Key Highlights

Litecoin plunges to $51 low and corrected upward

LTC risks further downward move as price reaches overbought region

Litecoin (LTC) Current Statistics

The current price: $52.49

Market Capitalization: $3,453,939,467

Trading Volume: $2,849,880,504

Major supply zones: $70, $80, $90

Major demand zones: $50, $30, $10

Litecoin (LTC) Price Analysis November 3, 2020

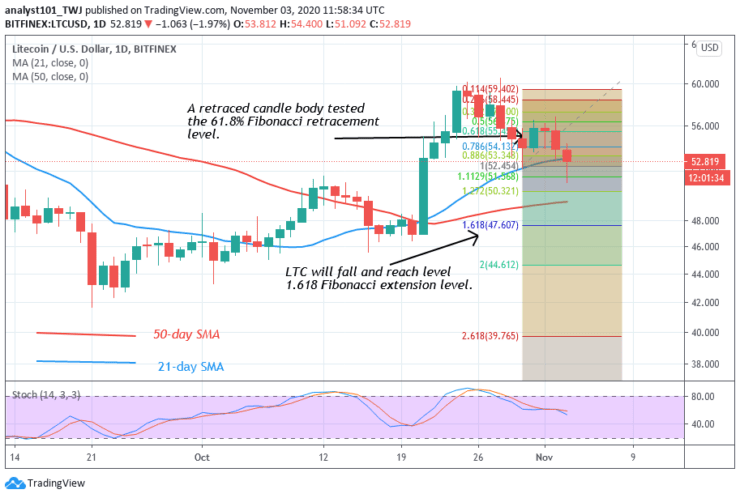

Litecoin has been on a downward move. Today, the bearish impulse reached a low of $51 and corrected upward. Presently, it is facing another rejection at the $53 high. There is a likelihood of a further downward move.

On the downside, if price retraces and breaks below the $51 support, the market will drop to $46 or $47 support. The coin will resume an uptrend if the price finds support above $51. The $51 support is where the coin resumes upside momentum.

Litecoin (LTC) Technical Indicators Reading

The coin is below the 60% range of the daily stochastic. It indicates that it is in the bearish momentum. The selling pressure of the coin will persist once the price breaks below the SMAs. The coin is at level 50 of the Relative Strength Index period 14. It indicates that there is a balance between supply and demand.

Conclusion

Litecoin is likely to further decline as price retests the $56 high. On October 30 downtrend; a retraced candle body tested the 61.8% Fibonacci Retracement level. This indicates that the market will further depreciate to level 1.618 Fibonacci extensions or $47 low.

Source: https://learn2.trade