value | |

| Outstanding at December 31, 2012 | |

| 960,000 | | |

$ | 48,000 | |

| Granted | |

| - | | |

| - | |

| Vested | |

| 240,000 | | |

| 12,000 | |

| Forfeited | |

| - | | |

| - | |

| Outstanding at December 31, 2013 | |

| 720,000 | | |

| 36,000 | |

| Granted | |

| - | | |

| - | |

| Vested | |

| 240,000 | | |

| 12,000 | |

| Forfeited | |

| - | | |

| - | |

| Outstanding at December 31, 2014 | |

| 480,000 | | |

$ | 24,000 | |

| Granted | |

| - | | |

| - | |

| Vested | |

| 180,000 | | |

| 9,000 | |

| Forfeited | |

| - | | |

| - | |

| Outstanding at September 30, 2015 | |

| 300,000 | | |

$ | 15,000 | |

Transfer

Agent and Registrar

Worldwide

Stock Transfer, LLC, One University Plaza, Suite 505, Hackensack, NJ 07601, Phone: (201) 820-2008, Fax: (201) 820-2010.

Listing

Our common

stock is currently quoted on the OTC Pink Market under the symbol “EAWD”; however, our securities are currently

highly illiquid, and subject to large swings in trading price, and are only traded on a sporadic and limited basis. On

February 11, 2016, the last reported sale price per share for our common stock as reported was $1.38.

INTERESTS

OF NAMED EXPERTS AND COUNSEL

No

expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion

upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering

of the Common Stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial

interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with

the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director,

officer, or employee.

The

financial statements as of December 31, 2014 and 2013 and each of the years then ended included in this prospectus and the registration

statement have been audited by Mallah Furman to the extent and for the periods set forth in their report appearing elsewhere herein

and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts

in auditing and accounting.

The validity of the issuance of

the Common Stock hereby will be passed upon for us by Law Office of Clifford J. Hunt, P.A. 8200 Seminole Boulevard Seminole, Florida

33772. Neither Mr. Hunt nor his law firm has any direct or indirect ownership interest in any of the shares of capital stock of

our Company.

DESCRIPTION

OF BUSINESS

Overview

The

Company focuses on green sustainable solutions to generate and purify water, as well as the production and reproduction of energy.

EAWC is primarily engaged in the promotion, development and commercialization of green technologies. In light of the increased

demand for water and energy around the world, the Company and its partners develop, manufacture, distribute and operate water

generation, water purification, and green energy production (Waste to Energy) technologies. http://www.eawctechnologies.com

Company

History

Merger

Agreement

Eurosport

Active World Corporation (the “Company”) (formerly Eagle International Holdings Group Inc. or “EIH”),

was incorporated under the laws of the State of Florida on August 23, 2000. EIH was a shell entity that was in the market to merge

with an operating company.

On

March 17, 2008, EIH entered into an Agreement and Plan of Acquisition (the “Merger Agreement”) with Inko Sport America,

LLC (“ISA”), a Florida privately held Limited Liability Company. In connection with the closing of the Merger Agreement,

ISA merged with and into EIH effective May 07, 2008, with the filing of the Merger Agreement with the Florida Secretary of State.

Pursuant

to the terms and conditions of the Merger Agreement:

| ● | As

a precondition of the consummation of the merger transaction, a reverse stock split of

EIH common stock was consummated on a one for 1,000 basis pursuant to which each 1,000

outstanding shares of EIH common stock was converted into one share of EAWC common stock.

After giving effect to the reverse stock split, the authorized capital stock of EIH immediately

prior to the closing of the Merger Agreement consisted of one billion shares of EIH common

stock, of which 106,214 shares (as a result of the reverse stock split) was issued and

outstanding with former EIH shareholders. |

| | | |

| ● | After

the reverse stock split, the merged companies ISA & EIH will operate under the name

of Eurosport Active World Corp (EAWC) and issuance of 20,500,000 (approximately 99% of

the issued and outstanding common stock of the Company). |

| | | |

| ● | Concurrent

with the closing of the Merger Agreement, 4,394,044 shares of common stock were issued

to EIH’s majority shareholder and officer, Michael Farkas, for the satisfaction

of obligations payable to him; and |

| | | |

| ● | Immediately

after the closing of the Merger Agreement, EAWC adopted ISA’s business plan and

changed its name to Eurosport Active World Corp (“EAWC”). Further, upon completion

of the merger, the prior officers and directors of EIH resigned and the current officers

and directors of the Company were appointed to their positions. |

This

transaction was accounted for as a recapitalization effected by a share exchange, wherein ISA was considered the acquirer for

accounting and financial reporting purposes.

ISA

was a development stage company, incorporated on February 24, 2005 in the State of Florida. Through December 31, 2012, the Company

had been primarily engaged in the promotion, development and commercialization of green technologies. In view of the increased

demand of water and energy, the Company began to focus its business goals on water generation, water purification, and green energy

production (Waste to Energy); acquiring and licensing the rights to sell and produce related technologies and securing through

collaboration with Green Tech research and developments centers in Europe, the research and development, technical maintenance,

education and training related to the technology.

We

were formed as a Green tech platform of renewable technologies industry. The Green Tech industry is subject to constant evolving

due to ongoing water scarcity as well as energy increased need, thereby making it a rapidly growing up market. The Green tech

industry is complex, because still require much promotion and information about its potential to be known furthermore regulations

in each country are different in a way that several segments are regulated by both federal and state governments. EAWC’s

approach assists general business operations with the growth and development of their business, by ensuring the efficient, profitable

and sustainable supply/generation of water and energy as required; allowing our potential customers to focus on the business while

been sustainable on its development. By using the technologies/services provided by EAWC, our clients are free to focus on compliance

with performance of their operations as well as with the water and energy consumption or generation regulations within their industry,

and to complete their primary business goals.

We

continue to be a development stage company. We have not yet generated any revenue from our operations. We presently have only

two employees, our Chief Executive Officer, Ralph Hofmeier and our Chief Operating Officer, Irma Velasquez. We presently rely

on third parties to manufacture our products, sell and distribute them.

EUROSPORT

ACTIVE WORLD CORP focuses on four main aspects of the Water and Energy business: Generation, Supply, Commercialization and Waste

to Energy. Assisting business owners and/or municipalities to build profitable and sustainable supply/generation of water and

energy as required; by selling them the required technology or technical service to enhance its productivity/operability. With

its technical arm (Swiss Water Tech R&D) and it global network of vendors, the company would add sustainable added value to

each of the projects.

Our

programs will be tailored to meet the needs and requests of our clients. We will assist our clients with growth by increasing

their customer base and assisting their operations and growth management in new markets.

We

will provide customized technologies and technical services, based upon client preference, which may include any or all of the

following:

| |

● |

Water/Energy

Generation |

| |

|

|

| |

● |

Waste

to Energy Plants

|

| |

|

|

| |

● |

Technical

assistance |

| |

|

|

| |

● |

Strategic

and financial partnering; |

| |

|

|

| |

● |

Project

management; |

The

company has consulted on a number of projects on a pro-bono basis to establish a strong corporate history toward obtaining a strong

sales client base. The cost of our technologies and/or for our services will be dependent upon particularities of the needs of

supplying/generation water or energy of each project/client company and the complexity of the client/project company business.

EAWC Technical consulting fees will be negotiated and established based upon factors such as the level of services requested by

the client.

Thus

far we have marketed our technologies and services primarily to the private sector and some municipalities of the states of California,

Nevada, Florida and Alaska in the United States of America (the “U.S.”) as well in other countries of the American

Continent such as Mexico, Puerto Rico and Chile, to mention some of them and other countries of the African Continent such as

South Africa and Kenya and India in the Asian Continent. EAWC has been doing business development since its reactivation in April

2012. Ralph Hofmeier, our president has been involved in the company since inception and is the founder, as well as Ms. Irma Velazquez

our COO. We focus on geographic areas, projects and budget levels where we believe there are significant demand for our technologies

& services and the potential for attractive returns to our company and investors. We do not consider our company to be a “blank

check company” as such term is defined in Securities and Exchange Commission Rule 419; however, we are a company with minimal

revenues and limited operations and our auditor has expressed substantial doubt about our ability to continue as a going concern.

The company has no present plans to be acquired or to merge with another company nor does the company, nor any of its shareholders,

have plans to enter into a change of control or similar transaction The company does now and will continue to operate as a Green

Tech commercial company, on an income-based sales and technical services through our agreements with the Swiss Water Tech R&D

Centre, for independent clients requiring our technologies, expertise, experience and international contact networks. Any acquisitions

that the company may make in the future, would be of companies similar in nature to our own, operating in similar or complementary

industry segments or geographic location; that would provide EAWC with new growth opportunities or competitive advantage.

However, even though our business plan does contemplate potential growth through the acquisition of specialty service providers

and other independent consulting services companies that would complement our business plan we are first and foremost a Green

Tech company EAWC anticipates growth through the consolidation of sales of technologies and

consulting service providers.

We

believe that our conduct to date evidences significant, bona fide business operations and a scenario that is wholly inapposite

to any attempt to create the mere appearance of a specific business plan and effort to avoid the application of Rule 419.

The

Company is focused on addressing areas of business, which concentrate on new technological and engineering concepts relating to

Water and Energy generation as well as Waste to Energy development and those related components that assist in advancing the Green

Tech industry. These include:

| ● | Advancement

of Atmosphere Water Generators, Energy self sufficient supply; |

| ● | Advance

new ideas on Waste to Energy implementation; |

| ● | Small,

Hi-energy cost effective generators; |

| ● | New

Syn Gas Engine/Motor Design, prototyping and manufacture. |

The

founders of Eurosport Active World Corp have extensive experience in both the technical development and operation processes aspects

associated with this industry, and for this reason, we intend to enhance the collaboration with its today technical provider the

Research & Development Centre (SWATE) to ensure the provision of the technical advice services and expended when required

on a contractual basis, to project owners that acquire the EAWC Technologies.

Agreements

with Swiss Water Tech Research and Development S.A.

Effective

February 1, 2013, and as amended on June 29, 2015, the Company entered into an exclusive Technology Transfer Agreement and License

Agreement (the "Technology Transfer and License Agreement") for a period of ten years with Swiss Water Tech Research

& Development S.A. (“SWATE”), an entity owned and controlled by the Company's Chief Executive Officer and Chief

Operating Officer who are the primary beneficiaries. Under the terms of the agreement, SWATE: (a) will transfer to the Company

the license to manufacture products developed by SWATE; (b) all know-how and technical assistance necessary for the exploitation

of their licensed patents and the manufacture of certain products; and (c) will grant the Company the use of certain related trademarks.

If the Company generates as a result of the products and licenses related to the Technology Transfer and License Agreement, the

Company is to pay to SWATE a minimum annual royalty fee stipulated in the agreement plus five percent of revenue generated. Since

the Company has not generated revenues, during 2013 the Company accrued the minimum fee of approximately $542,000 in accordance

with the terms of the agreement. On April 15, 2015, SWATE agreed to waive licenses fees for 2014 and 2015.

As part of the exclusive Technology

Transfer and License Agreement, on February 1, 2013, the Company was required to pay a non-refundable front-end fee of $6 million

in exchange for the use of newly developed systems, concepts and license of patent and trademark. The Company satisfied the required

payment through the issuance of 6 million shares of its common stock, valued at $1.00 per share. During 2013, the Company recognized

amortization expense in the amount of $550,000. On December 31, 2013 the Company evaluated the unamortized asset for impairment

and determined that due to its inability to secure revenue generating commercial contracts, the recoverability of this asset in

future periods was doubtful. Accordingly, the Company fully impaired the remaining unamortized value of the front-end fee of $5,450,000.

Our transactions with related parties were valued at zero dollars ($0.00) and values ascribed to securities utilized in such transactions

were determined arbitrarily and have no relationship to book value or any traditional market values.

Effective February 1, 2013, the Company

also entered into an International Service Contract with SWATE (the "SWATE Service Contract"). Under this agreement,

SWATE will provide operations management, engineering and technical services to the Company. These services include:

Financial and Accounting Matters

– SWATE shall maintain the Company’s general ledger, accounts receivable and accounts payable records, and fixed

asset records and provide billing and collection services. SWATE shall also provide, or cause to be provided to client, payroll

services, including assistance with regulatory compliance matters.

Insurance Matters –

SWATE shall provide or cause to be provided to the Company, insurance with the coverage, insurers and maximum deductibles as will

be requested by the Company via a written notice. All such insurance policies shall add the Company as an additional named insured,

and such insurers shall be required to provide the Company with no less than 30 days’ prior written notice of any change

or cancellation of any such insurance. In the event of any such potential change that may have a materially adverse effect on

the Company, or in the event of potential cancellation, Company shall be entitled to secure replacement insurance at its own cost.

IT Services – SWATE

shall provide certain general information technology services and infrastructure including assistance with installation, and maintenance

of telephonic and computer equipment. SWATE shall also provide the Company with the use of SWATE’s existing and future telephone

automatic call distribution networks and systems and email systems. SWATE shall provide such technical support and maintenance

as the Company reasonably requests for the Company and its clients.

Web Hosting and Maintenance of

Client Web Site – SWATE will provide Web hosting and maintenance services for the Company website. In consideration

of hosting and maintaining the Company website, Company transfers to SWATE the right to use the Company website has its own website

in its efforts to sell the Company’s products.

Customer Support –

SWATE shall provide and perform such services related to technical assistance to the Company’s and user customers and distributors,

customer training and any other tasks relating to servicing the Company’s customers and distributors.

Supply Chain Management –

SWATE shall provide and perform such services related to the delivery of physical Company packages to the Company’s distributors

or end-user customers; provided that the cost of these services to the Company will equal Administrative Services compensation

plus other direct costs and expenses related to packaging and shipping.

Development Support –

SWATE shall perform such specific consulting projects and research projects for the Company business development, from time to

time, as requested by the Company and upon such terms as may be agreed upon between the Company and SWATE; provided that the cost

of the services will equal SWATE’s salary and benefits costs for the employee-developers and other direct costs and expenses,

plus fifteen percent (15%).

Other Services Provided –