Currently, the broad markets are having trouble finding their

footing due to growing concerns over the political deadlock in

Washington. Yet, even in this backdrop, small cap securities are

leading the market higher, and are easily outpacing their large and

mid cap counterparts.

In fact, from a year-to-date look, small caps, as represented by

the largest and most popular ETF (IWM), have added over 23%,

compared to a gain of about 16% for SPY and just under 21% for IJH.

The small cap ETF has gathered over $5.2 billion in assets so far

in the year, propelling the fund’s base to roughly $27 billion.

The surge in small caps is expected to continue at least for the

rest of the year assuming the risk-on trade comes back, and

investors clamor for more domestic exposure. That is because small

caps have been riding high on seemingly limitless QE, and could

remain top picks if Washington gets its act together (read: 3

Growth ETFs to Buy for a Continued Small Cap Surge).

Interestingly, the top performers are spread across a number of

sectors, suggesting that there have been winners in every corner of

the space. Given this, small cap funds could be an excellent choice

for investors seeking a top pick in today’s market environment.

Below, we have highlighted the top three sector ETFs that are

outperforming in the small cap space and could be worth a closer

look for those with a slightly longer time horizon (see: all the

Small Caps ETFs here):

PowerShares S&P SmallCap Energy Fund

(PSCE)

Energy has been a strong performing sector this year thanks to a

solid trend in the energy exploration field and booming production

in regions like the Dakotas and Texas. In fact, the sector has

surged mainly due to a rise in U.S. oil production, which has cut

down on the nation’s net oil imports (read: 3 Top Performing Energy

ETFs in Focus Now).

One ETF that has largely benefited from this trend is PSCE. This

fund tracks the S&P Small Cap 600 Capped Energy Index and holds

28 stocks in the basket. It is the least popular and is less liquid

with AUM of $37 million and average daily volume of under 8,000

shares. The ETF charges 29 bps in fees per year from investors.

The product is largely concentrated across its top 10 securities

with Gulfport Energy making up for 16.03% share alone in the

basket. Other firms hold less than 9% of the total assets. About

half of the portfolio is tilted toward exploration and production,

closely followed by equipment & services (45%).

PSCE returned over 36% in the year-to-date time frame, clearly

outpacing the broad sector fund (XLE) and other products by wide

margin. The fund currently has a Zacks ETF Rank of 1 or ‘Strong

Buy’ rating with a High risk outlook.

PowerShares S&P SmallCap Materials Fund

(PSCM)

The materials sector is performing quite well this year on

recovering U.S. fundamentals and a turnaround in global trends in

wood products, chemicals, construction materials, and metals &

mining (read: 3 Forgotten Ways to Play Mining Sector with

ETFs).

A good way to play this trend is with PSCM, which follows the

S&P SmallCap 600 Capped Materials Index. This fund added 21.70%

year-to-date, outpacing the broad sector fund (XLB) and other

products by a wide margin. The ETF has accumulated $13.5 million in

its asset base while volume is paltry, suggesting additional cost

in the form of a wide bid/ask spread beyond the expense ratio of

0.29%.

With holdings of 29 stocks, the product is quite spread across

various securities. PolyOne Corp, HB Fuller Co and

Schweitzer-Mauduit International occupy the top three positions in

the basket with less than 19% share. In terms of industry exposure,

diversified chemicals, and forestry and paper products take the

largest share at 37% and 21%, respectively.

PSCM has a Zacks ETF Rank of 3 or ‘Hold’ rating with Medium risk

outlook.

PowerShares S&P SmallCap Industrials Fund

(PSCI)

The industrial sector has been gaining immense popularity of late

on a reversal of manufacturing activity led by robust car

sales. Increasing demand, lower interest on auto loans and a

resilient economy leading to higher consumer confidence contributed

to the big push in auto sales (read: These 3 ETFs Could Soar on

Strong Car Sales).

Investors seeking to play the rebounding trend in this space could

find PSCI an intriguing pick. The fund offers broad exposure to the

companies that provide industrial products and services by tracking

the S&P SmallCap 600 Capped Industrials Index. The ETF has AUM

of $63.1 million while trades in paltry volume. The illiquid nature

ensures additional cost for the product beyond the expense ratio of

0.29%.

The product has a large basket of 84 securities, which are widely

spread across them as each security holds less than 3.6% share.

Further, the fund is also widely diversified across various

industries including commercial services & supplies, heavy

machinery, aerospace & defense and electrical equipment (see

more in the Zacks ETF Center).

The ETF has returned over 26% in the year-to-date time frame,

clearly outpacing the broad sector fund (XLI) and other products by

wide margin. The fund currently has a Zacks ETF Rank of 3 or ‘Hold’

rating with Medium risk outlook.

Bottom Line

These small caps ETFs could be worthwhile in the coming months

given the ‘no taper’ decision by the Fed that has boosted the

appeal of pint-sized securities having robust growth opportunities.

So instead of looking to broad products, it might be a better idea

to drill down into these well-positioned sectors for solid returns

to close out 2013.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-SP MID (IJH): ETF Research Reports

ISHARS-R 2000 (IWM): ETF Research Reports

PWRSH-SP SC EGY (PSCE): ETF Research Reports

PWRSH-SP SC IND (PSCI): ETF Research Reports

PWRSH-SP SC MAT (PSCM): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

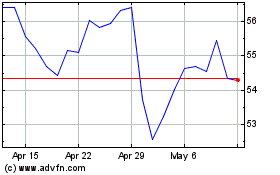

Invesco S&P SmallCap Ene... (NASDAQ:PSCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Invesco S&P SmallCap Ene... (NASDAQ:PSCE)

Historical Stock Chart

From Apr 2023 to Apr 2024