Avidbank Holdings, Inc. ("the Company") (OTCBB:AVBH), a bank

holding company and the parent company of Avidbank ("the Bank"), an

independent full-service commercial bank serving businesses and

consumers in Northern California, announced unaudited consolidated

net income of $996,000 for the fourth quarter of 2014 compared to

$635,000 for the same period in 2013.

Full Year and Fourth Quarter 2014

Financial Highlights

- Net income was $2,744,000 in 2014,

compared to $2,508,000 in 2013. Results for the 2013 period

included $748,000 in gains from the sale of investment securities

compared to $261,000 in the 2014 period.

- Diluted earnings per common share were

$0.62 for the year ended 2014, compared to $0.64 in 2013. Diluted

earnings per common share were $0.22 for the fourth quarter of

2014, compared to $0.15 for the fourth quarter of 2013.

- Net income was $996,000 for the fourth

quarter of 2014, compared to $635,000 for the fourth quarter of

2013. Results for the fourth quarter of 2013 included no gains from

the sale of investment securities compared to $239,000 in the

fourth quarter of 2014.

- Total assets decreased by 6% over the

past twelve months, ending the fourth quarter at $469 million.

- Total loans outstanding grew by 33% in

2014, ending the fourth quarter at $342 million.

- Total deposits decreased by 14% over

the past twelve months, ending the fourth quarter at $386

million.

- The Bank continues to be well

capitalized with a Tier 1 Leverage Ratio of 10.5% and a Total Risk

Based Capital Ratio of 12.2%.

Mark D. Mordell, Chairman and Chief Executive Officer, stated,

"The Bank's efforts to grow the loan portfolio by increasing loan

production staff and facilities were substantially achieved in

2014. Loans outstanding increased more than $84 million during the

year, a 33% rate of growth. These results confirm our progress as

we focus on our plan of sustained and prudent growth in our loan

portfolio. Net income for 2014 grew by 9% over 2013 primarily due

to higher loans outstanding and the need for a smaller loan loss

provision. We experienced solid growth in all four of our lending

divisions in 2014. Our net interest margin improved to 4.20% in the

fourth quarter as we have placed a substantial amount of our liquid

funds into higher yielding loans."

"The Bank's total deposits decreased by $64 million in 2014 as

the runoff of some large transactional and temporary accounts

outweighed our increase in relationship deposits. Core deposits

make up over 94% of total deposits and our demand and transaction

deposits have grown to 42% of total deposits as of the end of

2014", noted Mr. Mordell. "We have successfully deployed our

considerable level of liquid funds into loans. Our high level of

capital and the high quality of our loan portfolio provide us with

ample capacity for growth. We will be opening up a loan production

office in San Francisco by the end of the first quarter of

2015."

Results for the year ended December 31,

2014

Net interest income before provision for loan losses was $16.4

million in 2014, an increase of $1,172,000 or 7.7% over the prior

year. Higher outstanding loan balances and reductions in the rates

paid on deposits were partially offset by lower loan yields.

Average earning assets were $437 million in 2014, a 4% increase

over the prior year. Net interest margin was 3.79% for 2014 year to

date compared to 3.63% for 2013. The increase in net interest

margin was primarily caused by growth in average loans and a

decrease in Fed funds sold partially offset by a decline in loan

yields due to the current interest rate environment. A loan loss

provision of $39,000 was recorded in 2014 and a $245,000 provision

was made in 2013. We have experienced recoveries net of charge-offs

of $46,000 in 2014 compared to net recoveries of $63,000 in

2013.

Non-interest income, excluding gains on sales of securities, was

$1,307,000 in 2014, an increase of $591,000 or 83% over 2013. The

increase in non-interest income was due to an increase in service

charges and other fee generation activities as well as an increase

in earnings on bank owned life insurance. There were $261,000 of

gains on sales of securities in 2014 and $748,000 of gains on

securities sales in 2013.

Non-interest expense grew by $990,000 or 8% in 2014 to $13.4

million compared to $12.4 million in 2013. This growth was due to

investments in loan production personnel and facilities as we

continue to expand our footprint and grow our loan portfolio.

Results for the quarter ended December 31,

2014

For the three months ended December 31, 2014, net interest

income before provision for loan losses was $4.5 million, an

increase of $785,000 or 21% compared to the fourth quarter of 2013.

The increase was primarily the result of higher loans outstanding.

Average earning assets were $425 million in the fourth quarter of

2014, a 6% decrease over the fourth quarter of the prior year.

Earning assets decreased as loan growth was more than offset by

lower Fed funds. Net interest margin was 4.20% for the fourth

quarter of 2014, compared to 3.30% for the fourth quarter of 2013.

Net interest margin increased due to growth in loans for the

quarter. A loan loss provision of $39,000 was taken in the fourth

quarter of 2014 and no loan loss provision was taken in the fourth

quarter of 2013.

Non-interest income, excluding gains on sales of securities, was

$365,000 in the fourth quarter of 2014, an increase of $107,000 or

41% over the fourth quarter of 2013. The increase was due to

increases in service charges and other fee generation activities.

There were $239,000 of gains on sales of securities in the fourth

quarter of 2014 and no gains on securities sales in the fourth

quarter of 2013.

Non-interest expense grew by $360,000 in the fourth quarter of

2014 to $3.5 million compared to $3.1 million for the fourth

quarter of 2013. This growth was due to the investments in loan

production personnel mentioned previously. The company's full time

equivalent employees at December 31, 2014 and 2013 were 61 and 51,

respectively.

Balance Sheet

Total assets dropped to $469 million as of December 31, 2014,

compared to $484 million at September 30, 2014 and $501 million on

the same date one year ago. The decrease in total assets of $15

million, or 3%, from September 30, 2014 consisted of a decrease in

Fed funds due to a reduction in transactional and temporary

deposits.

The Company reported total gross loans outstanding at December

31, 2014 of $342 million, which represented an increase of $47

million, or 16%, over $295 million at September 30, 2014, and an

increase of $85 million, or 33%, over $257 million at December 31,

2013. The increase in total gross loans from September 30, 2014 was

primarily attributable to growth in construction and commercial

real estate loans. We also saw growth in asset based and commercial

loans. The increase in loans from December 31, 2013 was primarily

attributable to growth in commercial real estate, construction and

asset based loans. Non-accrual loans totaled $5.2 million or 1.5%

of total loans on December 31, 2014 compared to $2.0 million or

0.8% of total loans for the previous year-end. "Our high credit

standards have resulted in an absence of net charge-offs for both

the 2014 and 2013 years. Our increase in nonaccrual loans was

isolated to one client," observed Mr. Mordell.

The Company’s total deposits were $386 million as of December

31, 2014, which represented a decrease of $42 million, or 10%,

compared to $428 million at September 30, 2014 and a decrease of

$64 million, or 14%, compared to $450 million at December 31, 2013.

The decrease in deposits from September 30, 2014 was primarily

attributable to a decrease in money market and interest checking

accounts, while the decrease from December 31, 2013 was primarily

attributable to a decrease in money market and checking accounts

and certificates of deposit over $100,000.

Demand and transaction deposits represented 41.9% of total

deposits at December 31, 2014, compared to 43.7% at September 30,

2014 and 39.4% for the same period one year ago. Core deposits

represented 94.2% of total deposits at December 31, 2014, compared

to 95.1% at September 30, 2014 and 93.3% at December 31, 2013.

During the fourth quarter of 2014, short term Federal Home Loan

Bank advances totaling $25 million and excess liquidity of $17

million were utilized to facilitate loan originations, net of

repayments, of $42 million. These borrowings bear interest at an

annualized rate of 0.25% to 0.26% and mature on a weekly basis.

About Avidbank

Avidbank Holdings, Inc., headquartered in Palo Alto, California,

offers innovative financial solutions and services. We specialize

in the following markets: commercial & industrial, corporate

finance, asset-based lending, real estate construction and

commercial real estate lending, and real estate bridge financing.

Avidbank advances the success of our clients by providing them with

financial opportunities and serving them as we wish to be served –

with mutual effort, ingenuity and trust – creating long-term

banking relationships.

Forward-Looking Statement:

This news release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on current

expectations, estimates and projections about Avidbank's business

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements

due to numerous factors, including those described above and the

following: Avidbank's timely implementation of new products and

services, technological changes, changes in consumer spending and

savings habits and other risks discussed from time to time in

Avidbank's reports and filings with banking regulatory agencies. In

addition, such statements could be affected by general industry and

market conditions and growth rates, and general domestic and

international economic conditions. Such forward-looking statements

speak only as of the date on which they are made, and Avidbank does

not undertake any obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

release.

Avidbank Holdings, Inc.

Consolidated Balance Sheets

($000, except share, per share amounts and

ratios) (Unaudited)

Assets

12/31/2014

9/30/2014

6/30/2014

3/31/2014

12/31/2013

Cash and due from banks $17,986 $20,499 $18,049 $15,427 $16,905 Fed

funds sold 8,150 68,675 100,445 127,785

151,940 Total cash and cash equivalents 26,136 89,174 118,494

143,212 168,845 Investment securities - available for sale

79,501 78,710 65,282 58,397 58,983 Loans, net of deferred

loan fees 341,966 295,410 277,822 254,375 257,434 Allowance for

loan losses (4,873) (4,826) (4,809) (4,795)

(4,788) Loans, net of allowance for loan losses 337,093

290,584 273,013 249,580 252,646 Bank owned life insurance

11,944 11,857 11,783 11,694 11,607 Premises and equipment, net

1,024 1,108 1,210 1,287 1,175 Accrued interest receivable &

other assets 13,343 13,006 12,983 8,950

7,420 Total assets $469,041 $484,439 $482,765

$473,120 $500,676

Liabilities

Non-interest-bearing demand deposits $140,429 $166,733 $173,394

$151,538 $158,364 Interest bearing transaction accounts 21,170

20,415 15,523 18,041 18,991 Money market and savings accounts

185,778 201,189 194,892 205,237 222,324 Time deposits 38,544

39,453 42,777 47,250 50,625 Total deposits

385,921 427,790 426,586 422,066 450,304 FHLB Borrowing

25,000 - - - - Other liabilities 6,573 6,273 6,262

2,209 2,340 Total liabilities 417,494 434,063 432,848

424,275 452,644

Shareholders'

equity

Common stock/additional paid-in capital 45,206 45,080 44,985 44,774

44,531 Retained earnings 6,162 5,189 4,574 3,877 3,469 Accumulated

other comprehensive income 179 107 358 194

32 Total shareholders' equity 51,547 50,376 49,917 48,845

48,032 Total liabilities and shareholders' equity $469,041

$484,439 $482,765 $473,120 $500,676

Bank Capital

ratios

Tier 1 leverage ratio 10.53% 10.17% 10.36% 9.72% 9.66% Tier 1

risk-based capital ratio 11.03% 11.60% 11.89% 12.89% 12.44% Total

risk-based capital ratio 12.19% 12.82% 13.14% 14.14% 13.69%

Book value per common share $11.84 $11.61 $11.51 $11.34 $11.21

Total common shares outstanding 4,352,319 4,338,161 4,336,292

4,308,756 4,283,494

Other

Ratios

Non-interest bearing/total deposits 36.4% 39.0% 40.6% 35.9% 35.2%

Loan to deposit ratio 88.6% 69.1% 65.1% 60.3% 57.2% Allowance for

loan losses/total loans 1.42% 1.63% 1.73% 1.89%

1.86%

Avidbank Holdings, Inc.

Condensed Consolidated Statements of

Income

($000, except share, per share amounts and

ratios) (Unaudited)

Quarter Ended

Year Ended

12/31/2014

9/30/2014

12/31/2013

12/31/2014

12/31/2013

Interest and fees on loans and leases $4,128 $3,786 $3,485 $15,204

$14,498 Interest on investment securities 497 430 408 1,739 1,605

Other interest income 28 56 85 231 268

Total interest income 4,653 4,272 3,978 17,174 16,371 Interest

expense 170 175 280 798 1,167 Net

interest income 4,483 4,097 3,698 16,376 15,204 Provision

for loan losses 39 - - 39 245

Net interest income after provision for

loan losses

4,444 4,097 3,698 16,337 14,959 Service charges, fees and

other income 278 260 168 970 529 Income from bank owned life

insurance 87 74 90 337 187 Gain on sale of investment securities

239 22 0 261 748 Total non-interest

income 604 356 258 1,568 1,464 Compensation and benefit

expenses 2,147 2,072 1,813 8,295 7,339 Occupancy and equipment

expenses 568 568 493 2,325 2,241 Other operating expenses 762

705 811 2,745 2,795

Total expenses

3,477 3,345 3,117 13,365 12,375 Income before income taxes

1,571 1,108 839 4,540 4,048 Provision for income taxes 575

462 204 1,796 1,540 Net income $996

$646 $635 $2,744 $2,508 Preferred

dividends & warrant amortization - - - -

210

Net income applicable to common

shareholders

$996 $646 $635 $2,744 $2,298

Basic earnings per common share $0.23 $0.15 $0.15 $0.63

$0.66 Diluted earnings per common share $0.22 $0.15 $0.15 $0.62

$0.64 Average common shares outstanding 4,343,719 4,336,761

4,283,109 4,323,826 3,474,788 Average common fully diluted shares

4,428,005 4,419,603 4,344,871 4,400,659 3,565,490 Annualized

returns: Return on average assets 0.83% 0.54% 0.52% 0.57% 0.57%

Return on average common equity 7.95% 5.16% 5.29% 5.54% 6.23%

Net interest margin 4.20% 3.73% 3.30% 3.79% 3.63% Cost of

funds 0.16% 0.16% 0.26% 0.19% 0.30% Efficiency ratio 68.4% 75.1%

78.8% 74.5% 74.2%

Avidbank, Inc.

Interim Credit Trends

($000, except ratios) (Unaudited)

Allowance for Loan

Losses

12/31/2014

9/30/2014

6/30/2014

3/31/2014

12/31/2013

Balance, beginning of quarter $4,826 $4,809 $4,795 $4,788 $4,754

Provision for loan losses, quarterly 39 - - - - Charge-offs,

quarterly - - - - - Recoveries, quarterly 8 17 14

7 34 Balance, end of quarter $4,873 $ 4,826

$ 4,809 $ 4,795 $ 4,788

Nonperforming

Assets

Loans accounted for on a non-accrual basis $5,243 $6,412

$2,283 $3,099 $2,015

Loans with principal or interest

contractually past due 90 days or more and still accruing

interest

- - - - - Nonperforming loans 5,243

6,412 2,283 3,099 2,015 Other real estate owned - - -

- - Nonperforming assets $5,243 $6,412

$2,283 $3,099 $2,015

Loans restructured and in compliance with

modified terms

- - - - - Nonperforming assets &

restructured loans $5,243 $6,412 $2,283 $3,099

$2,015 Nonperforming Loans by Asset Type:

Commercial $5,243 $5,917 $1,779 $2,585 $1,492 Other real estate

secured loans - 495 504 514 523

Nonperforming loans $5,243 $6,412 $2,283

$3,099 $2,015

Asset Quality

Ratios

Allowance for loan losses / gross loans 1.42% 1.63% 1.73% 1.89%

1.86% Allowance for loan losses / nonperforming loans 92.94% 75.27%

210.64% 154.73% 237.62% Nonperforming assets / total assets 1.12%

1.32% 0.47% 0.66% 0.40% Nonperforming loans / gross loans 1.53%

2.17% 0.82% 1.22% 0.78% Net quarterly charge-offs / gross loans

0.00% -0.01% -0.01% 0.00% -0.01%

Avidbank Holdings, Inc.Steve Leen, 650-843-2204Executive Vice

President and Chief Financial

Officersleen@avidbank.comavidbank.com

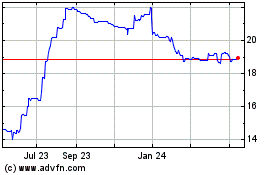

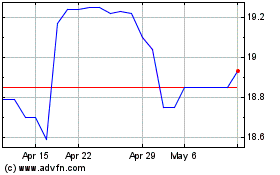

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Apr 2023 to Apr 2024