Avidbank Holdings, Inc. ("the Company") (OTCBB: AVBH), a bank

holding company and the parent company of Avidbank ("the Bank"), an

independent full-service commercial bank serving businesses and

consumers in Northern California, announced unaudited consolidated

net income of $646,000 for the third quarter of 2014 compared to

$436,000 for the same period in 2013.

Year-to-Date and Third Quarter 2014

Financial Highlights

- Net income was $1,749,000 for the first

nine months of 2014, compared to $1,875,000 for the first nine

months of 2013. Results for the 2013 period included $748,000 in

gains from the sale of investment securities compared to $22,000 in

the 2014 period.

- Diluted earnings per common share were

$0.40 for the first nine months of 2014, compared to $0.51 for the

first nine months of 2013.

- Net income was $646,000 for the third

quarter of 2014, compared to $436,000 for the third quarter of

2013. Results for the 2013 period included $67,000 in gains from

the sale of investment securities compared to $22,000 in the 2014

period.

- Diluted earnings per common share were

$0.15 for the third quarter of 2014, compared to $0.09 for the

third quarter of 2013.

- Total assets grew by 0.3% during the

past three months, ending the third quarter at $484 million.

- Total loans outstanding grew by 15%

during the first nine months of 2014, ending the third quarter at

$295 million.

- Total deposits grew by 0.3% over the

past three months, ending the third quarter at $428 million.

- The Bank continues to be well

capitalized with a Tier 1 Leverage Ratio of 10.2% and a Total Risk

Based Capital Ratio of 12.8%.

Mark D. Mordell, Chairman and Chief Executive Officer, stated,

"The Bank's efforts to grow the loan portfolio by increasing loan

production staff and facilities continued to yield positive results

in the third quarter of 2014. Loans outstanding increased more than

$17 million in the quarter, a 25% annualized rate of growth. These

results confirm our progress as we focus on our plan of sustained

and prudent growth in our loan portfolio. Net income for the third

quarter of 2014 grew by 48% over the third quarter of 2013

primarily due to higher loans outstanding and the absence of a loan

loss provision. We will continue with our plan to grow our loan

portfolio and leverage the investments in personnel and

infrastructure we have made. Our Real Estate Lending division,

which includes construction lending, has demonstrated substantial

growth in commitments in 2014."

"The Bank's total deposits increased by $1.2 million in the

third quarter, as the runoff of a large transactional account was

replaced by relationship deposits. In addition, core deposits make

up over 94% of total deposits and our non-interest bearing deposits

have grown to 39% of total deposits since the beginning of the

year," noted Mr. Mordell. "We are making progress toward deploying

our considerable level of liquid funds into loans. Our high level

of capital and the high quality of our loan portfolio provide us

with ample capacity for growth."

Results for the nine months ended

September 30, 2014

Net interest income before provision for loan losses was $11.9

million in 2014, an increase of $387,000 or 3.4% over the prior

year. Higher outstanding loan balances and reductions in the rates

paid on deposits were partially offset by lower loan yields.

Average earning assets were $441 million in the first nine months

of 2014, an 8% increase over the prior year. Net interest margin

was 3.66% for 2014 year to date compared to 3.79% for 2013. The

decline in net interest margin was primarily caused by a decline in

loan yields due to the current interest rate environment offset by

growth in average loans and a decrease in Fed funds sold. No loan

loss provision was recorded in the first nine months of 2014 and a

$245,000 provision was taken in the first nine months of 2013. We

have experienced recoveries net of charge-offs of $38,000 in 2014

compared to net recoveries of $29,000 in 2013.

Non-interest income, excluding gains on sales of securities, was

$943,000 in the first nine months of 2014, an increase of $485,000

or 106% over 2013. The increase in non-interest income was due to

an increase in service charges and other fee generation activities

as well as an increase in earnings on bank owned life insurance.

There were $22,000 of gains on sales of securities in the first

nine months of 2014 and $748,000 of gains on securities sales in

2013.

Non-interest expense grew by $633,000 or 7% in the first nine

months of 2014 to $9.9 million compared to $9.3 million in 2013.

This growth was due to investments in loan production personnel and

facilities as we continue to expand our footprint and grow our loan

portfolio.

Results for the quarter ended September

30, 2014

For the three months ended September 30, 2014, net interest

income before provision for loan losses was $4.1 million, an

increase of $282,000 or 7% compared to the third quarter of 2013.

The increase was primarily the result of higher loans outstanding.

Average earning assets were $442 million in the third quarter of

2014, a 3% increase over the third quarter of the prior year.

Earning assets increased due to loan growth partially offset by

lower Fed funds sold. Net interest margin was 3.73% for the third

quarter of 2014, compared to 3.60% for the third quarter of 2013.

Net interest margin increased due to growth in loans for the

quarter. No loan loss provision was taken in the third quarter of

2014 and a $245,000 provision was taken in the third quarter of

2013.

Non-interest income, excluding gains on sales of securities, was

$334,000 in the third quarter of 2014, an increase of $160,000 or

92% over the third quarter of 2013. The increase was due to

increases in service charges and other fee generation activities as

well as an increase in earnings on bank owned life insurance. There

were $22,000 of gains on sales of securities in the third quarter

of 2014 and $67,000 of gains on securities sales in the third

quarter of 2013.

Non-interest expense grew by $257,000 in the third quarter of

2014 to $3.3 million compared to $3.1 million for the third quarter

of 2013. This growth was due to the investments in loan production

personnel mentioned previously. The Company’s full-time equivalent

employees at September 30, 2014 and 2013 were 59 and 50,

respectively.

Balance Sheet

Total assets grew to $484 million as of September 30, 2014,

compared to $483 million at June 30, 2014 and $483 million on the

same date one year ago. The increase in total assets of $1.7

million, or 0.3%, from June 30, 2014 consisted of increases in the

loan and investment securities portfolios offset by a decrease in

Fed funds.

The Company reported total gross loans outstanding at September

30, 2014 of $295 million, which represented an increase of $17.6

million, or 6%, over $278 million at June 30, 2014, and an increase

of $50.9 million, or 21%, over $245 million at September 30, 2013.

The increase in total gross loans from June 30, 2014 was primarily

attributable to growth in commercial real estate and construction

loans. The increase in loans from September 30, 2013 was primarily

attributable to growth in commercial real estate and asset based

loans. Non-accrual loans totaled $6.4 million or 2.2% of total

loans on September 30, 2014 compared to $2.0 million or 0.8% of

total loans for the previous year-end. "Our high credit standards

have resulted in an absence of net charge-offs for both the 2014

and 2013 periods. Our increase in nonaccrual loans was isolated to

one client," observed Mr. Mordell.

The Company’s total deposits were $428 million as of September

30, 2014, which represented an increase of $1.2 million, or 0.3%,

compared to $427 million at June 30, 2014 and a decrease of $5.8

million, or 1%, compared to $434 million at September 30, 2013. The

increase in deposits from June 30, 2014 was primarily attributable

to an increase in money market and interest checking accounts

partially offset by a decrease in demand deposit accounts, while

the decrease from September 30, 2013 was primarily attributable to

a decrease in certificates of deposit over $100,000.

Demand deposits represented 43.7% of total deposits at September

30, 2014, compared to 44.3% at June 30, 2014 and 40.8% for the same

period one year ago. Core deposits represented 94.6% of total

deposits at September 30, 2014, compared to 93.9% at June 30, 2014

and 91.0% at September 30, 2013.

About Avidbank

Avidbank Holdings, Inc., headquartered in Palo Alto, California,

offers innovative financial solutions and services. We specialize

in the following markets: commercial & industrial, corporate

finance, asset-based lending, real estate construction and

commercial real estate lending, and real estate bridge financing.

Avidbank advances the success of our clients by providing them with

financial opportunities and serving them as we wish to be served –

with mutual effort, ingenuity and trust – creating long-term

banking relationships.

Forward-Looking Statement:

This news release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on current

expectations, estimates and projections about Avidbank's business

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements

due to numerous factors, including those described above and the

following: Avidbank's timely implementation of new products and

services, technological changes, changes in consumer spending and

savings habits and other risks discussed from time to time in

Avidbank's reports and filings with banking regulatory agencies. In

addition, such statements could be affected by general industry and

market conditions and growth rates, and general domestic and

international economic conditions. Such forward-looking statements

speak only as of the date on which they are made, and Avidbank does

not undertake any obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

release.

Avidbank Holdings, Inc.

Consolidated Balance Sheets

($000, except share, per share amounts and

ratios) (Unaudited)

Assets

9/30/2014

6/30/2014

3/31/2014

12/31/2013

9/30/2013

Cash and due from banks $ 20,499 $ 18,049 $ 15,427 $ 16,905 $

22,113 Fed funds sold 68,675 100,445

127,785 151,940

134,965 Total cash and cash equivalents 89,174

118,494 143,212 168,845 157,078 Investment securities -

available for sale 78,710 65,282 58,397 58,983 66,147 Loans,

net of deferred loan fees 295,410 277,822 254,375 257,434 244,501

Allowance for loan losses (4,826 ) (4,809 )

(4,795 ) (4,788 ) (4,754

) Loans, net of allowance for loan losses 290,584 273,013 249,580

252,646 239,747 Bank owned life insurance 11,857 11,783

11,694 11,607 11,517 Premises and equipment, net 1,108 1,210 1,287

1,175 1,171 Accrued interest receivable & other assets

13,006 12,983 8,950

7,420 7,574 Total

assets $ 484,439 $ 482,765 $ 473,120

$ 500,676 $ 483,234

Liabilities

Non-interest-bearing demand deposits

$

166,733

$

173,394

$

151,538

$

158,364

$

161,517

Interest bearing transaction accounts 20,415 15,523 18,041 18,991

15,226 Money market and savings accounts 201,189 194,892 205,237

222,324 198,731 Time deposits 39,453

42,777 47,250 50,625

58,081 Total deposits 427,790 426,586

422,066 450,304 433,555 Other liabilities 6,273

6,262 2,209

2,340 2,312 Total liabilities

434,063 432,848 424,275 452,644 435,867

Shareholders'

equity

Preferred stock

-

-

-

-

-

Common stock/additional paid-in capital 45,080 44,985 44,774 44,531

44,417 Retained earnings 5,189 4,574 3,877 3,469 2,834 Accumulated

other comprehensive income 107 358

194 32

116 Total shareholders' equity 50,376 49,917 48,845

48,032 47,367 Total liabilities and shareholders' equity $ 484,439

$ 482,765 $ 473,120 $

500,676 $ 483,234

Bank Capital

ratios

Tier 1 leverage ratio

10.17

%

10.36

%

9.72

%

9.66

%

10.22

%

Tier 1 risk-based capital ratio 11.60 % 11.89 % 12.89 % 12.44 %

12.76 % Total risk-based capital ratio 12.82 % 13.14 % 14.14 %

13.69 % 14.01 % Book value per common share $ 11.61 $ 11.51

$ 11.34 $ 11.21 $ 11.06 Total common shares outstanding 4,338,161

4,336,292 4,308,756 4,283,494 4,281,482

Other

Ratios

Non-interest bearing/total deposits

39.0

%

40.6

%

35.9

%

35.2

%

37.3

%

Loan to deposit ratio 69.1 % 65.1 % 60.3 % 57.2 % 56.4 % Allowance

for loan losses/total loans 1.63 % 1.73 % 1.89 % 1.86 % 1.94 %

Avidbank Holdings, Inc.

Condensed

Consolidated Statements of Income ($000, except share, per

share amounts and ratios) (Unaudited) Quarter Ended Year to

Date

9/30/2014

6/30/2014

9/30/2013

9/30/2014

9/30/2013

Interest and fees on loans and leases $ 3,786 $ 3,878 $ 3,630 $

11,076 $ 11,014 Interest on investment securities 430 437 393 1,242

1,196 Other interest income 56 60

72 204

184 Total interest income 4,272 4,375 4,095 12,522

12,394 Interest expense 175 209

280 628 887

Net interest income 4,097 4,166 3,815 11,894 11,507

Provision for loan losses - -

245 - 245

Net interest income after provision for loan losses 4,097

4,166 3,570 11,894 11,262 Service charges, fees and other

income 260 241 128 693 361 Income from bank owned life insurance 74

89 46 250 97 Gain on sale of investment securities 22

- 67 22

748 Total non-interest income 356 330

241 965 1,206 Compensation and benefit expenses 2,072 2,024

1,885 6,148 5,525 Occupancy and equipment expenses 568 620 537

1,757 1,688 Other operating expenses 705

669 666 1,984

2,043 Total non-interest expense 3,345

3,313 3,088 9,889 9,256 Income before income taxes 1,108

1,183 723 2,970 3,212 Provision for income taxes 462

487 287

1,221 1,337 Net income $ 646

$ 696 $ 436 $ 1,749

$ 1,875 Preferred dividends & warrant

amortization - -

38 - 206 Net

income applicable to common shareholders $ 646 $ 696

$ 398 $ 1,749 $ 1,669

Basic earnings per common share $ 0.15

$ 0.16 $ 0.09 $ 0.41 $ 0.52 Diluted earnings per common share $

0.15 $ 0.16 $ 0.09 $ 0.40 $ 0.51 Average common shares

outstanding 4,336,761 4,319,447 4,274,420 4,317,122 3,214,230

Average common fully diluted shares 4,419,603 4,397,544 4,315,848

4,395,979 3,257,599 Annualized returns: Return on average

assets 0.54 % 0.60 % 0.38 % 0.49 % 0.58 % Return on average common

equity 5.16 % 5.62 % 4.13 % 4.71 % 6.57 % Net interest

margin 3.73 % 3.98 % 3.60 % 3.66 % 3.79 % Cost of funds 0.16 % 0.20

% 0.28 % 0.20 % 0.31 % Efficiency ratio 75.1 % 73.7 % 76.1 % 76.9 %

72.8 %

Avidbank

Interim Credit Trends ($000, except ratios)

(Unaudited)

Allowance for Loan

Losses

9/30/2014 6/30/2014

3/31/2014 12/31/2013

9/30/2013 Balance, beginning of quarter $ 4,809 $

4,795 $ 4,788 $ 4,754 $ 4,764 Provision for loan losses, quarterly

- - - - 245 Charge-offs, quarterly - - - - (311) Recoveries,

quarterly 17 14 7 34

56 Balance, end of quarter $ 4,826 $

4,809 $ 4,795 $ 4,788 $

4,754

Nonperforming

Assets

Loans accounted for on a non-accrual basis $ 6,412 $ 2,283 $

3,099 $ 2,015 $ 686 Loans with principal or interest contractually

past due 90 days or more and still accruing interest -

- - - -

Nonperforming loans 6,412 2,283 3,099 2,015 686 Other real estate

owned - - - -

- Nonperforming assets $ 6,412 $ 2,283

$ 3,099 $ 2,015 $ 686 Loans

restructured and in compliance with modified terms -

- - - - Nonperforming

assets & restructured loans $ 6,412 $ 2,283

$ 3,099 $ 2,015 $ 686

Nonperforming Loans by Asset Type: Commercial $ 5,917

$ 1,779 $ 2,585 $ 1,492 $ - Construction Land Other real estate 495

504 514 523 686 Factoring and asset-based lending Other

Nonperforming loans $ 6,412 $

2,283 $ 3,099 $ 2,015 $

686

Asset Quality

Ratios

Allowance for loan losses / gross loans 1.63% 1.73% 1.89% 1.86%

1.94% Allowance for loan losses / nonperforming loans 75.27%

210.64% 154.73% 237.62% 693.00% Nonperforming assets / total assets

1.32% 0.47% 0.66% 0.40% 0.14% Nonperforming loans / gross loans

2.17% 0.82% 1.22% 0.78% 0.28% Net quarterly charge-offs / gross

loans -0.01% -0.01% 0.00% -0.01% 0.10%

Avidbank Holdings, Inc.Steve Leen, 650-843-2204Executive Vice

President and Chief Financial

Officersleen@avidbank.comavidbank.com

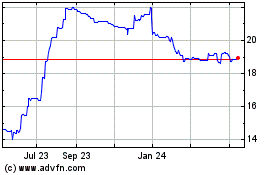

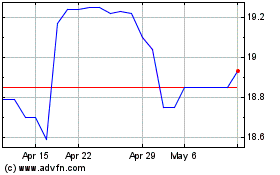

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Apr 2023 to Apr 2024