Four Corners, Inc. (FCNE.PK) (Four Corners or the Company)

announced today that it has entered into an agreement to acquire

all of the common stock of three commonly owned and managed

companies: Integrity Gaming, Inc. (Integrity); Aurora Gaming Inc.

(Aurora); and Integrity Gaming of Kansas, Inc. (Integrity KS)

(collectively, the Integrity Companies). Finalization of the deal

is principally dependent on Four Corners obtaining licenses in

certain of the markets where the Integrity Companies operate.

The Company also announced its financial results for the second

quarter of fiscal year 2011.

The Integrity Companies Acquisition

Integrity and Integrity KS are state-licensed

distributors of bingo products and services in Oklahoma, Kansas and

Arkansas. Aurora is a licensed distributor (through revenue

participation agreements) of class II and class III electronic

gaming machines to certain Native American casinos in Oklahoma and

Texas. The following financial information was derived from the

Integrity Companies’ combined financial statements as of and for

the year ended December 31, 2010. These financial statements are

preliminary and unaudited; accordingly, the amounts presented below

are subject to change, and those changes could be significant.

Millions Total assets $ 15.2

Total liabilities 15.7 Operating revenue 8.5 Net loss 0.11 EBITDA

5.0

Total purchase consideration will consist of $200,000 in cash,

1,000,000 shares of the Company’s common stock and contingent

consideration of up to an additional $800,000.

“We are excited about the opportunity to acquire the Integrity

Companies. The Integrity Companies are one of the largest

distributors of gaming machines and bingo products in the Oklahoma

market, and we believe this acquisition can help position us for

future growth and success,” said John J. Schreiber, the Company’s

chairman, president and chief executive officer. “We will continue

to selectively look at strategic distribution opportunities in

other markets that leverage our expertise and relationships.”

“We are delighted for the opportunity to join Four Corners,

which we believe will help expand and enhance our business

prospects,” said Phil Bowden, president of the Integrity

Companies.

Financial Update

The Company had consolidated income from continuing operations

of $23,000, or $0.00 per basic and diluted share, for the 13-week

period ended May 1, 2011, compared to consolidated income from

continuing operations of $253,000, or $0.02 per basic and diluted

share, for the 13-week period ended May 2, 2010. The decrease in

income from continuing operations for the 2011 period was primarily

due to $431,000 of corporate expenses arising from the litigation

and settlement of a lawsuit related to discontinued operations.

The Company had consolidated income from continuing operations

of $159,000, or $0.02 per basic and diluted share, for the 26-week

period ended May 1, 2011, compared to consolidated income from

continuing operations of $401,000, or $0.04 per basic and diluted

share, for the 26-week period ended May 2, 2010. The decrease in

income from continuing operations for the 2011 period was also

primarily due to the aforementioned litigation related

expenses.

The Company had consolidated net income for the subject 13-week

and 26-week periods in 2011 of $23,000 and $159,000, respectively.

Net income attributable to the Company for the comparable 13-week

and 26-week periods in 2010 was $107,000 ($0.01 per basic and

diluted share) and $81,000 ($0.01 per basic and diluted share),

respectively. Net income for the 2010 periods was adversely

affected by the operating results of a subsidiary the Company

divested on May 7, 2010, which were included in discontinued

operations.

Balance sheets as of May 1, 2011 and October 31, 2010 and

statements of operations and cash flows for the subject 13-week and

26-week periods in 2011 and 2010 are provided below.

About Four Corners

The Company is a holding company of certain subsidiaries whose

primary focus is the gaming industry. The Company’s wholly-owned

subsidiary, K&B Sales, Inc., distributes bingo supplies and

related equipment to charity bingo licensees in Texas. FC

Distributing LLC, a wholly-owned subsidiary of the Company,

distributes gaming machines and other gaming related equipment to

the Native American casino market in Oklahoma.

Forward-Looking Statements

Certain of the statements contained herein are statements of

future expectations, particularly the pending acquisition of the

Integrity Companies. These forward-looking statements are based on

management's current views and assumptions, which involve known and

unknown risks and uncertainties that could cause actual results,

performance or events to differ materially from those expressed or

implied in such statements. In addition to statements which are

forward-looking by reason of context, the words may, can, should,

expects, plans, intends, anticipates, believes, estimates,

predicts, potential, opportunity or continue and similar

expressions identify forward-looking statements.

Four Corners, Inc. Condensed Consolidated

Balance Sheets May 1, October 31,

2011 2010

ASSETS

(unaudited)

Current assets Cash and cash equivalents $

2,319,964 $ 3,023,661 Restricted cash (Note 14) 174,771 - Trade

accounts receivable, net 1,083,871 1,104,340 Inventory, net of

valuation allowance of $380,005 at 2011 and $292,978 at 2010

918,757 980,816 Prepaid expenses and other 323,575

433,591 Total current assets 4,820,938

5,542,408

Property and equipment, net

1,761,400 1,881,955

Other 54,272

23,453 Total assets $ 6,636,610 $ 7,447,816

LIABILITIES AND

STOCKHOLDERS' DEFICIENCY

Current liabilities Maturities of notes and interest payable

to related parties $ 1,459,570 $ 879,141 Trade accounts payable

308,544 298,716 Accrued expenses and other 762,149

1,712,279 Total current liabilities 2,530,263

2,890,136

Notes and interest payable

to related parties, less current maturities and discount

4,042,151 4,626,414

Other 218,599

244,554 Total liabilities 6,791,013

7,761,104

Stockholders' deficiency

Common stock, 10,479,658 shares issued and outstanding at 2011 and

2010 10,480 10,480 Additional paid-in capital 20,323,923 20,323,923

Accumulated deficit (20,488,806 ) (20,647,691 ) Total

stockholders' deficiency (154,403 ) (313,288 ) Total

liabilities and stockholders' deficiency $ 6,636,610 $

7,447,816

Four

Corners, Inc. Consolidated Statements of Operations

For the 13-week and 26-week Periods ended May 1, 2011 and May 2,

2010 (Unaudited) 13-week period ended

26-week period ended May 1, May 2, May

1, May 2, 2011 2010 2011

2010

Revenue

Bingo supply and services $ 4,380,667 $ 4,430,048 $ 8,364,118 $

8,167,731 Game distribution 115,205 -

219,885 - Total revenue

4,495,872 4,430,048 8,584,003

8,167,731

Expenses

Cost of sales (bingo supply and services) 2,332,904 2,318,538

4,418,850 4,287,979 Bingo supply and services 1,067,878 1,202,468

2,248,796 2,244,657 Game distribution 155,243 - 306,998 - Corporate

overhead 856,201 541,998

1,322,829 1,016,521 Total expenses

4,412,226 4,063,004 8,297,473

7,549,157

Operating income 83,646

367,044 286,530 618,574

Other income

(expense)

Interest income 2,870 - 4,687 150 Interest expense (89,500 )

(105,345 ) (183,360 ) (201,283 ) Other 33,352

- 67,828 - Total other income

(expense), net (53,278 ) (105,345 ) (110,845 )

(201,133 )

Income before income taxes 30,368 261,699

175,685 417,441

Income tax expense (7,813 )

(8,400 ) (16,800 ) (16,800 )

Income from

continuing operations 22,555 253,299 158,885 400,641

Loss

from discontinued operations - (229,024 )

- (464,538 )

Net income (loss) 22,555

24,275 158,885 (63,897 )

Loss from discontinued operations

attributable to noncontrolling interest -

82,699 - 144,637

Net income

attributable to Four Corners, Inc. $ 22,555 $ 106,974

$ 158,885 $ 80,740

Income (loss) per

share attributable to Four Corners, Inc. common stockholders:

Basic and Diluted Income from continuing operations $ - $

0.02 $ 0.02 $ 0.04 Loss from discontinued operations -

(0.01 ) - (0.03 ) Net income $ -

$ 0.01 $ 0.02 $ 0.01

Weighted-average number of common shares outstanding: Basic

10,479,658 10,479,658 10,479,658

10,479,658 Diluted 10,479,658

10,533,447 10,479,658 10,517,588

Income (loss) attributable to Four Corners, Inc.

common stockholders: Income from continuing operations $ 22,555

$ 253,299 $ 158,885 $ 400,641 Loss from discontinued operations

- (146,325 ) - (319,901 )

Net income $ 22,555 $ 106,974 $ 158,885 $

80,740

Four Corners, Inc.

Condensed Consolidated Statements of Cash Flows For the

26-week Periods ended May 1, 2011 and May 2, 2010

(Unaudited) 26-week period ended May 1,

May 2, 2011 2010 Net Cash provided

by Operating Activities of Continuing Operations $ 345,757 $

301,488

Cash Flows from

Investing Activities of Continuing Operations

Acquisitions of property and equipment (212,797 ) (201,530 )

Restricted cash (174,771 ) - Other (3,060 ) 9,033

Net cash used in investing activities of continuing

operations (390,628 ) (192,497 )

Cash Flows from

Financing Activities of Continuing Operations

Repayments of notes payable to related parties (141,000 ) (69,409 )

Payments of installment purchase agreements (414,798 ) (202,442 )

Other (3,737 ) (3,476 ) Cash used in financing

activities of continuing operations (559,535 )

(275,327 )

Cash Flows from

Discontinued Operations

Net cash used in operating activities of discontinued operations

(99,291 ) (310,033 ) Net cash provided by investing activities of

discontinued operations - 193,495 Net cash used in financing

activities of discontinued operations -

(181,074 ) Net cash used in discontinued operations (99,291

) (297,612 )

Net decrease in cash and cash

equivalents (703,697 ) (463,948 )

Cash and cash equivalents

- beginning of the period 3,023,661

1,024,017

Cash and cash equivalents - end of the

period $ 2,319,964 $ 560,069

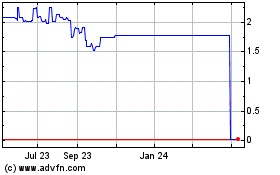

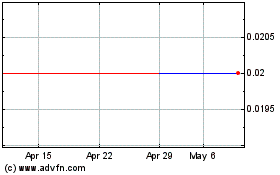

Four Corners (PK) (USOTC:FCNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Four Corners (PK) (USOTC:FCNE)

Historical Stock Chart

From Apr 2023 to Apr 2024