TIDMVCP

RNS Number : 9340Q

Victoria PLC

03 March 2021

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY

STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ANY

NOTES

VICTORIA PLC

THIS ANNOUNCEMENT IS INTED FOR HOLDERS OF THE SENIOR SECURED

NOTES DUE 2024 HELD IN THE REGULATION S GLOBAL NOTE BEARING ISIN

NUMBER XS2032590007 (COMMON CODE: 203259000)

3 March 2021 - Victoria PLC (the "Company") announces today the

results of its cash tender offer (the "Tender Offer") for its

outstanding Senior Secured Notes due 2024 held in the Regulation S

global notes bearing ISIN number XS2032590007 (Common Code:

203259000) (the "Notes") issued by the Company from the holders of

the Notes (each holder a "Noteholder" and together, the

"Noteholders"), as further described in the tender offer memorandum

dated as of 23 February 2021 (the "Tender Offer Memorandum").

The Tender Offer expired at 4:00 p.m., London time, on 2 March

2021 (the "Expiration Deadline").

The Tender Offer was made upon the terms and conditions of the

Tender Offer Memorandum. Capitalized terms used and not otherwise

defined in this announcement have the meanings ascribed to them in

the Tender Offer Memorandum.

The Company hereby announces that EUR127,918,000.00 in aggregate

principal amount of the Notes were validly tendered and not

withdrawn prior to the Expiration Date and will be accepted for

repurchase (the "Final Acceptance Amount") for an Aggregate Tender

Consideration of EUR133,687,634.90 million (including Accrued

Interest), subject to the conditions set forth in the Tender Offer

Memorandum, including satisfaction of the Financing Condition. The

Company reserves the right, in its sole discretion, to waive any

and all Conditions.

Purchase

Description Outstanding ISIN/ Minimum Price Aggregate

of the Principal Common Maturity Denomination per Final Acceptance Tender

Notes Amount(1) Code Date EUR1,000 Amount Consideration

------------- --------------- -------------- --------- -------------- ------------ ------------------ ------------------

EUR100,000

Senior and integral

Secured multiples EUR133,687,634.90

Notes XS2032590007/ July of EUR1,000 (including

due 2024 EUR476,010,000 203259000 15, 2024 thereafter EUR1,040.00 EUR127,918,000.00 Accrued Interest)

____________

(1) The Outstanding Principal Amount comprises the Notes, which

were originally sold pursuant to Regulation S under the Securities

Act (ISIN: XS2032590007; Common Code: 203259000), and does not

include the notes issued under the Indenture (as defined herein)

and originally sold pursuant to Rule 144A under the Securities Act

(ISIN: XS2032590189; Common Code: 203259018) (the "Rule 144A

Notes"). There can be no assurance that the Outstanding Principal

Amount continues to be held pursuant to the Regulation S global

notes. For the avoidance of doubt, the Tender Offer being made

pursuant to the Tender Offer Memorandum is only being made in

respect of the Notes which are held pursuant to Regulation S under

the Securities Act. The outstanding aggregate principal amount of

the Notes together with the Rule 144A Notes is EUR500,000,000

(collectively, the "Issued Notes").

Following the Tender Offer, EUR348,092,000.00 and

EUR372,082,000.00 in aggregate principal amount of the Notes and

the Issued Notes, respectively, will remain outstanding.

Subject to the Financing Condition, the Tender Offer is expected

to settle on 5 March 2021 (the "Payment Date") and all payments for

the Notes validly tendered and not withdrawn prior to the

Expiration Date will be made on the Payment Date.

The Tender Offer is part of a refinancing transaction in

connection with the Company's issuance of EUR500,000,000 in

aggregate principal amount of Senior Secured Notes on or prior to

the Payment Date (the "New Notes"), on terms and conditions

reasonably satisfactory to the Company (the "New Issuance"). The

proceeds of the New Notes, will be used (i) for general corporate

purposes, which may include, without limitation, the funding of one

or more acquisitions and/or the refinancing of certain existing

indebtedness of the Company, (ii) to complete the Tender Offer and

the Redemption (as defined herein) (the Tender Offer and the

Redemption together, the "Refinancing"), including the payment of

accrued and unpaid interest and Redemption and Tender Offer premia

and (iii) to pay the fees and expenses in connection with the

foregoing.

The Tender Offer is conditioned, amongst other conditions, on

the "Financing Condition," which is the issuance by the Company of

the New Notes, on or prior to the Payment Date, in a minimum amount

and on terms and conditions reasonably satisfactory to the Company.

There can be no assurance that the Company will be able to complete

the New Issuance and satisfy the Financing Condition.

To the extent the Financing Condition is satisfied, the Company

intends to redeem EUR50.0 million in aggregate principal amount of

Issued Notes in accordance with the terms of the "optional

redemption" provisions in the indenture governing the Issued Notes

dated 26 July 2019 (as amended from time to time, the "Indenture")

by and among the Company, the guarantors named therein, Deutsche

Trustee Company Limited, as trustee (the "Trustee"), Deutsche Bank

AG, London Branch as paying agent and Deutsche Bank Luxembourg S.A.

as registrar and National Westminster Bank PLC as security agent,

pursuant to the redemption notice issued by the Company on 3

February 2021 (the "Redemption"). The Redemption is expected to

take place on or about 9 March 2021 at a redemption price of

103.000%, plus accrued and unpaid interest, as set out in the

Indenture. Following the Tender Offer and the Redemption, the

Company may, in its sole and absolute discretion, redeem or

purchase further Issued Notes pursuant to the terms and conditions

of the Indenture.

Credit Suisse Securities (Europe) Limited and HSBC Bank plc are

acting as "Dealer Managers" for the Tender Offer. In connection

with the Tender Offer, Lucid Issuer Services Limited has been

appointed as tender agent (in such capacity, the "Tender Agent").

Holders with questions about the Tender Offer should contact the

Dealer Managers or the Tender Agent.

THE COMPANY

Victoria PLC

Worcester Road

Kidderminster

Worcestershire DY10 1JR

United Kingdom

Requests for information in relation to the Tender Offer should be

directed to:

THE DEALER MANAGERS

Credit Suisse Securities (Europe) Limited

One Cabot Square

Canary Wharf

London E14 4QJ

United Kingdom

Attn: Liability Management Group

Tel: +44 20 7883 8763

Email: liability.management@credit-suisse.com

HSBC Bank plc

8 Canada Square

London E14 5HQ

United Kingdom

Attention: Liability Management

Tel: +44 20 7992 6237

Email: LM_EMEA@hsbc.com

Requests for information in relation to the procedures for tendering

Notes and participating in the Tender Offer and the submission of an

Electronic Instruction should be directed to the Tender Agent:

THE TER AGENT

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Attention: Owen Morris / Jacek Kusion

Tel: +44 (0) 20 7704 0880

E-mail: victoria@lucid-is.com

This announcement is not an offer to purchase any Notes or a

solicitation of an offer to sell any Notes. The

Tender Offer is being made solely by means of the Tender Offer Memorandum.

DISCLAIMER

NOT FOR DISTRIBUTION FROM, WITHIN, IN OR INTO THE UNITED STATES,

ITS TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S.

VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN

MARIANA ISLANDS) OR ANY STATE OF THE UNITED STATES OR THE DISTRICT

OF COLUMBIA.

The Tender Offer is not being made and will not be made,

directly or indirectly, in or into, or by use of the mails of, or

by any means or instrumentality of interstate or foreign commerce

of, or of any facilities of a national securities exchange of, the

United States. This includes, but is not limited to, facsimile

transmission, electronic mail, telephone and the internet. The

Notes may not be tendered in the Tender Offer by any such use,

means, instrumentality or facility from or within the United States

or by persons located or resident in the United States.

Accordingly, copies of this announcement, the Tender Offer

Memorandum and any other documents or materials relating to the

Tender Offer are not being, and must not be, directly or

indirectly, mailed or otherwise transmitted, distributed or

forwarded (including, without limitation, by custodians, nominees

or trustees) in or into the United States or to any persons located

or resident in the United States. Any purported tender of Notes in

the Tender Offer resulting directly or indirectly from a violation

of these restrictions will be invalid and any purported tender of

Notes made by a person located or resident in the United States, or

any agent, fiduciary or other Intermediary acting on a

non-discretionary basis for a principal giving instructions from

within the United States will be invalid and will not be

accepted.

The distribution of the Tender Offer Memorandum in certain

jurisdictions may be restricted by law. Persons into whose

possession the Tender Offer Memorandum comes are required by the

Company, the Dealer Managers and the Tender Agent to inform

themselves about, and to observe, any such restrictions.

This announcement is neither an offer to purchase nor the

solicitation of an offer to sell any of the securities described

herein, nor shall there be any offer or sale of such securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful. The Tender Offer is made solely pursuant to the Tender

Offer Memorandum dated February 23, 2021.

This announcement must be read in conjunction with the Tender

Offer Memorandum. This announcement and the Tender Offer Memorandum

contain important information which should be read carefully before

any decision is made with respect to the Tender Offer. If any

Holder is in any doubt as to the action it should take, it is

recommended that such Holder seeks its own financial and legal

advice, including as to any tax consequences, immediately from its

stockbroker, bank manager, solicitor, accountant or other

independent financial or legal adviser. Any individual or company

whose Notes are held on its behalf by a broker, dealer, bank,

custodian, trust company or other nominee or intermediary must

contact such entity if it wishes to tender Notes in the Tender

Offer. None of the Company, the Dealer Managers or the Tender Agent

makes any recommendation as to whether Noteholders should

participate in the Tender Offer.

Any deadlines set by any intermediary will be earlier than the

deadlines specified in the Tender Offer Memorandum.

The information contained in this announcement does not

constitute an invitation or inducement to engage in investment

activity within the meaning of the United Kingdom Financial

Services and Markets Act 2000. In the United Kingdom, this

announcement is being distributed only to, and is directed only at

(i) persons who are outside the United Kingdom, (ii) persons in the

United Kingdom falling within the definition of investment

professionals (as defined in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Financial Promotion Order")), (iii) persons who are within Article

43 of the Financial Promotion Order or (iv) any other persons to

whom it may otherwise lawfully be made under the Financial

Promotion Order (all such persons together being referred to as

"relevant persons"). This announcement and the Tender Offer

Memorandum is directed only at relevant persons and must not be

acted on or relied on by persons who are not relevant persons.

This announcement contains forward-looking statements and

information that is necessarily subject to risks, uncertainties,

and assumptions. No assurance can be given that the transactions

described herein will be consummated or as to the terms of any such

transactions. The Company assumes no obligation to update or

correct the information contained in this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTESSLFUEEFSELD

(END) Dow Jones Newswires

March 03, 2021 02:00 ET (07:00 GMT)

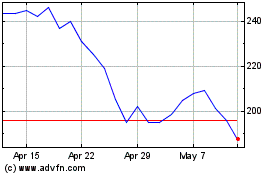

Victoria (LSE:VCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

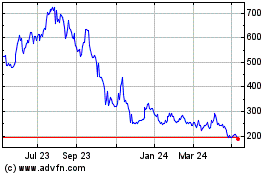

Victoria (LSE:VCP)

Historical Stock Chart

From Apr 2023 to Apr 2024