Sometimes in the biotechnology sector one company can provide investors with multiple opportunities to make money while limiting risk. This week, we have decided to revisit a very successful trade that we covered a couple of months ago. With a catalyst data approaching and the stock undergoing some consolidation, we feel it is ready to run again.

Insmed Incorporated (INSM) is a biopharmaceutical company that discovers and develops targeted inhaled therapies for those suffering from orphan lung diseases, such as cystic fibrosis patients with non-tuberculosis mycobacterial (NTM) lung infections. We covered the company in early May 2013 for a catalyst run up into the Phase III clinical trial results for ARIKACE in treating pseudomonas aeruginosa in cystic fibrosis patients. From our $8.50 call, the stock rallied to 52-week highs to $14.30 after several analyst upgrades and institutional buying. Afterwards, Insmed reported positive Phase III results and also did an offering to raise cash for future clinical trials. ARIKACE met the primary endpoint of non-inferiority to Novartis’ (NVS) drug TOBI. We believe it is time to revisit this successful trade because new catalysts are approaching for different indications.

- Product and Platform

Insmed’s lead product ARIKACE is in clinical trials for several indications. The company is working on treatments for patients with pseudomonas aeruginosa lung infections in cystic fibrosis, nontuberculous mycobacteria lung infections and pseudomonas aeruoginosa lunch infections in non-cystic fibrosis bronchiectasis. ARIKACE uses amikacin, which is a Food and Drug Administration (FDA) approved antibiotic for gram-negative infections. For a detailed explanation of ARIKACE and the Insmed platform, we would like to direct you to our previous article that highlights it in great detail.

The most pertinent indication is for patients with NTM lung infections. According to the Insmed presentation, there are about 50,000 patients diagnosed in the United States, growing at a rate of 8% per year. Even though these infections are quite prevalent, no approved treatments are available.

NTM lung infections can be quite serious. Patients require 7.6 courses of antibiotics and 40% of patients over 65 die from the infection. Since this is an unmet need, the FDA granted ARIKACE orphan status for this indication. ARIKACE also has Fast Track Designation and Qualified Infectious Disease Product (QIDP) for this indication. Insmed would have a long period of exclusivity because QIDP grants the drug 5 years of exclusivity and Orphan Status another 7 years. Since regulatory exclusivity is additive, Insmed would have 12 years of exclusivity on the market.

- In Vitro and In Vivo Studies

In order to get some indication of how ARIKACE would work against strains of NTM bacteria, Insmed did several studies before entering Phase II trials. Insmed conducted two different studies, one in vitro (taking place in a test tube) and one in vivo (in an organism).

From above, we can see that ARIKACE has produced positive results for In Vitro studies. ARIKACE was tested against amikacin for 5 different strains of the NTM bacterium M. Avium complex (MAC). At an equivalent concentration, ARIKACE showed greater activity against all 5 strains. Additionally, ARIKACE did not show any toxicity.

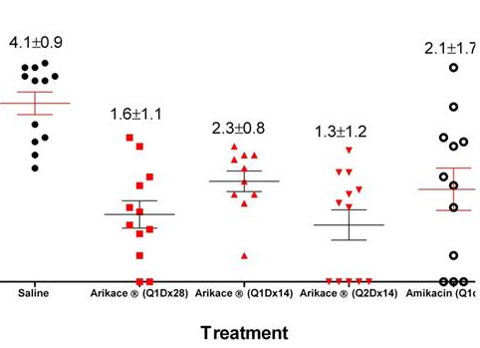

From above, we can again see that ARIKACE produced positive results for In Vivo studies. It was found that ARIKACE administered every other day was superior to a 25% higher dose of amikacin injection. This demonstrates that ARIKACE could have a better efficacy profile, as a lower dose is needed to achieve the desired result.

- Catalyst

After this consolidation period, Insmed has set up to run again into Phase II clinical trial results in patients with NTM lung infections in the United States. On March 18, 2013 the company stated:

“Insmed’s Phase 3 registrational study of ARIKACE in Europe and Canada completed enrollment and the company expects top-line clinical results in mid-2013. Insmed’s U.S. Phase 2 clinical trial in patients with NTM is well underway with clinical results expected in late 2013.”

With no approved treatment on the market and a long period of exclusivity, positive trial results would be a significant milestone for the company.

- Analyst Price Targets

Several reputable analysts are all bullish on Insmed. Canaccord Genuity, Lazard Capital, Leerink Swaan, UBS and Webush Securities cover Insmed. These analysts are very bullish on the future of Insmed and all have price targets higher than the current stock price. Recent analyst upgrades include:

- On May 15, 2013, Lazard Capital initiated coverage on Insmed with a buy and a price target of $21.

- On May 22, 2013, Canaccord Genuity raised its price target on Insmed from $12 to $17.

- On May 22, 2013, Leerink Swann raised its price target from $13 to $22.

- On June 18, 2013, UBS initiated covered on Insmed with a buy rating and a price target of $17.50.

A consensus of bullish analyst sentiment is always a good sign for a company’s future. These four analysts predict a price anywhere between $17 and $22, which would represent about a $6 to $10 gain from current prices.

We saw this kind of bullish analyst consensus in Trius Therapeutics (TSRX). Trius Therapeutics is a biopharmaceutical company that focuses on the discovery, development and commercializing of antibiotics for serious infections. At the time of our coverage, analysts were predicting a price anywhere between $14 and $20 when the stock was priced at $7.50. Trius was recently bought out for $13.50 a share with a $2.00 contingent value right (CVR).

Cash Position

On July 15, 2013, Insmed did a public offering of common stock, which raised about $60M. The company now reports having $81.61M in cash and burns about $36.61M. This should leave the company with enough cash to fund its operations in the near term. Additionally, the public offering was received very well, as the stock has since rallied.

One company that had an offering received very well is AcelRx Pharmaceuticals (ACRX). AcelRx is a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for the treatment of acute and breakthrough pain. On July 19, 2013, AcelRx offered 570,000 shares priced at $11.65. Investors aggressively bought the offering and the stock now sits at $11.96 per share. We covered AcelRx this year when it was about $6.50 per share. It reached highs since of $13.50, which effectively makes it more than a double.

Keryx Biopharmaceuticals (KERX) is another company which did an offering that was received very well by investors. Keryx is a company that works on developing and commercializing novel therapies for the treatment of renal disease. On January 30, 2013, Keryx offered 8,234,000 shares priced at $8.49 per share. The offering was quickly bought by investors and continued to run higher.

Chart

(click to enlarge)

The Insmed chart is setting up for another run. The chart is making a longer-term flagging continuation pattern and is making a higher low. After the offering, we can see through the accumulation/distribution line that the stock was aggressively acquired. Additionally, we can see that the money flow is wedging higher and the MACD is about to cross positive. With a catalyst approaching and a bullish chart, it is highly likely that the stock begins a new run through the end of the year.

- Conclusion

Insmed has been a big winner for investors over the past year, as the stock ran from $2.86 to $14.30. We feel that this recent offering and pullback has given investors another chance to renter the stock for a continued run throughout the year. We expect that Insmed takes out its 52-week high of $14.30 and continues higher into its 4Q data release.

Additional disclosure: Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky — always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.