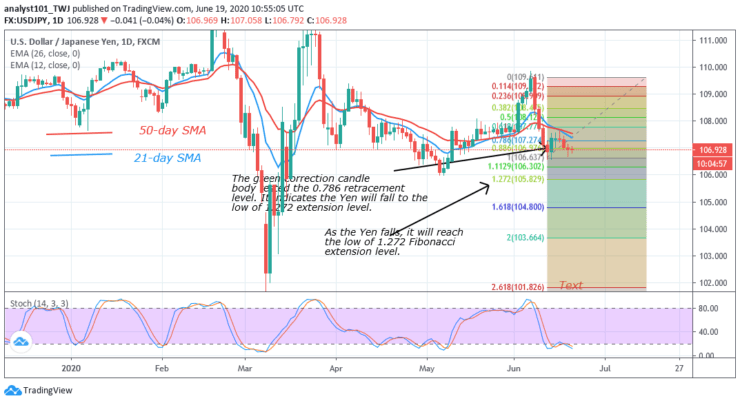

Key Support Levels: 104.000, 103.000, 102.000

USD/JPY Price Long-term Trend: Ranging

USD/JPY pair is currently on a downward move. The green correction candle body tested the 0.786 retracement level. It indicates that the Yen will fall to a low of 1.272 extension level. After reaching the target price, the market will reverse. However, the reversal will not be immediate.

Daily Chart Indicators Reading:

The 21-day SMA and 50-day SMA are sloping downward. The market is now in a downtrend. The Yen has fallen below a 20% range of daily stochastic. It indicates that the market is approaching the oversold region. Buyers are likely to emerge when the pair reached the oversold.

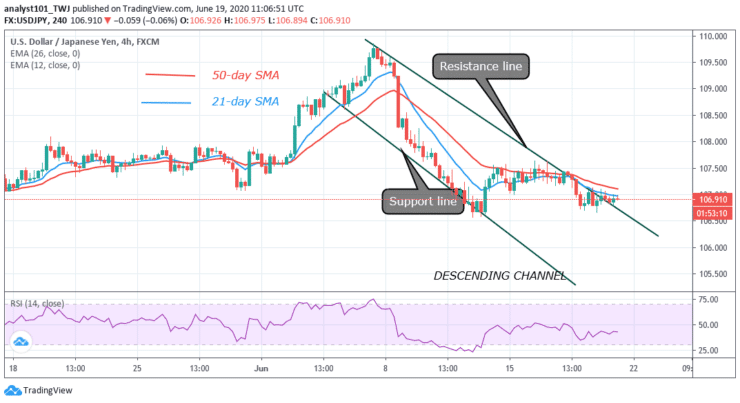

USD/JPY Medium-term Trend: Bearish

The USD/JPY pair is currently on a descending channel. The price is testing the 12-day EMA on the upside. The Japenese Yen will fall if resisted by the 12-day EMA. The market will fall and reach a low of level 106.000.

4-hour Chart Indicators Reading

The SMAs are also sloping downward. The pair has fallen to level 44 of the Relative Strength Index. It indicates that Yen is in the downtrend zone and likely to fall.

General Outlook for USD/JPY

The pair is presently retesting the 12-day EMA. Perhaps, after the retest, it will make a downward move. As long as the price bars are below the EMAs, the market will continue to have a downward movement.

Source: https://learn2.trade