AB&T Financial Corporation Announces Second Quarter 2010 Results

July 29 2010 - 3:45PM

Business Wire

AB&T Financial Corporation (OTC Bulletin Board: ABTO), the

parent company of Alliance Bank & Trust Company, today reported

net income for the six months ended June 30, 2010 of $132 thousand

or $0.01 per basic and diluted share an increase of $690 thousand

compared to a net loss of $558 thousand or $(0.25) per basic and

diluted share for the six month period ended June 30, 2009. Net

income for the three months ended June 30, 2010 was $50 thousand or

$0.0 per basic and diluted share, an increase of $286 thousand

compared to a net loss of $236 thousand or $(0.11) per basic and

diluted share for the three month period ended June 30, 2009. The

primary reasons for the increases were improvements in our net

interest income, and decreases in our provision for loan losses

over the same six months of 2009.

Assets at June 30, 2010 were $172.6 million, a decrease of $4.1

million or 2.3% over the $176.7 million at December 31, 2009. Loans

totaled $134.7 million at June 30, 2010 compared to $140.0 million

at December 31, 2009, a decrease of $5.3 million. Investment

securities available for sale increased $5.9 million to $10.9

million at June 30, 2010.

Total deposits decreased to $139.2 million on June 30, 2010,

from $143.7 million as of December 31, 2009, due to management’s

efforts to continue to reduce reliance on wholesale funding

sources. Non-time deposits increased from $34.7 million at December

31, 2009 to $39.3 million at June 30, 2010, an increase of $4.6

million or 13.3%.

Net interest income for the six months ended June 30, 2010 was

$2.5 million, an increase of approximately $769 thousand or 45.6%

from the six months ended June 30, 2009.

Daniel C. Ayscue, President and CEO, commented, “Capital

preservation and continued focus on margin improvements have

allowed us to move forward in a very positive fashion compared to

the economic challenges of the last two years. We feel strongly

that as our local and region economies improve, Alliance will be

well positioned for future opportunities.”

Alliance Bank & Trust Company, which opened in Gastonia,

North Carolina in 2004, operates four North Carolina banking

offices, in Gastonia (2), Kings Mountain and Shelby.

AB&T Financial Corporation is the parent company of Alliance

Bank & Trust Company, which operates 4 community oriented

branches in Gaston and Cleveland Counties in North Carolina that

offer a full array of banking services. Additional information on

Alliance Bank & Trust’s locations and the products and services

offered are available at www.alliancebankandtrust.com.

Certain matters set forth in this news release may contain

forward-looking statements that are provided to assist in the

understanding of anticipated future financial performance. However,

such performance involves risks and uncertainties that may cause

actual results to differ materially from those in such statements.

A discussion of certain factors that may cause such forward-looking

statements to differ materially from the Company’s actual results,

can be found in the Company’s filings with the Securities and

Exchange Commission, including without limitation its annual report

on Form 10-K, its quarterly reports on Form 10-Q, and its current

reports on Form 8-K. The Company does not undertake a duty to

update any forward-looking statements in the release.

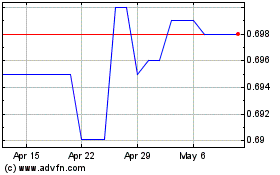

AB and T Financial (PK) (USOTC:ABTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

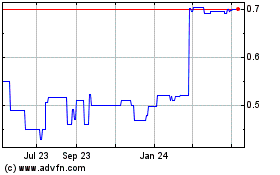

AB and T Financial (PK) (USOTC:ABTO)

Historical Stock Chart

From Apr 2023 to Apr 2024