FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

Of The Securities Exchange Act of 1934

For the month of November, 2014

MAX RESOURCE CORP.

(SEC File No. 0-30780)

Suite 2300 – 1066 West Hastings Street

Vancouver, B.C. V6E 3X2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under Cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ____

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No x

![[form6ksept2014q001.jpg]](form6ksept2014q001.jpg)

Condensed Interim Consolidated Financial Statements

For the nine months ended September 30, 2014

(Unaudited)

Expressed in Canadian Dollars

These unaudited condensed interim consolidated financial statements of Max Resource Corp. for the nine months ended September 30, 2014 have been prepared by management and approved by the Board of Directors. These unaudited condensed interim consolidated financial statements have not been reviewed by the Company’s external auditors.

Max Resource Corp.

Condensed interim consolidated statements of financial position

(Expressed in Canadian dollars - unaudited)

As at

| | | |

|

Notes

|

September 30,

2014

| December 31,

2013

|

ASSETS

| | | (Audited)

|

Current assets

| | | |

Cash

| | $

23,070

| $

203,229

|

Prepaids

| | 4,793

| 4,223

|

Taxes recoverable

| | 1,012

| 128

|

| | 28,875

| 207,580

|

Non-current assets

| | | |

Equipment

| 3

| 513

| 765

|

Reclamation deposits

| 4

| 53,498

| 32,097

|

Exploration and evaluation assets

| 4

| 528,765

| 2,138,969

|

| | 582,776

| 2,171,831

|

TOTAL ASSETS

| | $

611,651

| $

2,379,411

|

| | | |

LIABILITIES

| | | |

Current liabilities

| | | |

Trade payables and accrued liabilities

| 5

| $

324,606

| $

306,728

|

| | | |

SHAREHOLDERS’ EQUITY

| | | |

Share capital

| 6

| 14,059,099

| 13,754,038

|

Share purchase warrant reserve

| 7

| 292,851

| 288,562

|

Share-based payment reserve

| 7

| 2,086,821

| 1,997,335

|

Deficit

| | (16,151,726)

| (13,967,252)

|

| | 287,045

| 2,072,683

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

| | $

611,651

| $

2,379,411

|

Nature and continuance of operations (Note 1)

Commitments (Note 4)

See accompanying notes to the condensed interim consolidated financial statements

4

Max Resource Corp.

Condensed interim consolidated statements of loss and comprehensive loss

(Expressed in Canadian dollars - unaudited)

| | | | | |

|

Notes

| Three Months Ended

September 30,

2014

| Three Months Ended

September 30,

2013

| Nine Months Ended

September 30,

2014

| Nine Months Ended

September 30,

2013

|

| | | | | |

Expenses

| | | | | |

Amortization

| | $

84

| $

84

| $

252

| $

252

|

Consulting

| 8

| -

| 23,155

| 13,466

| 57,503

|

Management fees

| 8

| -

| 30,000

| -

| 90,000

|

Office and miscellaneous

| | 9,680

| 11,668

| 26,629

| 28,794

|

Foreign exchange loss

| | 8,776

| -

| 15,205

| -

|

Professional fees

| | 4,409

| 8,050

| 27,847

| 45,634

|

Stock-based compensation

| 6

| 9,540

| -

| 89,486

| -

|

Transfer agent, filing fees and

shareholder relations

| | 22,766

| 39,014

| 75,208

| 120,751

|

Travel and related costs

| | -

| 2,778

| 3,353

| 13,568

|

| | (55,255)

| (114,749)

| (251,446)

| (356,502)

|

| | | | | |

Other items

| | | | | |

Interest income

| | -

| -

| -

| 2,196

|

Write-off of exploration and

evaluation assets

| | (1,933,028)

| (664,494)

| (1,933,028)

| (664,494)

|

| | (1,933,028)

| (664,494)

| (1,933,028)

| (662,298)

|

| | | | | |

Loss and comprehensive loss for the

period

|

| $

(1,988,283)

| $

(779,243)

| $

(2,184,474)

| $

(1,018,800)

|

| | | | | |

| | | | | |

Loss per share – basic and diluted

| 6

| $

(0.06)

| $

(0.03)

| $

(0.08)

| $

(0.04)

|

See accompanying notes to the condensed interim consolidated financial statements

5

Max Resource Corp.

Condensed interim consolidated statement of changes in equity

(Expressed in Canadian dollars - unaudited)

| | | | | | | | |

| | Share capital

| | Reserves

| | |

| | Number of

shares

| Amount

| | Share purchase warrant reserve

| Share-based payment reserve

| Deficit

| Total

|

Balance at December 31, 2012

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (12,872,731)

| $ 3,167,204

|

Comprehensive loss:

| |

| | | | | | |

Loss and comprehensive loss for the period

| | -

| -

| | -

| -

| (1,018,800)

| (1,018,800)

|

Balance at September 30, 2013

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (13,891,531)

| $ 2,148,404

|

Balance at December 31, 2013

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (13,967,252)

| $ 2,072,683

|

Comprehensive loss:

| |

| | | | | | |

Loss and comprehensive loss for the period

| | -

| -

| | -

| -

| (2,184,474)

| (2,184,474)

|

| |

| | | | | | |

Shares issued for cash

| | 6,320,000

| 316,000

| | -

| -

| -

| 316,000

|

Share issuance costs – finders’ warrants

| | -

| (4,289)

| | 4,289

| -

| -

| -

|

Share issuance costs - cash

| | -

| (6,650)

| | -

| -

| -

| (6,650)

|

Stock-based compensation

| | -

| -

| | -

| 89,486

| -

| 89,486

|

Balance at September 30, 2014

| | 30,825,985

| $ 14,059,099

| | $ 292,851

| $ 2,086,821

| $

(16,151,726)

| $ 287,045

|

See accompanying notes to the condensed interim consolidated financial statements

6

Max Resource Corp.

Condensed interim consolidated statements of cash flows

(Expressed in Canadian dollars - unaudited)

| | |

| Nine-months ended

|

| September 30,

2014

| September 30,

2013

|

| | |

Operating activities

| | |

Loss for the period

| $

(2,184,474)

| $

(1,018,800)

|

Items not involving cash:

| | |

Amortization

| 252

| 252

|

Stock-based compensation

| 89,486

| -

|

Write-off of exploration and evaluation assets

| 1,933,028

| 664,494

|

Changes in non-cash working capital items:

| | |

Decrease (increase) in prepaids

| (570)

| 3,825

|

Decrease (increase) in taxes recoverable

| (884)

| 20,670

|

Increase in trade payables and accrued liabilities

| 17,878

| 164,112

|

Net cash flows used in operating activities

| (145,284)

| (165,447)

|

| | |

Investing activities

| | |

Expenditures on exploration and evaluation assets

| (322,824)

| (62,978)

|

Recovery of reclamation bonds

| -

| 22,152

|

Additions to reclamation bonds

| (21,401)

| -

|

Net cash flows used in investing activities

| (344,225)

| (40,826)

|

| | |

Financing activities

| | |

Shares issued for cash

| 316,000

| -

|

Share issuance costs

| (6,650)

| -

|

Net cash flows provided by financing activities

| 309,350

| -

|

Decrease in cash

| (180,159)

| (206,273)

|

Cash, beginning of period

| 203,229

| 510,288

|

Cash , end of period

| $

23,070

| $

304,015

|

Supplemental disclosure with respect to cash flows (Note 11)

See accompanying notes to the condensed interim consolidated financial statements

7

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

1.

Nature and continuance of operations

Max Resource Corp. (the “Company”) was incorporated on April 25, 1994, under the laws of the province of Alberta, Canada, and its principal activity is the acquisition and exploration of mineral properties in Canada and the United States. The Company’s shares are traded on the TSX Venture Exchange (“TSX-V”) under the symbol “MXR”.

The Company’s head office is located at #2300 – 1066 West Hastings Street, Vancouver, British Columbia, Canada, V6E 3X2 and its registered and records office is located at 700 - 9th Avenue S.W.

Calgary, Alberta, Canada, T2P 3V4.

These unaudited condensed interim consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning that it will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the ordinary course of operations. Different bases of measurement may be appropriate if the Company is not expected to continue operations for the foreseeable future. As at September 30, 2014, the Company had an accumulated deficit of $16,151,726 and a working capital deficit of $295,731 and, to date, the Company has not generated any revenues to meet its operating and administrative expenses or its other obligations. As at September 30, 2014, the Company had not advanced its properties to commercial production and is not able to finance day to day activities through operations. The Company’s continuation as a going concern is dependent upon the successful results from its mineral property exploration activities, the recovery of the carrying value of its assets, and its ability to attain profitable operations and generate funds therefrom and/or raise equity capital or borrowings sufficient to meet current and future obligations. These uncertainties cast a significant doubt on the ability of the Company to continue operations as a going concern. Management intends to finance operating costs over the next twelve months with funds on hand, proceeds from private placements of the Company’s common shares and loan proceeds from related parties.

2.

Statement of compliance and adoption of new accounting standards

These unaudited condensed interim consolidated financial statements were authorized for issue on November 27, 2014 by the directors of the Company.

Statement of compliance with International Financial Reporting Standards

These unaudited condensed interim consolidated financial statements, including comparatives, have been prepared in accordance with International Accounting Standard 34 “Interim Financial Reporting” (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and Interpretations of the IFRS Interpretations Committee.

These unaudited condensed interim consolidated financial statements do not include all of the information required of a full annual financial report and is intended to provide users with an update in relation to events and transactions that are significant to an understanding of the changes in financial position and performance of the Company since the end of the last annual reporting period. It is therefore recommended that this financial report be read in conjunction with the audited annual consolidated financial statements of the Company for the year ended December 31, 2013.

2.

Statement of compliance and adoption of new accounting standards (cont’d)

Adoption of new accounting standards

On January 1, 2014, the Company adopted the “Amendment to IAS 32 Financial Instruments: Presentation”. There were no adjustments required on the adoption of this amendment.

Other accounting standards or amendments to existing accounting standards that have been issued but have future effective dates are either not applicable or are not expected to have a significant impact on the Company’s financial statements.

3.

Equipment

| |

Cost:

| |

At December 31, 2013 and September 30, 2014

| $

5,148

|

Amortization:

| |

At December 31, 2012

| 4,045

|

Charge for the year

| 338

|

At December 31, 2013

| 4,383

|

Charge for the period

| 252

|

At September 30, 2014

| 4,635

|

Net book value:

| |

At December 31, 2013

| $

765

|

At September 30, 2014

| $

513

|

8

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

4.

Exploration and evaluation assets

| | | | | | | |

| Balance

December 31, 2012

|

Additions

|

Write-offs

| Balance

December 31,

2013

|

Additions

| Write-offs

| Balance

September 30,

2014

|

Acquisition costs:

| | | | | | | |

| | | | | | | |

Diamond Peak, NV

| $ 47,308

| $ -

| $ (47,308)

| $ -

| $ -

| $ -

| $ -

|

East Manhattan, NV

| 268,642

| 32,882

| -

| 301,524

| 4,154

| -

| 305,678

|

Table Top, NV

| 79,738

| -

| (79,738)

| -

| -

| -

| -

|

Majuba Hill, NV

| 298,192

| 58,703

| -

| 356,895

| 90,410

| (447,305)

| -

|

| 693,880

| 91,585

| (127,046)

| 658,419

| 94,564

| (447,305)

| 305,678

|

| | | | | | | |

Exploration costs:

| | | | | | | |

| | | | | | | |

Diamond Peak, NV

| 62,286

| -

| (62,286)

| -

| -

| -

| -

|

East Manhattan, NV

| 110,568

| 33,200

| -

| 143,768

| 79,319

| -

| 223,087

|

Table Top, NV

| 475,162

| -

| (475,162)

| -

| -

| -

| -

|

Majuba Hill, NV

| 1,272,556

| 64,226

| -

| 1,336,782

| 148,941

| (1,485,723)

| -

|

| 1,920,572

| 97,426

| (537,448)

| 1,480,550

| 228,260

| (1,485,723)

| 223,087

|

| $ 2,614,452

| $ 189,011

|

$ (664,494)

| $ 2,138,969

| $ 322,824

| $ (1,933,028)

| $ 528,765

|

9

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

4.

Exploration and evaluation assets (cont’d)

Diamond Peak, Nevada, United States

On May 9, 2006, the Company entered into an Option Agreement, as amended June 30, 2010, to acquire a 100% interest in the claims in Eureka County, Nevada, the “Diamond Peak Property”, from The Wendt Family Trust. The Wendt Family Trust is controlled by Clancy J. Wendt, the Vice President of Exploration for the Company. The terms of the Option Agreement required the issuance to the Wendt Family Trust of 100,000 shares (issued) of the Company with a fair value of $40,000 at date of issue and certain rental payments.

During the year ended December 31, 2012, the Company incurred $1,823 for geological consulting on the Diamond Peak project and received a refund on state property fees in the amount of $3,417. During the year ended December 31, 2013, the Company decided to no longer proceed with the property and, as a result, wrote off $109,594 to the consolidated statement of loss and comprehensive loss.

At September 30, 2014, the BLM holds a $15,809 reclamation bond (December 31, 2013 - $15,809) from the Company to guarantee reclamation of the property.

East Manhattan, Nevada, United States

On November 11, 2007, as amended December 4, 2008 and December 21, 2010, the Company entered into an option agreement with MSM Resource LLC (“MSM”), a Nevada corporation, for the acquisition of a 100% interest in the East Manhattan Wash mineral claims located in Nye County, Nevada.

The terms of the option agreement with MSM call for the payment of $27,874 (US$28,000) on execution of the agreement (paid), $25,029 (US$20,000) by December 4, 2008 (paid), $26,603 (US$25,000) by. December 4, 2009 (paid), $40,560 (US$40,000) by December 4, 2010 (paid), US$50,000 by December 4, 2011 and US$100,000 by December 12, 2012, subject to securing a drill permit, which has been applied for but not yet been received. During the year ended December 31, 2013, the Company paid $20,714 (2012 - $19,788) (US$20,000) while waiting to receive the drill permit for the property.

In addition, the Company must make exploration expenditures totaling US$700,000 on the claims including the following minimum expenditures (subject to receipt of drill permits and securing a drill rig, which to the date of these financial statements has not been received):

(i)

on or before the second anniversary, US$50,000 (completed);

(ii)

on or before the fourth anniversary, a further US$150,000 (deferred until drill permit received);

(iii)

on or before the fifth anniversary, a further US$200,000 (deferred until drill permit received); and

(iv)

on or before the sixth anniversary, a further US$300,000 (deferred until drill permit received).

The East Manhattan Property is subject to a 3% NSR royalty. Upon full exercise of the option, the Company will own 100% of the project.

During the year ended December 31, 2012, the Company incurred geological consulting of $2,387 and received a refund of state property fees of $3,773 on the East Manhattan project. During the year ended December 31, 2013, the Company incurred $28,653 for geological consulting, $2,534 for assaying and field expenses of $2,013 on the East Manhattan project. During the nine months ended September 30, 2014, the Company incurred $27,676 for geological consulting, $41,091 for assaying and $10,552 for field expenses on the East Manhattan Project.

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

4.

Exploration and evaluation assets (cont’d)

East Manhattan, Nevada, United States (cont’d)

During the nine months ended September 30, 2014, the Company paid $20,754 (US$18,800) to the Bureau of Land Management (“BLM”) for a reclamation bond (December 31, 2013 - $Nil) to guarantee reclamation of the property.

Table Top, Nevada, United States

On August 31, 2009, the Company entered into an option agreement with Energex to acquire a 100% interest in the Table Top claims in Humboldt County Nevada.

The terms of the Option Agreement with Energex required the payment of $5,400 (US$5,000) upon execution of the Agreement (paid), US$25,000 on the first anniversary of the Agreement (deferred), US$35,000 on the second anniversary of the Agreement and US$50,000 on each anniversary thereafter for a term of ten years, subject to renewal. The Company could have purchased the property at any time for US$300,000, at which point the annual payments would have ceased. The Table Top property was subject to a 3% NSR royalty. Upon full exercise of the option agreement, the Company would have owned 100% of the project.

During the year ended December 31, 2013, the Company decided not to proceed with the property and expensed $554,900 to the statement of loss and comprehensive loss.

Majuba Hill, Nevada, United States

On March 4, 2011, the Company entered into an option agreement (“Agreement”) to acquire up to a 75% interest in the Majuba Hill property in Pershing County, Nevada from Claremont Nevada Mines LLC., (“Claremont”) of Nevada. The terms of the Agreement with Claremont allowed the Company to earn an initial 60% interest in the property over six years by spending US$6,500,000 on exploration of the property.

The Company could increase its interest in the property to 75% by spending a further US $3,500,000 on exploration over a subsequent two-year period. The Majuba Hill property would be subject to a 3% NSR payable to the vendor, 1.5% of which could be purchased at any time for US$1,500,000.

On December 3, 2012, the Company entered into a Mining Lease and Option to Purchase Agreement (the “Lease Agreement”) with Claremont and JR Exploration LLC of Utah, as amended on December 3, 2013 and February 13, 2014. Under the terms of this new Lease Agreement, which replaces the previous Agreement with Claremont referenced above, the Company can acquire a 100% interest in the Majuba Hill property by the payment to Claremont of US$1,000,000 over a four year period, with US$200,000 having been paid on signing and the balance payable over a four year period as follows:

(i)

US$40,000 on or before December 3, 2013 (paid);

(ii)

US$10,000 on or before February 14, 2014 (paid);

(iii)

US$15,000 on or before March 31, 2014 (paid);

(iv)

US$16,000 on or before April 30, 2014 (paid);

(v)

US$17,000 on or before May 31, 2014 (paid);

(vi)

US$24,755 on or before June 30, 2014 (paid);

(vii)

US$59,500 on or before October 31, 2014;

(viii)

US$17,000 on or before November 30, 2014;

(ix)

US$200,000 on or before December 3, 2014;

(x)

US$200,000 on or before December 3, 2015; and

(xi)

US$200,000 on or before December 3, 2016.

4.

Exploration and evaluation assets (cont’d)

Majuba Hill, Nevada, United States (cont’d)

Under the terms of this new Lease Agreement, there will be no annual work commitments and the NSR will be reduced from 3% to 1%.

On April 9, 2012, the Company entered into a mineral lease with New Nevada Resources LLC (“NNR”) for 560 acres of mineral rights immediately adjacent of its Majuba Hill project in Nevada. The mineral lease with NNR is for a term of 20 years and calls for annual lease payments of $15 per acre in the first year increasing incrementally to $30 per acre in year four and subsequent years. NNR has the right to retain a 15% working interest or it can convert it to a net smelter return of 0.5% on base metals and 1% on precious metals in addition to retaining an overriding NSR of 1.75% on base metals and 3% on precious metals. During the year ended December 31, 2013, the Company terminated the lease.

During the year ended December 31, 2012, the Company paid $244,996 (US$228,400) in lease payments on the Majuba Hill property and received a refund of state property fees in the amount of $1,330.

During the year ended December 31, 2012, the Company incurred $181,781 for geological consulting fees, $204,469 for drilling and $57,588 for field expenses on the Majuba Hill project. During the year ended December 31, 2013, the Company incurred $49,914 for geological consulting fees, $7,381 for assaying and $6,931 for field expenses on the Majuba Hill project. During the nine months ended September 30, 2014, the Company incurred $45,060 for geological consulting, $74,937 for assaying, and field expenses of $28,944 on the Majuba Hill property.

Subsequent to the nine months ended September 30, 2014, the Company was unable to continue making the lease payments due on the Majuba Hill project, due to market conditions, and relinquished the property to the vendor. As a result, the Company wrote off $1,933,028 of accumulated acquisition and exploration costs during the nine months ended September 30, 2014.

At September 30, 2014, the BLM holds a $16,935 reclamation bond (December 31, 2013 - $16,288) from the Company to guarantee reclamation of the property. The Company increased its reclamation bond by $647 during the nine months ended September 30, 2014.

4.

Trade payables and accrued liabilities

The components of trade payables and accrued liabilities are as follows:

| | |

| September 30, 2014

| December 31, 2013

|

Trade payables

| $

43,973

| $

22,753

|

Amounts due to related parties (Note 8)

| 280,633

| 268,975

|

Accrued liabilities

| -

| 15,000

|

| $

324,606

| $

306,728

|

11

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

6.

Share capital

Authorized share capital

Unlimited number of common shares without par value.

Issued share capital

At September 30, 2014, there were 30,825,985 issued and fully paid common shares (December 31, 2013 – 24,505,985).

During the nine months ended September 30, 2014, the Company completed a non-brokered private placement of 6,320,000 units at $0.05 per unit for gross proceeds of $316,000. Each unit is comprised of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share at a price of $0.12 per share until March 26, 2016. If at any time prior to the expiry date of the warrants, the closing price of the common shares of the Company on the TSX-V is equal to or greater than $0.25 for 30 consecutive days, then the Company may elect to provide notice to the warrant holders that the warrants will expire 30 days from the date of the notice. Finders’ fees of $6,650 and 133,000 share purchase warrants, valued at $4,289, were paid in connection with this private placement. Each share purchase warrant is exercisable at $0.12 into one common share until March 26, 2016. The fair value of the share purchase warrants was determined using the Black-Scholes option-pricing model with the following assumptions: expected life - two years; volatility – 129%; dividend rate – nil; risk free interest rate – 1.06%.

Basic and diluted loss per share

The calculation of basic and diluted loss per share for the nine months ended September 30, 2014 was based on the loss attributable to common shareholders of $2,184,474 (2013 - $1,018,800) and the weighted average number of common shares outstanding of 28,835,069 (2013 – 24,505,985). Diluted loss per share did not include the effect of 2,725,000 (2013 – 2,680,000) outstanding stock options and 6,453,000 (2013 – nil) share purchase warrants as they are anti-dilutive.

Stock options

The Company has adopted an incentive stock option plan, which provides that the Board of Directors of the Company may from time to time, in its discretion, and in accordance with the TSX-V requirements, grant to directors, officers, employees and technical consultants to the Company, non-transferable stock options to purchase common shares, provided that the number of common shares reserved for issuance will not exceed 20% of the Company’s issued and outstanding common shares to a maximum of 4,901,197. Such options will be exercisable for a period of up to 5 years from the date of grant. Options granted typically vest on the grant date.

12

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

6.

Share capital (cont’d)

Stock options (cont’d)

The changes in options during the year ended December 31, 2013 and nine months ended September 30, 2014 are as follows:

| | |

| |

| Number of options

| Weighted average exercise price

|

Options outstanding, December 31, 2012

| 3,280,000

| $

0.26

|

Options expired

| (1,080,000)

| 0.29

|

Options outstanding, December 31, 2013

| 2,200,000

| 0.24

|

Options cancelled

| (250,000)

| 0.25

|

Options expired

| (1,525,000)

| 0.24

|

Options granted

| 2,300,000

| 0.10

|

Options outstanding, September 30, 2014

| 2,725,000

| $

0.12

|

Options exercisable, September 30, 2014

| 2,425,000

| $

0.13

|

Details of options outstanding as at September 30, 2014 are as follows:

| | |

Exercise price

| Number of options

outstanding

| Expiry Date

|

$ 0.25

| 425,000

| February 22, 2015

|

0.10

| 2,300,000

| May 7, 2016

|

| 2,725,000

| |

The weighted average remaining contractual life of stock options outstanding at September 30, 2014 is 1.41 years.

During the nine months ended September 30, 2014, the Company granted 1,700,000 (2013 – nil) stock options to directors, officers, and consultants of the Company. The Company’s investor relations firm was also granted 600,000 options. The fair value of all the options granted during the period is $97,619 (2013 - $nil), based on the Black-Scholes option pricing model, with the following assumptions: risk free rate 1.07%; volatility of 136.20%; dividend rate 0%; forfeiture rate 0%; and expected life of 2 years. Stock-based compensation expense of $89,486 (2013 - $nil) was recognized on options that vested during the nine months ended September 30, 2014.

13

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

6.

Share capital (cont’d)

Warrants

The changes in warrants during the year ended December 31, 2013 and the nine months ended September 30, 2014 are as follows:

| | |

| |

| Number of warrants

| Weighted average exercise price

|

Warrants outstanding, December 31, 2012

| 2,016,755

| $

0.38

|

Warrants expired

| (2,016,755)

| 0.38

|

Warrants outstanding, December 31, 2013

| -

| -

|

Warrants issued

| 6,453,000

| 0.12

|

Warrants outstanding, September 30, 2014

| 6,453,000

| $

0.12

|

Details of share purchase warrants as at September 30, 2014 are as follows:

| | |

Exercise price

| Number of warrants

outstanding

| Expiry Date

|

$ 0.12

| 6,453,000

| March 26, 2016

|

7.

Reserves

Share based payment reserve and share purchase warrant reserve

The reserves record items recognized as stock-based compensation expense until such time that the stock options or warrants are exercised, at which time the corresponding amount will be transferred to share capital.

8.

Related party transactions

The following amounts due to related parties are included in trade payables and accrued liabilities:

| | |

| September 30,

2014

| December 31,

2013

|

Company controlled by a director of the Company

| $

131,220

| $

130,000

|

Director of the Company

| 149,413

| 138,975

|

| $

280,633

| $

268,975

|

These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

8.

Related party transactions (cont’d)

Key management personnel compensation

| | |

| Nine months ended

|

| September 30,

2014

| September 30,

2013

|

Short-term employee benefits:

| | |

Management fees

| $ -

| $ 90,000

|

Consulting

| 13,466

| -

|

Geological consulting

| 72,735

| 90,000

|

Stock-based compensation

| 25,466

| -

|

| $ 111,667

| $ 180,000

|

9.

Financial risk and capital management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors the risk management processes. The type of risk exposure and the way in which such exposure is managed is provided as follows:

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Company’s primary exposure to credit risk is on its cash held in bank accounts. The majority of cash is deposited with major banks in Canada. As most of the Company’s cash is held by two banks there is a concentration of credit risk. This risk is managed by using major banks that are high credit quality financial institutions as determined by rating agencies. The Company’s secondary exposure to risk is on its taxes recoverable. This risk is considered to be minimal.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company has a planning and budgeting process in place to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis. The Company ensures that there are sufficient funds to meet its short-term business requirements, taking into account its anticipated cash flows from operations and its holdings of cash and cash equivalents.

Historically, the Company's primary source of funding has been the issuance of equity securities for cash, primarily through private placements. The Company’s access to equity financing is dependent upon market conditions and market risks. There can be no assurance of continued access to significant equity funding.

Foreign exchange risk

Foreign currency risk is the risk that the fair values of future cash flows of a financial instrument will fluctuate because they are denominated in currencies that differ from the respective functional currency. The Company is exposed to currency risk as it incurs expenditures that are denominated in United States dollar while its functional currency is the Canadian dollar. The Company does not hedge its exposure to fluctuations in foreign exchange rates. The majority of cash is held in Canadian dollars.

9.

Financial risk and capital management (cont’d)

The following is a summary of Canadian dollar equivalent financial assets and liabilities that are denominated in United States dollars:

| | |

| September 30,

2014

| December 31, 2013

|

Cash

| $

8,003

| $

14,335

|

Trade payables and accrued liabilities

| (133,895)

| (138,975)

|

| $

(125,892)

| $

(124,640)

|

Based on the above net exposures, as at September 30, 2014, a 10% change in the United States dollar to Canadian dollar exchange rate could impact the Company’s comprehensive loss by $12,589 (December 31, 2013 - $12,464).

Interest rate risk

Interest rate risk is the risk due to variability of interest rates. The Company is exposed to interest rate risk on its bank account. The income earned on the bank account is subject to the movements in interest rates. The Company has cash balances and no-interest bearing debt, therefore, interest rate risk is nominal.

Capital Management

The Company's policy is to maintain a capital base sufficient to maintain investor and creditor confidence and to sustain future development of the business. The capital structure of the Company consists of working capital and share capital. There were no changes in the Company's approach to capital management during the year. The Company is not subject to any externally imposed capital requirements.

Classification of financial instruments

Financial assets included in the statement of financial position are as follows:

| | |

| September 30,

2014

| December 31,

2013

|

Cash

| $

23,070

| $

203,229

|

Loans and receivables:

| | |

Prepaids

| 4,793

| 4,223

|

Taxes recoverable

| 1,012

| 128

|

Reclamation deposits

| 53,498

| 32,097

|

| $

82,373

| $

239,677

|

Financial liabilities included in the statement of financial position are as follows:

| | |

| September 30,

2014

| December 31,

2013

|

Non-derivative financial liabilities:

| | |

Trade payables

| $ 43,973

| $ 22,753

|

Amounts due to related parties

| 280,633

| 268,975

|

| $ 324,606

| $ 291,728

|

14

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

9.

Financial risk and capital management (cont’d)

Fair value

The fair value of the Company’s financial assets and liabilities approximates the carrying amount.

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

·

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

·

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

·

Level 3 – Inputs that are not based on observable market data.

The following is an analysis of the Company’s financial assets measured at fair value as at September 30, 2014 and December 31, 2013:

| | | |

| As at September 30, 2014

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

23,070

| $

-

| $

-

|

| | | |

| As at December 31, 2013

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

203,229

| $

-

-

| $

-

|

9.

Segmented information

The primary business of the Company is the acquisition and exploration of mineral properties in the United States.

10.

Supplemental cash flow information

During the nine months ended September 30, 2014 and 2013, the Company incurred the following non-cash transactions that are not reflected in the statement of cash flows:

| | |

| Nine months ended

|

| September 30,

2014

| September 30,

2013

|

Net deferred exploration costs for exploration and evaluation assets included in trade payables and accrued liabilities

| $ -

| $ 49,600

|

Finders warrants issued in connection with a private placement

| $ 4,289

| $ -

|

15

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

MAX RESOURCE CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL POSITION AND RESULTS OF OPERATIONS

For the nine months ended September 30, 2014

The following discussion and analysis should be read in conjunction with the unaudited condensed interim consolidated financial statements and related notes for Max Resource Corp. (“MAX” or the “Company”) for the nine months ended September 30, 2014. This discussion is based on information available as at November 27, 2014.

Management is responsible for the preparation and integrity of the unaudited condensed interim consolidated financial statements, including the maintenance of appropriate information systems, procedures and internal controls. Management is also responsible for ensuring that information disclosed externally, including the unaudited condensed interim consolidated financial statements and Management Discussion and Analysis (“MD&A”), is complete and reliable.

The accompanying September 30, 2014 unaudited condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to the preparation of financial statements. All amounts are expressed in Canadian dollars, unless otherwise stated.

Certain statements made may constitute forward-looking statements. Such statements involve a number of known and unknown risks, uncertainties and other factors. Actual results, performance and achievements may be materially different from those expressed or implied by these forward-looking statements. Additional information about MAX is available at www.sedar.com.

Overview

Exploration and Evaluation Assets

On November 14, 2014, the Company advised that, due to market conditions, it was unable to continue making the lease payments due on its Majuba Hill copper/silver project in Nevada and relinquished the property to the vendor. As a result of the termination of the option agreement, the Company wrote off $1,933,028 of accumulated acquisition and exploration costs during the nine months ended September 30, 2014.

During July 2014 the Company commenced drilling at its East Manhattan Wash gold project in Nevada. A shallow seven hole drill program was completed and assay results from the first two holes announced in September 2014.

East Manhattan Wash gold project, Nye County, Nevada

In December, 2007, MAX entered into an Option Agreement to acquire a 100 % interest in the East Manhattan Wash (“EMW”) claims in the Manhattan Mining District, Nye County, Nevada from MSM LLC, a Nevada corporation. The EMW property is comprised of 78 claims (1,560 acres) located 40 miles north of the town of Tonopah.

During June 2014, MAX received approval from the U.S. Forest Service to begin drilling at EMW after July 15, 2014. Drilling commenced July 19, 2014 and targeted a surface soil anomaly exposed over a surface area in excess of 1,650 m by 450 m that was identified by soil sampling programs that were conducted by MAX between 2009 and 2013. Mineralization appears to be free gold in a volcanic lithic welded tuff that will be drill tested to determine the overall depth of the gold mineralization, extend the known mineralization below cover, and determine the overall grade. This seven hole drill program was completed in early August, with assay results from the first two holes released on September 12, 2014.

These first two holes were drilled vertically to a depth of 39.3 m and 38.1 m respectively and returned anomalous gold throughout their entire length. The best drill result was from hole EMW-02, which returned 13.7 m of 0.106 g/t Au beginning at a depth of 1.5 m, with hole EMW-07 returning 7.62 m of 0.034 g/t Au. Due to a concern about the effect that coarse gold in the sample may have had upon these assay results, these two drill holes were subsequently re-assayed at a different laboratory using a larger sample size from the reject in order to verify the initial results. The original assays, which were conducted on 250 gram splits, showed high variability at grades >~0.1 ppm, therefore 1000 gram splits were used to reduce the effect that coarse gold might have on the results. While this second lab reported higher gold values on the higher grade sections of the mineralized intercepts previously reported, this did not result in a meaningful increase in the length or overall grade of the mineralized intervals.

Core from the remaining five holes drilled this summer was reviewed based on this new information and it was determined that the gold mineralization intercepted at EMW represents supergene mineralization at surface that does not have sufficient overall grade to warrant further analysis of the remaining drill core.

This drill data we now have will be considered, in conjunction with the extensive surface sampling data we have compiled, in identifying targets for future exploration at EMW, which may include targeting higher grade vein systems at depth, which is what the Manhattan mining district is primarily known for.

Exploration History

More than 1,000,000 ounces of gold have been mined in the Manhattan Mining District. Production has included the nearby Manhattan mine (1974-1990), an open-pit operation that produced 236,000 ounces of gold at an average grade of 0.08 ounce per ton (“opt”). The Echo Bay East and West Pit deposits operated in the early 1990s, producing 260,000 ounces at an average grade of 0.06 opt. The Round Mountain Mine (Kinross/Barrick), situated eight miles north of East Manhattan Wash, is a conventional open pit operation that has produced more than 12 million ounces of gold to date.

In March 2009, the Company announced the results of the first large (bulk) sample taken from the EMW claims. This bulk sample weighed 793 pounds and was crushed to particles of less than 1 millimetre in size. The sample was then processed on a Wilfley Table to concentrate the heavy minerals. From this concentrate, a fired bead was made to produce a gold/silver “button”. This button, which weighed 2.67 grams, was then analyzed using a NITON x-ray analyzer and was found to contain approximately 80% gold and 20% silver. On a per ton basis, this is equivalent to 6.1 grams of gold/silver per ton, or 4.9 g/t gold and 1.2 g/t silver.

Following up the results of the bulk sample, MAX completed three large volume soil sampling grids in May of 2009 at EMW. The sampling program was designed to delineate the geometry of the native gold mineralization in three areas of interest. Significant values in the samples that were taken ranged from 0.05 ppm to 0.32 ppm gold with two of the zones being open in at least three directions.

The first two grids are located in a volcanic rhyolite lithic tuff hosting coarse gold. These areas, the “Gold Pit” and the “Old Drill Hole” grids, were sampled first by clearing a 1 meter by 1 meter area of surface debris then removing the organic (A) and root (B) soil horizons in turn. The sample was collected and consisted of a mixture of the soils directly above the bedrock (C horizon) and a portion of the bedrock below the soil. The sample was then sieved to ¼ inch minus then bagged.

These holes ranged from 12 inches to 48 inches in depth. Each hole location was identified with a 16 inch wooden stake labelled with an aluminum tag and backfilled to minimize disturbance. This technique was used to look at a small representative area and obtain any coarse gold trapped in the bedrock fractures.

In the first area, the Old Drill Hole grid, 30 samples were taken. The values ranged from nil to 0.32 ppm gold. The mineralized zone was 1200 feet long and 600 feet wide and was open in all four directions. Further work was undertaken to define the full areal extent of mineralization in this zone.

At the Gold Pit grid, located approximately 500 feet west of the Old Drill Hole grid, the area of significant mineralization was 1000 feet long by 250 feet wide. Again, the values range from nil to 0.32 ppm Au. The geology of the “Gold Pit” area consists of lithic rhyolitic and lapilli tuffs. These tuffs are locally argillically altered with minor local silicification.

A metallurgical sample was also taken and the entire sample contained 0.018 opt Au. This sample was found to contain visible native gold in the concentrate, middling’s, and the reject, with equal values in each of the three sizes. The gold found is from fine to coarse grained in size and did not seem to be in any one size fraction.

In early November 2009, MAX received the assays from additional soil sampling completed at EMW. The sampling was designed to further delineate the geometry of the native gold mineralization in the two main areas of interest, the “Gold Pit” and the “Old Drill Hole Grid”, which sampling now indicates are joined. A total of 138 samples were taken, with significant values ranging from 0.05 ppm to 1.5 ppm (1.5 g/t) gold. The total mineralized zone now encompasses an area 5,500 by 1,500 feet in size while still remaining open to the north, east, and west.

MAX staff also sampled historic prospector pits to the southeast of the Old Drill Hole Grid and returned high gold values (0.96 g/t) from soils around the pits that indicate that the mineralized zone continues and may be linked to another mineralized zone sampled by MAX further south, the “Southeast Extension”.

In September 2010, MAX completed additional soil sampling that was designed to further delineate the geometry of the native gold mineralization at EMW, which previously encompassed the “Gold Pit”, the “Old Drill Hole Grid” and now includes the “Southeast Extension”. This sampling has filled in the open areas within these grids, where 163 new samples were taken with significant values ranging from 0.05 ppm to 1.27 ppm (1.27 g/t) gold. While the total mineralized zone now exposed at surface encompasses an area in excess of 1,650 m by 450 m in size, the mineralized area is much larger but is covered by either overburden or alluvium.

The Gold Pit, Old Drill Hole Grid and Southeast Extension are located in a volcanic rhyolite lithic tuff hosting coarse gold. The sampling between the three pits has now enabled MAX to identify structural linear features seen in air photo images along with argillic alteration that appears to define where strong gold values may be found. Historic pits dug by earlier prospectors have helped to define the areas of mineralization and to confirm the presence of gold. A soil sampling map is available on our web site at www.maxresource.com.

In August 2013 MAX announced assay results from additional bulk sampling completed at EMW. This bulk sampling was undertaken to prepare for drilling planned for this fall, subject to permitting. Just north of this area, the very small streams all contain free gold that can be recovered by conventional gold panning techniques. During the 2013 program, two 10 kg samples were taken, one from the same area as the 2009 bulk sample and the second from an area approximately 150 meters to the east. The first 10 kg sample returned 1.5 g/t au and the second sample returned 0.87 g/t Au.

Drilling commenced July 19, 2014 and targeted a surface soil anomaly exposed over a surface area in excess of 1,650 m by 450 m that was identified by soil sampling programs that were conducted by MAX between 2009 and 2013. Mineralization appears to be free gold in a volcanic lithic welded tuff that will be drill tested to determine the overall depth of the gold mineralization, extend the known mineralization below cover, and determine the overall grade. This shallow seven hole drill program was completed in early August 2014 with assay results released in September, as described earlier in this report.

During the year ended December 31, 2013, the Company incurred $28,653 for geological consulting fees, $2,534 for assaying costs and field expenses of $2,013 on the East Manhattan project.

During the nine months ended September 30, 2014, the Company incurred $27,676 for geological consulting, $41,091 for drilling and assays and $10,552 for field expenses on the East Manhattan Project.

Private placement

During the nine months ended September 30, 2014, the Company completed a non-brokered private placement of 6,320,000 units at $0.05 per unit for gross proceeds of $316,000. Each unit is comprised one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share at an exercise price of $0.12 per share until March 26, 2016. If at any time prior to the expiry date of the warrants, the closing price of the common shares of the Company on the TSX Venture Exchange (“TSX-V”) is equal to or greater than $0.25 for 30 consecutive days, then the Company may elect to provide notice to the warrant holders that the warrants will expire 30 days from the date of the notice. Finders’ fees of $6,650 and 133,000 share purchase warrants, valued at $4,289, were paid in connection with this private placement. Each share purchase warrant is exercisable at $0.12 into one common share for a two year period.

The net proceeds from this private placement were used to fund exploration activities conducted this spring and summer at the Company’s Majuba Hill (silver/copper/gold) and East Manhattan Wash (gold) projects in Nevada and for general working capital.

Results of Operations

During the three months ended September 30, 2014 (the “current period”), the Company incurred a loss of $1,988,283 as compared to a loss of $779,243 for the three months ended September 30, 2013 (the “comparative period”). The significant changes during the current period compared to the comparative period are as follows:

Management fees decreased to $nil during the current period, from $30,000 during the comparative period. The reason for the decrease was that the Company’s CEO did not charge any fees for the current period.

Transfer agent, filing fees and shareholder relations expenses decreased to $22,766 during the current period from the $39,014 incurred during the comparative period. This was primarily due to reduced expenditures on investor relations activities and advertising during the current period.

A foreign exchange loss of $8,776 was incurred during the current period, with no such loss being incurring during the comparative period. The loss was mainly a result of a change in foreign currency rate regarding a trade payable balance denominated in United States Dollars.

Stock-based compensation expense increased to $9,540 as a result of the vesting of stock options granted by the Company during the three months ended September 30, 2014 (see above). No options vested or were granted during the comparative period.

Subsequent to September 30, 2014, the Company elected not to make a US$59,500 option payment on the Majuba Hill project when due on October 31, 2014 and, as a result, received notice of termination of the Majuba option agreement from the vendor. As a result of the termination of the agreement, the Company wrote off $1,933,028 of accumulated acquisition and exploration costs during the current period.

Due to the abandonment of the Diamond Peak and Table Top properties in August 2013 when annual Bureau of Land Management (“BLM”) payments became due, the Company wrote off acquisition and exploration expenses of $664,494 during the comparative period.

During the nine months ended September 30, 2014 (the “current nine-month period”), the Company incurred a loss of $2,184,474 as compared to a loss of $1,018,800 for the nine months ended September 30, 2013 (the “comparative nine-month period”). The significant changes during the current nine-month period compared to the comparative nine-month period are as follows:

Management fees decreased to $nil during the current nine-month period, from $90,000 accrued during the comparative nine-month period. The reason for the decrease was that the Company’s CEO did not accrue any fees for the current nine-month period.

Transfer agent, filing fees and shareholder relations expenses decreased to $75,208 during the current nine-month period from the $120,751 incurred during the comparative nine-month period. This was primarily due to decreased expenditures on investor relations activities and advertising during the current nine-month period.

A foreign exchange loss of $15,205 was incurred during the current nine-month period, with no such loss being incurring during the comparative nine-month period. The gain was mainly a result of a change in foreign currency rate regarding a trade payable balance denominated in United States Dollars.

Professional fees decreased to $27,847 during the current nine-month period from $45,634 incurred during the comparative nine-month period. During the comparative nine-month period a monthly fee of $3,500 was being charged for accounting and administrative services. This fee was reduced to $1,500 per quarter commencing June 1, 2013.

Stock-based compensation expense increased to $89,486 as a result of the vesting of stock options granted by the Company during the current nine-month period (see above). No options vested or were granted during the comparative nine-month period.

Due to the abandonment of the Diamond Peak and Table Top properties in August 2013 when annual Bureau of Land Management (“BLM”) payments became due, the Company wrote off acquisition and exploration expenses of $664,494 during the comparative nine-month period. This compares to a write-off of $1,933,038 during the current nine-month period on relinquishment of the Majuba Hill project.

Summary of Quarterly Results

| | | | | | | | |

| Q3-14

| Q2-14

| Q1-14

| Q4-13

| Q3-13

| Q2-13

| Q1-13

| Q4-12

|

Other Items ($)

|

(1,933,028)

|

-

|

-

|

-

|

(664,494)

|

1,030

|

1,166

|

1,572

|

Loss ($)

| (1,988,283)

| (136,949)

| (59,242)

| (75,721)

| (779,243)

| (113,045)

| (126,512)

| (109,978)

|

Loss per Share($)

|

(0.06)

|

(0.01)

|

(0.00)

|

(0.00)

|

(0.03)

|

(0.00)

|

(0.01)

|

(0.01)

|

The loss for the fourth quarter of fiscal 2012 decreased to $109,978 from the loss of $1,310,135 incurred during the third quarter of fiscal 2012. The decrease was primarily due to the elimination of the $1,177,622 write-off of certain exploration and evaluation assets that occurred in the prior quarter.

The loss for the first quarter of fiscal 2013 increased to $126,512 from the loss of $109,978 incurred during the fourth quarter of fiscal 2012. The increase was primarily due to additional audit fees incurred with respect to the 2012 year end audit in excess of the amount that had been accrued.

The loss for the second quarter of fiscal 2013 decreased to $113,045 from the loss of $126,512 incurred during the first quarter of fiscal 2013. There was an overall decrease in most expenses as management continues to focus on cash preservation. Consulting is the only expense that increased during the current period as a result of expensing a higher percentage of Clancy Wendt’s monthly invoices that were previously capitalized to exploration and evaluation assets.

The loss for the third quarter of fiscal 2013 increased to $779,243 from $113,045 incurred in the second quarter of fiscal 2013. The primary change between these two quarters relates to the write-off of $664,494 on abandonment of the Diamond Peak and Table Top properties during the current quarter.

The loss for the fourth quarter of fiscal 2013 decreased to $75,721 from $779,243 incurred in the third quarter of fiscal 2013. The primary change between these two quarters relates to the write-off of $664,494 on abandonment of the Diamond Peak and Table Top properties that was recorded during the prior quarter.

The loss for the first quarter of fiscal 2014 decreased to $59,242 from $75,721 incurred during the fourth quarter of fiscal 2013. The primary change between these two quarters relates to a decrease in management fees to $nil in the first quarter from the $30,000 incurred in the fourth quarter of fiscal 2013. The decrease in management fees was offset by an increase in consulting fees as a result of the Company incurring costs to its VP exploration for non-exploration work.

The loss for the second quarter of fiscal 2014 increased to $136,949 from $59,242 mainly as a result of stock-based compensation expense of $79,946 relating to stock options that were granted and vested during the second quarter (see above).

The loss for the third quarter of fiscal 2014 increased to $1,988,283 from $136,949 primarily due to a write-off of $1,933,028 during the current quarter due to the subsequent relinquishment of the Majuba Hill project in November 2014.

Liquidity and Solvency

At September 30, 2014, the Company had a working capital deficiency of $295,731 and cash on hand of $23,070. This compares to a working capital deficiency of $99,148 at December 31 2013, inclusive of cash of $203,229.

The decrease in cash of $180,159 during the nine months ended September 30, 2014 was due to net cash used in operating activities of $145,284, expenditures on exploration and evaluation assets of $322,824 and the purchase of a reclamation bond of $21,401, offset by the receipt of $309,350 of net proceeds from the closing of the non-brokered private placement.

As of the date of this report, MAX has approximately $15,000 in cash. The Company will need to find additional sources of funding in order to maintain its interests in its key property through the balance of 2014 as well as fund its general and administrative expenses through the same period. The Company has commitments in the future (next fiscal year and beyond) on its mineral property and may be forced to abandon this property if the Company does not have the financial means to meet these commitments, or does not feel it is fiscally prudent to do so.

During fiscal 2014, MAX has focused its efforts and cash resources on limited exploration at its Majuba Hill and East Manhattan Wash projects in Nevada. It is anticipated that the Company will have to obtain other financing or raise additional funds in order to meet its commitments and conduct further exploration at East Manhattan Wash during the balance of fiscal 2014 and beyond. While the Company has been successful in the past in obtaining financing through the sale of equity securities, there can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in the delay or indefinite postponement of further exploration and development of its property, or the loss of its property.

Related Party Transactions

Related party balances

The following amounts due to related parties are included in trade payables and accrued liabilities:

| | |

| September 30,

2014

| December 31,

2013

|

Company controlled by a director of the Company

| $

131,220

| $

130,000

|

Director of the Company

| 149,413

| 138,975

|

| $

280,633

| $

268,975

|

These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

Key management personnel compensation

During the three months ended September 30, 2014, the Company accrued management fees of $Nil (2013 - $30,000) to a private company controlled by Stuart Rogers, the CEO of the Company.

During the three months ended September 30, 2014, the Company paid or accrued geologic consulting fees of $22,109 (2013 - $30,000) to a private company controlled by Clancy Wendt, the VP Exploration and a Director of the Company.

Financial Risk and Capital Management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors the risk management processes, inclusive of documented investment policies, counterparty limits, and controlling and reporting structures. The type of risk exposure and the way in which such exposure is managed is provided as follows:

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Company’s primary exposure to credit risk is on its cash held in bank accounts. The majority of cash is deposited in bank accounts held with major banks in Canada. As most of the Company’s cash is held by two banks there is a concentration of credit risk. This risk is managed by using major banks that are high credit quality financial institutions as determined by rating agencies. The Company’s secondary exposure to risk is on its GST receivable. This risk is considered to be minimal.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company has a planning and budgeting process in place to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis. The Company ensures that there are sufficient funds to meet its short-term business requirements, taking into account its anticipated cash flows from operations and its holdings of cash and cash equivalents.

Historically, the Company's sole source of funding has been the issuance of equity securities for cash, primarily through private placements. The Company’s access to financing is always uncertain. There can be no assurance of continued access to significant equity funding.

Foreign exchange risk

Foreign currency risk is the risk that the fair values of future cash flows of a financial instrument will fluctuate because they are denominated in currencies that differ from the respective functional currency. The Company is exposed to currency risk as it incurs expenditures that are denominated in United States dollar while its functional currency is the Canadian dollar. The Company does not hedge its exposure to fluctuations in foreign exchange rates.

The following is an analysis of Canadian dollar equivalent of financial assets and liabilities that are denominated in United States dollars:

| | |

| September 30,

2014

| December 31, 2013

|

Cash

| $

8,003

| $

14,335

|

Trade payables and accrued liabilities

| (133,895)

| (138,975)

|

| $

(125,892)

| $

(124,640)

|

Based on the above net exposures, as at September 30, 2014, a 10% change in the United States dollar to Canadian dollar exchange rate could impact the Company’s loss and comprehensive loss by $12,589 (December 31, 2013 - $12,464).

Interest rate risk

Interest rate risk is the risk due to variability of interest rates. The Company is exposed to interest rate risk on its bank account. The income earned on the bank account is subject to the movements in interest rates. The Company has cash balances and no-interest bearing debt, therefore, interest rate risk is nominal.

Capital Management

The Company's policy is to maintain a strong capital base so as to maintain investor and creditor confidence and to sustain future development of the business. The capital structure of the Company consists of working capital and share capital. There were no changes in the Company's approach to capital management during the year. The Company is not subject to any externally imposed capital requirements.

17

Classification of financial instruments

Financial assets included in the statement of financial position are as follows:

| | |

| September 30,

2014

| December 31,

2013

|

Cash

| $

23,070

| $

203,229

|

Loans and receivables:

| | |

Prepaids

| 4,793

| 4,223

|

Taxes recoverable

| 1,012

| 128

|

Reclamation deposits

| 53,498

| 32,097

|

| $

82,373

| $

239,677

|

Financial liabilities included in the statement of financial position are as follows:

| | |

| September 30,

2014

| December 31,

2013

|

Non-derivative financial liabilities:

| | |

Trade payables

| $ 43,973

| $

22,753

|

Amounts due to related parties

| 280,633

| 268,975

|

| $ 324,606

| $

291,728

|

Fair value

The fair value of the Company’s financial assets and liabilities approximates the carrying amount.

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

·

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

·

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

·

Level 3 – Inputs that are not based on observable market data.

The following is an analysis of the Company’s financial assets measured at fair value as at September 30, 2014 and December 31, 2013:

| | | |

| As at September 30, 2014

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

23,070

| $

-

-

| $

-

|

| | | |

| As at December 31, 2013

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

203,229

| $

-

| $

-

|

Contingencies

The Company is not aware of any contingencies or pending legal proceedings as of November 27, 2014.

Off Balance Sheet Arrangements

The Company has no off Balance Sheet arrangements as of November 27, 2014.

Proposed Transactions

The Company has no proposed transactions as of November 27, 2014. .

18

Equity Securities Issued and Outstanding

The Company has 30,825,985 common shares issued and outstanding as of November 27, 2014. . In addition, there are 2,725,000 incentive stock options outstanding with exercise prices ranging between $0.10 and $0.25expiring between February 22, 2015 and May 7, 2016 and 6,453,000 share purchase warrants outstanding with an exercise price of $0.12 per share expiring on March 26, 2016.

Disclaimer

The information provided in this document is not intended to be a comprehensive review of all matters concerning the Company. It should be read in conjunction with all other disclosure documents provided by the Company. No securities commission or regulatory authority has reviewed the accuracy or adequacy of the information presented herein.

Certain statements contained in this document constitute “forward-looking statements”. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance, or achievements expressly stated or implied by such forward-looking statements. Such factors include, among others, the following: mineral exploration and development costs and results, fluctuation in the prices of commodities for which the Company is exploring, foreign operations and foreign government regulations, competition, uninsured risks, recoverability of resources discovered, capitalization requirements, commercial viability, environmental risks and obligations, and the requirement for obtaining permits and licenses for the Company’s operations in the jurisdictions in which it operates.

18

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the nine months ended September 30, 2014

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

MAX RESOURCE CORP.

Date: November 28, 2014

By /s/ Stuart Rogers

Stuart Rogers

Director

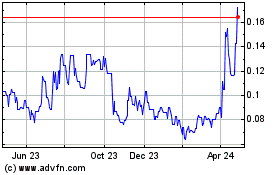

Max Resource (PK) (USOTC:MXROF)

Historical Stock Chart

From Mar 2024 to Apr 2024

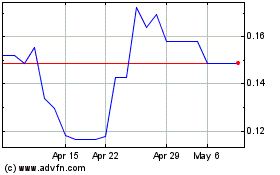

Max Resource (PK) (USOTC:MXROF)

Historical Stock Chart

From Apr 2023 to Apr 2024