Orlando,

FL -- July 27, 2021 -- InvestorsHub NewsWire --

via Emerging Markets

Sponsored Commentary -- Exciting news from

profiled company Pennexx Foods Inc. (Other

OTC: PNNX), a

technology company within the Software / Internet and Fintech

industries who gave the market a little insight not often seen at

their strata of the market.

It's

worth reviewing.

In

a very recent

press release the Company

confirmed that it had in fact had its second straight quarter of

profitability and expects to have breakout performance in

the third and fourth quarters of this year.

Profitability is no small feat for companies on

this exchange and a second profitable quarter consecutively

suggests that the first wasn't an anomaly and that a trend may be

forming. The Company saying in print that it expects "breakout

performances" the next two quarters might be even more

exciting.

Kinda

makes you want to see that Annual Report next year,

right?

And

despite the warm fuzzies generated by the aforementioned there was

another line that we think stands out.

From the

same release:

"They

also anticipate a dramatic rise in the number of users registered

to https://yoursocialoffers.com (YSO)."

This

means one of the Company's real profit engines is expected to

expand dramatically. You do the math on your own chalkboard as to

what this might mean.

Even

further down in the release are two nuggets that frankly could have

been standalone subjects for an Emerging Markets

Report.

Two

excerpts:

"Growing

organically without having to raise significant funds during this

phase of the company proves the commercial viability of the YSO

(Social Media Deals and Coupon) platform and reduces any need for

dilution of the stock keeping shareholder value

high."

He's

absolutely right and as experienced small and microcap reporters we

can tell you that predatory financing and subsequent dilution is

among the biggest, if not the biggest, enemy to

success.

And

this…

"Pennexx

is poised to achieve its goals embarked upon earlier this year

which is anticipated to grow the value of the company such as

becoming fully audited and uplisted to the

OTCQB."

Fully

audited and ascending to the 'QB are massive improvements for

Pennexx. As we've mentioned before, rising to the OTCQB

historically positions companies for better lending propositions

and makes them available to a much broader class of brokers and

investors, nevermind the inherent benefits of transparency for all

concerned.

Doesn't

hurt that all this contemplated success is aligning with a company

coming off two great quarters with very high expectations for the

next two.

About The

Emerging Markets Report:

The Emerging Markets

Report is owned and operated by Emerging Markets

Consulting (EMC), a syndicate

of investor relations consultants representing years of experience.

Our network consists of stockbrokers, investment bankers, fund

managers, and institutions that actively seek opportunities in the

micro and small-cap equity

markets.

For

more informative reports such as this, please sign up

at http://www.emergingmarketsllc.com/newsletter.php

Must Read OTC Markets/SEC policy on stock

promotion and investor protection

Section 17(b) of the Securities Act of 1933

requires that any person that uses the mails to publish, give

publicity to, or circulate any publication or communication that

describes a security in return for consideration received or to be

received directly or indirectly from an issuer, underwriter, or

dealer, must fully disclose the type of consideration (i.e. cash,

free trading stock, restricted stock, stock options, stock

warrants) and the specific amount of the consideration. In

connection therewith, EMC has received the following compensation

and/or has an agreement to receive in the future certain

compensation, as described below.

We may purchase Securities of the Profiled

Company prior to their securities becoming publicly traded, which

we may later sell publicly before, during or after our

dissemination of the Information, and make profits therefrom. EMC

does not verify or endorse any medical claims for any of its client

companies.

EMC is under contract to receive $75,000

from TC Special Investments LLC on behalf of

Pennexx Foods

Inc.

for various marketing services including

this report. EMC does not independently verify any of the content

linked-to from this editorial. http://emergingmarketsllc.com/disclaimer.php

Emerging Markets Consulting,

LLC

Florida

Office

390 North

Orange Ave STE 2300

Orlando, FL

32801

E-mail:

jamespainter@emergingmarketsllc.com

Web:

www.emergingmarketsllc.com

SOURCE: Emerging Markets

Sponsored Commentary

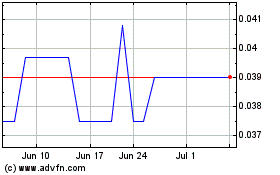

Pennexx Foods (PK) (USOTC:PNNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

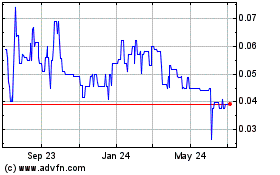

Pennexx Foods (PK) (USOTC:PNNX)

Historical Stock Chart

From Apr 2023 to Apr 2024