TIDMVCP

RNS Number : 7092R

Victoria PLC

10 March 2021

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY

JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT.

NOT FOR PUBLICATION IN THE UNITED STATES. THIS ANNOUNCEMENT IS FOR

INFORMATION PURPOSES ONLY AND IS NOT AN OFFER TO PURCHASE OR A

SOLICITATION OF AN OFFER TO SELL ANY NOTES.

10 March 2021

Victoria PLC

("Victoria", the "Company", or the "Group")

Announcement of pricing of EUR250 million senior secured notes

due 2028

Refinancing of Existing Debt at a Reduced Coupon

Victoria PLC (LSE: VCP) is pleased to announce that it has

successfully priced an offering of EUR250 million in aggregate

principal amount of 3.75% fixed rate senior secured notes, due 2028

(the "Notes"). The offer, which was announced this morning, is

leverage neutral (subject to transaction costs and redemption

premia).

The Board of Victoria is delighted with this outcome, with

pricing only 0.125% above the recently issued 2026 notes, despite

the longer, 7-year, maturity.

Net proceeds from the issuance of the Notes will be used solely

to refinance, in full, the remainder of the Group's outstanding

5.25% senior notes due 2024 (the "2024 Notes") to further improve

the maturity profile and cost of the Group's debt. On completion of

the refinancing, the Group's senior secured notes will have a

weighted average coupon of 3.67%, which represents a full 1.58% in

savings compared to the 2024 Notes.

The Notes will be issued at par and will be the general, senior

obligations of the Company and will be guaranteed by certain of the

Company's subsidiaries. Interest on the Notes will be payable

semi-annually in arrears. The offering of the Notes is expected to

close and the Notes are expected to be issued on or about 19 March

2021, subject to customary conditions precedent for similar

transactions.

Geoff Wilding, Executive Chairman of Victoria, commented:

"We are delighted with the level of support shown again from

bond investors, which has enabled the entire EUR250 million issue

to be placed in less than a day. Apart from the 1.58% average

coupon reduction, which saves the Group c.GBP7 million of annual

interest cost versus the original 2024 notes, completion of this

refinancing means that the earliest of the Group's senior debt will

not fall due until August 2026, with the notes issued today not due

until March 2028. It is the Board's view that these long-dated

bonds, in conjunction with the Group's strong cash generation,

places Victoria in a very robust financial position.

Finally, the Board advises that trading continues to be

resilient since the start of the calendar year despite the UK

lockdowns, and looks forward to updating shareholders in due

course."

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy the Notes or any other security and

shall not constitute an offer, solicitation or sale in the United

States or in any jurisdiction in which, or to any persons to whom,

such offering, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any

jurisdiction.

The Notes and the related guarantees have not been, and will not

be, registered under the U.S. Securities Act of 1933, as amended

(the "Securities Act") and may not be offered or sold within the

United States or to, or for the account or benefit of, U.S. persons

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities

Act.

This announcement may include projections and other

"forward-looking" statements within the meaning of applicable

securities laws. Any such projections or statements reflect the

current views of the Company about future events and financial

performance. The use of any of the words "expect," "anticipate,"

"continue," "will," "project," "should," "believe," "plans,"

"intends" and similar expressions are intended to identify

forward-looking information or statements. Although the Company

believes that the expectations and assumptions on which such

forward-looking statements and information are reasonable, undue

reliance should not be placed on the forward-looking statements and

information because the Company can give no assurance that such

statements and information will prove to be correct. Since

forward-looking statements and information address future events

and conditions, by their very nature they involve inherent risks

and uncertainties.

The forward-looking statements and information contained in this

announcement are made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information future events or otherwise, unless so required by

applicable securities laws. Within the United Kingdom, this

announcement is directed only at persons having professional

experience in matters relating to investments who fall within the

definition of "investment professionals" in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 ("relevant persons"). The investment or investment activity to

which this announcement relates is only available to and will only

be engaged in with relevant persons and persons who receive this

announcement who are not relevant persons should not rely or act

upon it.

Manufacturer target market (MIFID II product governance; UK

MiFIR product governance) is eligible counterparties and

professional clients only (all distribution channels). No PRIIPs or

UK PRIIPs key information document (KID) has been prepared as not

available to retail investors in EEA or the United Kingdom,

respectively.

FOR FURTHER INFORMATION CONTACT:

Victoria PLC N+1 Singer (Nominated Adviser and

(+44 (0) 1562 749 610) Joint Broker)

Geoff Wilding (+44 (0) 207 496 3095)

Philippe Hamers Rick Thompson

Michael Scott Phil Davies

Alex Bond

Berenberg (Joint Broker) Peel Hunt (Joint Broker)

(+44 (0) 203 207 7800) (+44 (0) 207 418 8900)

Ben Wright Adrian Trimmings

Mark Whitmore Andrew Clark

Tejas Padalkar

----------------------------------

Buchanan Communications (Financial

PR)

(+44 (0) 207 466 5000)

Charles Ryland

Chris Lane

Tilly Abraham

----------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSAFWUEFSEID

(END) Dow Jones Newswires

March 10, 2021 02:00 ET (07:00 GMT)

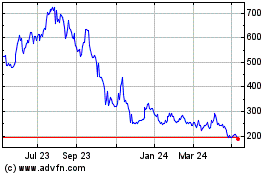

Victoria (LSE:VCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

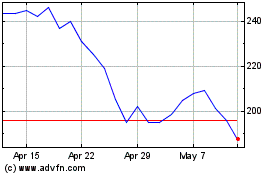

Victoria (LSE:VCP)

Historical Stock Chart

From Apr 2023 to Apr 2024