TIDMVIN

RNS Number : 2866S

Value and Indexed Prop Inc Tst PLC

15 November 2021

VALUE AND INDEXED PROPERTY INCOME TRUST PLC

Unaudited Half-Yearly Financial Report

For the Six Months Ended 30 September 2021

Value and Indexed Property Income Trust PLC (VIP) is an

investment trust company listed on the London Stock Exchange. It

now invests mainly in direct UK commercial property, with some UK

property-backed securities, to deliver secure, long-term

index-linked income. Its performance benchmark changed on 1 April

2021 from the FTSE All Share Index to the MSCI UK Quarterly

Property Index.

GBP1,000 invested in Value and Income Trust PLC, now VIP, when

OLIM took over as Managers in 1986 had grown, with dividends

reinvested, to GBP27,117 at end September 2021. The total return

was 10.7% p.a., against 5.7% p.a. for the FTSE All Share Index,

where GBP1,000 would have grown to GBP7,130.

VIP's dividend per share has risen every year and grown tenfold

over the 35 years, while the Retail Price Index has trebled. The

medium term dividend policy is for increases at least in line with

inflation, underpinned by VIP's index-related property income.

Summary

30 September 2021 31 March 2021 30 September 2020

GBPm % GBPm % GBPm %

------------ ----- ----- ------- ------ --------- --------

UK Property 110.1 59.2 81.1 45.7 77.1 44.9

------------ ----- ----- ------- ------ --------- --------

UK Equities 30.3 16.3 28.6 16.1 83.2 48.4

------------ ----- ----- ------- ------ --------- --------

Cash 45.7 24.5 67.9 38.2 11.5 6.7

------------ ----- ----- ------- ------ --------- --------

186.1 100.0 177.6 100.0 171.8 100.0

------------ ----- ----- ------- ------ --------- --------

Over the six months ended 30 September 2021, VIP's share price

rose by 1.8% while the net asset value per share, valuing debt at

its market value, rose by 8.6%. VIP's independent property

revaluation showed a 10.5% total return over the six months against

7.6% for the MSCI Quarterly Property Index.

VIP pays dividends quarterly, around the end of January, April,

July and October. For VIP's year ending 31 March 2022, each of the

three interim dividend payments has been increased from 2.9p to

3.0p (+3.4%), with the final dividend to be announced, before

payment in late July 2022.

The first quarterly dividend of 3.0p per Ordinary Share was paid

on 29 October 2021 to all Shareholders on the register on 1 October

2021. The second quarterly dividend of 3.0p per Ordinary Share will

be paid on 28 January 2022 to those Shareholders on the register on

31 December 2021. The ex-dividend date will be 30 December 2021.

The third quarterly dividend of 3.0p per Ordinary Share will be

paid on 29 April 2022 to those Shareholders on the register on 1

April 2022. The ex-dividend date will be 31 March 2022. The Board

will announce in due course the proposed fourth and final payment

for the year which, subject to Shareholders' approval, will be paid

on or around 29 July 2022.

30 September 2021 31 March 2021 30 September 2020

-------------------------- ----------------- ------------- -----------------

Net asset value per share

(valuing debt at market) 278.82p 256.67p 226.47p

========================== ================= ============= =================

Net asset value per share

(valuing debt at par) 290.52p 271.10p 243.50p

========================== ================= ============= =================

Ordinary Share price 222.00p 218.00p 173.50p

========================== ================= ============= =================

Dividend per share 6.00p 12.30p 5.80p

(first and second (total) (first and second

interim) interim)

========================== ================= ============= =================

ENQUIRIES:

Louise Cleary

OLIM Property Limited, Investment Manager, Property

Tel: 020 7846 3252

Patrick Harrington

OLIM Property Limited, Investment Manager, Equities

Tel: 020 7846 3252

Website:

https://www.olimproperty.co.uk/value-and-indexed-property-income-trust.html

Investment Manager's Report

VIP's Property Portfolio

Savills' independent valuation at end September 2021 totalled

GBP110,050,000 with a running yield of 5.8% against GBP80,550,000

at end March 2021. Eight new properties were bought for

GBP22,480,000.

Capital values of the 31 properties held over the six months

rose in total by 8.1%. All sectors showed useful gains with

industrials up by 11.1%, supermarkets up by 8.0%, the two bowling

alleys by 9.9%, pubs by 3.8% and others by 8.1%, including the

caravan park by 11.2%.

Since the end of March, eight new freehold properties were

bought, totalling GBP22,480,000 at a net initial yield of 4.9%

after all costs. All have index-linked rent increases; three

industrials, two petrol filling stations, two hotels (one under

construction) and a supermarket. Their valuation at 30 September

totalled GBP23,000,000, which is 2.3% above their total purchase

costs including Stamp Duty Land Tax and agents' and legal fees.

This includes GBP1,000,000 for a site purchase for a new Premier

Inn development at Alnwick, where a further GBP6,000,000 will be

payable on expected completion due June 2022.

There have been nine rent increases over the half year and a

lease extension at Thirsk, plus 100% of the June to September rents

have been collected.

The total return on the portfolio, taking capital and income

together and deducting all costs, was 10.5% over the six months,

against 7.6% for the MSCI Quarterly Index.

We have been managing VIP's Property Portfolio since 1986 and

the performance record for full years is set out in the 2021

Interim Report.

Sale

Contracts were exchanged in September with completion fixed for

November 2021, for the sale of the pub at Thornton Cleveleys for

GBP950,000.

COVID-19 and Rent Collection

From end March to end September, 100% of all rents due were

collected.

Rent Reviews

There have been nine index-linked rent reviews since end March,

six with annual rent reviews delivering an average increase of 2.9%

and three with five yearly increases rising by 15.2% on

average.

The running yield on valuation was 5.8% at the end of September

(MSCI: 4.4%) against 6.4% at the end of March. There were no empty

properties, against an MSCI void rate of 9.7%. All 39 properties

and 40 tenancies are let on full repairing and insuring leases with

upwards only rent reviews and a weighted average unexpired lease

length of 13.8 years (if the tenants' break options are exercised),

with 65% of the income having leases with over 10 years to expiry

(33 out of 40 tenancies).

The Market

A Polarised Recovery Post Pandemic

UK commercial property capital values have, on average,

recovered their pandemic losses, and are now pushing ahead as the

economy rebounds from the crisis. Underlying rental growth has also

turned positive after falling for over a year. Capital values, as

measured by the MSCI Quarterly Index rose by 5.3% over the six

months to end September, to give a total return of 7.6%.

Industrial/warehouse property accounts for most of this gain with

alternative investments also improving, retail patchy and office

values still flat.

These averages mask highly divergent trends across different

property sub-sectors, reflecting fundamental structural changes in

work and spending patterns across the UK, which COVID has

highlighted and speeded up. The table included in the 2021 Interim

Report of capital value changes in the MSCI Quarterly Index from

the beginning of the pandemic at end March 2020 to the latest

figures for end September 2021, shows that the pattern of winners

and losers is stark.

Total commercial property transaction volumes halved from normal

levels in the first six months of the pandemic, with Central London

office sales and lettings both near their nadir in 2009, along with

shopping centres and high street retail. But the strongest sectors,

industrials and supermarkets, were hardly affected and are now

running well above pre-pandemic averages. Turnover and valuations

are now rising rapidly in retail warehousing, alternatives, hotels

and leisure. Offices present a very mixed picture, with long-let

and super prime stock hot and much older secondary stock virtually

unsaleable. Meanwhile, property void rates have risen from 8.2% to

9.6% (and 13.1% to 17.8% on offices) since March 2020.

Rental income was under pressure during the pandemic, from a

combination of tenants unable or unwilling to pay, defaults and

insolvencies, and rising void levels as tenants exercise break

clauses or vacate at lease expiry, or sign new leases at lower

rents in weaker sectors.

As a result, rents actually received on the properties

comprising the MSCI Quarterly Index have fallen by over 9% since

the start of the pandemic in March 2020, as the table in the 2021

Interim Report shows.

The Government has repeatedly suspended landlords' traditional

tools for enforcing rent collection - eviction orders, use of

Commercial Rent Arrears Recovery (CRAR) bailiffs and statutory

demands for winding up. The latest extension is until end March

2022, with no clarity on what will follow. With almost all

properties now open again and able to trade normally, there is no

longer any excuse for tenants not to pay their rent promptly and in

full; rent collection rates should therefore now be back to normal

on professionally managed institutional property portfolios.

Sector Prospects

Warehouse/Industrials - A Virtuous Circle of Rental and Capital

Growth

Warehouse and Industrial property has delivered most of

commercial property's capital growth over the past year for the

right reason: voracious occupier demand, especially from food and

online retailers driving up rents across the country for both "big

box" warehouses near motorways and smaller units on estates nearer

city centres. Valuation yields have come down to reflect improving

rental growth prospects, and this virtuous circle is far from

over.

Investment demand from mainstream institutions, specialist

funds, private equity and overseas investors has driven transaction

volumes in the first half of 2021 to double the five year average

for the whole industrial/ warehouse sector, despite the reluctance

of most potential sellers.

Even if rising costs and supply chain problems put pressure on

some weaker occupiers as economic growth slows over the next year,

industrial property values will still be supported by the

conversion of older and lower value sites to residential and other

alternative uses. Well-located industrial and warehouse property in

all sizes should continue to outperform the property market as a

whole for at least another year.

Offices - At the Foot of the Performance Charts

Offices are now bottom of the performance charts, not retail

property. As the gradual return to the office continues, there is

no sign of office rents or capital values in general rising.

Occasional headline-grabbing investment or letting deals for the

very best space are just a sign of a flight from quantity to

quality, with tenants usually downsizing at the same time, leaving

property owners with obsolescent or obsolete space which will cost

a fortune to upgrade.

Mid and back-office work is now done much more from home or

partly at low cost non-city centre locations. Cost reduction is

tenants' top priority, with break clauses exercised in most cases

and tenants demanding considerable capital expenditure from

landlords to renew leases even in part. Many London office

buildings, in particular, will not be economic to upgrade to the

necessary A-C Energy Performance Certificate ratings, so will

become unlettable. Functional obsolescence and depreciation will

therefore need to be factored more specifically into most office

valuations, leading to rises in average office valuation yields and

falls in capital values to reflect lower effective net rents and

greater

re-letting risk.

Retail - Off the Bottom Overall - Out of Town Buoyant, In Town

Improving if Rents Realistic

Many retailers in high streets and shopping centres were already

on their last legs before COVID; online retail sales market share

reached 36% in 2020, up from 20% a year before and only 14% five

years ago. The pandemic hit them hard in two ways: mainly by

getting older shoppers, in particular, used to the range and

convenience of shopping online, but also by encouraging a switch

from public transport and parking in congested city centres to the

relative ease of car-borne shopping out of town, especially where

well-run retail warehouse operators like B&Q, trade counters,

B&M and Home Bargains trade alongside the leading supermarkets.

Retail warehouse rents were under downward pressure

pre-pandemic, but have now stabilised and capital values are

growing rapidly - partly because many institutional investors have

missed the market in industrial property, want no more offices, and

have money which they are struggling to invest.

On the high street, the steepest falls in property values have

happened in "prime" Central London and other prime highly valued

cities and towns which are now unaffordable for both multiple and

individual retailers. Unfair business rates had already crippled

urban high streets in less prosperous parts of the UK, with

fundamental reform rejected in the latest Budget. Suburbs and

market towns with more affordable rents and an attractive mix of

convenience and independent traders are outperforming as shops

re-open and new retailers take space. Transaction volumes are

rising again for high street shops and shopping centres, but only

at double figure yields unless they offer compelling residential or

other alternative use values.

Supermarkets

Supermarkets and convenience stores (including petrol filling

stations) had a good crisis, often with increases of 20%-30% in

their turnover, part of which they have retained with more people

working on average nearer home. The market leaders are much better

at combining physical and online shopping than most non-food

retailers.

The bidding war for Morrisons, with their mainly freehold

portfolio, shows how highly private equity investors value UK

supermarkets' stable and sustainable cash flows. On-line

penetration remains far lower than in non-food retail, and many

consumers still prefer the choice and convenience of a nearby food

shop in a small or medium-sized store, where the Co-op is

particularly well placed, along with Aldi, Lidl, Sainsburys, Tesco

and M&S Food.

Non-Traditional Alternatives - Well-Funded Strong Survivors

Thrive

Property in the "Alternatives" sector - i.e., everything except

office, industrial or retail - has been growing rapidly in

importance for institutional investors in recent years and now

accounts for one-sixth of the MSCI Quarterly Property Index. It

covers a wide range of property types and tenants, often with long,

index-linked leases, so tenants' covenant strengths and ability to

pay are crucial.

COVID with its ever-changing lockdowns posed a once in a

lifetime challenge to alternative sector operators and investors.

Tenants with strong long-term business models and short-term crisis

management, working with investors who knew how and when to give

help and improve leases, have usually come out of COVID stronger

than before it struck. But their weaker multiple competitors, and

many private operators, have been savagely squeezed or forced out

of business altogether.

Alternatives - Leisure and Hotels - Record Non-City Centre

Trade

The leading pubcos, like Greene King and Wetherspoons, as well

as most traditional regional brewers, have strong balance sheets

with plenty of freehold assets and borrowing capacity. Profitable,

spacious pubs with outside space, have been trading well above

pre-pandemic levels outside Central London, and should, therefore,

be able to manage rising cost pressures. Pubs of this type in

suburban, smaller town and rural locations will be both short and

long-term winners, with more of their customers working nearer home

for part of the week for the foreseeable future.

Hotel values have also bottomed out. Modern hotels in prosperous

smaller towns and rural areas, serving British holidaymakers,

workers and businesses, are very well placed to grow their profits

and outperform large city centre and airport hotels dependent on

international business and travel. Zoom and ESG will kill first

class corporate frequent flying. Covenant strength will remain

crucial for investment value - for example, a Premier Inn is valued

well above a similar Travelodge, because long-term investors hate

CVA's (Company "Voluntary" Arrangements). Caravan parks have also

been outstanding COVID beneficiaries and will continue to

outperform.

Other Alternatives

Health and Fitness clubs are steadily rebuilding their

memberships. The leading brands on large out of town sites, with

good car parking and customers often able to work from home, offer

the best long-term investments. The two main ten pin bowling

companies are both also trading exceptionally well and offer a

sensibly priced family treat which cannot be replicated online.

Direct-let student accommodation investments on long leases to

well-established universities will continue to perform well, but

indirect student housing investments with nomination agreements or

third-party providers may not benefit from yield hardening for safe

long-let property.

COVID has hit care homes hard with costs rising and severe,

partly Brexit-related staff shortages. High quality homes with

self- funded residents will continue to outperform those dependent

on squeezed local authority budgets. Medical centres and private

hospitals will stay in demand as the NHS faces years of non-COVID

catch up and outsources more profitable work.

The Economy

The UK, like most developed Western economies, is on track to

recover to its pre- COVID level of national output by the end of

2021, but inflationary pressures and severe sectoral labour

shortages are generally worse here. It is now clear that the

pandemic struck at a particularly awkward time for Britain

post-Brexit, as our exporters and importers were still struggling

to adjust to new trading rules and restrictions, while many workers

from the EU left the country, with only a small fraction of them

now willing or able to return.

As furlough has just ended, it looks likely that a substantial

number of older workers, in particular, have dropped out of the

labour market permanently. Furloughed workers were heavily

concentrated at the end in the aviation, travel and live

entertainment industries, so there is a fundamental sectoral and

geographical mismatch with the jobs employers are desperate to

fill.

Shortages and sharply rising prices of energy, timber, car

components, commodities in general and other internationally traded

goods are to be expected in a rapidly recovering world economy, and

these markets should gradually return towards more normal levels

next year. But the danger for the UK is that employers aggressively

bidding up labour costs (with active encouragement from Government)

across a wide variety of stressed sectors, from lorry driving to

food picking and processing and from hospitality to care homes to

the NHS, will set off a wage-price spiral which may prove hard to

bring under control. Sharply rising food and fuel prices in the

short term may also hurt lower-paid employees who have not been

able to work from home as easily as people in better paid and white

collar jobs.

UK GDP has bounced back strongly in 2021, with the estimated

growth rate just revised up by the Office for Budget Responsibility

(OBR) and a strong boost from re-opening retail and leisure outlets

as Britons holidayed in this country. But business tax rises (N.I.

and Corporation Tax) and labour, energy and materials shortages are

clouding the outlook for profits. The employers' National Insurance

increase will cost businesses an extra GBP8bn a year, overtaking

corporation tax - and, unlike corporation tax, it has to be paid

whether a business is profitable or not. The recovery is clearly

slowing and UK GDP may be growing at less than 3% again by late

2022, and under 2% in 2023.

Price inflation is rising rapidly, with the annual rates of CPI

(+3.1%) and RPI (+4.9%) near ten-year highs and heading higher,

probably to over 6% for the R.P.I. this winter. The annual rate of

output price (factory gate) inflation has risen from -0.2% in

December to +6.7% in September, while input price (raw material)

inflation shot up from 0.9% to 11.4%, and the oil price has risen

by over 60%. The Bank of England, clearly, should now stop their

asset purchase programme, which has led to the Bank now owning

almost half of all gilts, reducing the effective maturity of UK

Government debt from 11 to 4 years. This is a very risky position

for a country whose government debt is now around 85% of GDP, and a

public sector annual deficit of 6.5% of GDP, with rising interest

payments on index-linked gilts putting further pressure on the

public finances.

UK domestic spending has been the main driver of economic

recovery in 2021, with savings exceptionally high in total

post-pandemic and housing market transactions and prices at record

levels. But real earnings are now under pressure at the lower end

of the income scale, from the GBP20 a week cut in Universal Credit

and rising energy and food bills, with higher National Insurance

payments to come in April. Even modest rises in mortgage interest

payments could seriously stretch some household budgets from late

2022.

Unless there are serious further outbreaks of COVID or

especially dangerous new variants, the world economy should

continue its strong recovery over the next year, under the lead of

the United States and China. Inflation is rising but generally

manageable across most of the developed world. International

interest rates have been kept artificially low by massive

Government bond buying programmes, but these are now tapering off

and both short and long term interest rates will rise. Commercial

property markets are benefitting as recovering world economies and

trade support tenant demand and rental growth. The risk will be if

Central Banks lose control and interest rates have to be raised too

far and too fast - but commercial property yields are generally so

far above interest rates, particularly in the UK, that property has

a healthy margin of safety before that should become a serious

concern.

Conclusion - Index-Linked Income as the Holy Grail

UK commercial property values stabilised in late 2020 and have

been rising with the recovering economy in 2021. Industrials will

be the star performer, and the office sector will struggle. Retail

values have now bottomed out, with gains for supermarkets,

convenience stores and retail warehouses outweighing slowing rates

of decline in shopping centres and high street shops. The

alternative sectors are also on the up, with pubs, hotels, bowling,

health and fitness and caravan parks benefitting strongly outside

London from "staycations" and working from home. Healthcare and

nursing home investments will stay in demand despite their staffing

problems. The commercial property market in 2022, with slowing

growth and rising interest rates, looks likely to deliver lower but

still satisfactory average real returns with industrials and

alternatives still leading the way and offices bringing up the

rear.

The last year and a half has taught UK property investors a

stark lesson: stick to properties let at affordable rents to strong

tenants on long, preferably index-linked, leases. Safe, long-term

indexed income is now being valued ever more highly in a yield-

hungry world of slashed equity dividends, negative real interest

rates and rising costs and prices. Avoid offices and in-town retail

and stay safely on the right side of structural change. The

direction of travel for UK interest rates and price and wage

inflation is clearly upwards, with no destination yet in sight.

UK Equities

Portfolio

The first six months of VIP's financial year saw sales of

non-property backed equities of GBP22.7m and purchases of GBP22.8m,

completing the reorganisation of the equity portfolio. The direct

equity portfolio is now valued at just over GBP30m in 10

investments.

New investment has been focused on industrial property with new

holdings in Tritax Big Box REIT, Urban Logistics REIT and Warehouse

REIT, plus a new holding in Tesco and an increased holding in Wm

Morrison Supermarkets, prior to the initial bid approach.

Elsewhere, new holdings have been made in Real Estate Credit

Investments, which advances loans secured on property, Residential

Secure Income REIT, which operates in the retirement housing and

the shared ownership sector, and PRS REIT, which has a portfolio of

over 5,000 private rented homes. The holding in Legal & General

is being retained as it is a significant property investor with a

high and growing yield.

Performance

VIP's remaining equity portfolio outperformed the FTSE All Share

Index during the reporting period. Adjusted for the sizeable

disposals and reinvestments made over the period, the portfolio

recorded a total return of 9.2% compared to the 8.0% achieved by

the FTSE All Share Index. The performance was helped by the

portfolio orientation towards industrial property, which has been

the strongest part of the commercial property market. However, the

largest single contributor to performance was Wm Morrison

Supermarkets which rose 61% over the six months after it became the

subject of a takeover battle between two US private equity houses.

Civitas Social Housing was a disappointing performer when directors

were shown to have undisclosed shareholdings in the company's

tenants. The shares have, therefore, been sold because of poor

governance.

The Market

The first six months of VIP's financial year has seen world

stock markets continue their recovery as economies have bounced

back from their lockdown-inspired recessions. The UK stock market,

as measured by the FTSE All Share Index rose by 5.9% and delivered

a total return of 8.0%, although the UK market continued to lag the

stronger returns seen elsewhere in the world, particularly in the

US. Nonetheless, the relative value in the UK stock market has been

demonstrated by a number of high-profile takeover bids.

Property backed equities have generally performed well,

especially REITs and investment companies focused on industrial

property, where strong occupational and investment demand is

driving rents and capital values higher.

Investment Manager

OLIM Property Limited

12 November 2021

Interim Board Report

Management and Administration of VIP

Value and Indexed Property Income Services Limited (VIS), a

wholly owned subsidiary of the Company, is the Company's

Alternative Investment Fund Manager (AIFM). As AIFM, VIS has

responsibility for the overall portfolio management and risk

management of the assets of the Company. VIS has delegated its

portfolio management responsibilities for the property and equity

portfolios to OLIM Property Limited (OLIMP) (the Investment

Manager). The delegation by VIS of its portfolio management

responsibilities is in accordance with the delegation requirements

of the Alternative Investment Fund Managers Directive (AIFMD). The

Investment Manager remains subject to the supervision and direction

of VIS. The Investment Manager is responsible to VIS and ultimately

to the Company in regard to the management of the investment of the

assets of the Company in accordance with the Company's investment

objective and policy. VIS has a risk committee which reviews the

effectiveness of the Company's internal controls and risk

management systems and procedures and identifies, measures, manages

and monitors the risks identified as affecting the Company's

business.

BNP Paribas Securities Services is the Company's Depositary and

oversees the Company's custody and cash arrangements.

Principal and Emerging Risks and Uncertainties

The Board carries out a regular review and robust assessment of

the principal and emerging risks facing the Group, including those

that would threaten its business model, future performance,

solvency or liquidity. These principal and emerging risks and

uncertainties are set out in full in the Strategic Report within

the 2021 Annual Report, and are considered equally applicable to

the second half of the financial year as for the period under

review.

Climate Change and Social Responsibility Risk

The Board recognises that climate change is an important

emerging risk that all companies should take into consideration

within their strategic planning. However, the Company has little

direct impact on environmental issues. As an investment trust

company, the Company has no direct employee or environmental

responsibilities. The Board is aware that the Manager continues to

take into account environmental, social and governance matters when

considering investment proposals.

Other Risks

The Directors are cognisant of the continuing impact of the

coronavirus (COVID-19) pandemic and the implications for the

activities of the Manager and on the performance of investee

companies and assets.

While VIP's property portfolio is sufficiently robust to

withstand the current market impacts of the pandemic, there is a

risk that property values may fall and tenants may struggle to pay

rent. If this happens, there is a risk that loan to value and

interest cover covenants could be breached. If this were to occur,

VIP has sufficient cash and liquid equity investments to cover any

loan repayments triggered by covenant breaches.

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

-- the condensed set of Financial Statements within the

Half-Yearly Financial Report has been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting';

and

-- the Interim Report includes a true and fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's Disclosure,

Guidance and Transparency Rules.

For and on behalf of the Board of Value and Indexed Property

Income Trust PLC

James Ferguson

Chairman

12 November 2021

Group Statement of Comprehensive Income

For the 6 months ended 30 September 2021

6 months ended 6 months ended Year ended

30 September 2021 30 September 2020 31 March 2021

(Unaudited) (Unaudited) (Audited)

Notes Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

INCOME

Rental income 2 3,133 - 3,133 2,239 - 2,239 5,359 - 5,359

Investment income 2 1,096 - 1,096 2,376 - 2,376 3,414 - 3,414

Other income 2 - - - 107 - 107 159 - 159

=========== ---------- -------------------- ------- --------- -------- ------- ------- -------

4,229 - 4,229 4,722 - 4,722 8,932 - 8,932

GAINS AND LOSSES

ON INVESTMENTS

Realised

gains/(losses)

on held-

at-fair-value

investments and

investment )

properties - 7,280 7,280 - (3,008 (3,008 ) - 8,588 8,588

Unrealised gains

on held-at-fair-

value investments

and investment

properties - 1,465 1,465 - 272 272 - 1,185 1,185

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

TOTAL INCOME 4,229 8,745 12,974 4,722 (2,736 1,986 8,932 9,773 18,705

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

EXPENSES

Investment

management

fees (529) - (529) (148) (345) (493) (301) (702) (1,003)

Other operating

expenses (526) - (526) (394) - (394) (771) - (771)

FINANCE COSTS (1,513) - (1,513) (2,537) - (2,537) (5,084) - (5,084)

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

TOTAL EXPENSES (2,568) - (2,568) (3,079) (345) (3,424) (6,156) (702) (6,858)

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

PROFIT/(LOSS)

BEFORE

TAXATION 1,661 8,745 10,406 1,643 (3,081) (1,438 ) 2,776 9,071 11,847

TAXATION (200) 1,083 883 (153) 66 (87) (359) 1,132 773

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

PROFIT/(LOSS)

ATTRIBUTABLE TO )

EQUITY

SHAREHOLDERS

OF PARENT COMPANY 1,461 9,828 11,289 1,490 (3,015 (1,525 ) 2,417 10,203 12,620

----------- ---------- -------------------- ------- --------- -------- ------- ------- -------

EARNINGS PER

ORDINARY

SHARE )

(Pence) 3 3.35 22.57 25.92 3.27 (6.61 (3.34 ) 5.35 22.56 27.91

The total column of this statement represents the Statement of

Comprehensive Income of the Group, prepared in accordance with

IFRS. The revenue return and capital return columns are

supplementary to this and are prepared under guidance issued by the

Association of Investment Companies. All items in the above

statement derive from continuing operations.

All income is attributable to the equity holders of Value and

Indexed Property Income Trust PLC, the parent company. There are no

minority interests.

The Board has declared a first quarterly dividend of 3.00p per

share (2021 - 2.90p), which was paid on 29 October 2021 to all

Shareholders on the register on 1 October 2021 (ex-dividend date 30

September 2021). A second quarterly dividend of 3.00p per share

(2021 - 2.90p) will be paid on 28 January 2022 to those

Shareholders on the register on 31 December 2021, with an

ex-dividend date of 30 December 2021. The third quarterly dividend

of 3.00p (2021 - 2.90p) will be paid on 29 April 2022 to those

Shareholders on the register on 1 April 2022. The ex-dividend date

will be 31 March 2022.

The Notes form part of these Financial Statements.

Group Statement of Financial Position

For the 6 months ended 30 September 2021

As at As at As at

30 September

2021 31 March 2021 30 September 2020

(Unaudited) (Audited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ASSETS Notes

NON CURRENT ASSETS

Investment properties 110,085 81,132 77,076

Investments held at

fair value through

profit or loss 30,304 28,581 83,239

8 140,389 109,713 160,315

Deferred tax asset 2,141 1,258 398

Receivables 2,695 2,017 -

145,225 112,988 160,713

CURRENT ASSETS

Cash and cash equivalents 42,665 65,965 26,928

Receivables 1,140 972 744

--------- ---------- ------------

43,805 66,937 27,672

TOTAL ASSETS 189,030 179,925 188,385

CURRENT LIABILITIES

Debenture stock - - (15,000)

Payables (2,898) (2,318) (1,590)

------------

(2,898) (2,318) (16,590)

TOTAL ASSETS LESS CURRENT

LIABILITIES 186,132 177,607 171,795

NON-CURRENT LIABILITIES

Payables (2,890) (2,862) (4,234)

Borrowings (56,701) (56,662) (56,649)

(59,591) (59,524) (60,883)

--------- --------- --------------

NET ASSETS 126,541 118,083 110,912

--------- --------- --------------

EQUITY ATTRIBUTABLE TO EQUITY SHAREHOLDERS

Called up share capital 4,555 4,555 4,555

Share premium 18,446 18,446 18,446

Retained earnings 6 103,540 95,082 87,911

--------- --------- --------------

TOTAL EQUITY 126,541 118,083 110,912

--------- --------- --------------

NET ASSET VALUE PER ORDINARY

SHARE (Pence) 290.52p 271.10p 243.50p

These Financial Statements were approved by the Board on 12

November 2021 and signed on its behalf by James Ferguson,

Chairman.

The Notes form part of these Financial Statements.

Group Statement of Changes in Equity

For the 6 months ended 30 September 2021

6 months ended 30 September 2021

(Unaudited)

Share Retained

Share capital premium earnings Total

Notes GBP'000 GBP'000 GBP'000 GBP'000

Net assets at 31 March

2021 4,555 18,446 95,082 118,083

Profit for the period - - 11,289 11,289

Dividends paid 4 - - (2,831) (2,831)

------------------------ -------------------- --------------------- -------------

Net assets at 30

September

2021 4,555 18,446 103,540 126,541

------------------------ -------------------- --------------------- -------------

Year ended 31 March 2021 (Audited)

Net assets at 31 March

2020 4,555 18,446 92,306 115,307

Profit for the period - - 12,620 12,620

Dividends paid 4 - - (5,512) (5,512)

Buyback of Ordinary

Shares

for Treasury - - (4,332) (4,332)

------------------------ -------------------- --------------------- -------------

Net assets at 31 March

2021 4,555 18,446 95,082 118,083

------------------------ -------------------- --------------------- -------------

6 months ended 30 September 2020 (Unaudited)

Net assets at 31 March

2020 4,555 18,446 92,306 115,307

Loss for the period - - (1,525) (1,525)

Dividends paid 4 - - (2,870) (2,870)

------------------------ -------------------- --------------------- -------------

Net assets at 30

September

2020 4,555 18,446 87,911 110,912

------------------------ -------------------- --------------------- -------------

The Notes part of these Financial Statements.

Group Statement of Cash Flows

For the 6 months ended 30 September 2021

6 months ended 6 months ended Year ended

30 September

2021 30 September 2020 31 March 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

CASH FLOWS FROM OPERATING

ACTIVITIES

Rental income received 2,089 2,219 5,218

Dividend income received 1,320 2,420 3,486

Interest received 2 43 244

Operating expenses

paid (1,182) (843) (1,673)

NET CASH INFLOW FROM

OPERATING ACTIVITIES 2,229 3,839 7,275

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of investments

held at fair value

through profit or loss (21,224) (4,500) (4,500)

Purchase of investment

properties (22,492) (6,209) (17,553)

Sale of investments

held at fair value

through profit or loss 22,681 12,874 79,584

Sale of investment

properties - - 4,725

------------- ----------- ----------

NET CASH (OUTFLOW)/INFLOW

FROM INVESTING

ACTIVITIES (21,035) 2,165 62,256

CASH FLOW FROM FINANCING

ACTIVITIES

Repayment of debenture

stock - - (15,000)

Fees paid relating

to loans (18) (4) (4)

Interest paid on loans (1,602) (2,527) (4,938)

Finance cost of leases (39) (95) (191)

Payments of lease

liabilities (4) (8) (17)

Dividends paid (2,831) (2,870) (5,512)

Buyback of Ordinary

Shares for Treasury - - (4,332)

NET CASH OUTFLOW FROM

FINANCING ACTIVITIES (4,494) (5,504) (29,994)

NET (DECREASE)/INCREASE

IN CASH AND CASH

EQUIVALENTS (23,300) 500 39,537

Cash and cash equivalents

at the start of the

period 65,965 26,428 26,428

----------- ----------------- ---------

CASH AND CASH

EQUIVALENTS

AT THE OF THE

PERIOD 42,665 26,928 65,965

----------- ----------------- ---------

The Notes form part of these Financial Statements.

Notes to the Financial Statements

1 Accounting policies

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs) which comprise

standards and interpretations approved by the International

Accounting Standards Board (IASB) together with interpretations of

the International Accounting Standards and Standing Interpretations

Committee approved by the International Accounting Standards

Committee (IASC) that remain in effect, and to the extent that they

have been adopted by the European Union.

The functional and presentational currency of the Group is

pounds sterling because that is the currency of the primary

economic environment in which the Group operates. The Financial

Statements and the accompanying notes are presented in pounds

sterling and rounded to the nearest thousand pounds except where

otherwise indicated.

(a) Basis of preparation

The Financial Statements have been prepared on a going concern

basis and on the historical cost basis, except for the revaluation

of certain financial assets. Where presentational guidance set out

in the Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' (the SORP)

issued by the Association of Investment Companies (AIC) in April

2021 is consistent with the requirements of IFRSs, the Directors

have sought to prepare the Financial Statements on a basis

compliant with the recommendations of the SORP.

The Board has considered the requirements of IFRS 8, 'Operating

Segments'. The Board is charged with setting the Group's investment

strategy. The Board has delegated the day to day implementation of

this strategy to the Investment Manager but the Board retains

responsibility to ensure that adequate resources of the Group are

directed in accordance with its decisions. The Board is of the view

that the Group is engaged in a single segment of business, being

investments in UK commercial properties and UK quoted equities. The

view that the Group is engaged in a single segment of business is

based on the fact that one of the key financial indicators received

and reviewed by the Board is the total return from the investment

portfolio taken as a whole. A review of the investment portfolio is

included in the Investment Manager's Report.

All expenses and finance costs are accounted for on an accruals

basis. Expenses are presented as capital where a connection with

the maintenance or enhancement of the value of investments can be

demonstrated. In this respect and in accordance with the SORP, the

investment management fees are allocated 100% to income, in line

with the general practice of property companies.

The Group's Financial Statements have been prepared using the

same accounting policies as those applied for the Financial

Statements for the year ended 31 March 2021 which received an

unqualified audit report.

(b) Going concern

The Group's business activities, together with the factors

likely to affect its future development and performance, are set

out in the Interim Report. The financial position of the Group as

at 30 September 2021 is shown in the Statement of Financial

Position. The cash flows of the Group for the half year to 30

September 2021, which are not untypical, are set out in the

Statement of Cash Flows. The Group had fixed debt totalling

GBP56,701,000 as at 30 September 2021; none of the borrowings is

repayable before 2026. As at 30 September 2021, the Group's total

assets less current liabilities exceeded its total non current

liabilities by a factor of over 3.

The assets of the Group consist mainly of investment properties

and securities that are held in accordance with the Group's

investment policy, as set out in the Interim Report. Most of these

securities are readily realisable, even in volatile markets. The

Directors, who have reviewed carefully the Group's forecasts for

the coming year and having taken into account the liquidity of the

Group's investment portfolio and the Group's financial position in

respect of cash flows, borrowing facilities and investment

commitments (of which there is none of significance, apart from a

GBP6 million payment due on completion of the Alnwick hotel

development), are not aware of any material uncertainties that may

cast significant doubt upon the Group's ability to continue as a

going concern. Accordingly, the Directors believe that it is

appropriate to continue to adopt the going concern basis in

preparing the Group's Financial Statements.

(c) Basis of consolidation

The consolidated Financial Statements incorporate the Financial

Statements of the Company and the entity controlled by the Company

(its subsidiary). An investor controls an investee when it is

exposed, or has rights, to variable returns from its involvement

with the investee and has ability to affect those returns through

its power over the investee. The Company consolidates the investee

that it controls. All intra-group transactions, balances, income

and expenses are eliminated on consolidation.

Value and Indexed Property Income Services Limited is a private

limited company incorporated in Scotland under company number

SC467598. It is a wholly owned subsidiary of the Company and has

been appointed to act as the Alternative Investment Fund Manager of

the Company.

(d) Presentation of Statement of Comprehensive Income

In order to reflect better the activities of an investment trust

company and in accordance with guidance issued by the AIC,

supplementary information which analyses the Statement of

Comprehensive Income between items of a revenue and capital nature

has been presented alongside the Statement of Comprehensive Income.

In accordance with the Company's Articles, net capital returns may

be distributed by way of dividend.

(e) Dividends payable

Interim dividends are recognised as a liability in the period in

which they are paid as no further approval is required in respect

of such dividends. Final dividends are recognised as a liability

only after they have been approved by Shareholders in general

meeting.

(f) Investments

Equity investments

All equity investments are classified on the basis of their

contractual cash flow characteristics and the Group's business

model for managing its assets. The business model, which is the

determining feature, is such that the portfolio of equity

investments is managed, and performance is evaluated, on the basis

of fair value. Consequently, all equity investments are measured at

fair value through profit or loss.

For listed investments, fair value through profit or loss is

deemed to be bid market prices or closing prices for SETS stocks

sourced from the London Stock Exchange. SETS is the London Stock

Exchange electronic trading service covering most of the market

including all FTSE 100 constituents and most liquid FTSE 250

constituents along with some other securities. Gains and losses

arising from changes in fair value are included in net profit or

loss for the period as a capital item in the Statement of

Comprehensive Income and are ultimately recognised in the retained

earnings.

Investment properties

Investment properties are initially recognised at cost, being

the fair value of consideration given, including transaction costs

associated with the investment property. Any subsequent capital

expenditure incurred in improving investment properties is

capitalised in the period incurred and included within the book

cost of the property.

After initial recognition, investment properties are measured at

fair value. Gains and losses arising from changes in fair value are

included in net profit or loss for the period as a capital item in

the Statement of Comprehensive Income and are ultimately recognised

in retained earnings.

The Group leases out all of its properties on operating leases.

A property held under an operating lease is classified and

accounted for as an investment property where the Group holds it to

earn rental, capital appreciation or both. Any such property leased

under an operating lease is carried at fair value. Fair value is

established by half-yearly professional valuation on an open market

basis by Savills (UK) Limited, Chartered Surveyors and Valuers, and

in accordance with the RICS Valuation - Global Standards January

2020 (the 'RICS Red Book'). The determination of fair value by

Savills is supported by market evidence.

Leases

The Group leases properties that meet the definition of

investment property. These right-of-use assets are presented as

part of Investment Properties in the Statement of Financial

Position and held at fair value.

2 Income

6 months ended 6 months ended

30 September 30 September Year ended

2021 2020 31 March 2021

GBP'000 GBP'000 GBP'000

Investment income

Dividends from listed investments

in UK 1,096 2,376 3,414

Other operating income

Rental income 3,133 2,239 5,359

Interest receivable on short term

deposits - 107 159

-------------- -------------- --------------

Total income 4,229 4,722 8,932

-------------- -------------- --------------

3 Return per Ordinary Share

6 months ended 6 months ended

30 September 30 September Year ended

2021 2020 31 March 2021

GBP'000 GBP'000 GBP'000

The return per Ordinary Share is based on

the following figures:

Revenue return 1,461 1,490 2,417

Capital return 9,828 (3,015) 10,203

Weighted average Ordinary Shares

in issue 43,557,464 45,549,975 45,216,413

Return per share - revenue 3.35p 3.27p 5.35p

Return per share - capital 22.57p (6.61p) 22.56p

-------------- -------------- --------------

Total return per share 25.92p (3.34p) 27.91p

-------------- -------------- --------------

4 Dividends paid

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Dividends on Ordinary Shares:

Third quarterly dividend of 2.90p

per share

(2021 - 2.90p) paid 30 April 2021 1,263 1,321 1,321

Final dividend of 3.60p per share

(2021 - Fourth quarterly 3.40p)

paid 30 July 2021 1,568 1,549 1,549

First quarterly dividend of 2.90p

per share paid

30 October 2020 * - - 1,321

Second quarterly dividend of 2.90p

per share paid

29 January 2021 * - - 1,321

-------------- -------------- ----------

Dividends paid in the period 2,831 2,870 5,512

-------------- -------------- ----------

* First and second quarterly dividends for the year to 31 March

2022 have been declared with pay dates falling after 30 September

2021. These have not been included as liabilities in these

Financial Statements. See Note 5.

5 Interim dividend

The Directors have declared a first quarterly dividend of 3.00p

per Ordinary Share, paid on 29 October 2021 to Shareholders

registered on 1 October 2021, with an ex dividend date of 30

September 2021 (2021 - 2.90p). A second interim dividend of 3.00p

per share will be paid on 28 January 2022 to Shareholders

registered on 31 December 2021, with an ex dividend date of 30

December 2021 (2021 - 2.90p).

The third quarterly dividend of 3.00p (2021 - 2.90p) will be

paid on 29 April 2022 to those Shareholders on the register on 1

April 2022. The ex-dividend date will be 31 March 2022.

6 Retained earnings

Revenue Capital Total

GBP'000 GBP'000 GBP'000

The table below shows the movement in retained

earnings analysed between revenue and capital items.

At 31 March 2021 96 94,986 95,082

Movement during the period:-

Profit for the period 1,461 9,828 11,289

Dividends paid (see Note 4) (2,831) - (2,831 )

-------- --------- --------

At 30 September 2021 (1,274 ) 104,814 103,540

-------- --------- --------

7 Transaction costs

During the period, expenses were incurred in acquiring and

disposing of investments classified as fair value through profit or

loss. These have been expensed through capital and are included

within gains and losses on investments in the Statement of

Comprehensive Income.

The total costs are as follows:-

6 months ended

6 months ended 30 September Year ended

30 September 2021 2020 31 March 2021

GBP'000 GBP'000 GBP'000

Purchases 84 27 27

Sales 23 13 75

------------------ -------------- --------------

107 40 10

------------------ -------------- --------------

8 Fair value hierarchy disclosures

The table below sets out fair value measurements using the IFRS

13 Fair Value hierarchy:-

At 30 September 2021 (unaudited) Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 30,304 - - 30,304

Investment properties - - 110,085 110,085

--------- --------- --------- ---------

30,304 - 110,085 140,389

Borrowings - (61,795) - (61,795)

--------- --------- --------- ---------

30,304 (61,795) 110,085 78,594

--------- --------- --------- ---------

At 31 March 2021 (audited) Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 28,581 - - 28,581

Investment properties - - 81,132 81,132

--------- --------- --------- ---------

28,581 - 81,132 109,713

Borrowings - (62,652) - (62,652)

--------- --------- --------- ---------

28,581 (62,652) 81,132 47,061

--------- --------- --------- ---------

At 30 September 2020 (unaudited) Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Equity investments 83,239 - - 83,239

Investment properties - - 77,076 77,076

--------- --------- --------- ---------

83,239 - 77,076 160,315

Borrowings - (79,757) - (79,757)

--------- --------- --------- ---------

83,239 (79,757) 77,076 80,558

--------- --------- --------- ---------

Fair value categorisation within the hierarchy has been

determined on the basis of the degree to which the inputs to the

fair value measurements are observable and the significance of the

inputs to the fair value measurement in its entirety as

follows:-

Level 1 - inputs are unadjusted quoted prices in an active

market for identical assets

Level 2 - inputs, not being quoted prices, are observable,

either directly (i.e. as prices) or indirectly (i.e. derived from

prices)

Level 3 - inputs are not observable

The fair value of the debenture is determined by comparison with

the fair values of equivalent gilt edged securities, discounted to

reflect the differing levels of credit worthiness of the borrowers.

The fair values of the loans are determined by a discounted cash

flow calculation based on the appropriate inter-bank rate plus the

margin per the loan agreement. These instruments are therefore

considered to be Level 2 as defined above. There were no transfers

between Levels during the period. All other assets and liabilities

of the Group are included in the Balance Sheet at fair value.

9 Relationship with the Investment Manager and other Related Parties

Matthew Oakeshott is a Director of OLIM Property Limited which

has an agreement with the Group to provide investment management

services.

OLIM Property Limited receive an investment management fee of

0.60% of the capital assets that it manages.

The investment management agreement with OLIM Limited ceased

with effect from 28 February 2021 and responsibility of the equity

portfolio moved to OLIM Property Limited. OLIM Limited received an

investment management fee of GBPnil (half year to 30 September

2020: GBP292,000 and year to 31 March 2021: GBP524,000).

OLIM Property Limited received an investment management fee of

GBP529,000 (half year to 30 September 2020: GBP201,000 and year to

31 March 2021: GBP479,000). At the period end, the balance owed by

the Group to OLIM Property Limited was GBP97,000 (31 March 2021:

GBP84,000) comprising management fees for the month of September

2021, subsequently paid in October 2021.

Value and Indexed Property Income Services Limited is a wholly

owned subsidiary of Value and Indexed Property Income Trust PLC and

all costs and expenses are borne by Value and Indexed Property

Income Trust PLC. Value and Indexed Property Income Services

Limited has not traded during the period.

10 Half Yearly Report

The financial information contained in this Half Yearly

Financial Report does not constitute statutory accounts as defined

in sections 434 - 436 of the Companies Act 2006. The financial

information for the six months ended 30 September 2021 and 30

September 2020 has not been audited.

The information for the year ended 31 March 2021 has been

extracted and abridged from the latest published audited Financial

Statements and do not constitute the statutory accounts for that

year. Those Financial Statements have been filed with the Registrar

of Companies and included the Report of the Independent Auditor,

which contained no qualification or statement under section 498 of

the Companies Act 2006.

This Half-Yearly Report was approved by the Board on 12 November

2021.

Other information

A full copy of the 2021 Interim Report and Financial Statements

will be printed and issued to Shareholders. In due course, a copy

will be available on the Company's website at:

https://www.olimproperty.co.uk/value-and-indexed-property-income-trust.html

.

Neither the content of the Company's website nor the contents of

any website accessible from hyperlinks on the Company's website (or

any other website) is incorporated into, or forms part of, this

announcement.

The 2021 Interim Report and Financial Statements will be

submitted to the National Storage Mechanism and will be available

for inspection at:

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism.

By order of the Board

Maven Capital Partners UK LLP

Company Secretary

0141 306 7400

12 November 2021

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLRLRLFLIL

(END) Dow Jones Newswires

November 15, 2021 02:00 ET (07:00 GMT)

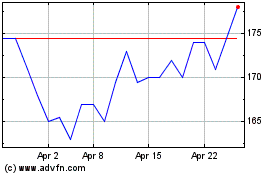

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From Apr 2023 to Apr 2024