It was a historic half of the year

Wuhan is once again in the center of the scandal, but this time not with coronavirus, with the counterfeit gold scandal. European markets end the week with losses, whilst ECB’s Lagarde warned of possible disinflation as coronavirus crisis transforms economy. American stocks, on the other hand, registered the best quarterly performance in over two decades.

Without any doubt, it was one of the most eventful quarters in modern history. Some of the equity markets were able to recover quite fast, whereas others are still struggling. Looking ahead it is expected that many of the same topics will dominate news coverage (COVID-19, trade confrontation, China vs India, economic recovery, presidential elections in the U.S., etc.). Thus, besides quarantine measures, investors will keep an eye on the policy adaptations from the Federal Reserve and the rest of Central Banks.

As we enter Q3, markets remain turbulent. The VIX is indicating a quite volatile summer, where Q2 earnings releases will finally reveal the real damage to the corporate sector and potentially give us a rough sketch of what’s ahead.

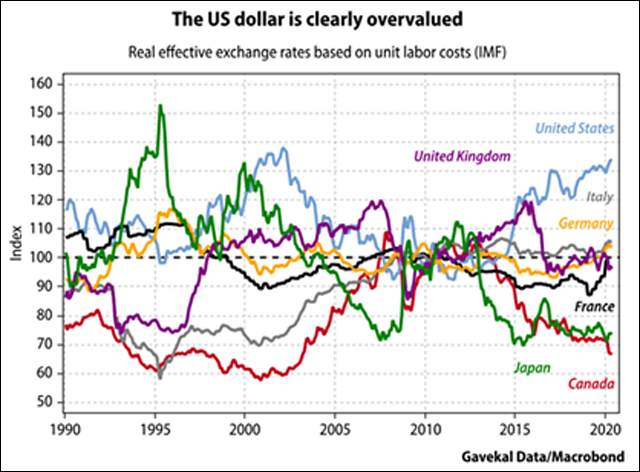

Talking about stimulus measures that have been approved, low-interest rates did decrease the financial pressure on companies, however, a massive amount of capital and labor have been misallocated. As a result, the number of so-called zombie companies has risen dramatically. On the other hand, we might see a weak USD soon. Something that potentially could help European equities.

In terms of the future sectors of the economy, we might expect further improvement in the green transformation. Even now, despite the fact the most of the companies have lost during this quarantine, they didn’t suspend their green programs, at least on the paper. In this context, we could say that the environment is put before economic growth. Some believe it’s a moment to focus on solar, wind, electric vehicles, hydro, nuclear, bioplastic, recycling, and water. Even though, keep in mind that some of them are more stable than the overall business cycle, whereas the rest is more cyclical.

It is worth noting that most of the green industries require huge amounts of capital to operate and thus the low-interest-rate environment has helped fund growth in then and making projects more profitable. If interest rates rise, again this should have a negative effect on their operating conditions and especially on equity valuations as high growth stocks fall more than value stocks in a rising interest rate environment.

Considering the uncertainty, we are living in, gold will likely to continue performing well. In times of market turmoil, currency spikes, and monstrous volatility, money is always looking for a safe haven. Someone believes in a pound, for some, the sun rises with the yen…

For now, the rise in U.S. coronavirus cases that could be attributed to increasing tests, keep weighing on the European stocks, even despite the fact that deaths are still down. Some believe that less optimistic data could deteriorate prospects for a rebound in the global economy. Nevertheless, we shouldn’t forget about government stimulus and the beginning of easing the lockdown.

The President of the European Central Bank Christine Lagarde said that a falling trend in price pressures would persist over the next two years. “The transition to new economic models will be disruptive — they will probably be more disruptive in the first two years, obviously hitting employment and production — and then we can hope it improves productivity.”

After the outbreak of the crisis, ECB revised inflation projections for 2021 and 2022 down by 0.6 and 0.3 percentage points, respectively; moreover, projected inflation falls monotonically with the severity of the crisis scenario.

Fiscal policy has in turn capitalized on supportive financial conditions to absorb, in large part, the loss in private sector income, preventing a much steeper surge in unemployment. Guarantee schemes and banking supervision crisis-relief measures have avoided a credit freeze, supporting a record uptake of liquidity during the latest round of the ECB’s targeted long-term refinancing operations (TLTROs).

Returning to scandals, Wuhan-based and NASDAQ-listed Kingold Jewelry is being accused of depositing fake gold bars as collateral to obtain loans from 14 Chinese financial institutions. Apparently, the 83 tonnes of gold were purportedly valued at 20.6 billion yuan but many of them have turned out to be gilded copper. The situation is aggravated by the fact that pledges were insured by the state insurance company PICC Property and Casualty. 4% of China’s gold reserves are relatively few in relative terms. It is unlikely that it could shake the yuan or, moreover, affect the GDP.

But such a precedent makes one question: how much more gold can be fake in China? Or maybe there is something else fake there? Economic statistics, for example? Also, in connection with the situation of the coronavirus, such thoughts come to mind that maybe these “viruses” are needed to hide something?

In the case of macroeconomic data, there was a decrease in the unemployment rate from a peak of 14.7 percent in April to 11.1%. Total nonfarm payroll employment rose by 4.8 million in June.

Macroeconomic Data & Events

The upcoming week it is crucial to keep an eye on the Reserve Bank of Australia policy meeting and some economic data out of the US and Canada. The ISM non-manufacturing index should be highlighted.

July 6: ISM Non-Manufacturing PMI for the U.S. and PMIs for the Euro area, Germany, and the UK.

July 7: Interest rate Decision and Statement in Australia

July 8: European Commission releases Economic Growth Forecasts

July 9: Consumer & Producer Price Index in China and Jobless Claims in the U.S.

July 10: Canada’s employment data