TIDMVIN

RNS Number : 5368O

Value and Indexed Prop Inc Tst PLC

10 June 2022

VALUE AND INDEXED PROPERTY INCOME TRUST PLC

ANNUAL FINANCIAL REPORT

FOR THE YEARED 31 MARCH 2022

Chairman's Statement

You will see from the Manager's Report that VIP has been

successful in continuing with its plan, that I wrote about last

year, to establish a portfolio of properties on long leases with

inflation linked rent reviews. This has involved greater investment

activity than usual, but the re-arrangement of our portfolio has

now broadly been completed. Since VIP's year end, we have borrowed

an additional GBP8 million from an existing lender. The net

decrease in cash is due to the purchase of additional properties,

in line with the Company's investment policy.

Many of the Company's index-linked leases provide for maximum

and minimum increases at future rent review, often described as

'caps and collars'. The details of these are shown in Note 9 to the

Financial Statements. The Financial Statements have been prepared

under IFRS (International Financial Reporting Standards) and IFRS

16 requires that these minimum rent increases, which may arise only

many years in the future, are averaged over the whole life of the

lease. As detailed in Note 10 to the Financial Statements, an

increase in amounts due from brokers this year has arisen due to

the sale of an investment in the quoted portfolio which straddled

the year end and the cash was received in full two days later.

The Board is recommending a final dividend of 3.6p per share

making total dividends of 12.6p per share for the year to 31 March

2022, compared to 12.3p per share in the previous year, an increase

of 2.4%. Subject to Shareholder approval at the Annual General

Meeting (AGM), the final dividend will be paid on 29 July 2022 to

Shareholders on the register on 1 July 2022. The ex-dividend date

is 30 June 2022. It will be the 35(th) year of dividend increases

following the reconstruction of the Company. In the short term this

will require some use of our capital reserves. In the medium term,

however, the Board will aim to ensure that the dividend is paid

from rents and dividends received (after interest costs and

management expenses) and that the indexed leases permit future

increases in line with inflation.

Net Asset Value total return (with debt at par) and Share Price

total return are considered by the Board to be Alternative

Performance Measures (APMs) as explained further in the Business

Review in the Annual Report and defined in the Glossary in the

Annual Report. Over the year, the Net Asset Value total return

(with debt at par) was 15.6% (2021: 12.3%) and the Share Price

total return was 15.8% (2021: 39.3%). This compares with the FTSE

All-Share Index total return of 13.0% (2021: 26.7%). The total

return from the property portfolio was 20.2% (2021: 2.3%) (the MSCI

UK Quarterly Property Index total returns were 19.6% (2021: 0.9%))

and from the equity portfolio was 24.1% (2021: 26.6%). From 1 April

2021, our performance comparator was changed from the FTSE

All-Share Index to the MSCI UK Quarterly Property Index to reflect

the change in our investment policy.

As provided in the Circular issued to Shareholders in December

2020, there will be an opportunity in the future for Shareholders

who wish to sell their shares to do so at Net Asset Value less

costs. The Board's intention is to table a proposal at the AGM to

be held in 2026.

As noted in previous statements, the difference between the fair

value and the nominal value of our Debenture Stock and our secured

loans is reducing over the life of the Debenture, which would be

repaid at its nominal (par) value. The figures are set out in Note

17 to the Financial Statements. We announced on 24 May 2022 that we

intend to repay this Debenture early to reduce interest costs and

provide greater flexibility in the management of our portfolio.

This years' AGM will be held in the offices of Shepherd &

Wedderburn LLP, 1 Exchange Crescent, Conference Square, Edinburgh,

EH3 8UL on Friday, 8 July 2022 at 12.30pm. The Notice of Annual

General Meeting can be found in the Annual Report. The Board

encourages Shareholders to vote using the Proxy Form, which can be

submitted to Computershare, the Company's Registrar. Proxy Forms

should be completed and returned in accordance with the

instructions thereon and the latest time for the receipt of Proxy

Forms is 12.30pm on Wednesday, 6 July 2022. Proxy votes can also be

submitted by CREST or online using the Registrar's Share Portal

Service at www.investorcentre.co.uk/eproxy.

I announced last year that I intended to retire during the

course of 2022 and, accordingly, I shall be retiring after the AGM

and John Kay will become Chairman. Over the years, I have

appreciated greatly the support of my colleagues on the Board, and

also the professionalism and attention to detail of our Managers

and Secretaries.

The outlook for markets is dominated at present by the major

uncertainties of inflation and Ukraine. However, property with long

term, inflation-related leases offers good value in these

circumstances.

James Ferguson

Chairman

10 June 2022

Summary of Portfolio

31 March 2022 31 March 2021

GBPm % GBPm %

UK Property 155.8 83.0 81.1 46.2

------------ ------- ------ ------- ------

UK Equities 26.9 14.3 28.6 16.3

------------ ------- ------ ------- ------

Cash 5.2 2.7 66.0 37.5

------------ ------- ------ ------- ------

187.9 100.0 175.7 100.0

------------ ------- ------ ------- ------

Property Manager's Report

Property Portfolio

The Market

The MSCI UK Quarterly Property Index, the most representative

measure of the performance of institutional investment property

portfolios, showed a total return of 16.3% over 2021, with capital

growth of 11.5%. Estimated rental values were up overall by 1.8%,

with retail 3% down on average, offices and alternatives virtually

level and industrial property up 9%. Differential movements in

capital values were more dramatic, with industrial property up by

no less than 31%, retail and alternative sector properties up on

average by 3%-4% and offices flat. For 2021 as a whole, total

returns, taking capital and income together, for

industrial/warehouse property averaged 36%, with retail and

alternatives averaging 8%-10% and offices only 5%. 2021 was the

first year since 2009 when retail property in the UK outperformed

offices. There will be many more as the office sector remains

locked in long term structural decline.

Total returns will be lower but still satisfactory over 2022 as

a whole. They may be around 12% overall, with returns for

industrials, retail and the alternative sectors all in the early

teens but offices only around 5% with capital values flat, rents

under pressure and voids through the roof. Property's real returns

will be far lower, with the RPI already up 9% year on year. It will

stay higher for longer than the Bank of England or the market

expects. Stagflation is here to stay for at least as long as the

war in Ukraine drags on.

UK Commercial Property - Average Annual % Growth Rates to March

2022

3 Months 6 Months 1 Year 3 Years 5 Years 10 Years

-------------------------- -------- ------ ------- ------- --------

Capital Values +14.8 +17.9 +14.9 +1.9 +2.2 +3.3

--------------- --------- -------- ------ ------- ------- --------

Rental Values +4.6 +4.6 +3.1 -0.3 +0.3 +1.2

--------------- --------- -------- ------ ------- ------- --------

Total Returns +18.8 +22.2 +19.6 +6.4 +6.7 +8.3

--------------- --------- -------- ------ ------- ------- --------

Source: MSCI UK Quarterly Property Index - Annualised

These returns to the end of March are higher than the calendar

year figures quoted above because capital value growth accelerated

through 2021 after a dull first quarter.

Comparative Investment Yields - End December (Except end March

2022)

March

2022 2021 2020 2019 2017 2011 2008 2006

Property (Equivalent

Yield) 5.0 5.1 5.8 5.6 5.6 6.9 8.3 5.4

-------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

Long Gilts: Conventional 1.6 1.0 0.2 1.0 1.4 2.5 3.7 4.6

--------------------- --------------------------- ----- ------ ------ ------ ------ ------ ------ ------

Index Linked -2.2 -2.6 -2.6 -2.0 -1.8 -0.2 0.8 1.1

------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

UK Equities 3.1 3.1 3.4 4.1 3.6 3.5 4.5 2.9

-------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

RPI (Annual

Rate) * 9.0 7.1 0.9 2.2 4.1 4.8 0.9 4.4

-------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

Property less Conventional

Yield Gaps: Gilts 3.4 4.1 5.6 4.6 4.2 4.4 4.6 0.8

--------------------- --------------------------- ----- ------ ------ ------ ------ ------ ------ ------

less Index Linked Gilts 7.2 7.7 8.4 7.6 7.4 7.1 7.5 4.4

------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

less Equities 1.9 2.0 2.4 1.5 2.0 3.4 3.8 2.5

------------------------------------------------- ----- ------ ------ ------ ------ ------ ------ ------

Source: MSCI UK Quarterly Property Index and ONS for the RPI

(*to December except March 2022)

Property transaction volumes and market liquidity improved

markedly through 2021 with an estimated total turnover of GBP65

billion, higher than in 2019 pre-pandemic and above the long term

averages. This trend has continued so far in 2022. Industrial

property volumes were strongest but activity increased in

previously quiet sectors, especially leisure, hotels and retail,

with relentless demand for retail warehouses and supermarkets

supplemented recently by buyers of in town retail at high yields.

Prime, especially long-let offices were active but the market for

older secondary offices is getting worse, with some now virtually

unlettable and unsaleable where they do not meet environmental

standards. There is a growing "brown discount" for properties in

all sectors with non-compliant Energy Performance Certificates

(EPCs).

Property void rates rose from 8.2% at the start of the pandemic

in March 2020 to a peak of 10.2% in June 2021 and remain high at

around 10%. As the table below shows, industrial and retail void

rates have fallen markedly from their COVID peaks, but office voids

shot up from 13.1% in March 2020 to 19.4% now, well above the

previous record high of 14.8% for office voids in 2013.

During the COVID crisis, the Government, under political and

tenant pressure, repeatedly suspended landlords' traditional tools

for enforcing rent collection - eviction orders, use of Commercial

Rent Arrears Recovery (CRAR) bailiffs and statutory demands for

winding up. They have also introduced a fiendishly complicated

legal arbitration procedure for rent arrears run up during COVID.

This will be a bonanza for lawyers and no real help for landlords

and tenants who should have done a deal long ago.

Apart from that, landlords are able again to use their normal

strong powers to enforce prompt payment of rent from commercial

property tenants, including the use of bailiffs where necessary.

With all properties throughout the UK now able to open again and

trade normally, there is no longer any excuse for strong tenants

not to pay their rent promptly and in full; rent collection rates

should, therefore, now be back to normal on all professionally

managed institutional property portfolios.

Property Prospects by Sector

Warehouse/Industrials - an Overheated Market - Yields have

Fallen Far Enough

Warehouse and industrial property delivered most of commercial

property's total capital growth in 2021 for the right reasons, with

voracious demand, mainly from food and online retailers, driving up

rents right across the UK for both "big box" warehouses near

motorways and smaller units on estates nearer city centres.

Valuation yields were forced down to reflect improving rental

growth prospects, and the outlook for rental growth remains good,

vacancy rates for both "big box" units and traditional industrial

estates are very low (and now negligible in parts of the South

East, Midlands and East Anglia). Driven by the explosion of online

retailing, 2021 saw the second highest ever take up of logistics

"big boxes" at 34.1 million square feet, only slightly below the

exceptional performance in 2020 at 35.8 million square feet and 71%

above 2019. 2022 will be slower.

Over GBP18 billion was invested across the industrial/warehouse

sector in 2021, nearly double the 2020 transaction volume and over

60% above the previous highest annual level recorded in 2017. But

the industrial property investment market is now running white hot,

too hot in our view, with yields bid down to unsustainably low

levels by panic buyers, who are having to make wholly unrealistic

rental growth projections to justify the prices they are paying.

Sellers are hard to find. Rapidly rising interest rates and other

economic pressures have started to cool this overheated market. The

latest UK figures showed online non-food retail sales down to 39%

of the total, against 63% a year ago. Amazon recorded its first

quarterly loss since 2015 at the end of April, the share price fell

16% instantly and has fallen 26% to date. The share prices of the

larger property REITS focusing on large warehouses followed suit

with Segro -25% and Tritax Big Box -22%.

Rapidly rising costs and supply chain problems, together with a

weakening economy and consumer confidence, are already putting

pressure on the strong occupiers and may affect some weaker

occupiers more acutely this year, although industrial property

values will still be supported by the conversion of older and lower

value sites to residential and other alternative uses, especially

in southern England. Well-located industrial and warehouse property

in all sizes from logistics "big boxes" on motorway junctions to

"last mile" urban sheds and estates of smaller units should still

outperform offices and probably the property market as a whole for

the rest of the year. But risks are rising and selling

opportunities should be taken where valuation yields have fallen

too far to generate satisfactory long-term returns.

Offices - Locked in Long Term Relative Decline - the Way we Work

has Changed for Good

Offices have taken over the performance wooden spoon from retail

for the first time in twelve years and may hold it for the

foreseeable future. Investors' long overdue focus on ESG is hitting

office values harder than on most other sectors, because so many

older office buildings, in London in particular, simply cannot be

updated to suitable standards at realistic cost. Occasional

headline-grabbing investment or letting deals for the very best

space are just a sign of a flight from quantity to quality, with

tenants usually downsizing at the same time, giving owners of their

old space a hospital pass. There is still some demand for high

quality city centre offices, but for more limited space for

meeting, training and prestige purposes.

Mid and back-office work is now being done far more from home,

or partly at low cost non-city centre locations. Unnecessary

offices are one cost that businesses can now cut, with break

clauses exercised in most cases and tenants demanding considerable

capital expenditure from landlords to renew leases, even in part.

Functional obsolescence and depreciation will, therefore, need to

be factored more specifically into most office valuations, keeping

capital values under continuing downward pressure to reflect lower

effective net rents and greater re-letting risk, as valuers start

to reflect this risk properly.

The public sector, the largest UK office tenant, has clearly now

adopted a long-term hybrid working model, and would have serious HR

and legal problems and additional trade union pressure if it tried

to force any employee back to the office full-time, despite the

Minister for Government Efficiency publicly applying pressure. Many

UK companies are also downsizing, going hybrid, closing their head

office altogether and taking temporary space nearby instead. Those

employers such as some American investment banks or law firms

requiring full office attendance will, therefore, find staff

recruitment and retention ever more difficult in a climate where

talented employees feel more able to negotiate the way they work,

irrespective of age or sex.

Retail - Bouncing Back, Led by Retail Warehouses and

Supermarkets

The COVID pandemic hit the high street hard where it had already

been hurting for many years: first, by getting many more older

shoppers, in particular, used to the range and convenience of

non-food shopping in particular, online; and second, by making

people switch from public transport or parking in congested

city-centres to easier and safer car-borne shopping out of town.

Retail warehouse rents are rising again, especially where well-run

operators like B&Q, B&M and Home Bargains trade alongside

the leading supermarkets, and capital values are growing rapidly -

some institutional investors missed the market in industrial

property, want no more offices, and have money which they are

struggling to invest.

On the high street, the steepest falls in property values

happened in "prime" central London and other prime highly valued

cities and towns which are now unaffordable for both multiple and

individual retailers. Unfair business rates had already crippled

urban high streets in less prosperous parts of the UK, and the

Government's latest partial attempt at rates reform will be too

little, too late for many locations. Prosperous suburbs and market

towns with affordable rents and an attractive mix of convenience

and independent traders have proved more resilient during the

crisis and are generally recovering better than bigger centres.

Transaction volumes are rising again for high street shops and

shopping centres, and as rental values have been reset at

affordable and sustainable levels, there are now growing signs of

capital growth from the retail bargain basement.

Supermarkets and convenience stores (including petrol filling

stations), have done well during COVID, often with increases of

20%-30% in their turnover, part of which they are able to retain

with more people working on average nearer home. Online food sales'

market share has slipped back from 16% to 11% now with Sainsbury's

reporting online sales down from 21% to 15% of their total. Aldi,

Lidl, and their older-established grocery competitors are fighting

fiercely for stores under 15,000 - 20,000 sq. ft. The leading

supermarkets are also much better at combining physical and online

shopping than most non-food retailers.

Non-Traditional Alternatives - Index-Linked Leases to Strong

Survivors are Key

Property in the "Alternatives" sector - i.e. everything except

office, industrial or retail - has been growing rapidly in

importance for institutional investors in recent years and now

accounts for one-sixth of the MSCI UK Quarterly Property Index. It

covers a wide range of property types and tenants, often with long,

index-linked leases. With the RPI now rising at an annual rate of

9% and the CPI at 7%, these index-linked leases hold the key to

sustained outperformance so long as the individual property rents

are well covered by operating profits and paid by strong multiple

tenants.

COVID with its ever-changing lockdowns posed a once in a

lifetime challenge to alternative sector operators and investors.

Tenants with strong long-term business models and short-term crisis

management, working with investors who knew how and when to give

help and improve leases, came through the COVID challenge stronger

than ever before, with their weaker multiple competitors, and many

private operators, savagely squeezed or forced out of business

altogether. Alternative investments are, therefore, outperforming

most property sectors again, and probably even industrials over

2022, but with strong survivor bias and variations within and

between different sub-sectors, as outlined below.

Alternatives - Leisure and Hotels - Strong Tenants Trading

Stronger than ever Outside City Centres

Well-let pubs have proved far safer investments than

restaurants, where many private-equity backed multiple chains were

already drowning in debt pre-COVID. The leading pubcos, like Greene

King and Wetherspoons, as well as most traditional regional

brewers, have strong balance sheets with plenty of freehold assets

and borrowing capacity. Profitable, spacious pubs with outside

space, have been trading exceptionally well and above pre-pandemic

levels over the past year, apart from central London. Pubs of this

type in suburban, smaller town and rural locations will stay short

and long-term winners whilst consumer spending on food and drink

remains at current levels.

Hotel values are also well off the bottom. Modern hotels in

prosperous smaller towns and rural areas, serving British

holidaymakers, workers and businesses, have been performing really

strongly over the past year, proving resilient even during the

latest COVID surge. They will continue to outperform large city

centre and airport hotels dependent on international business and

travel. Zoom, Teams and ESG have slashed expensive corporate

frequent flying. Covenant strength will remain crucial for hotels'

investment value - for example, a Premier Inn is valued well above

a similar Travelodge, because long-term investors hate CVAs

(Company "Voluntary" Arrangements). Caravan parks should also trade

very strongly for many years to come.

Health and Fitness clubs have been rebuilding their memberships

but will be suffering from the squeeze on real incomes. The leading

brands on large out of town sites, with good car parking and

customers often able to work from home, offer the best long-term

investments.

The two main ten pin bowling companies, who dominate the market,

are going from strength to strength and offer a sensibly priced

family treat which cannot be replicated online. But bingo halls and

cinemas face a tougher future as lockdowns drove away many of their

older customers and the operators are vulnerable to online

competition.

Alternatives - Student Housing and Care Homes - Covenant

Strength Key

Direct-let investments on long leases to well-established

universities should continue to perform well but indirect student

housing investments with nomination agreements or third-party

providers, depending more on the local residential letting market,

are less clear beneficiaries of yield hardening for safe, long-let

property.

COVID has hit care homes hard. Costs and vacancy rates are

rising because of more deaths, slower admissions and severe Brexit

and vaccination-related staff shortages, while some private-equity

backed care home providers need more equity and lower rents. High

quality homes with self-funded residents will continue to

outperform those dependent on squeezed local authority budgets. The

rise in National Insurance contributions has raised staff costs for

care homes, and the Government's reforms to social care funding

will not deliver meaningful extra cash for another three to four

years. Medical centres and private hospitals will stay in demand as

the NHS faces years of non-COVID catch up and outsourcing more

profitable work.

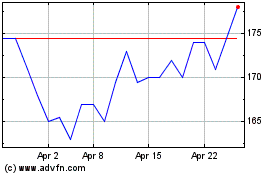

25 years ago Gordon Brown gave the Bank of England Monetary

Policy Committee the power to set interest rates to meet a stated

inflation target. As the chart above shows, until recently, their

record has been good. Even including the current inflation tsunami,

annual UK CPI growth over the past quarter of a century has

averaged exactly 2% (with the RPI at 2.8%). Official interest rates

have averaged 2.6%, compared with 10.4% over the previous 25 years

and 8.4% for the RPI (CPI figures are not available). But success,

as so often in business and government, has bred complacency and

groupthink, reinforced by similar flawed inflation models in other

Western Central Banks. Massive Quantitative Easing was the only

possible response to the 2008/9 banking crash, which hit the UK

hardest of all the main Western economies, but the Bank persisted

with the policy far longer and stronger than was necessary or

prudent, leaving Britain in our present agonizing double bind of

unsustainably low interest rates and high inflation. The Bank

really has no alternative now to raising interest rates rapidly to

stop inflation expectations taking a real hold, as they did in

eerily similar circumstances in the early 1970's after the first

oil price shock. Inflation has also rocketed in the US to 8.3% (a

new 40 year high) and 7.4% in the Eurozone.

The March consumer price figures (CPI + 7.0% and RPI + 9.0% year

on year) clearly show inflation heading higher over the next few

months, probably into double figures for the CPI and 12% for the

RPI Inflation may still be around the current rates at the year

end. The latest Producer Price Indices show output prices up by

11.5% year on year and input prices up by 19.2%.

So Britain is now suffering stagflation, with average real

incomes likely to fall by at least 2% and maybe up to 3% over 2022

as a result of increases in tax and National Insurance combined

with average earnings and benefits lagging far behind price rises.

UK domestic consumer spending was the main engine of UK economic

recovery in 2021, with exceptionally high pandemic savings being

spent by better off households, and employees gradually returning

to work. That will not be repeated in 2022, and forecasts, like the

OBR's in March, for UK GDP to grow by 3.8% this year now look far

too high. A technical recession may well be looming later this year

on a quarter by quarter basis. Q1 2022 may be only just up, with

Q2, Q3, Q4 all down. Although GDP figures are often subject to

major subsequent revisions. Any progress later in 2023 will be

critically dependent on progress towards peace in Ukraine and

easing disruption to international trade, not least with China, and

supply shortages around the world. There is still a danger of

renewed outbreaks of COVID, especially in less developed countries

where vaccination rates are very low. Food and energy shortages,

serious as they feel in richer countries like the UK, could

actually kill millions especially in Africa, if the war in Ukraine

and disruption of world trade drag on.

Conclusion - Index-Linked Income Still Seriously Undervalued

UK commercial property values stabilised in late 2020 and have

since been rising rapidly. Industrials have been by far the star

performers, but their yield re-rating must be over as prices are

clearly overheating especially at the prime end of the market.

Offices' relative performance is going from bad to worse. Retail

values started to recover early in 2021, as gains for retail

warehouses, supermarkets and convenience stores offset slowing

rates of decline in shopping centres and high street shops, which

have now finally bottomed out. The alternative sectors have also

bounced back strongly with pubs, hotels, bowling and caravan parks

booming, especially outside London. Healthcare and nursing home

investments will stay in demand despite their staffing problems.

2022 may see a similar pattern of relative property performance,

despite current short term interest rate rises, and possibly sharp

increases in current unsustainably low long term bond yields, with

alternatives, retail and industrials leading the way and offices

bringing up the rear.

The COVID crisis has taught UK property investors a stark

lesson: stay on the right side of structural change, avoid offices,

and stick wherever you can to properties let to strong tenants at

affordable rents on long, preferably index-linked, leases. Safe,

long-term indexed income will be even more highly prized as

inflation rises faster for longer than myopic markets and

complacent central bankers expect. Wars are always inflationary,

and however long the hot war lasts in Ukraine, the West is clearly

now in an economic cold war with Russia and its allies, with

sanctions and shortages biting for years to come.

Secure, index-linked, UK property offers massive yield margins

over index-linked gilts, and a comfortable yield cushion still over

conventional bonds. It is still seriously undervalued.

Portfolio Summary

VIP specialises in UK commercial properties with long, strong,

index-related income streams to deliver above average long term

real returns.

31 March 30 September 31 March

PORTFOLIO SUMMARY 2022 2021 2021

--------------------------------------- ------------------ -------------- -------------

Portfolio Value: GBP155,478,000* GBP110,050,000 GBP80,550,000

--------------------------------------- ------------------ -------------- -------------

Contracted Income: GBP8,339,944 GBP6,336,645 GBP5,151,786

--------------------------------------- ------------------ -------------- -------------

Contracted income as a % of Portfolio

Value: 5.4% 5.8% 6.4%

--------------------------------------- ------------------ -------------- -------------

Total Number of Properties: 43 39 31

--------------------------------------- ------------------ -------------- -------------

Total Number of Tenants (the Portfolio

is 100% let): 43 40 32

--------------------------------------- ------------------ -------------- -------------

Contracted Indexed Rent: 95.8% 92.4% 90.6%

--------------------------------------- ------------------ -------------- -------------

Weighted Average Unexpired Lease 12.8 years 13.8 years 15.1 years

Term (if all tenants exercise break

options):

--------------------------------------- ------------------ -------------- -------------

Annual Total Return March to March: 20.2% (MSCI:19.6%) - 2.3%

(MSCI: 0.9%)

--------------------------------------- ------------------ -------------- -------------

*Savills Valuation - NB: This figure does not include GBP6m

committed to complete the Alnwick Hotel Development. The fair

valuation given by Savills excludes prepaid or accrued operating

lease income arising from the spreading of lease incentives or

minimum lease payments and for adjustments to recognise finance

lease liabilities for one leasehold property, both in accordance

with IFRS 16. For further information see Note 9 to the Financial

Statements.

Performance and Independent Revaluation

Savills' independent valuation at 31 March 2022 on the direct

commercial property portfolio increased to GBP155,478,000 with a

running yield of 5.4% (from 5.7% as at end-December 2021). This is

up from the half-yearly valuation at 30 September 2021 of

GBP110,050,000, the increase driven by both net acquisitions and

valuation uplift.

VIP's property portfolio produced a total return on all 43

properties of 20.2% over the past year to March, against 19.6% for

the MSCI UK Quarterly Property Index, the main benchmark for

commercial property performance. Properties held throughout had a

total return of 23.5%, the difference reflecting the acquisition

costs on 14 properties bought during the year.

VIP's property portfolio total returns on All Assets of 20.2%

over the past year and 8.8% over the past six months were driven by

a valuation uplift of 8.5% on the 38 properties held over the six

months (leisure 16.1%, industrials 12.4%, supermarkets 8.1%, other

7.1%, hotels 5.4%, pubs 4.1% and roadside 2.0%).

The longer term returns on the property portfolio have been

between 10% and 12% a year over 3, 5, 10 and 20 years and 35 years

and are above the MSCI averages over all these periods. The real

returns above the Retail Price Index from VIP's property portfolio

were 10% last year and between 5% and 9% a year over all cumulative

periods from 3 to 35 years since the inception of OLIM Property's

management.

Contracted rental income rose by 6% on held properties. The

average lot size is GBP3,600,000, ranging from GBP1,150,000 to

GBP13,000,000.

Properties

All 43 properties are let and 100% occupied on full repairing

and insuring leases (tenants are responsible for repair,

maintenance and outgoings), plus there is an agreement for lease in

place at Alnwick where a Premier Inn hotel (80 bedrooms plus hotel)

is currently under construction with completion due summer 2022.

All 43 tenancies have upwards only rent increases and a weighted

average unexpired length of 12.8 years (19.8 years if the break

options are not exercised). All the properties valued at 31 March

2022 are freehold with the exception of two which are long

leasehold with 109 and 83 years to run (Doncaster and Fareham).

Purchases to 31 March 2022

Fourteen new properties were purchased over the year for

GBP63,430,000 in total including costs, at an average net initial

yield of 5.3% (plus there will be an additional GBP6,000,000 to be

paid on practical completion during late summer of 2022 of the

Premier Inn Hotel at Alnwick, which is currently under

construction); their average weighted unexpired lease length at 31

March 2022 is 10.4 years (if the break options are exercised). The

newly purchased freehold properties consist of two hotels (one

under construction), six industrials, three petrol filling stations

with convenience stores and three supermarkets. Seven of the

properties have RPI-linked rent increases, four have CPI-linked

rent increases and three with fixed increases.

Purchases and Sales since March 2019

Year March to March Purchases No. of properties Sales No. of properties

-------------------- -------------- ----------------- ------------- -----------------

2019/2020 GBP10,800,000 5 GBP9,200,000 5

-------------------- -------------- ----------------- ------------- -----------------

2020/2021 GBP17,600,000 7 GBP4,750,000 2

-------------------- -------------- ----------------- ------------- -----------------

2021/2022 GBP63,430,000 14 GBP3,260,000 2

-------------------- -------------- ----------------- ------------- -----------------

Total GBP91,830,000 26 GBP17,210,000 9

-------------------- -------------- ----------------- ------------- -----------------

Purchase Pipeline

Further properties with long, strong, index-linked income are

under active investigation.

Sales to 31 March 2022

The sale of two short-let overrented properties completed during

the year: a petrol filling station in Southampton and a pub in

Thornton Cleveleys for a combined GBP3.3m, 4.9% above valuation and

at a net sale yield of 8.8%.

Sales since 31 March 2022

Since the year end, two properties have completed: a Buzz Bingo

in Bradford and a Co-op store in Barton upon Humber for a combined

GBP3.3m in total (39.5% above valuation) at a net sale yield of

6.2%.

Rent Reviews

The portfolio now has 96% of contracted income (42 out of 43

tenancies) with index-linked or fixed rent increases. Only one

property, the industrial at Fareham, has three yearly open market

upwards only reviews (the December 2021 sweep up clause has since

been agreed with a 4% uplift and is to be documented

imminently).

Nineteen rent reviews completed over the course of the year

(twelve with annual rent increases and seven with five yearly

review patterns), sixteen RPI-linked rent increases and three with

fixed rental increases: 7 pubs, 5 supermarkets, 2 petrol filling

stations, 1 bingo hall, 1 bowling alley, 1 library, a driving test

centre and the caravan park giving a combined 6.9% uplift on their

passing rents.

Rent Collection

100% of all contracted rents due were collected in the year to

31 March 2022 and landlords' rights to enforce rent collection are

now back to normal.

The portfolio remains well-spread with a focus on index-linked

rent reviews and the sectors of the UK commercial property market

which benefit from structural change-industrials (33%),

supermarkets (27%) and alternatives (40% mainly leisure, pubs and

hotels). We do not invest in offices. VIP'S safe, long let indexed

portfolio should prove resilient. It has outperformed through

previous turbulent times as shown by the Property Record Table in

the Annual Report, delivering long term above average real returns

(benchmark MSCI UK Quarterly Property Index).

Louise Cleary & Matthew Oakeshott

OLIM Property Limited

10 June 2022

Equity Manager's Report

UK Equities

Market Background

The UK stock market gave a good absolute return over VIP's

financial year, with the FTSE All-Share Index delivering a total

return of 13.0%, against 19.6% for UK property. For most of the

year progress was steady, driven by improving sentiment as lockdown

restrictions were eased progressively. However, share prices

dropped sharply in February and early March 2022 after the Russian

invasion of Ukraine. They then recovered to end the quarter only

marginally down.

Property shares were strong over the year to end March 2022,

with the FTSE All Share Real Estate Investment Trusts ("REITs")

Index generating a total return of 22.5%. REIT NAV performance was

strong, benefiting from the post-pandemic recovery in commercial

property values and, in particular, from the strength in industrial

property sector valuations.

Performance

VIP's equity portfolio performed well ahead of the wider stock

market, reflecting the better performance of property stocks as a

whole. The portfolio recorded a total return of 24.1%, which also

outperformed the FTSE All Share REITs Index. The portfolio

benefited from its high exposure to its new investments in

industrial property, and from the strong performances of its two

Food Retailers, Wm Morrison Supermarkets and Tesco. The former was

the subject of competing private equity takeover bids and was

eventually taken private at 287p per share, generating a profit of

over GBP1.5m for VIP. Tesco's share price was aided by strong

trading and this holding was also subsequently disposed of at a

significant profit.

Portfolio

The last twelve months saw sales of equities of GBP36.2m and

purchases of GBP30.5m giving total transactions of GBP66.7m, with

net sales of GBP5.7m. During the year we completed the sale of the

portfolio's legacy holdings, switching into property-backed

securities. The new portfolio focused on the industrial sector with

three specialist industrial REITs, Tritax Big Box REIT, Urban

Logistics REIT and Warehouse REIT, and a large holding in BMO Real

Estate Investments, which mainly invests in industrial property and

retail warehouses. A new holding in Tesco was established and an

increased investment in Wm Morrison Supermarkets was made, both at

small premiums to their respective asset values, in order to gain

exposure to the resilient food retail property sector. As noted

above, both of these investments were realised before the year end

at a significant profit. New holdings were also made in PRS REIT

and Residential Secure Income REIT, which both have exposure to

attractive RPI-linked leases, and in Real Estate Credit

Investments, which advances loans secured on property. An initial

holding in Civitas Social Housing was sold after corporate

governance issues came to light. At the end of March 2022, the

equity portfolio had 7 remaining investments valued at

GBP26.9m.

Since the year end, the portfolio's three specialist industrial

property holdings, Tritax Big Box REIT, Urban Logistics REIT and

Warehouse REIT, have been sold for a good profit and at a premium

to their most recent NAVs. The proceeds have been partly

re-invested in BMO Real Estate Investments at a discount of

25%.

Patrick Harrington

OLIM Property Limited

10 June 2022

Business Review

This Business Review is intended to provide an overview of the

strategy and business model of the Company as well as the key

measures used by the Directors in overseeing its management. The

Company is an investment trust company that invests in accordance

with the investment objective and investment policy outlined in

this Business Review.

Value and Income Trust PLC changed its name on 22 January 2021

to Value and Indexed Property Income Trust PLC (VIP or the

Company). VIP's Ordinary Shares are listed on the Premium segment

of the Official List and traded on the main market of the London

Stock Exchange. The Company is registered as a public limited

company in Scotland under company number SC050366. VIP is an

investment company within the meaning of Section 833 of the

Companies Act 2006. The Company has one class of share. VIP is a

member of the Association of Investment Companies (AIC).

The Group

Value and Indexed Property Income Services Limited (VIS), a

wholly owned subsidiary of the Company, is authorised by the

Financial Conduct Authority to act as the Company's Alternative

Investment Fund Manager (AIFM).

Capital Structure

As at 31 March 2022, and as at the date of this Annual Report,

VIP's share capital consisted of 43,557,464 Ordinary Shares of 10p

nominal value in issue and 1,992,511 Ordinary Shares of 10p each

held in Treasury. Each Ordinary Share in issue entitles the holder

to one vote on a show of hands and, on a poll, to one vote for

every share held.

Share Dealing

Shares in VIP can be purchased and sold in the market through a

stockbroker, or indirectly through a lawyer, accountant or other

professional adviser. Further information on how to invest in VIP

is detailed in the Annual Report.

Recommendation of Non-Mainstream Investment Products

VIP currently conducts its affairs so that the shares issued by

it can be recommended by independent financial advisers to ordinary

retail investors in accordance with the rules of the Financial

Conduct Authority (FCA) in relation to non-mainstream investment

products and intends to do so for the foreseeable future. VIP's

shares are excluded from the FCA's restrictions which apply to

non-mainstream investment products because they are shares in an

investment trust company and the returns to investors are based on

investments in directly held property and publicly quoted

securities.

Highlights of the Year

-- Net Asset Value total return (with debt at par)* of 15.6%

(2021: 12.3%) over one year and 2.7% (2021: -8.5%) over three

years.

-- Share Price total return* of 15.8% (2021: 39.3%) over one

year and 13.3% (2021: -3.3%) over three years.

-- FTSE All-Share Index total return of 13.0% (2021: 26.7%) over

one year and 16.8% (2021: 9.9%) over three years.

-- MSCI Quarterly Property Index total return of 19.6% over one year.

-- Dividends for year up 2.4% - increased for the 35th consecutive year.

Financial Record

31 Mar 2022 31 Mar 2021

NAV (valuing debt at par) (p) 314.3 271.1

----------- -----------

NAV (valuing debt at market) (p)* 305.0 256.6

----------- -----------

Ordinary share price (p) 239.0 218.0

----------- -----------

Discount of share price to NAV (valuing

debt at market) (%) 21.6 15.0

----------- -----------

Dividend per share (p) 12.6 12.3

----------- -----------

Total assets less current liabilities

(GBPm) 196.5 177.6

----------- -----------

* This is an Alternative Performance Measure (APM) which has

been explained in the Glossary in the Annual Report.

Investment Objective and Investment Policy

Investment Objective

The Company invests mainly in directly held UK commercial

property to deliver secure, long-term, index-linked income and

partly in property-backed UK securities. The Company aims to

achieve long-term, real growth in dividends and capital value

without undue risk.

Investment Policy

The Company's policy is to invest in directly held UK commercial

property, property-backed securities listed on the London Stock

Exchange and cash or near cash securities. The Company will not

invest in overseas property or securities or in unquoted companies.

UK directly held commercial property will usually account for at

least 80 per cent. of the total portfolio but it may fall below

that level if relative market levels and investment value, or a

desired increase in cash or near cash securities, make it

appropriate.

The UK commercial property portfolio

The Company will target secure income and capital returns linked

to inflation, mainly through its diversified portfolio of UK

property assets, let or pre-let to a broad range of strong tenants

on long leases with rental growth subject to index-linked or fixed

increases. The Company has not set any geographical limits, except

that it may invest in all four nations of the United Kingdom. It

has also set no structural limits and expects the portfolio to be

focused on (but not limited to), the industrial/ warehouse,

supermarket, roadside and leisure sectors (including for example,

caravan parks, pubs, hotels, garden and bowling centres) income

strips and ground rents. Offices and high street retail properties

would not be priority sectors for investment. In order to manage

risk in the portfolio, at the time of purchase, no single property

asset will exceed in value 25 per cent. Of the Company's gross

asset value and no single tenant (except UK Government and public

sector) will account for more than 30 per cent. Of the Company's

total rental income.

The UK quoted securities portfolio

In order to limit the risk to the Company's overall total

portfolio of assets that are derived from any particular securities

investment, no individual shareholding will account for more than

10 per cent. of the gross assets of the Company at the time of

purchase. The Company will not use derivatives. The Company is

permitted to invest cash held for working capital purposes and

awaiting investment in cash deposits, gilts and money market

funds.

No material changes may be made to the Company's investment

policy described above without the prior approval of Shareholders

by the passing of an Ordinary Resolution.

Borrowing policy

The Company has a longstanding policy of funding most of the

increases in its property portfolio through the judicious use of

borrowings. Gearing will normally be within a range of 25 per cent.

and 50 per cent. of the total portfolio. The Company will not raise

new borrowings if total net borrowings would then represent more

than 50 per cent. of the total assets.

Until 2015, all borrowings had been long-term debentures to

provide secure long-term funding, and avoiding the risks associated

with short-term funding of having to sell illiquid assets at a low

point in markets if loans had to be repaid. Detail of the Company's

current borrowings, comprising two fixed term secured loan

facilities and the 9.375% Debenture Stock 2026, can be found in

Notes 12 and 24 to the Financial Statements. As announced on 24 May

2022, the Company has voluntarily decided to redeem the 2026

Debenture Stock early on 28 June 2022. The redemption price will be

determined in accordance with the conditions set out in the Trust

Deed and will be communicated to holders of the 2026 Debenture

Stock shortly before the redemption date.

Performance, Results and Dividend

As at 31 March 2022, the Net Asset Value (NAV) total return

(with debt at par) over one year was 15.6% and the Share Price

total return over one year was 15.8%. This compares to the FTSE

All-Share Index total return over one year of 13.0% and the MSCI UK

Quarterly Property Index total return of 19.6%. Total assets less

current liabilities were GBP196.5 million. A review of the

performance of the property and equity portfolios is detailed in

the Chairman's Statement in the Annual Report and in the Property

and Equity Manager's Reports in the Annual Report.

For the year to 31 March 2022, quarterly dividends of 3.0p per

share were each paid on 29 October 2021, 28 January 2022 and 29

April 2022. The Directors have declared that a final dividend of

3.6p per Ordinary Share (2021: 3.6p), if approved by Shareholders

at the 2022 AGM, is paid on 29 July 2022 to Shareholders on the

register on 1 July 2022. The ex-dividend date is 30 June 2022. This

represents an annual increase in dividends of 2.4% as compared with

the 9.0% and 7.0% annual increases in the Retail Price and Consumer

Price Indices, respectively, as at the end of March 2022.

Principal and Emerging Risks and Uncertainties

The Board has an ongoing process for identifying, evaluating and

monitoring the principal and emerging risks and uncertainties

facing the Group and the Parent Company. The risk register forms a

key part of the Group and the Parent Company's risk management

framework used to carry out a robust assessment of the risks,

including a significant focus on the controls in place to mitigate

them. The principal and emerging risks and uncertainties which

affect the Group's and the Company's business are:

Market Risk

The fair value of, or future cash flows from, a financial

instrument held by the Group may fluctuate because of changes in

market prices. This market risk comprises three elements - price

risk, interest rate risk and currency risk.

Price Risk

Changes in market prices (other than those arising from interest

rate or currency risk) may affect the value of the Group's

investments.

For equities, asset allocation and stock selection, as set out

in the Investment Policy in the Annual Report, both act to reduce

market risk.

OLIM Property Limited (OLIM Property) is the Investment Manager

responsible for the management of the Company's property and

equities portfolios.

VIS delegates its portfolio management responsibilities to OLIM

Property, which, as well as managing the property portfolio,

actively monitors market prices throughout the year and reports to

VIS and to the Board, which meet regularly in order to review

investment strategy. The equity investments held by the Group are

listed on the London Stock Exchange. All investment properties held

by the Group are commercial properties located in the UK with

long-term, index-linked income streams.

Interest Rate Risk

Interest rate movements may affect:

-- the fair value of the investments in property;

-- the level of income receivable on cash deposits; and

-- the fair value of borrowings.

The possible effects on fair value and cash flows that could

arise as a result of changes in interest rates are taken into

account when making investment and borrowing decisions.

The Board imposes borrowing limits to ensure that gearing levels

are appropriate to market conditions and reviews these on a regular

basis. Current borrowings comprise a debenture stock and two

secured term loans, with four and eleven year terms remaining,

providing secure long-term funding. It is the Board's policy to

maintain a gearing level, measured on the most stringent basis of

calculation after netting off cash equivalents, of between 25% and

50%.

Currency Risk

A small proportion of the Group's investment portfolio is

invested in securities whose fair value and dividend stream are

affected by movements in foreign exchange rates. It is not the

Company's policy to hedge this risk.

Liquidity Risk

This is the risk that the Group will encounter difficulty in

meeting obligations associated with its financial liabilities.

The Group's assets comprise readily realisable securities which

can be sold to meet commitments, if required, and investment

properties which, by their nature, are less readily realisable. The

maturity of the Company's existing borrowings is set out in the

interest rate risk profile section of Note 21 to the Financial

Statements.

Credit Risk

This is the failure of a counterparty to a transaction to

discharge its obligations under that transaction that could result

in the Group suffering a loss.

The risk is not significant and is managed as follows:

-- investment transactions are carried out on behalf of VIP by

an outsourced dealing agent. Settlement of these transactions is

executed by a large investment bank whose credit standing is

reviewed periodically by OLIM Property (which reports to VIS).

-- the risk of counterparty exposure due to failed trades

causing a loss to the Group is mitigated by the review of failed

trade reports on a daily basis. In addition, a stock reconciliation

to third party administrators' records is performed on a daily

basis to ensure that discrepancies are picked up on a timely basis.

VIS carries out periodic reviews of the Depositary's operations and

reports its findings to the Company. This review also includes

checks on the maintenance and security of investments held.

-- cash is held only with reputable banks with high quality

external credit ratings which are monitored on a regular basis.

Property Risk

The Group's commercial property portfolio is subject to both

market and specific property risk. Since the UK commercial property

market has been markedly cyclical for many years, it is prudent to

expect that to continue.

The price and availability of credit, real economic growth and

the constraints on the development of new property are the main

influences on the property investment market.

Against that background, the specific risks to the income from

the portfolio are tenants being unable to pay their rents and other

charges or leaving their properties at the end of their leases. All

leases are on full repairing and insuring terms, with upward only

rent reviews and the average unexpired lease length is 20 years

(2021: 17 years) and 13 years if break options are exercised.

Details of the tenant and geographical spread of the portfolio are

set out on in the Annual Report. The long-term record of

performance through the varying property cycles since 1987 is set

out in the Annual Report. OLIM Property is responsible for property

investment management, with surveyors, solicitors and managing

agents acting on the portfolio under OLIM Property's

supervision.

Political Risk

The EU (Future Relationship) Act 2020 came into effect on 1

January 2021 and the full political, economic and legal

consequences of the UK leaving the European Union (EU) are not yet

known. It is possible that investments in the UK may be more

difficult to value and assess for suitability of risk, harder to

buy or sell and may be subject to greater or more frequent rises

and falls in value. In the longer term, there is likely to be a

period of uncertainty as the UK seeks to negotiate its ongoing

relationship with the EU and other global trade partners. The UK's

laws and regulations, including those relating to investment

companies, may in future, diverge from those of the EU. This may

lead to changes in the operation of the Company or the rights of

investors in the territories in which the shares of the Company may

be promoted and sold.

The Board reviews regularly the political situation, together

with any associated changes to the economic, regulatory and

legislative environment, to ensure that any risks arising are

mitigated as effectively as possible.

An explanation of certain economic and financial risks and how

they are managed is contained in Note 21 to the Financial

Statements.

Climate Change and Social Responsibility Risk

The Board recognises that climate change is an important

emerging risk that all companies should take into consideration

within their strategic planning. As referred to elsewhere in the

Strategic Report and in the Statement of Corporate Governance in

the Annual Report, the Company has little direct impact on

environmental issues. As an investment trust company, the Company

has no direct employee or environmental responsibilities. The Board

is aware that the Manager continues to take into account

environmental, social and governance matters when considering

investments.

Economic Risk

The valuation of the Company's investments may be affected by

underlying economic conditions, such as fluctuating interest rates,

rising inflation, increased fuel and energy costs, and the

availability of bank finance, all of which can be impacted during

times of geopolitical uncertainty and volatile markets, including

during the coronavirus pandemic and the situation in Ukraine. The

Board monitors the economic and market environment closely, and the

situation in Ukraine, and believes that the diverse well-spread,

long let indexed portfolio should prove resilient.

Other Key Risks

Additional risks and uncertainties include:

-- Discount volatility: The Company's shares may trade at a

price which represents a discount to its underlying net asset

value.

-- Regulatory risk: The Directors strive to maintain a good

understanding of the changing regulatory agenda and consider

emerging issues so that appropriate changes can be implemented and

developed in good time. The Group operates in a complex regulatory

environment and, therefore, faces a number of regulatory risks. A

breach of Section 1158 of the Corporation Tax Act 2010 would result

in the Company being subject to capital gains tax on portfolio

investments. Breaches of other regulations, including but not

limited to, the Companies Act 2006, the FCA Listing Rules, the FCA

Disclosure, Guidance and Transparency Rules, the Market Abuse

Regulation, the Packaged Retail and Insurance-based Investment

Products (PRIIPs) Regulation, the Second Markets in Financial

Instruments Directive (MiFID II) and the General Data Protection

Regulation (GDPR), could lead to a number of detrimental outcomes

and reputational damage.

The Company is also required to comply with tax legislation

under the Foreign Account Tax Compliance Act and the Common

Reporting Standard. The Company has appointed its registrar,

Computershare, to act on its behalf to report annually to HM

Revenue & Customs (HMRC).

The Company's privacy policy is available to view on the

Company's web pages hosted by the Investment Manager at

https://www.olimproperty.co.uk/value-and-indexed-property-income-trust.html.

Breaches of controls by service providers to the Company could

also lead to reputational damage or loss. The Audit and Management

Engagement Committee monitors compliance with regulations by

reviewing internal control reports from the Administrator and from

the Investment Manager.

Alternative Investment Fund Managers Directive

The Alternative Investment Fund Managers Directive (AIFMD)

introduced an authorisation and supervisory regime for all managers

of authorised investment funds in the EU.

In accordance with the requirements of the AIFMD, the Company

appointed VIS as its Alternative Investment Fund Manager (AIFM) and

BNP Paribas Securities Services as its Depositary. VIS's status as

AIFM remains unchanged following the UK's departure from the EU.

The Board has controls in place in the form of regular reporting

from the AIFM and the Depositary to ensure that both are meeting

their regulatory responsibilities in relation to the Company.

Key Performance Indicators

At each Board Meeting, the Directors consider a number of

performance measures to assess the Company's success in achieving

its objectives and which also enable Shareholders and prospective

investors to gain an understanding of its business.

A historical record of these performance measures, with

comparatives, together with the Alternative Performance Measures

(APMs) are shown in the Highlights of the Year and Financial Record

section of the Business Review. Definitions of the APMs can be

found in the Glossary in the Annual Report.

Following the change in investment policy to invest

predominantly in property, the Directors have carried out a review

of the key performance indicators to determine the performance of

the Company. The Directors have identified the following as key

performance indicators:

-- Net asset value and share price total returns relative to the

MSCI UK Quarterly Property Index and FTSE All-Share Index (total

returns); and

-- Dividend growth relative to consumer price inflation.

The Manager's Reports report on how the Company performed during

the year under review against these indices.

The net asset value (NAV) total return is considered to be an

appropriate long-term measure of Shareholder value as it includes

the current NAV per share and the sum of dividends paid to

date.

The share price total return relative to the FTSE All-Share

Index (total return) is the theoretical return including

reinvesting each dividend in additional shares in the Company at

the current mid-market price on the day that the shares go

ex-dividend.

The medium term dividend policy is for increases at least in

line with inflation.

The Board reviews the Company's rental and investment income and

operational expenses on a quarterly basis, as the Directors

consider that both of these elements are important components in

the generation of Shareholder returns. Further information can be

found in Notes 2 and 4 to the Financial Statements in the Annual

Report.

In addition, the Directors will consider economic, regulatory

and political trends and factors that may impact on the Company's

future development and performance.

Share Buy-backs

No Ordinary Shares were bought back in the year to 31 March 2022

(2021: 1,992,511 Ordinary Shares bought back). As at 31 March 2022,

and as at the date of this Annual Report, 1,992,511 Ordinary Shares

of 10p each are held in Treasury. Further information can be found

in Note 14 to the Financial Statements.

At the forthcoming AGM, the Board will seek the necessary

Shareholder authority to continue to conduct share buy-backs.

Statement of Compliance with Investment Policy

The Company is adhering to its stated investment policy and

managing the risks arising from it. This can be seen in various

tables and charts throughout this Annual Report, and from the

information provided in the Chairman's Statement and in the

Manager's Property and Equity Reports in the Annual Report.

The Board's Section 172 Duty and Stakeholder Engagement

The Directors recognise the importance of an effective Board and

its ability to discuss, review and make decisions to promote the

long-term success of the Company and protect the interests of its

key stakeholders. As required by Provision 5 of The AIC Code of

Corporate Governance (the AIC Code) (and in line with The UK

Corporate Governance Code (the Code)), the Board has discussed the

Directors' duty under Section 172 of the Companies Act and how the

interests of key stakeholders have been considered in the Board

discussions and decision making during the year. This has been

summarised in the table below:

Stakeholder Form of Engagement Influence on Board decision

making

Shareholders AGM - Shareholders are encouraged Dividend declarations - The

to attend the AGM and are provided Board recognises the importance

with the opportunity to ask questions of dividends to Shareholders

and engage with the Directors and takes this into consideration

and the Manager. Shareholders when making decisions to pay

are also encouraged to exercise quarterly and propose final

their right to vote on the resolutions dividends for each year. Further

proposed at the AGM (please refer details regarding dividends

to the Chairman's Statement in for the year under review can

the Annual Report). be found in the Chairman's

Shareholder documents - The Company Statement in the Annual Report.

reports formally to Shareholders Share buy-back policy - the

by publishing Annual and Interim Directors recognise the importance

Reports, normally in June and to Shareholders of the Company

November each year. maintaining a buy-back policy

Significant matters or reporting and considered this when establishing

obligations are disseminated the current programme. Further

to Shareholders by way of announcement details can be found in this

to the London Stock Exchange. Business Review in the Annual

The Company Secretary acts as Report and in the Directors'

a key point of contact for the Report in the Annual Report.

Board and all communications Shareholder communication and

received from Shareholders are feedback from the Broker feeds

circulated to the Board. directly into the Board's annual

Other Shareholder events include strategy review, the asset

investor and wealth manager lunches allocation considerations and

and roadshows organised by the the Manager's guidance on desirable

Company's Broker at which the investment characteristics.

Manager is invited to present.

-------------------------------------------- -----------------------------------------

Investee companies Quarterly Board Meetings - The The Manager worked closely

and assets Manager reports to the Board with all tenants during the

on the Company's investment portfolio COVID-19 pandemic, and, as

and the Directors challenge the a result,100% of all contracted

Manager where they feel it is rents due were collected in

appropriate. the year to 31 March 2022.

The Directors are aware that

the exercise of voting rights

is key to promoting good corporate

governance and, through the

Manager, ensures that the listed

companies are encouraged to

adopt best practice corporate

governance. The Board has delegated

the responsibility for monitoring

the listed companies to the

Manager and has given it discretion

to vote in respect of the Company's

holdings in the equity portfolio,

in a way that reflects the

concerns and key governance

matters discussed by the Board.

-------------------------------------------- -----------------------------------------

Manager Quarterly Board Meetings - The The Directors and the Manager

Manager attends every Board Meeting are cognisant of the Company's

and presents a detailed portfolio investment policy and the strategy

analysis and reports on key issues agreed by the Board, which

such as performance of the property the Manager has been tasked

and equities portfolios. with implementing, which has

resulted in a reduction in

the number of equity investments

and an increase in the number

of properties held in the portfolio.

The Board engages constructively

with the Manager to ensure

investments are consistent

with the agreed strategy and

investment policy.

-------------------------------------------- -----------------------------------------

Registrar Review meetings and control reports. The Directors review the performance

of all third party service

providers; this includes ensuring

compliance with GDPR.

-------------------------------------------- -----------------------------------------

Depositary Regular statements and control The Directors review the performance

and Custodian reports received, with all holdings of all third party providers,

and balances reconciled. including oversight of securing

the Company's assets.

-------------------------------------------- -----------------------------------------

Advisers The Company relies on the expert The Directors review the performance

audit, accounting and legal advice of all third party service

received from its Auditor, Administrator providers.

and Legal Advisers.

-------------------------------------------- -----------------------------------------

There were no key decisions made in the year to 31 March 2022

that require to be disclosed.

Employee, Environmental and Human Rights Policy

As an investment trust company, the Company has no direct

employee or environmental responsibilities, nor is it responsible

for the emission of greenhouse gases. Its principal responsibility

to Shareholders is to ensure that the investment portfolio is

properly managed and invested. The Company has no employees and,

accordingly, has no requirement to report separately on employment

matters.

Management of the investment portfolio is undertaken by the

Investment Manager through members of its portfolio management

team. In light of the nature of the Company's business, there are

no relevant human rights issues and, therefore, the Company does

not have a human rights policy.

Independent Auditor

The Company's Independent Auditor is required to report if there

are any material inconsistencies between the content of the

Strategic Report and the Financial Statements. The Independent

Auditor's Report can be found in the Annual Report.

Future Strategy

The Board and the Investment Manager intend to maintain the

strategic policies set out above for the year ending 31 March 2023

as it is believed that these are in the best interests of

Shareholders.

The Company's Viability Statement is included in the Annual

Report.

Approval

This Business Review, and the Strategic Report as a whole, was

approved by the Board of Directors and signed on its behalf by:

James Ferguson

Chairman

10 June 2022

Going Concern

The Group and the Parent Company's business activities, together

with the factors likely to affect their future development and

performance, are set out in the Directors' Report, and the

financial position of the Group and of the Parent Company is

described in the Chairman's Statement within the Strategic Report.

In addition, Note 21 to the Financial Statements includes: the

policies and processes for managing the financial risks; details of

the financial instruments; and the exposures to market price risk,

interest rate risk, liquidity risk, credit risk and price risk

sensitivity. The Directors believe that the Group and the Parent

Company are well placed to manage their business risks.

Following a detailed review, the Directors have a reasonable

expectation that the Group and the Parent Company have adequate

financial resources to enable them to continue in operational

existence for the foreseeable future, being at least 12 months from

approval of the Financial Statements, and accordingly, they have

continued to adopt the going concern basis (as set out in Note 1(b)

to the Financial Statements) when preparing the Annual Report and

Financial Statements.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with UK adopted

international accounting standards and applicable laws and

regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law, the Directors

are required to prepare the Group Financial Statements, and have

elected to prepare the Company Financial Statements, in accordance

with UK adopted international accounting standards. Under company

law, the Directors must not approve the Financial Statements unless

they are satisfied that they give a true and fair view of the state

of affairs of the Group and Company and of the profit or loss for

the Group and Company for that period.

In preparing these Financial Statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether they have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006, subject to any material

departures disclosed and explained in the Financial Statements;

-- state whether they have been prepared in accordance with UK

adopted international accounting standards, subject to any material

departures disclosed and explained in the Financial Statements;

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business; and

-- prepare a Directors' Report, a Strategic Report and

Directors' Remuneration Report which comply with the requirements

of the Companies Act 2006.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company

and, hence, for taking reasonable steps for the prevention and

detection of fraud and other irregularities.

The Directors are responsible for ensuring that the Annual

Report and Financial Statements, taken as a whole, is fair,

balanced and understandable and provides the information necessary

for Shareholders to assess the Group's position and performance,

business model and strategy.

The Directors are responsible for ensuring the Annual Report and

Financial Statements are made available on a website. Financial

Statements are published on the Company's web pages hosted by the

Investment Manager in accordance with legislation in the United

Kingdom governing the preparation and dissemination of financial

statements, which may vary from legislation in other jurisdictions.