UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June

12, 2015

POWERSTORM HOLDINGS, INC.

(Exact name of

registrant as specified in its charter)

| Delaware |

|

333-184363 |

|

45-3733512 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

31244 Palos Verdes Dr. W, Ste 245

Rancho Palos Verdes, CA 90275-5370 |

| (Address of principal executive offices)(Zip Code) |

| Registrant’s telephone number, including area code: 1-424-327-2991 |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers

Appointment of Directors

On June 24, 2015, Powerstorm Holding, Inc.’s (the “Company”) Board of Directors (the “Board”) approved

the appointment of Mr. Michael Porter as a new Director to serve on the Board.

Mr. Porter is 72 years old. He earned his

Bachelor’s Degree from Rider University. Currently he sits on the President’s Council for the University. He

also completed Harvard University Business School’s Owners/Presidents Management program in 2002. Mr. Porter has owned

the investor relations firm Porter, LeVay & Rose for 45 years. The company specializes in small to mid-cap stocks, including

micro-cap. He has extensive experience overseeing the activities of a company, as he has sat on three boards prior to joining Powerstorm.

Having worked with many companies overseeing many disciplines, Mr. Porter is well known and well respected within the industry,

and also possesses a valuable familiarity with the Sarbanes-Oxley Act.

Additionally, since Mr. Porter is not an

employee of the Company, the Company and Mr. Porter entered into a Director Agreement, dated as of June 24, 2015, which sets forth

the terms of Mr. Porter’s appointment as a Director of the Company (the “Porter Director Agreement”). The Porter

Director Agreement provides that, unless terminated earlier pursuant to the Porter Director Agreement, Mr. Porter will serve as

a Director commencing on June 24, 2015 and terminating one year later subject to a one year renewal term upon re-election by a

majority of the shareholders. The Porter Director Agreement further provides that, as sole consideration for Mr. Porter’s

directorship, Mr. Porter will receive 50,000 shares of common stock of the Company and expense reimbursement.

Mr. Porter is also subject to certain confidentiality

and non-solicitation provisions as set forth in the Porter Director Agreement. Lastly, under the Porter Director Agreement, the

Company agreed to cover Mr. Porter’s directors’ and officers’ liability insurance and indemnify Mr. Porter for

certain losses caused by, or relating to Mr. Porter’s performance of his duties as a Director of the Company.

Item 1.01 Entry into a Material Definitive Agreements.

The Equity Group- Consulting Contract

The Company and The Equity Group Inc. (the

“Equity Group”) entered into a consulting contract dated as of June 25, 2015 pursuant to which the Company engaged

the Equity Group for investor relations services (the “Consulting Contract”). Under the Consulting Contract, the Company

will pay the Equity Group a monthly fee of $7,500. Prior to the Company completing a financing, this fee will be paid as follows:

(1) $3,750 will be paid at the beginning of each month and (2) $3,750 will be accrued and become payable upon completion of the

financing. The Company will also issue the Equity Group $25,000 in connection with, and on the same terms as, the next financing

closed by the Company. The Equity Group will also be reimbursed by the Company for any all reasonable and necessary out of pocket

expenses, subject to approval by the Company of expenses in excess of $500.

The Consulting Contract term commenced

on June 29, 2015. After the first 90-day period, either party may terminate the Consulting Contract upon 30 days’ notice.

The Consulting Contract includes indemnity provisions for both parties.

Carebourn Capital, L.P.- Financing

On June 16, 2015, the Company closed a

financing transaction pursuant to a Securities Purchase Agreement, dated June 12, 2015 (“Securities Purchase Agreement”)

and Convertible Promissory Note, dated June 12, 2015 (the “Note”), each entered into by the Company and Carebourn Capital,

L.P. (the “Purchaser”). Pursuant to the Securities Purchase Agreement, the aggregate principal amount of the 10% convertible

note is $87,000 and, as described below, the purchase price of the Note is $80,000.

The Securities Purchase Agreement provides

that the Company will use the proceeds from the sale of the Note for working capital and other general corporate purposes and that

the Company will reimburse Purchaser $3,000 for expenses Purchaser incurred in connection with the Securities Purchase Agreement

and Note.

The terms of the Note are as follows:

The Note, dated June 12, 2015 (the “Issue

Date”), earns interest at an annual rate equal to 10% and provides for a maturity date of February 16, 2016. Any amount of

principal or interest not paid when due will bear interest at an annual rate of 22% applied from the due date until the date of

payment. The Note carries an original issue discount of $4,000. As described above, the Company agrees to pay the Purchaser $3,000

to cover certain fees incurred in connection with the Securities Purchase Agreement and Note. The original issue discount and the

amount for fees are included the initial principal amount of the Note. As a result, the purchase price of the Note is $80,000,

which is an aggregate $87,000 in initial principal balance, less the $4,000 original issue discount and $3,000 in fees.

The conversion price is equal to 57% multiplied

by the average of the lowest three trading prices for the Company’s common stock during the 10-day period ending on the latest

complete trading day prior to the date of conversion (represents a 43% discount). The convertibility of the Note may be limited

if, upon conversion, the Purchaser or any of its affiliates would beneficially own more than 4.99% of the Company’s common

stock. While the Purchaser’s conversion rights exist, the Company will reserve a sufficient number of shares from its authorized

and unissued shares of common stock to provide for the issuance of common stock upon the full conversion of the Note.

The Company may prepay the Note in full

by paying off all principal, interest and any other amounts owing multiplied by (i) 125% if prepaid during the period commencing

on the Issue Date through 30 days thereafter, (ii) 130% if prepaid between 31 days and 60 days following the Issue Date, (iii)

135% if prepaid between 61 days and 90 days following the Issue Date, (iv) 140% if prepaid between 91 days and 120 days following

the Issue Date, (v) 140% if prepaid between 121 days and 150 days following the Issue Date, and (vi) 140% if prepaid between 151

days and 180 days following the Closing Date. After the expiration of 180 days following the Issue Date, the Company has no right

of prepayment.

The Purchaser represented that it is an “accredited investor”

as that term is defined in Rule 501 of Regulation D.

Item 3.02 Unregistered Sales of Equity Securities.

The applicable information set forth in Item 1.01 of this Current

Report on Form 8-K is incorporated by reference in this Item 3.02.

The securities underlying the Note are exempt from registration

pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation

D as promulgated under the Securities Act.

The foregoing securities under Securities Purchase Agreement

were offered and sold without registration under the Securities Act of 1933 (the “Securities Act”) in reliance on the

exemptions provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder and in reliance on similar

exemptions under applicable state laws.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

POWERSTORM HOLDINGS, INC. |

| |

|

|

| Date: July 2, 2015 |

By: |

/s/ Michel

Freni |

| |

|

Michel Freni |

| |

|

Chief Executive Officer |

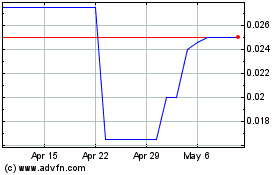

Powerstorm (PK) (USOTC:PSTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

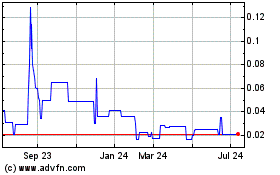

Powerstorm (PK) (USOTC:PSTO)

Historical Stock Chart

From Apr 2023 to Apr 2024