Mineral Mountain Announces Update to Financing Transaction

January 21 2014 - 2:01PM

Marketwired

Mineral Mountain Announces Update to Financing Transaction

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 21, 2014) -

Mineral Mountain Resources Ltd. ("Mineral Mountain")

(TSX-VENTURE:MMV)(OTCQX:MNRLF) announces that it has agreed to

amend the terms of the share exchange financing transaction with

Global Resources Investment Ltd. announced in our press release of

November 6, 2013 (the "November 6, 2013 Press Release").

As announced in the November 6, 2013 Press Release, Mineral

Mountain will issue and deliver to Global Resources Investment

Trust Plc. ("GRIT") 28,600,000 common shares at a deemed price of

$0.07 per share (which would result in GRIT holding approximately

19.94% of Mineral Mountain's common shares post-closing). Due to

the decline in the value of the Canadian dollar from November 2013

to present, instead of issuing 1,205,733 ordinary shares at a

deemed price of £1.00 per share, GRIT would issue and deliver to

Mineral Mountain 1,121,128 ordinary shares at the same deemed price

of £1.00 per share (the "GRIT Shares"). Mineral Mountain would then

endeavor to sell the GRIT Shares to realize cash proceeds.

Closing of the transaction on the above amended terms remains

subject to a number of conditions precedent, including receipt of

acceptance for filing from the TSX Venture Exchange ("TSXV") and

GRIT successfully listing on the London Stock Exchange.

In connection with the transaction, Mineral Mountain has agreed

to pay to certain arm's length individuals a finder's fee

consisting of Mineral Mountain shares in accordance with the

policies of the TSXV and subject to receipt of TSXV approval.

About Mineral Mountain and the Holy Terror Project

Mineral, through its wholly owned subsidiary Mineral Mountain

Resources (SD) Inc., is focused on the exploration and, if

warranted, development of its key asset, the Holy Terror Project in

the Keystone Mining district in the southeastern part of the Black

Hills of South Dakota. The Holy Terror Project is centered along

the southwestern extension of the Homestake Gold Trend and covers

approximately 4000 acres straddling a major gold bearing structural

corridor measuring about 15 km in strike length and 1.5 km in

width. The Keystone District contains historic gold mines, eight of

which occur within the Holy Terror Project. Production of these

mines came from early Proterozoic gold mineralization associated

with iron formation, and shear zones similar to the deposits at the

former Homestake gold mine which, over 120 years produced 40

million ounces of gold in the northern Black Hills. The Holy Terror

Project is very well located near Rapid City where it can be easily

accessed by a network of roads and has hydro-electricity and modern

internet services to the drill site. As well, the area has a

skilled labour force and is a low cost exploration area. South

Dakota has low political risk and a jurisdiction that embraces

mineral development.

On Behalf of the Board of Directors

MINERAL MOUNTAIN RESOURCES LTD.

Nelson W. Baker, President and CEO

Reader Advisory

Neither TSX Venture Exchange nor its Regulation Service

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

This release includes certain statements that may be deemed

to be "forward-looking information" under Canadian securities laws.

All statements in this release, other than statements of historical

facts, that address events or developments that Mineral Mountain

expects to occur, constitute forward looking-information. Forward

looking information consists of statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "could" or "should" occur. Although Mineral

Mountain believes the expectations expressed in such

forward-looking information are based on reasonable assumptions,

such information does not constitute guarantees of future

performance and actual results may differ materially from those in

forward-looking information. Factors that cause the actual results

to differ materially from those in forward-looking information

include the ability of GRIT to complete its stock exchange listing,

the ability for Mineral Mountain to resell its shares of GRIT, gold

prices, results of exploration and development activities,

regulatory changes, defects in title, availability of materials and

equipment, timeliness of government approvals, continued

availability of capital and financing and general economic, market

or business conditions. Mineral Mountain cautions the foregoing

list of important factors is not exhaustive. Investors and others

who base themselves on Mineral Mountain's forward-looking

information should carefully consider the above factors as well as

the uncertainties they represent and the risk they entail. Mineral

Mountain believes that the expectations reflected in the

forward-looking information are reasonable, but no assurance can be

given that these expectations will prove to be correct. Please see

the public filings of Mineral Mountain at www.sedar.com for further

information.

Mineral Mountain Resources Ltd.Brad BakerVice-President

Corporate Development & Director(778)

383-3975bbaker@mineralmtn.comwww.mineralmtn.com

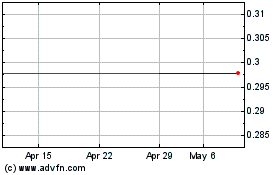

Badlands Resources (QB) (USOTC:MNRLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

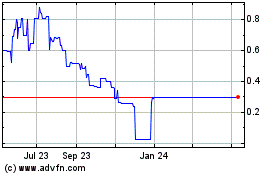

Badlands Resources (QB) (USOTC:MNRLF)

Historical Stock Chart

From Apr 2023 to Apr 2024