Mineral Mountain Announces Closing to Financing Transaction

March 07 2014 - 5:09PM

Marketwired

Mineral Mountain Announces Closing to Financing Transaction

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 7, 2014) -

Mineral Mountain Resources Ltd. ("Mineral Mountain")

(TSX-VENTURE:MMV)(OTCQX:MNRLF) Further to the Company's news

release of January 21, 2014, and February 27, 2014 the Company

announces that it has closed its securities exchange with Global

Resources Investment Trust plc ("GRIT").

The Company issued 28,600,000 common shares at a deemed price of

$0.07 per share to GRIT, (which results in GRIT holding

approximately 19.94% of Mineral Mountain's common shares) in

exchange for 1,121,128 ordinary shares of GRIT (the "GRIT Shares"),

at the deemed price of £1.00 per GRIT Share. The securities issued

to GRIT are subject to resale restrictions expiring July 8,

2014.

The Company will now seek to sell the GRIT Shares through the

facilities of the London Stock Exchange. During the first six

months, all sales of GRIT Shares will be arranged by GRIT. While

the Company will seek to maximize the proceeds it receives from the

sale of its GRIT Shares, there is no assurance as to the timing of

disposition or the amount that will be realized. Funds realized

from the sale of the GRIT Shares will be used by the Company for

exploration work.

The GRIT Shares were distributed pursuant to a prospectus

published by GRIT in the UK on February 28, 2014. GRIT's

application to list its ordinary shares on the premium listing

segment of the Official List and to trade on the London Stock

Exchange's main market became effective today. GRIT's distribution

of the GRIT Shares to the Company and other Canadian based issuers

was also made pursuant to a discretionary exemption order granted

by the Ontario and British Columbia Securities Commissions by order

dated November 13, 2013.

GRIT has been established to exploit investment opportunities in

the junior mining and natural resources sectors worldwide, with an

investment objective to generate medium and long-term capital

growth. GRIT has conducted share exchange transactions with 41

junior resource companies (32 headquartered in Canada), acquiring

an initial portfolio of their securities in exchange for 39,520,012

ordinary shares having a deemed value of £39,520,012 (approximately

C$73,250,000).

In connection with the transaction, Mineral Mountain has agreed

to pay to certain arm's length individuals a finder's fee

consisting of Mineral Mountain shares in accordance with the

policies of the TSXV. The finder's fee payable by the Company will

only be paid in conjunction with the actual sale by the Company of

the GRIT shares, and will be based on the actual cash value

received from the sale of such GRIT shares.

About Mineral Mountain and the Holy Terror Project

Mineral Mountain, through its wholly owned subsidiary Mineral

Mountain Resources (SD) Inc., is focused on the advance exploration

and, if warranted, development of its most advanced asset, the Holy

Terror Project located in the Keystone Mining district in the

southeastern part of the Black Hills of South Dakota, U.S.A. The

Holy Terror Project is centered along the southwestern extension of

the Homestake Gold Trend and covers approximately 5000 acres

straddling a major gold bearing structural corridor measuring about

15 km in strike length and 1.5 km in width. The Keystone District

contains historic, turn of the century gold mines, eight of which

occur within the Holy Terror Project. Production of these mines

came from early Proterozoic gold mineralization associated with

iron formation, and shear zones similar to the deposits at the

western hemisphere's deepest and richest mine, the Homestake gold

mine, which, over 120 consecutive years produced 40 million ounces

of gold in the northern Black Hills. The Holy Terror Project is

very well located near Rapid City where it can be easily accessed

by a network of roads and has hydro-electricity and modern internet

services to the drill site. As well, the area has a skilled labor

force and can be explored year round at low cost. According to a

recent poll released by CNBC, South Dakota was ranked first overall

in the United States for conducting business in 2013, has low

political risk and a jurisdiction that embraces mineral

development.

On Behalf of the Board of Directors, MINERAL MOUNTAIN RESOURCES

LTD.

Nelson W.

Baker, President and CEO

Reader Advisory

Neither TSX Venture Exchange nor its Regulation Service

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

This release includes certain statements that may be deemed

to be "forward-looking information" under Canadian securities laws.

All statements in this release, other than statements of historical

facts, that address events or developments that Mineral Mountain

expects to occur, constitute forward looking-information. Forward

looking information consists of statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "could" or "should" occur. Although Mineral

Mountain believes the expectations expressed in such

forward-looking information are based on reasonable assumptions,

such information does not constitute guarantees of future

performance and actual results may differ materially from those in

forward-looking information. Factors that cause the actual results

to differ materially from those in forward-looking information

include the ability of GRIT to complete its stock exchange listing,

the ability for Mineral Mountain to resell its shares of GRIT, gold

prices, results of exploration and development activities,

regulatory changes, defects in title, availability of materials and

equipment, timeliness of government approvals, continued

availability of capital and financing and general economic, market

or business conditions. Mineral Mountain cautions the foregoing

list of important factors is not exhaustive. Investors and others

who base themselves on Mineral Mountain's forward-looking

information should carefully consider the above factors as well as

the uncertainties they represent and the risk they entail. Mineral

Mountain believes that the expectations reflected in the

forward-looking information are reasonable, but no assurance can be

given that these expectations will prove to be correct. Please see

the public filings of Mineral Mountain at www.sedar.com for further

information.

Mineral Mountain Resources Ltd.Brad BakerVice-President

Corporate Development & Director(778)

383-3975bbaker@mineralmtn.comwww.mineralmtn.com

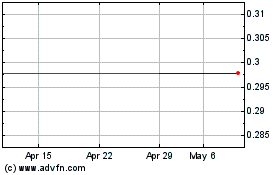

Badlands Resources (QB) (USOTC:MNRLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

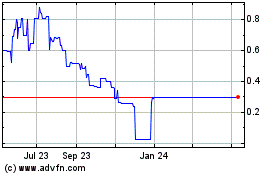

Badlands Resources (QB) (USOTC:MNRLF)

Historical Stock Chart

From Apr 2023 to Apr 2024