Often times, certain biotech institutional investors just seem to pick winner after winner, and stay on a hot streak — so to speak. Baker Brothers LLC is one such institution that is becoming well-known and gaining great respect from the small cap biotech space. The company was founded in the year 2000 and is run by brothers Julian C. Baker and Felix Baker, Ph.D.

Last year, the Bakers made a significant bet on ACADIA Pharma (ACAD) when the stock was selling for under $2 per share. Many investors felt ACADIA was a long shot, at best, to receive positive data from its 2nd Phase III trial of pimavanserin, which is designed to treat Parkinson’s disease psychosis (PDP). However, on November 27th, 2012, the company reported positive data results, prompting a huge rally in the stock that has continued to this day. Since PDP is a serious unmet need, the speculation continues to swell around ACADIA, and an FDA approval which could come late next year should further rally the stock, perhaps even 100% or higher. The Baker Brothers currently hold over 19M shares of ACADIA stock, and have recently increased their position by over 27%.

The Bakers hold a huge 20M + share position in XOMA Corp. (XOMA). XOMA has several near-term catalysts that the Bakers likely find interesting. The company expects to release Phase II top-line data on its drug gevokizumab, for the indication of erosive osteoarthritis of the hand with elevated CRP in October. Additionally, XOMA anticipates full results from its two POC studies in patients with erosive osteoarthritis of the hand, and data from the National Eye Institute’s study of gevokizumab in patients with active non-infectious anterior scleritis later this year. With an investment of over 20M shares in XOMA, it is clear the Bakers are very bullish on XOMA’s chances of positive data from these studies.

The Bakers also have a 19M + share position in Seattle Genetics Inc. (SGEN). In the last 2 years, Seattle Genetics has almost tripled in price, going from around $15 to near $40 a share today. Many analysts have recently raised their price targets on the company, as it recently posted higher-than-expected second quarter earnings, not to mention a strong and deep developmental pipeline. Alternatively, some analysts have downgraded the stock, believing the shares have risen too far, too fast. So far, the bearish view on Seattle Genetics is losing out big-time.

Jim Cramer recently mentioned Seattle Genetics as a strong take-over candidate in the ever consolidating biotech sector, where small cap companies are increasingly being acquired by monster large cap biotechs. I agree with Jim and also like the company’s longer-term prospects, while feeling even the bullish analysts might be a bit too low in their price target estimates. Based on the Baker’s large buy here, it seems they are also very bullish on Seattle Genetic’s prospects.

Additionally, the Bakers have also opened a new position in Incyte Corp (INCY) recently, purchasing over 14M shares. Incyte focuses on the discovery, development, and commercialization of proprietary small molecule drugs for oncology and inflammation. Incyte has a significant catalyst coming up in the beginning of next year, according to the company:

RESPONSE, a Phase III study being conducted under a Special Protocol Assessment (SPA) in collaboration with Novartis, is evaluating ruxolitinib in patients with polycythemia vera (PV), and results are expected in early 2014. Completion of this pivotal trial, if positive, would allow for the filing of a supplemental new drug application submission in the first half of 2014. The FDA has granted fast track designation for ruxolitinib for the treatment of patients with PV who are resistant to or intolerant of hydroxyurea.

The Bakers like to buy biotechs with near-term catalysts, and as mentioned, they have been very successful with this, earning themselves and their clients huge returns in a short period of time. Perhaps the most interesting of their recent buys could be Halozyme (HALO). Halozyme engages in the research, development, and commercialization of human enzymes. Its research focuses on human enzymes that transiently modify tissue under the skin to facilitate the delivery of injected drugs and fluids, or to alter abnormal tissue structures for clinical benefit.

Along with a large increase in Acadia shares, the Bakers have recently more than doubled their initial investment in Halozyme, as indicated by the chart below, up 105%.

| Company | Class | Value of Shares ($1,000s) | Change in Value ($1,000s) | Change (%) | Shares Held |

| XOMA CORP DEL | COM | 95,088 | New | 20,274,581 | |

| ACADIA PHARMACEUTICALS | COM | 417,062 | 90,566 | 27.74 | 19,955,126 |

| SEATTLE GENETICS INC | COM | 821,805 | New | 19,322,947 | |

| INCYTE CORP | COM | 541,770 | New | 14,810,559 | |

| HALOZYME THERAPEUTICS INC | COM | 51,377 | 26,428 | 105.93 | 6,553,150 |

A 6.5M share investment is significant in a small cap company such as Halozyme. Perhaps it’s because the company expects to hear a decision soon from The European Medicines Agency (EMA) on MabThera Subcutaneous (SC), and Herceptin SC.

Halozyme is in partnership with Hoffman-La Roche with three biologic subcutaneous solutions. Subcutaneous Herceptin and subcutaneous Mabthera are currently in Phase III clinical trials, while subcutaneous Actemra has completed a Phase 1 clinical trial.

According to the company’s recent earning’s call;

Before Herceptin SC product launch in EU can get underway, the European Commission must provide marketing authorization, which we believe could be forthcoming soon. In the meantime, we continue to work closely with Roche on the manufacture of the necessary rHuPH20 supply to support the launch and rollout of Herceptin (SC) in numerous territories around the globe.

Our second relevant program with Roche, MabThera SC, is also under review by European regulators. As a reminder, Roche filed its MAA for MabThera SC in December of last year, and we look forward to updates on the regulatory status of this program.

Herceptin SC and MabThera SC are part of a family of human enzymes, known as hyaluronidases, which increase the absorption and dispersion of biologics, drugs and fluids which addresses certain therapeutic areas such as diabetes, oncology, and dermatology that have significant unmet medical need. Both are administered subcutaneously through the use of the rHuPH20 enzyme, instead of intravenously.

The Bakers are not the only investors to have made a bullish bet on Halozyme. Recently, company director Kathryn E. Falberg bought $681.6K of the company’s stock in the open market, at an average cost of $6.82 a share. Many times, company directors are awarded stock options, and often times acquire the shares at no monetary cost to themselves. Sadly, many biotech companies see directors constantly dump these shares on the open market. With Halozyme, this is not the case.

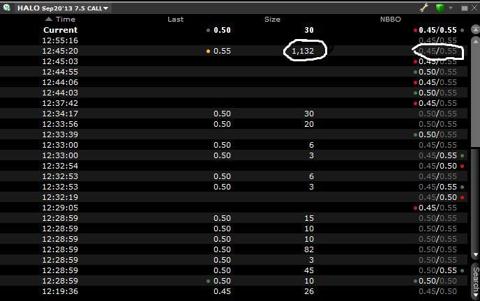

I have been watching Halozyme since both The Baker Brothers and Falberg’s buy. I have especially been keeping an eye on the option chain. Often times, sudden short term call contract purchases are a tip-off of positive news coming soon. The other day, I noticed a block of 1132 September $7.50 strike contracts bought at $0.55, and took a screen shot of the buy.

(click to enlarge) It seems strange to me that someone would “gamble” over $62k on a call option that expires next month simply on a “hunch.” In my opinion, this almost always means that someone “knows something.” After the option buy, I decided to buy some shares of the stock.

It seems strange to me that someone would “gamble” over $62k on a call option that expires next month simply on a “hunch.” In my opinion, this almost always means that someone “knows something.” After the option buy, I decided to buy some shares of the stock.

60 Minute 20 day Chart:

I have marked in white where I show a nice tight bullish wedge forming after gapping up the other day. The chart indicates to me that it will up-fill back over $9 very soon, within a trading session or so. The purple line, which is the accumulation/distribution line, shows the same wedge after sellers took profit from the big gap up the other day.

Upcoming Catalysts:

MabThera SC CHMP, HyQvie (Baxter drug) US refile, fast acting insulin update all catalysts coming soon. CHMP meetings end on Sep 19th, so meeting minutes should be out on Sep 20th or so, likely around options expiration date $HALO. We expect a gap up to over $9.50

With the near-term catalysts, The Baker Brother’s bullish bet, the director’s substantial open market buy, along with the single big call option buy, it seems to me that Halozyme might be a substantial gainer in the near-term. Biotech traders and investors should take a serious look at this company for both long and short term positions.

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky — always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.