At StockMatusow we strive to identify companies that we feel have the potential for both short and long term gains. This week we detail a company that we think could nearly double in value in the short term. Enanta Pharmaceuticals (ENTA) is a biotechnology company that focuses on the development of small molecules to treat infectious diseases. The company had a fairly recent IPO that debuted on the market on March 21, 2013at $14 per share and closed that day at $17.18 per share. The company has gained investor interest since its IPO and has begun to appreciate over the last few months. Enanta is one of the few IPO’s that has products in late stages of development with upcoming data releases. With a strong financial positioning and good management, we believe Enanta is very undervalued.

- Hepatitis C Virus

Enanta’s main focus is developing therapies for the Hepatitis C virus (HCV). HCV is a virus that causes inflammation of the liver and is usually transmitted between people through bodily fluids. Although HCV usually is symptom-less at the beginning, the virus actually is a leading cause of chronic liver disease. This disease is quite serious, as it is the leading cause of liver death in the United States. According to the CDC, about 350,000 people die every year from HCV-related liver diseases and about 3.2M people in the United States are chronically invested with HCV. In 2011, treatments for HCV grossed worldwide sales of over $3.5B and are expected to continue growing.

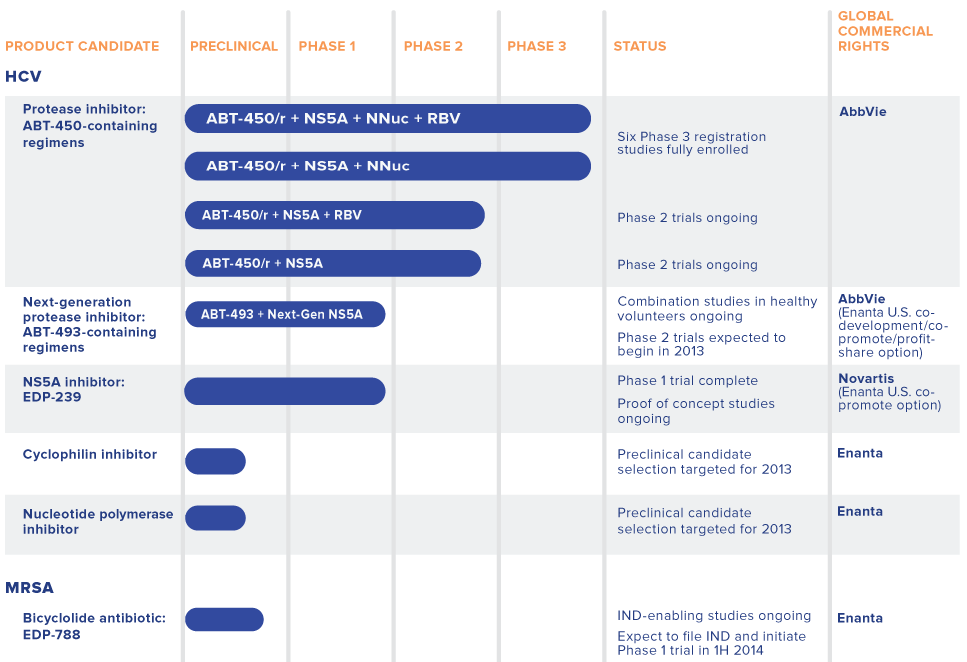

- Products

HCV drug resistance occurs very quickly with single component therapies used in the past such as ribavirin and PEG-interferon. Typically these drugs are combined with several types of inhibitors that stop the virus at the different levels. Enanta is combining several drugs together into a “cocktail” to try to develop a therapy that attacks HCV from all angles. Below are some of the components: 1. Protease Inhibitors – Stop HCV at viral protease (which is an enzyme), where protein chains are cleaved into smaller proteins. Protease inhibitors have been the most intensively studied due to the high efficacy against HCV. 2. NS5B Polymerase Inhibitors – Work by slowing down HCV at the site of replication. They attack the virus by slowing the replication of viral RNA (which holds all of the viral information) that is transcribed into DNA. This combination attacks assembly and replication of the virus. NS5A are the newest class of anti-HCV molecules. 3. Rabavirin – Is also combined in half of these cocktails being studied in trials. Ribavirin is an antiviral agent that has been around since the 1980′s. Enanta has an array of ongoing trials to treat HCV. The company’s product furthest along in development is ABT-450, a protease inhibitor. ABT-450 is being studies in several clinical trials as a “cocktail.” In May, Enanta received Breakthrough Therapy Designation for ABT-450.

- ABT-450 Phase IIb “Aviator” Trial Data

The company released Phase IIb data on April 23, 2013 for ABT-450 and presented several posters on the results. The data showed positive results for both safety and efficacy when compared to other HCV drugs such as sofosbuvir, a product from Gilead (GILD) also in clinical trials. In clinical trials, Sustained Viral Response (SVR) rates are used to show the percentage of patients who show no level of a virus in their blood during treatment. When the virus (which in ENTA/ABBV’s case is Hepatitis C), is suppressed to undetectable levels for a certain time period after treatment, the patient is known to have this SVR. SVR12 measures this rate at 12 weeks, SVR24 at 24 weeks, etc. The 24 week rate is more typically used since newer therapies are much more potent and effective than traditional ones. When we look at SVR rates of patients in the ENTA/ABBV Aviator trial, we see that these cocktails have demonstrated extremely high SVR rates against genotype I Hepatitis C patients, which is the most common genotype in America. SVR rates of 96%-99% were achieved after 12 weeks in treatment-naïve patients, or patients that are new to treatment. In addition, SVR rates of 90%-95% were seen in patients after 24 weeks of treatment, reinforcing the efficacy of these cocktails. It is also noteworthy that in sofosbuvir trials, a potential future competitor, around 90% of patients who have previously failed treatment reached an SVR at 12 weeks, falling short of Enanta’s 93%. Trials studying antivirals also tend to show the bulk of efficacy and safety by the end of phase II trials, and rarely make it through these trials while not eventually getting through phase III trials. This is the reason why Gilead’s and ABBV/ENTA’s therapies will almost certainly make it to market. Luckily, the HCV market is massive, and both therapies will be able to grab an almost equally sized piece of that market due to the fact that they are the first all oral, interferon-free options. Gilead’s Sofosbuvir is seen in as a sure approval and is expected to be approved on 12/8 of this year with a NDA submission before mid-year. With breakthrough designation of ABT-450 in May, now ABBV/ENTA could possibly make it to market just before sofosbuvir. Whichever therapy comes to market first will also be an impact on sales. Being the first all oral, interferon-free therapy for HCV is a highly anticipated event for doctors. Whichever therapy doctors can prescribe to their patients first may determine which one they will prescribe as their go-to choice. Achillion Pharmaceuticals (ACHN) is one small cap biotechnology company that is working on developing an HCV therapy. The company’s leading drug candidate is sovaprevir, which is in Phase II clinical development. Recently, the Food and Drug Administration (FDA) announced it is keeping a clinical holdon sovaprevir and the stock plummeted. Achillion was trading at over a $900M market cap earlier this year, however is now down to below $300M. Although there are many HCV therapies in development, we think Enanta could see a valuation of over $600M before Phase III data release and near $900M-$1B after good results. Achillion provides a good measuring stick to compare how Enanta could be valued. With a current market cap around $370M, we believe Enanta has significant room to run.

- Partnerships

Enanta has levered several partnerships that have put the company in good financial standing. In 2006, Enanta partnered with AbbVie (ABBV) for development of ABT-450. Upon signing, Enanta received $57.2M and the potential for $335M more in milestone payments. Thus far, Enanta has received $55M of the milestone payments. Additionally, the company will receive a royalty payment on future ABT-450 sales. As part of the agreement, AbbVie also agreed to pay for all costs of developing, marketing, and commercializing ABT-450. These terms are quite bullish for Enanta because the burden of paying for the clinical trials is on AbbVie. Enanta also has a similarly structured partnership with Novartis (NVS). In 2012, Novartis and Enanta partnered for the development of EDP-239. Enanta received $34.4M at signing and an additional $11M the following year when Phase I trials began. As the product progresses, Enanta is eligible to receive $395M in milestone payments and royalties on EDP-239 sales. Like AbbVie, Novartis has agreed to pay for all development, marketing, and commercialization for EDP-239.

- Catalyst

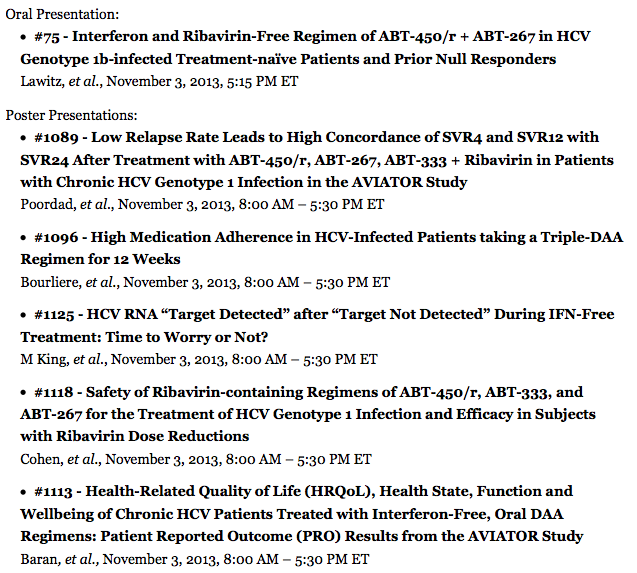

Enanta has a very near term catalyst that we feel should bring attention to the company. The company will be releasing Phase III trial data from ABT-450 for HCV at the 64th Annual Meeting of the American Association for the Study of Liver Diseases (AASLD) on November 3, 2013. On October 1, 2013 the company released a Press Release (PR) that stated:

There will be an oral presentation at AASLD highlighting data from study M13-393 (PEARL-I). PEARL-I is an interferon-free and ribavirin-free 320-patient study being conducted by Abbvie to evaluate the once-daily, two-DAA regimen consisting of ABT-450/r + ABT-267 in GT-1b and GT-4 HCV patients. SVR4 rates were 100% (39/39) in GT-1b treatment-naïve patients and 87.9% (29/33) among prior null responders (observed data). SVR12 rates will be presented during an oral presentation of this data on November 3.

The company is going to present one oral presentation and five poster presentations at the meeting. Below are the names and times each presentation will be given.  With a full slate of presentations at this meeting, it seems like the company is projecting it has positive data to announce. We expect good news to rally the stock past 52-week highs as investors realize the potential of Enanta. We believe Enanta could warrant a speculative run similar to that of several oncological companies such as Celldex Therapeutics (CLDX), which has been on a tear in 2013 as investors have been speculating just how successful the company could become if data remains positive, resulting in eventual FDA approval. Celldex is using antibodies and immunodulators to develop treatments for several unmet oncological needs. Its leading product candidates are rindopepimut, an immunotherapy that targets the tumor specific oncogene called EGFRvIII, and CDX-011, a fully-human monoclonal antibody-drug conjugate (ADC) that targets glycoprotein NMB (GPNMB).

With a full slate of presentations at this meeting, it seems like the company is projecting it has positive data to announce. We expect good news to rally the stock past 52-week highs as investors realize the potential of Enanta. We believe Enanta could warrant a speculative run similar to that of several oncological companies such as Celldex Therapeutics (CLDX), which has been on a tear in 2013 as investors have been speculating just how successful the company could become if data remains positive, resulting in eventual FDA approval. Celldex is using antibodies and immunodulators to develop treatments for several unmet oncological needs. Its leading product candidates are rindopepimut, an immunotherapy that targets the tumor specific oncogene called EGFRvIII, and CDX-011, a fully-human monoclonal antibody-drug conjugate (ADC) that targets glycoprotein NMB (GPNMB).

- Conclusion

With the bullish sentiment by insiders and upcoming catalysts, and a very low market cap of around $370M, we believe Enanta is undervalued The company has levered great deals with big pharmaceutical companies that allows it to develop its pipeline and generate revenue without taking the financial risk. The fact that Novartis and AbbVie would pay for all of the development, marketing, and commercialization for Enanta’s products is also very bullish. Additionally, Zacks recently added Enanta to its number 1 ranked list, indicating a strong buy. We believe the stock could reach $30 a share in the short term and could be a double in the long term. Disclosure: We are long ENTA. Disclaimer