Investment Partners Asset Management Announces That a Shareholder Proposal Submitted by a Fund IT Manages Has Been Included in

August 29 2012 - 10:44AM

Investment Partners Asset Management ("IPAM") announced today that

a shareholder proposal submitted by a fund it manages has been

included as

PROPOSAL NO. 3 in the proxy statement

of closed-end fund Foxby Corp. (OTC:FXBY) ("Foxby" or the "Fund")

for consideration at the Fund's upcoming meeting of shareholders.

The proposal puts to a vote of shareholders a request that

Foxby's board of directors consider seeking an appropriate

registered investment company, or series thereof (including other

Winmill funds), with the potential goal of effecting a merger or

similar transaction with such company or series that is in the best

interests of the Fund and its shareholders.

This shareholder proposal was originally sent to Foxby in May of

2009 for consideration at that year's annual meeting. However,

after voluntarily delisting its shares from the American Stock

Exchange in late 2008, Foxby chose not to hold shareholder meetings

until recent events required it to do so in order to approve its

proposed advisory contract. As such, the upcoming meeting is the

first opportunity shareholders have had to vote on the shareholder

proposal or any other matter in 3 years.

Gregg Abella of IPAM stated: "Although the supporting statement

for the shareholder proposal in the proxy statement was written in

2009 and cites data from that timeframe, we believe the issues

raised in the shareholder proposal still remain valid. In our

opinion, it just seems like common sense that the board consider

alternatives for Foxby."

Foxby has still not regained the December 31, 2007 share price

of $2.96 and net-asset value per share of $3.43. However,

through August 27, 2012, Foxby has recovered somewhat from its

December 31, 2008 level in that its share price has increased from

$0.55 to $1.55 and its net-asset value per share has increased from

$1.26 to $2.13. The Fund has paid distributions or dividends

to shareholders twice in the past 5 years: $0.02 per share in the

fourth quarter of 2007, and $0.01 per share in the second quarter

of 2012. According to data from CEFConnect, as of August 24,

2012, Foxby appeared to be among the smallest, if not the smallest,

of closed-end funds (showing total assets of less than $7 million,

and common assets of less than $6 million); and compared to other

closed-end funds its shares traded at among the highest discounts

to net-asset value (at approximately 28%). Since Foxby still

seems to have the same number of shares outstanding on July 31,

2012 as it did in 2009, it does not appear that the Fund has taken

steps during that time to reduce its discount by repurchasing

shares in the open market. Expenses have come in lower than

projected in the 2009 shareholder proposal (at $92,369, for a 2.02%

expense ratio, in fiscal year 2011 for example), in part because

Foxby has eliminated annual meetings and the expenses associated

with a share listing on a national exchange such as the New York

Stock Exchange or Nasdaq. IPAM believes, however, that the OTC

market is not an appropriate market for a closed-end fund.

While IPAM thinks it would be prudent for Foxby's board to

consider a merger at this time, it encourages other shareholders to

follow their conscience when voting their proxies. As

fiduciaries on behalf of its clients, IPAM intends to send a clear

message to Foxby's board that the time has come to consider merging

Foxby with another fund (including other Winmill funds).

Accounts managed by IPAM and its affiliates currently own 83,831

shares of Foxby Corp. (excluding fractional shares). For the

reasons stated above, IPAM announced it intends to vote "FOR" this

shareholder proposal in accounts for which it has voting

authority.

About Investment Partners Asset Management

IPAM is an investment management firm, which adheres to a

combination of value investing, special situation participation, as

well as seeking to exploit inefficiencies created by fluctuations

and volatility of securities prices to obtain long-term investment

gains. Founded in 1995, IPAM manages investments for individuals

and families, businesses, and non-profit organizations applying

their comprehensive approach balanced with research and insight.

For more information about IPAM, please visit their website at

www.investmentpartners.com.

CONTACT: For more information contact:

Gregg T. Abella, Co-Principal

Tel: 732-205-0391

Email: gabella@investmentpartners.com

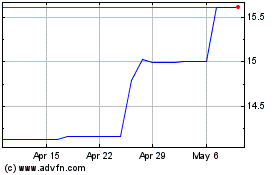

Foxby (PK) (USOTC:FXBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foxby (PK) (USOTC:FXBY)

Historical Stock Chart

From Apr 2023 to Apr 2024