TIDMVCP

RNS Number : 8175C

Victoria PLC

23 June 2021

For Immediate Release

23 June 2021

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Victoria PLC

('Victoria' or the 'Group')

Acquisition of Cali Bamboo Holdings Inc.

North America Distribution Expansion

Victoria PLC, (LSE: VCP) the international designers,

manufacturers and distributors of innovative flooring, is delighted

to announce the further expansion of its existing North American

distribution business with the acquisition of Cali Bamboo Holdings

Inc. ("Cali").

Cali is an exceptionally high-growth US-based business that has

achieved an organic CAGR of 17% for the past five years via its

online B2C customer acquisition model, data-driven analytics, a

high-touch consultative sales team, and direct delivery capability,

alongside B2B channels.

Key terms of the Acquisition

-- For the 12 months ended 30 April 2021, Cali generated

unaudited total revenues of US$171.6 million (GBP124.3m(1) ) (Y/E

31 December 2020: US$151.1m) and normalised EBITDA of US$13.8

million (GBP10.0m(1) ) (2020: US$11.7m).

-- Total consideration paid was US$76.1 million (GBP55.1m(1) )

and was funded entirely from the Group's cash balances. In

addition, Cali had approximately US$27.8 million (GBP20.1m(1) ) of

net debt, which was repaid on completion.

-- Victoria's leverage remains in line with our stated financial policy.

The acquisition of Cali will be immediately

earnings-accretive.

Strategic rationale for the Acquisition

The integration of Cali with Victoria's existing business will

create opportunities for value-creating revenue synergies by

expanding Victoria's US distribution, where the Group currently

sells c. US$33 million of flooring each year.

However, very significantly, the acquisition also gives Victoria

access to the intellectual property and online management

experience of Cali, which the Group will leverage to partner with

its key retailers to accelerate growth in its existing UK,

European, and Australasian markets .

Established in 2004, Cali is a multi-channel US flooring

distributor with 49.5% of revenue from direct to consumer and

direct to contractor channels driven by the Cali website, 29.0% of

revenue from speciality retailers (B2B), and 21.5% of revenue from

consumers via national home centres. This direct customer access,

combined with Cali's bespoke data analytics capabilities, enables

informed decisions about new products and channel-specific

marketing initiatives that allows Cali to constantly tune its

channel and product mix to better address ever changing customer

needs. The result has been consistent revenue and profitability

growth in excess of industry averages and across economic

cycles.

There are several distinct aspects to Cali's business model that

gives Victoria's board confidence that a high growth rate can be

maintained:

-- Cali's fast growing direct to consumer/contractor business is

highly profitable on a first order basis and increasingly benefits

from a growing mix of repeat professional customers (today 47% of

contractor/professional sales are repeat orders up from 28% in

2017). Unit economic measures like LTV / CAC (LifeTime Value /

Customer Acquisition Cost) and fully costed ROAS (Return On Average

Sale) are very attractive on an absolute basis and well above

industry benchmarks from other D2C verticals.

-- For the past 3 year's Cali's direct to consumer/contractor

channel has benefitted from consistent increases in average order

value and customer lifetime value alongside declining CAC. This

highlights Cali's "headroom" to efficiently increase advertising

spend to accelerate growth. Victoria plans to make use of Cali's

high cash conversion and continue investing aggressively in digital

marketing channels to further accelerate profitable growth and

continue to build out its e-commerce capabilities.

-- The Cali lifestyle brand and sustainability-themed product

portfolio resonates in particular with Millennials, the largest US

demographic, now entering their peak home-buying years (38% of home

sales in 2019 were to Millennials). The business's brand and

genuine customer care appeals to this large group of customers as

evidenced by a Net Promotor Score of 81 - higher than many leading

brands, including Amazon, Starbucks, Netflix, and Sony. (Source:

Customer Guru)

-- 51.9% of Cali's revenues are in the US's highest growth

flooring product category of LVT/LVP (Luxury Vinyl Tile/Luxury

Vinyl Plank), with the balance consisting of engineered hardwoods,

composite decking, and other items.

-- Cali has coverage across the US, which is a c. US$29 billion

flooring market (Freedonia) . Online sales, which are still only 4%

of the total residential market, are growing at 11% per annum (

Flooring Weekly) and we believe Cali's historical investment into

performance marketing knowhow and fulfilment infrastructure makes

them well positioned to capture a substantial portion of the

flooring market as online penetration increases.

Like all companies acquired by Victoria, Cali will continue to

operate with a high degree of autonomy under experienced and

committed managers, led by CEO Renee Thomas Jacobs, whilst

benefiting from access to an even wider range of products to

support its rapid growth.

The Acquisition of Cali is another step in Victoria's strategy

of growing its business with earnings accretive acquisitions, and

then using available synergies to drive further increases in margin

and revenue across the Group. The Board believes that Cali presents

an excellent strategic fit with Victoria's existing business and

will have strong long term growth prospects as part of the

Group.

Philippe Hamers, Group Chief Executive, commented:

"Victoria has been successfully selling a significant amount of

product into the US$29 billion - and growing - US market for many

years. The acquisition of Cali represents a step-change for the

Group presenting both revenue synergies alongside meaningful

exposure to the fast-growing online sales channel. We will also be

using the knowledge and online systems developed by Cali to partner

with our existing key retailers in the UK, Europe, and Australia to

accelerate our growth and earnings in these markets.

Cali has a very high-quality management team who are passionate

about the business and the result is indisputable: it has been

organically growing revenues at more than 17% annually for the last

five years with strong operating cash conversion."

Geoff Wilding, Executive Chairman, said:

"Victoria has now invested a little over GBP160 million in the

current financial year to add approximately GBP27 million of EBITDA

to the Group. This is a significant acquisition for Victoria and

helps towards our objective of increasing our commitment to North

America where the practical support and deep sector experience of

Koch Equity Development has proven invaluable.

We continue to have substantial amounts of capital to deploy and

are in active discussions with additional high-quality

opportunities to grow our business. Therefore, shareholders can

expect further acquisitions."

(1) Applying a GBP:USD exchange rate of 1.38

(2) Leverage ratios calculated in-line with the Group's debt

facilities

The person responsible for arranging the release of this announcement on behalf of the Company

is Michael Scott, Group Finance Director.

For more information contact:Victoria PLC

Geoff Wilding, Executive Chairman

Philippe Hamers, Group Chief Executive

Michael Scott, Group Finance Director +44 (0) 1562 749 610

N+1 Singer (Nominated Adviser and Joint

Broker)

Rick Thompson, Phil Davies, Alex Bond +44 (0) 207 496 3095

Berenberg (Joint Broker)

Ben Wright, Mark Whitmore, Tejas Padalkar

Peel Hunt (Joint Broker)

Adrian Trimmings, Andrew Clark +44 (0) 203 207 7800

Buchanan Communications (Financial PR) +44 (0) 207 418 8900

Charles Ryland, Chris Lane, Vicky Hayns,

Tilly Abraham +44 (0) 20 7466 5000

About Victoria

Established in 1895 and listed since 1963

and on AIM since 2013 (VCP.L), Victoria

PLC, is an international manufacturer and

distributor of innovative flooring products.

The Group, which is headquartered in Kidderminster,

UK, designs, manufactures and distributes

a range of carpet, flooring underlay, ceramic

tiles, LVT (luxury vinyl tile), artificial

grass and flooring accessories.

Victoria has operations in the UK, Spain,

Italy, Belgium, the Netherlands and Australia

and employs approximately 3,800 people

across more than 25 sites. Victoria is

the UK's largest carpet manufacturer and

the second largest in Australia, as well

as the largest manufacturer of underlay

in both regions.

The Group's strategy is designed to create

value for its shareholders and is focused

on consistently increasing earnings and

cash flow per share via acquisitions and

sustainable organic growth. (Further information

about Victoria can be found on its website,

www.victoriaplc.com .)

About Cali

Cali was founded in 2004 by two college

friends who, while on a surfing trip to

Hawaii and cutting bamboo as a casual job,

thought that bamboo could and should be

used as a building product in place of

traditional trees. Not only is bamboo the

fastest growing plant on earth and rapidly-renewable,

it could also help reduce global warming

and save animal habitat loss.

Since then, the business has developed

as a US-wide online flooring product designer

and distributor with an absolute commitment

to customer service and environmental sustainability

. (Further information about Cali can be

found on its website www.calibamboo.com

.)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUOVVRABUNURR

(END) Dow Jones Newswires

June 23, 2021 02:00 ET (06:00 GMT)

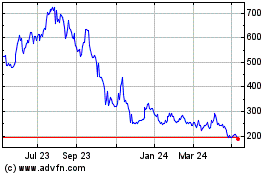

Victoria (LSE:VCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

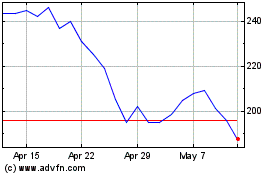

Victoria (LSE:VCP)

Historical Stock Chart

From Apr 2023 to Apr 2024