ProShares, a premier provider of alternative ETFs, announced

today forward and reverse share splits on 21 of its ETFs. The

splits will not change the value of a shareholder’s investment.

Forward Splits

Twelve ETFs will forward split shares 2-for-1:

Ticker

ProShares ETF Split Ratio

CSM Large Cap Core Plus 2:1 SAA

Ultra SmallCap600 2:1 UMDD

UltraPro MidCap400 2:1 SSO Ultra

S&P500 2:1 UPRO UltraPro S&P500

2:1 DDM Ultra Dow30 2:1

UDOW UltraPro Dow30 2:1 RXL

Ultra Health Care 2:1 QLD Ultra

QQQ 2:1 UYG Ultra Financials

2:1 ROM Ultra Technology 2:1 BIB

Ultra Nasdaq Biotechnology 2:1

All splits will apply to shareholders of record as of the close

of the markets on May 18, 2015, payable after the close of the

markets on May 19, 2015. The funds will trade at their post-split

price on May 20, 2015. The ticker symbol and CUSIP numbers for the

funds will not change.

The splits will decrease the price per share of each fund with a

proportionate increase in the number of shares outstanding. For

example, for the 2-for-1 splits, every pre-split share will result

in the receipt of two post-split shares, which will be priced at

half the net asset value (“NAV”) of a pre-split share.

Illustration of a Forward Split

The following table shows the effect of a hypothetical 2-for-1

split:

Period # of Shares Owned

Hypothetical NAV Value of Shares

Pre-Split 100 $100.00

$10,000.00 Post-Split 200 $50.00

$10,000.00

Reverse Splits

Nine ETFs will reverse split shares at the following split

ratios:

Ticker

ProShares ETF Split Ratio

Old CUSIP New CUSIP SRS

UltraShort Real Estate 1:4 74348A871

74348A244 SCC UltraShort Consumer

Services 1:4 74348A616

74348A236 RXD UltraShort Health Care

1:4 74347B102 74348A228 RWM

Short Russell2000 1:4 74347R826

74348A210 BOIL Ultra Bloomberg Natural

Gas 1:4 74347W122

74347W296 UCD Ultra Bloomberg Commodity

1:4 74347W106 74347W288 YCL

Ultra Yen 1:4 74347W866

74347W270 UVXY Ultra VIX Short-Term Futures

1:5 74347W346 74347W312

UCO Ultra Bloomberg Crude Oil 1:5

74347W650 74347W320

All reverse splits will be effective at the market open on May

20, 2015, when the funds will begin trading at their post-split

price. The ticker symbol for the funds will not change. All funds

undergoing a reverse split will be issued a new CUSIP number,

listed above.

The reverse splits will increase the price per share of each

fund with a proportionate decrease in the number of shares

outstanding. For example, for a 1-for-4 reverse split, every four

pre-split shares will result in the receipt of one post-split

share, which will be priced four times higher than the NAV of a

pre-split share.

Illustration of a Reverse Split

The following table shows the effect of a hypothetical 1-for-4

reverse split:

Period # of Shares Owned

Hypothetical NAV Value of Shares

Pre-Split 1,000 $10.00

$10,000.00 Post-Split 250 $40.00

$10,000.00

Fractional Shares from Reverse Splits

For shareholders who hold quantities of shares that are not an

exact multiple of the reverse split ratio (for example, not a

multiple of 4 for a 1-to-4 reverse split), the reverse split will

result in the creation of a fractional share. Post-reverse split

fractional shares will be redeemed for cash and sent to your broker

of record. This redemption may cause some shareholders to realize

gains or losses, which could be a taxable event for those

shareholders.

About ProShares

ProShares offers the nation's largest lineup of alternative

ETFs. We help investors to go beyond the limitations of

conventional investing and face today's market challenges.

ProShares helps investors build better portfolios by providing

access to alternative investments delivered with the liquidity,

transparency and cost effectiveness of ETFs. Our wide array of

alternative ETFs can help you reduce volatility, manage risk and

enhance returns.

ProShares has the largest lineup of alternative ETFs in the

United States according to Strategic Insight, based on analysis of

all the known alternative ETF providers (as defined by Strategic

Insight) by their number of funds and assets (as of 1/31/2015).

Geared (Short or Ultra) ProShares ETFs seek returns that are

either 3x, 2x, -1x, -2x or -3x the return of an index or other

benchmark (target) for a single day, as measured from one

NAV calculation to the next. Due to the compounding of daily

returns, ProShares' returns over periods other than one day will

likely differ in amount and possibly direction from the target

return for the same period. These effects may be more pronounced in

funds with larger or inverse multiples and in funds with volatile

benchmarks. Investors should monitor their ProShares holdings

consistent with their strategies, as frequently as daily. For more

on correlation, leverage and other risks, please read the

prospectus.

Investing involves risk, including the possible loss of

principal. ProShares ETFs are generally non-diversified and

each entails certain risks, which may include risk associated with

the use of derivatives (swap agreements, futures contracts and

similar instruments), imperfect benchmark correlation, leverage and

market price variance, all of which can increase volatility and

decrease performance. Short positions lose value as security prices

increase. Leverage can increase market exposure and magnify

investment risk. Narrowly focused investments and investments in

smaller companies typically exhibit higher volatility. There are

additional risks related to commodity investments due to large

institutional purchases or sales, and natural and technological

factors such as severe weather, unusual climate change, and

development and depletions of alternative resources. There are

additional risks due to debt levels in the underlying countries,

inflation and interest rates, investment activity, and global

political and economic concerns. Certain derivative instruments

will subject the fund to counterparty risk and credit risk, which

could result in significant losses for the fund. Please see their

summary and full prospectuses for a more complete description of

risks. There is no guarantee any ProShares ETF will achieve its

investment objective.

Investing in ETFs involves a substantial risk of loss. BOIL,

UCD, YCL, UVXY and UCO are not investment companies regulated under

the Investment Company Act of 1940 and are not afforded its

protections. Please read the prospectus carefully before

investing. These ETFs generate a K-1 tax form. UVXY invests in

futures. VIX futures are among the most volatile futures contracts.

A fund's exposure to its index may subject that fund to greater

volatility than investments in traditional securities, which may

adversely affect an investor's investment in that fund. VIX futures

indexes are mean reverting; funds benchmarked to them should not be

expected to appreciate over extended periods. Due to defined time

periods and other features, VIX futures indexes and funds

benchmarked to them can be expected to perform differently than the

VIX. These ETFs are not suitable for all investors.

Carefully consider the investment objectives, risks, charges

and expenses of ProShares before investing. This and other

information can be found in their summary and full prospectuses.

Read them carefully before investing.

This information must be accompanied or preceded by a current

ProShares Trust II prospectus

(http://www.proshares.com/funds/trust_ii_prospectuses.html).

ProShares Trust II (issuer) has filed a registration statement

(including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the

prospectus in that registration statement and other documents the

issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free

by visiting EDGAR on the SEC website at sec.gov. Alternatively, the

issuer will arrange to send you the prospectus if you request it by

calling toll-free 866.776.5125 or visiting ProShares.com.

ProShares are distributed by SEI Investments Distribution Co.,

which is not affiliated with the funds' advisor or sponsor.

Media:Hewes Communications, Inc.Tucker Hewes,

212-207-9451tucker@hewescomm.comorInvestors:ProShares,

866-776-5125ProShares.com

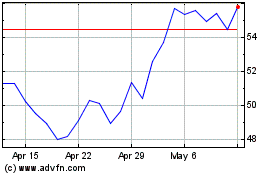

ProShares Ultra NASDAQ B... (NASDAQ:BIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

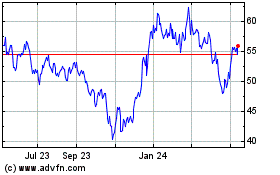

ProShares Ultra NASDAQ B... (NASDAQ:BIB)

Historical Stock Chart

From Apr 2023 to Apr 2024