TIDMUSG

RNS Number : 7244D

Ultimate Sports Group PLC

28 June 2019

28 June 2019

Ultimate Sports Group PLC

("USG" or the "Company" or the "Group")

Final Results and Notice of AGM

Ultimate Sports Group PLC, the AIM listed investment vehicle, is

pleased to announce its results for the year ended 31 December

2018. The Company also gives notice that its Annual General Meeting

('AGM') will be held at the Hellenic Centre 16/18 Paddington

Street, London W1U 5AS on 24 July 2019 at 11.30am. Copies of the

Notice of AGM together with the Annual Report for the year ended 31

December 2018 will be posted to shareholders and be available to

view on the Company's website www.ultimatesportsgroup.me.

The financial information set out in this announcement does not

constitute statutory accounts as defined in the Companies Act

2006.

The Group Statement of Comprehensive Income, Group Statement of

Financial Position, Group Statement of Changes in Equity, Group

Statement of Cash Flows and associated notes have been extracted

from the Group's 2018 statutory financial statements upon which the

auditor's opinion is unqualified and does not include any statement

under section 498 of the Companies Act 2006.

Those financial statements will be delivered to the Registrar of

Companies following the release of this announcement.

This announcement and the annual report and accounts are

available on the Company's website www.ultimatesportsgroup.me . A

copy of the report and accounts will be sent to shareholders who

have elected to receive a printed copy with details of the annual

general meeting in due course.

Chairman's Statement and Chief Executive's Review

We are reporting a total comprehensive loss from continuing

activities of GBP144,485 before tax against a total comprehensive

loss before tax and discontinued activities for the prior year of

GBP780,192. There were no discontinued activities in the year ended

31 December 2018, whilst in the prior year there was a profit from

discontinued activities after tax of GBP53,567. USG's consolidated

cash balances as at 31 December 2018 were GBP535,329 (2017-

GBP129,611) The directors are not recommending the payment of a

dividend.

FUNDRAISE

As set out in the circular to shareholders issued in February

2018, the Company raised GBP537,500 (before legal and other

professional expenses) by the issue of 10,750,000 new shares at 5p

per share following approval obtained from shareholders at the

General Meeting in March 2018.

SUBSTANTIAL SHAREHOLDERS

The Company welcomes the involvement of Mr Richard Bernstein as

a strategic shareholder following on from the fundraising concluded

in March 2018. The Company also entered into an agreement with Mr

Bernstein pursuant to which he will seek to introduce the Company

to potential investment or acquisition opportunities. To date Mr

Bernstein has carried out and continues to undertake initial due

diligence on potential introductions at his own expense with follow

up work undertaken by the Company.

PANTHEON LEISURE PLC ("PANTHEON ")

USG holds 85.87% of the issued share capital of Pantheon which

in turn owns 100% of the operating business of a Sport and Leisure

division which trades as Sport in Schools Ltd and The Elms Sport in

Schools ("ESS").

Pantheon as a group made a profit of GBP32,817 for the year

ended 31 December 2018 (2017 (profit - GBP2,950).

SPORT IN SCHOOLS LIMITED

On a turnover of GBP1,546,733 (2017- GBP1,368,710) ESS

contributed a much- improved divisional profit of GBP100,754 (2017

- GBP28,255). The improved result is a combination of increased

turnover by virtue of additional schools engaged, increased income

from existing schools due to an increase in government subsidies,

improved weather conditions resulting in less working days lost in

2018 and tighter control of overheads.

CORPORATE GOVERNANCE CODE

In accordance with changes to AIM Rules regarding corporate

governance our Annual Report & Accounts and Company website

reflect compliance with (and any departures from) the Guidance set

out in the QCA Corporate Governance Code.

PROSPECTS

We continue to pursue, from a firm financial base, a strategy of

developing the business of ESS and to carefully appraise all

acquisition opportunities, including those proposed by Mr

Bernstein.

R L Owen (Chairman)

G M Simmonds (Chief Executive)

* *S * *

For further information, please visit www.ultimatesportsgroup.me

or contact:

Ultimate Sports Group PLC

Geoffrey Simmonds, Managing Director +44 (0)20 7935 0823

St Brides (Financial PR)

Catherine Leftley/Gaby Jenner +44 (0)20 7236 1177

Cantor Fitzgerald Europe (Nomad and Broker)

David Foreman +44 (0)20 7894 7000

Consolidated statement of comprehensive income for the year

ended 31 December 2018

2018 2017

Notes GBP GBP

Continued activities

Revenue 6 1,547,006 1,369,193

Cost of sales (725,638) (769,310)

----------- -----------

Gross profit 821,368 599,883

Administrative expenses (965,943) (833,533)

----------- -----------

Operating Loss before exceptional

items (144,575) (233,650)

Exceptional item and non-

recurring costs 8 - (563,325)

----------- -----------

Operating loss 9 (144,575) (796,975)

Finance income 11 718 -

Finance costs 12 (628) (3,714)

Other gains and losses 13 - 20,497

----------- -----------

Loss before taxation (144,485) (780,192)

Taxation 14 - 17,572

----------- -----------

Loss after taxation from continuing

activities (144,485) (762,620)

Profit for the year from discontinued

activities 7 - 53,567

----------- -----------

(144,485) (709,053)

----------- -----------

Attributable to:

Equity holders of the parent

company (149,121) (709,470)

Non-controlling interests 4,636 417

----------- -----------

(144,485) (709,053)

----------- -----------

Other comprehensive loss

Losses on available-for-sale

investments taken to equity - (1,838)

Taxation on items taken directly

to equity 14 - 331

Other comprehensive loss - (1,507)

----------- -----------

Comprehensive loss attributable

to:

Equity holders of the parent

company (149,121) (710,977)

Non-controlling interests 4,636 417

Total comprehensive loss (144,485) (710,560)

=========== ===========

Loss per share (basic and diluted)

Loss from operations per share 15 (0.0051)p (0.0319)p

Other comprehensive loss per

share - (0.0001)p

---------- ----------

Total comprehensive loss per

share (0.0051)p (0.0320)p

========== ==========

Consolidated statement of financial position as at 31 December

2018

Notes 2018 2017

GBP GBP

Non-current assets

Goodwill and other intangibles 17 59,954 60,054

Property, plant and equipment 19 13,168 12,923

Total non-current assets 73,122 72,977

------------ ------------

Current assets

Trade and other receivables 20 89,760 68,981

Cash and cash equivalents 535,329 129,611

------------ ------------

Total current assets 625,089 198,592

------------ ------------

Total assets 698,211 271,569

Current liabilities

Trade and other payables 21 239,911 173,661

Borrowings 24 - 2,000

------------ ------------

Total current liabilities 239,911 175,661

------------ ------------

Total liabilities 239,911 175,661

Net assets 458,300 95,908

Equity

Share capital 25 2,388,664 2,281,164

Share premium account 782,031 393,454

Merger reserve 325,584 325,584

Retained earnings (2,979,116) (2,840,795)

Equity attributable to shareholders

of the parent company 517,163 159,407

Non- controlling interests (58,863) (63,499)

Total Equity 458,300 95,908

============ ============

Consolidated To

statement equity

of changes in holders

equity Fair of the

Share Share Merger value Retained parent Non-controlling

capital premium reserve reserve earnings company interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at

1 January

2017 2,048,664 393,454 325,584 (1,507) (2,123,512) 642,683 (63,916) 578,767

Issue of

new shares 232,500 - - - - 232,500 - 232,500

Share issue

costs - - - - (7,813) (7,813) - (7,813)

Released on

sale of

available

for sale

investments - - - 1,838 - 1,838 - 1,838

Deferred

tax on

items

taken

directly to

equity - - - (331) - (331) - (331)

Loss for

the year - - - - (709,470) (709,470) 417 (709,053)

Reserves at

1 January

2018 2,281,164 393,454 325,584 - (2,840,795) 159,407 (63,499) 95,908

Issue of

new shares 107,500 430,000 - - - 537,500 - 537,500

Share issue

costs - (41,423) - - - (41,423) - (41,423)

Share based

payments - - - - 10,800 10,800 - 10,800

Loss for

the year - - - - (149,121) (149,121) 4,636 (144,485)

At 31

December

2018 2,388,664 782,031 325,584 - (2,979,116) 517,163 (58,863) 458,300

========== ========= ========= ======== ============ ========== ================ ==========

Company statement of financial position as at 31 December

2018

Notes 2018 2017

GBP GBP

Non-current assets

Investment in subsidiaries 18 505,755 516,468

Property, plant and equipment 19 - 1

------------ ------------

Total non-current assets 505,755 516,469

------------ ------------

Current assets

Trade and other receivables 20 361,793 342,203

Cash and cash equivalents 413,656 81,459

------------ ------------

Total current assets 775,449 423,662

------------ ------------

Total assets 1,281,204 940,131

Current liabilities

Trade and other payables 21 319,715 284,317

Total current liabilities 319,715 284,317

------------ ------------

Total liabilities 319,715 284,317

Net assets 961,489 655,814

Equity

Share capital 25 2,388,664 2,281,164

Share premium account 782,031 393,454

Merger reserve 325,584 325,584

Retained earnings (2,534,790) (2,344,388)

Total equity 961,489 655,814

============ ============

Company statement of changes in equity

Share Share Retained

capital premium Merger reserve earnings Total

GBP GBP GBP GBP GBP

At 1 January

2017 2,048,664 393,454 325,584 (1,316,258) 1,451,444

Issue of new

shares 232,500 - - - 232,500

Share issue costs - - - (7,813) (7,813)

Loss for the

year - - - (1,020,317) (1,020,317)

At 1 January

2018 2,281,164 393,454 325,584 (2,344,388) 655,814

Issue of new

shares 107,500 430,000 - - 537,500

Share issue costs - (41,423) - - (41,423)

Share based payments - - - 10,800 10,800

Loss for the

year - - - (201,202) (201,202)

At 31 December

2018 2,388,664 782,031 325,584 (2,534,790) 961,489

================= ========= =============== ============ ============

Consolidated statement of cash flows for the year ended 31

December 2018

Note 2018 2017

GBP GBP

Cash flow from all operating activities

Loss before taxation from continuing

activities (144,485) (780,192)

Profit before taxation from discontinued

activities 32c - 53,567

-------------------------- ------------------------

(144,485) (726,625)

Adjustments for:

Finance income (718) -

Finance expense 628 3,714

Impairment and amortisation of intangible

assets 100 520,792

Share based payments 10,800 -

Other gains and losses - (103,097)

Depreciation 7,507 26,145

Loss/ (profit) on disposed tangible

assets 1 (30,865)

Operating cash flow before working

capital movements (126,167) (309,936)

(Increase)/decrease in receivables (20,779) 28,720

Increase/(decrease) in payables 66,250 (48,886)

Net cash absorbed by operations (80,696) (330,102)

-------------------------- ------------------------

Taxation - 17,241

-------------------------- ------------------------

Cash flow from investing activities

Finance income 718 -

Property, plant and equipment acquired (7,753) (9,820)

Intangible asset development costs - (16,300)

Proceeds on sale of property, plant

and equipment - 33,187

Net proceeds on sale of business - 82,600

Proceeds on disposal of available

for sale investments - 48,334

Net cash (absorbed)/from investing

activities (7,035) 138,001

-------------------------- ------------------------

Cash flow from financing activities

Finance expense (628) (3,714)

Funds from share issue 496,077 224,687

Repayment of borrowings (2,000) (45,939)

Net cash from financing activities 493,449 175,034

-------------------------- ------------------------

Net increase in cash and cash equivalents

in the year 32b 405,718 174

Cash and cash equivalents at the

beginning of the year 129,611 129,437

Cash and cash equivalents at the

end of the year 535,329 129,611

========================== ========================

Company statement of cash flows for the year ended 31 December

2018

Notes 2018 2017

GBP GBP

Cash flow from operating activities

Loss before tax (201,202) (1,020,317)

Adjustments for:

Finance income (17,218) (16,500)

Finance expense - 3,714

Share based payments 10,800 -

Other gains - (1,034)

Provision for impairment in value

of investments in subsidiaries 10,713 90,103

Provision for intra group indebtedness 78,765 889,245

Depreciation and write offs - 18,592

Loss/(profit) on disposed tangible

assets 1 (30,865)

Operating cash flow before working

capital movements (118,141) (67,062)

Increase in receivables (81,855) (242,954)

Increase in payables 35,398 1,244

Net cash absorbed by operations (164,598) (308,772)

---------- ------------

Cash flow from investing activities

Finance income 718 -

Proceeds on sale of property, plant

& equipment - 33,187

Proceeds on sale of investments for

resale - 2,721

---------- ------------

Net cash inflow from investing activities 718 35,908

---------- ------------

Cash flow from financing activities

Funds from share issue 496,077 224,687

Finance expense - (3,714)

Hire purchase repayments - (42,439)

Net cash from financing activities 496,077 178,534

Net increase /(decrease) in cash

and cash equivalents in the year 32b 332,197 (94,330)

Cash and cash equivalents at the

beginning of the year 81,459 175,789

Cash and cash equivalents at the

end of the year 413,656 81,459

========== ============

Notes to the group and parent company financial statements

1. General information

Ultimate Sports Group Plc is a public company limited by shares,

domiciled and incorporated in England and Wales and its activities

are as described in the strategic report on pages 5 to 7.

These financial statements are prepared in pounds sterling being

the currency of the primary economic environment in which the group

operates.

2. Basis of Accounting

The consolidated financial statements of the group and the

financial statements of the parent company for the year ended 31

December 2018 have been prepared under the historical cost

convention and are in accordance with International Financial

Reporting standards ("IFRS") as adopted by the EU. These policies

have been applied consistently except where otherwise stated.

For the purpose of the preparation of these consolidated

financial statements, the group has applied all standards and

interpretations that are effective for accounting periods beginning

on or after 1 January 2018. The adoption of new standards and

interpretations in the year has not had a material impact of the

group's financial statements.

IFRS 15

The group has adopted IFRS 15 retrospectively in its

consolidated financial statements for the year ended 31 December

2018. IFRS 15 replaces all existing revenue requirements in IFRS

and sets out principles for recognising revenue that must be

applied using a 5-step model. Revenue should only be recognised

when (or as) control of goods or services is passed to the

customer, when distinct 'performance obligations' are met, at the

amount to which the entity expects to be entitled. The group has

completed its assessment of IFRS and has not identified any

material differences between the group's current revenue

recognition policy and the requirements of IFRS 15.

Future standards in place but not yet effective.

No new standards, amendments or interpretations to existing

standards that have been published and that are mandatory for the

Group's accounting periods beginning on or after 1 January 2019, or

later periods, have been adopted early. The following standards and

amendments are not yet applied at the date of authorisation of

these financial statements:

-- IFRS 16 - Leases (effective 1 January 2019)

-- Annual Improvements to IFRS Standards 2015 - 2017 Cycle (effective 1 January 2019)

-- IAS 12 - Income taxes (effective 1 January 2019)

-- Definition of Material (Amendments to IAS 1 and IAS 8) (effective 1 January 2020)

-- Definition of a Business (Amendments to IFRS 3) (effective 1 January 2020)

Except for IFRS 16, see below, the group does not believe that

there will be a material impact on the financial statements from

the adoption of these standards / interpretations.

IFRS 16 requires the recognition of an asset and liability by

introducing a lessee accounting model. As at 31 December 2018, the

group would recognise an asset and liability in respect of leases

of approximately GBP79,000.

There were no material changes in the financial statements as a

result of adopting new or revised accounting standards during the

year.

3. Significant accounting policies

(a) Basis of consolidation

The financial statements of the group incorporate the financial

statements of the company and entities controlled by the company,

which are its subsidiary undertakings. Control is achieved where

the company has the power to govern the financial and operating

policies of its subsidiary undertakings so as to benefit from their

activities.

Details of subsidiary undertakings are set out in note 18.

All intra-group transactions and balances have been eliminated

in preparing the consolidated financial statements.

(b) Revenue

Revenue arises from the disposal of available-for-sale

investments and income from sports and leisure activities

undertaken by the company and its subsidiary undertakings. In the

case of sports and leisure activities it represents invoiced and

accrued amounts for services supplied in the year, exclusive of

value added tax and trade discounts.

(c) Intangible assets

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the group's interest in the fair value of

the identifiable assets and liabilities of subsidiary entities at

the date of acquisition. Goodwill is initially recognised as an

asset at cost and is subsequently measured at cost less any

accumulated impairment losses. Goodwill which is recognised as an

asset is reviewed for impairment at least annually. Any impairment

is recognised immediately in the statement of comprehensive income

and is not subsequently reversed.

For the purpose of impairment testing, goodwill is allocated to

each of the group's cash generating units expected to benefit from

synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. If the recoverable amount of the cash generating unit is

less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill

allocated to the unit then to the other assets of the unit pro-rata

on the basis of the carrying amount of each asset in the unit. An

impairment loss recognised for goodwill is not reversed in a

subsequent period.

On disposal of a subsidiary, associate or jointly controlled

entity, the amount of goodwill is included in the determination of

the profit or loss on disposal.

Goodwill arising on acquisitions before the date of transition

to IFRS's has been retained at the previous UK GAAP amounts subject

to being tested for impairment at that date.

Development costs are expensed in arriving at the operating

profit or loss for the year unless the directors are satisfied as

to the technical, commercial and financial viability of individual

project. In this situation, the expenditure is recognised as an

asset and is reviewed for impairment on an annual basis.

Any impairment is recognised immediately in the income statement

in administrative expenses and is not subsequently reversed.

3. Significant accounting policies

(d) Plant and equipment

Plant and equipment is stated at cost less depreciation.

Depreciation is provided at rates calculated to write off the cost

less their estimated residual value over their expected useful

lives.

The rates applied to these assets are as follows:

Plant & equipment 25% & 10% straight line

Motor vehicles 33.3% - straight line

(e) Operating leases

Rentals applicable to operating leases, where substantially all

of the benefits and risks of ownership remain with the lessor, are

charged against revenue as and when incurred.

(f) Deferred taxation

Deferred taxation is provided in full in respect of timing

differences between the treatment of certain items for taxation and

accounting purposes. The deferred tax balance is not

discounted.

The recognition of deferred tax assets is limited to the extent

that the group anticipates making sufficient taxable profits in the

future to absorb the reversal of the underlying timing

differences.

(g) Trade receivables

Trade receivables are recognised at fair value. A provision for

impairment of trade receivables is established where there is

objective evidence that the company or group will not be able to

collect all amounts due according to the original terms of the

receivables. Significant financial difficulties of the debtor,

probability that the debtor will enter bankruptcy or liquidation

and default or delinquency of payments are considered indicators

that the trade receivable is impaired. The amount of the provision

is the difference between the asset's carrying amount and the

present value of estimated future cash flows. The carrying amount

of the asset is reduced through the use of an allowance account and

the amount of the loss is recognised in the income statement within

administrative expenses. When a trade receivable is uncollectable

it is written off against the allowance account for trade

receivables.

(h) Investments

Investments are classified as available for sale, are measured

at fair value. Gains or losses in changes in fair value are

recognised directly in equity, until the security is disposed of or

is determined to be impaired, at which time the cumulative gain or

loss previously recognised in equity is included in the net profit

or loss for the period. Impairment losses recognised in profit or

loss are not subsequently reversed through profit or loss.

Fair value of quoted investments is based on current bid prices.

If an investment is suspended from trading, fair value is based on

quoted bid prices on the first day that trading recommences

following suspension.

Investments in subsidiary undertakings are stated at cost less

provision for impairment in the parent company balance sheet.

(i) Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held

at call with banks. Bank overdrafts are shown as borrowings within

current liabilities.

3. Significant accounting policies (continued)

(j) Financial liabilities and equity

Financial liabilities and equity instruments are classified

according to the substance of the contractual arrangements entered

into. An equity instrument is any contract that evidences a

residual interest in the assets of the group after deducting all of

its liabilities.

Ordinary shares are classified as equity. Incremental costs

directly attributable to new shares are shown in equity as a

deduction from the proceeds.

Trade payables are recognised initially at fair value and

subsequently measured at amortised cost using the effective

interest method.

Borrowings are recognised initially at fair value, net of

transaction costs incurred. Borrowings are subsequently stated at

amortised cost, any difference between the proceeds (net of

transaction costs) and the redemption value is recognised in the

income statement over the period of the borrowing using the

effective interest method.

Borrowings are classified as current liabilities unless the

group has an unconditional right to defer settlement of the

liability for at least 12 months after the date of the statement of

financial position.

4. Critical accounting judgements and key sources of estimation uncertainty

The preparation of the group's financial statements requires the

directors to make judgements, estimates and assumptions that effect

the application of policies and reported amounts in the financial

statements. These judgements and estimates are based on the

director's best knowledge of the relevant facts and circumstances.

Information about such judgements and estimation is contained in

the accounting policies and/or notes to the financial

statements.

Deferred tax asset

At the present time the directors' do not consider that there is

sufficient certainty regarding the utilisation of tax losses

available in the group. As a result, no deferred tax asset has been

recognised.

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash generating units to which the

goodwill has been allocated. The value in use calculation requires

the entity to estimate the future cash flows expected to arise from

the cash generating unit and a suitable discount rate in order to

calculate present value. The carrying amount of goodwill is the

deemed cost on first time application of IFRS.

Details of the impairment review calculation are given in note

17.

Impairment of intangible assets

The carrying value of intangible assets comprising unamortised

website costs are determined by reference to an assessment of

future income generated by the UltimatePlayer.me platform. Having

regard to the Board's decision to delay future plans for further

website development, all unamortised costs have been fully impaired

as an exceptional item in 2017 (note 8).

5. Going concern

The directors have prepared financial forecasts covering the 12

months following approval of these financial statements, which show

the Group can continue to carry on trading within its existing

finance facilities over that period.

In view of the above, the directors consider it appropriate to

prepare the financial statements on a going concern basis.

6. Business segment analysis

Segmental information with regard to continuing and non-

continuing activities is disclosed below and is based on the

different business activities in the group.

All turnover, profits, losses, assets and liabilities relate to

operations undertaken in the UK.

Sports and Social

Year ended 31 December 2018 leisure media website Consolidated

GBP GBP GBP

Revenue 1,546,733 273 1,547,006

=========== =============== =============

Segment operating profit/(loss)* 100,754 (32,399) 68,355

=========== ===============

Group operating expenses** (212,930)

-------------

Operating loss (144,575)

Finance revenues less finance

costs 90

Loss before taxation (144,485)

Taxation -

Loss after taxation from

continuing activities (144,485)

Sports and Social

Year ended 31 December 2017 leisure media website Consolidated

GBP GBP GBP

Revenue 1,368,710 483 1,369,193

=========== =============== =============

Segment operating profit/(loss)* 28,255 (587,536) (559,281)

=========== ===============

Group operating expenses** (237,694)

Operating loss (796,975)

Other gains and losses 20,497

Finance revenues less finance

costs (3,714)

Loss before taxation (780,192)

Taxation relating to the

social media website 17,572

-------------

Loss after taxation from

continuing activities (762,620)

Discontinued activities 53,567 53,567

----------- -------------

(53,567) (709,053)

=========== =============

*Segment operating profit in relation to Sports and Leisure is

after charges for depreciation of GBP7,507 (2017: GBP7,553).

Segment operating losses in relation to the social media website is

after charges for amortisation and impairment of GBPNil (2017:

GBP520,792).

** 'Group operating expenses' represent the costs of running the

group as a whole. The directors consider that the costs of running

Pantheon Leisure Plc of GBP68,824 (2017: GBP53,370) form part of

these costs as opposed to forming part of the segmental costs of

the sports and leisure division.

Financial position at 31 Sports Social

December 2018 and leisure media website Consolidated

GBP GBP GBP

Segment assets 86,555 1,388 87,943

============= ==================

Non segmental assets 610,268

-------------

Consolidated total assets 698,211

=============

Segmental liabilities 203,071 - 203,071

============= ==================

Non segmental corporate liabilities 36,840

-------------

239,911

Capital additions 7,753 -

Depreciation/amortisation 7,507 -

and impairment

============= ==================

Financial position at 31

December 2017

Sports Social

and leisure media website Consolidated

GBP GBP GBP

Segment assets 55,714 1,846 57,560

============= ==================

Non segmental assets 214,009

-------------

Consolidated total assets 271,569

=============

Segment liabilities 158,457 4,162 162,619

============= ==================

Non segmental corporate liabilities 13,042

-------------

175,661

=============

Capital additions 9,820 16,300

Depreciation/amortisation

and impairment 7,553 520,792

============= ==================

Non segmental assets include group cash balances of GBP535,329

(2017: GBP129,611), goodwill of GBP59,954 (2017: GBP59,954), other

assets and receivables of GBP14,985 (2017: GBP24,444). Non

segmental liabilities include trade and other payables of GBP36,840

(2017: GBP13,042).

Sports and leisure segment assets include GBPnil (2017:

GBP2,727) from discontinued activities. Segment liabilities include

GBPnil (2017: GBP8,638) from discontinued activities.

7. Discontinued activities

2018 2017

GBP GBP

Revenue - 11,015

Cost of sales and expenses - (40,048)

---------------- --------------------

Operating loss - (29,033)

Net proceeds on disposal - 82,600

---------------- --------------------

- 53,567

------------------- --------------------

Football Partners Limited ceased small-sided football league activities

in December 2016 and disposed of its trade for GBP100,000 in 2017.

8. Exceptional item and non- recurring costs

2018 2017

GBP GBP

Exceptional item:

Development cost - full impairment - 462,073

Non- recurring costs:

Website expenditure and amortisation - 101,252

- 563,325

======= ==========

9. Operating loss

2018 2017

The operating loss is stated GBP GBP

after charging /(crediting):

Auditors' remuneration - audit

services 18,900 20,875

Operating lease rentals - land

and buildings 17,635 13,507

Depreciation of property, plant

and equipment 7,753 26,145

Amortisation - Website development - 58,719

Impairment - Website development - 462,073

======= ========

Included in the audit fee for the group is an amount of GBP7,000

(2017: GBP6,700) in respect of the Company.

The auditors received fees of GBP1,630 (2017: GBP1,250) in

respect of the provision of services in connection with advice

relating to the group's interim results, and general advice.

10. (a) Staff Costs

Employee benefit costs were

as follows: Group

2018 2017

GBP GBP

Wages and salaries 1,152,825 1,128,737

Social security costs 58,061 67,549

Pension contributions 12,634 7,019

Share based payment 10,800 -

1,234,320 1,203,305

========== ==========

The average numbers of employees, including directors during the

year, were as follows:-

No. No.

Administration, sales and coaching

staff 94 115

======== ======

(b) Directors' remuneration

2018 2017

An analysis of directors' remuneration (who are

the key management personnel) is set out below: GBP GBP

Salary and consultancy fees 21,250 32,859

======= =======

Executive directors 16,250 32,859

Non-executive directors 5,000 -

------- -------

21,250 32,859

======= =======

The total cost of key management personnel being the executive

directors and including employers' national insurance was GBP21,250

(2017: GBP32,859).

The following amounts were paid for the services of the

directors in the year:

2018 2017

GBP GBP

Salaries Salaries

and benefits and benefits

R L Owen 13,750 15,996

G Simmonds - 16,863

D Hillel 2,500 -

J Zucker 2,500 -

D J Coldbeck 2,500 -

-------------- --------------

21,250 32,859

-------------- --------------

There were no directors' benefits (2017- GBP17,859).

11. Finance income

2018 2017

GBP GBP

Interest revenue - bank deposits 718 -

----- -----

12. Finance costs

2018 2017

GBP GBP

Bank overdraft interest 628 -

Interest on obligations under

hire purchase agreements - 3,714

------------------ ------

628 3,714

------------------ ------

13. Other gains and losses

2018 2017

GBP GBP

Profit on disposal of available

for sale investments - 20,497

--- -------

Investments in AIM listed companies were disposed of in 2017

giving rise to gains of GBP20,497 before fair value adjustments of

GBP1,838 recognised in the Statement of Other Comprehensive Income

in that year.

14. Taxation

2018 2017

GBP GBP

Deferred tax (credit)/charge

Origination and reversal of

temporary differences - (331)

Total deferred tax (credit)/(charge - (331)

Research and development tax

credits - (17,241)

--- ---------

Tax credit in income statement - (17,572)

=== =========

No income tax charge arises based on the loss for the year

(2017: nil).

The group has unutilised tax losses of GBP6,443,000 (2017:

GBP6,311,000) which includes GBP2,380,000 (2017: GBP2,364,000) in

relation to the company's subsidiary undertakings. Where it is

anticipated that future taxable profits will be available to

utilise these losses a deferred tax asset or a reduction in

deferred tax liability is recognised as appropriate.

Factors affecting the tax charge in the year

2018 2017

GBP GBP

Loss on ordinary activities before taxation (144,485) (724,787)

========== ==========

Loss on ordinary activities before taxation

at the standard rate of UK corporation

tax of 19% (2017: 19.25%) (27,452) (139,521)

Effects of:

Expenses not deductible for tax purposes 5,370 -

Share based payments 2,052 -

Dividend income 3,943 -

Temporary differences in respect of depreciation

and capital allowances not reflected in

deferred tax (79) 97,121

Unutilised tax losses not recognised as

a deferred tax asset 16,166 42,400

Adjustment on available-for-sale investments - (331)

Research and development tax credits - (17,241)

---------- ----------

Tax credit - (17,572)

========== ==========

In 2017 claims for tax credits in relation to research and

development costs were made giving rise to cash credits of

GBP17,241.

15. Loss per share

Basic loss per share has been calculated on the group's loss

attributable to equity holders of the parent company of GBP149,121

(2017: GBP709,470) and on the weighted average number of shares in

issue during the year, which was 29,174,996 (2017: 22,211,434).

Comprehensive loss per share is based on the same number of

shares and on the comprehensive loss for the year attributable to

the equity holders in the parent company of GBP149,121 (2017:

GBP710,977).

In view of the group loss for the year, share warrants and

options to subscribe for ordinary shares in the company are

anti-dilutive and therefore diluted earnings per share information

is not presented. There are options outstanding at 31 December 2018

on 307,500 ordinary shares and on 1,500,000 share warrants.

16. Loss for the financial year

As permitted by Section 400 of the Companies Act 2006, the

profit and loss account for the company is not presented as part of

these financial statements.

The consolidated loss for the year of GBP144,485 (2017-loss:

GBP709,053) includes a loss of GBP201,202 (2017-loss: GBP1,020,317)

dealt with in the accounts of the company.

17. Goodwill, intangibles and development costs

2018 2018 2018 2017

GBP GBP GBP GBP

Goodwill

Website and other

development intangibles Total Total

Cost at 1 January 587,187 60,054 647,241 630,941

Additions in the year - - - 16,300

------------- ------------- -------- --------

Cost at 31 December 587,187 60,054 647,241 647,241

------------- ------------- -------- --------

Amortisation at 1 January 587,187 - 587,187 66,395

Charged in the year - - - 58,719

Impairment write off - 100 100 462,073

------------- ------------- -------- --------

Amortisation at 31 December 587,187 100 587,287 587,187

------------- ------------- -------- --------

Carrying value at 31 December - 59,954 59,954 60,054

============= ============= ======== ========

Goodwill of GBP59,954 included above relates to the acquisition

of Pantheon Leisure Plc which is included at its deemed cost on

first time application of IFRS.

The Group acquired intangible assets costing GBP100 in 2013

following the acquisition of a subsidiary. The asset has been fully

impaired and written off in 2018.

Goodwill acquired in a business combination is allocated, at

acquisition, to cash generating units ("CGUs") that are expected to

benefit from that business combination. The carrying amount of

goodwill relates wholly to the leisure activities business

segment.

The recoverable amounts of the CGUs are determined from value in

use calculations. The key assumptions for the value in use

calculations are those regarding forecast revenues and operating

costs. Management have taken into account the following two

elements:

(i) Based on current assessments of the Sport in Schools

activities made by the directors, they consider that revenues will

continue to grow in 2019 and 2020; and

(ii) Operational costs are monitored and controlled

Development costs

Ultimate Player Limited continued to operate the

UltimatePlayer.me platform during the year. As a result of the

decision taken by the Board in 2017, to delay future plans for

further website development, unamortised development costs were

fully impaired and written off as an exceptional item in the prior

year (see note 8).

18. Investments in Subsidiaries

Company 2018 2017

Cost GBP GBP

Shares 1,947,932 1,947,932

Loan notes 220,000 220,000

---------- ----------

Total cost at beginning

and end of year 2,167,932 2,167,932

========== ==========

Provision for impairment

At 1 January 1,651,464 1,561,361

Increase of provision in

year 10,713 90,103

---------- ----------

At 31 December 1,662,177 1,651,464

========== ==========

Carrying value at 31 December 505,755 516,468

========== ==========

Included in investments is GBP220,000 of loan notes which carry

an interest coupon of 7.5% and are repayable on demand at par.

The following companies were subsidiaries at the balance sheet

date and the results and year end position of these companies has

been included in these consolidated financial statements. The

registered office for all the companies listed below is at 30 City

Road, London EC1Y 2AB.

Description

and proportion Country of

of share capital incorporation

Subsidiary undertakings owned or registration Nature of business

Westside Acquisitions Ordinary 100% England & Holding company

Limited Wales

Reverse Take-Over Investments Ordinary 100% England & Acquisition and development

Limited * Wales of shell companies

Westsidetech Limited Ordinary 100% England & Dormant

Wales

Westside Mining Plc Ordinary 100% England & Investment - inactive

Wales

Westside Sports Limited Ordinary 100% England & Holding company

Wales

Ultimate Player Limited Ordinary 100% England & Social media website

Wales

Football Data Services Ordinary 100% England & Website data services

Limited Wales - inactive

FootballFanatix Limited Ordinary 100% England & Social media website

Wales - inactive

Pantheon Leisure Plc ** Ordinary 85.87% England & Holding company

Wales

Sport in Schools Limited Ordinary 85.87% England & Sports coaching in

*** Wales schools

Football Partners Limited Ordinary 85.87% England & Dormant

*** Wales

The Elms Group Limited Ordinary 85.87% England & Inactive

*** Wales

Footballdirectory.co.uk Ordinary 85.87% England & Dormant

Limited **** Wales

* 33(1) /(3) % held indirectly through Westside Acquisitions Limited

** held indirectly through Westside Sports Limited

*** held indirectly through Pantheon Leisure Plc

**** held indirectly through The Elms Group Limited

19. Property, plant and equipment

Plant and

Group equipment Motor Vehicles Total

GBP GBP GBP

Cost

At 1 January 2017 148,443 83,662 232,105

Additions 9,820 - 9,820

Disposals (63,691) (83,662) (147,353)

Cost at 31 December 2017 94,572 - 94,572

Additions 7,753 - 7,753

Disposals (1,848) - (1,848)

At 31 December 2018 100,477 - 100,477

Depreciation

At 1 January 2017 137,787 62,748 200,535

Charge for the year 7,553 18,592 26,145

Disposals (63,691) (81,340) (145,031)

At 31 December 2017 81,649 - 81,649

Charge for the year 7,507 - 7,507

Disposals (1,847) (1,847)

----------- --------------- ----------

At 31 December 2018 87,309 - 87,309

=========== =============== ==========

Carrying value

At 31 December 2018 13,168 - 13,168

=========== =============== ==========

At 31 December 2017 12,923 - 12,923

=========== =============== ==========

Plant and

Company equipment Motor Vehicles Total

GBP GBP GBP

Cost

At 1 January 2017 1,848 83,662 85,510

Disposals - (83,662) (83,662)

Cost at 31 December 2017 1,848 - 1,848

Disposals (1,848) - (1,848)

----------- --------------- ---------

At 31 December 2018 - - -

----------- --------------- ---------

Depreciation

At 1 January 2017 1,847 62,748 64,595

Disposals - (81,340) (81,340)

Charge for year - 18,592 18,592

----------- --------------- ---------

At 31 December 2016 1,847 - 1,847

Disposals (1,847) - (1,847)

At 31 December 2017 - - -

----------- --------------- ---------

Carrying value

At 31 December 2018 - - -

=========== =============== =========

At 31 December 2017 1 - 1

=========== =============== =========

The company was party to hire purchase agreements in respect of

its motor vehicles during the prior year.

Depreciation charged on assets subject to hire purchase

agreements in the year was GBPNil. (2017: GBP18,592). The net book

value of these assets at the end of the year and at the end of last

year was GBPNil.

20. Receivables and loan notes

Non-current assets

Company

In 2018, amounts due within one year included GBP220,000 of loan

notes (2017 - GBP220,000). The loan notes are convertible into 50

million new shares in Pantheon Leisure Plc (the borrower) at any

time before redemption. The loan notes carry an interest coupon of

7.5% and are repayable on demand at par.

Pantheon Leisure Plc is a subsidiary undertaking of Ultimate

Sports Group Plc.

The loan notes are included in investments.

Group

The group has no receivables and loan notes classified as

non-current assets.

Current assets

Group Company

2018 2017 2018 2017

GBP GBP GBP GBP

Trade receivables 62,768 24,371 - -

Other receivables 18,681 17,375 10,166

Amounts due from subsidiary undertakings - - 347,102 318,053

Prepayments and deferred expenditure 8,311 27,235 4,525 24,150

89,760 68,981 361,793 342,203

======= ======= ======== ========

The average credit period given for trade receivables at the end

of the year is 15 days (2017:6 days). Trade receivables are stated

net of a provision for irrecoverable amounts of GBPNil (2017:

GBPNil).

Amounts due from subsidiary undertakings are stated net of

provisions for irrecoverable amounts which total GBP1,454,629

(2017: GBP1,375,864).

The total charge in the year in respect of irrecoverable

receivables in the group accounts was GBPNil (2017: GBPNil).

As at 31 December, the ageing analysis of trade receivables, all

of which are due and not impaired is as follows:

GBP

<3 months

2018 62,768

2017 24,371

==========

21. Trade and other payables

Group Company

2018 2017 2018 2017

GBP GBP GBP GBP

Trade payables 9,760 982 - -

Other payables 24,672 1,216 - -

Taxes and social security 99,459 74,981 - -

Amounts due to subsidiary undertakings - - 287,793 273,573

Accruals and deferred income 106,020 96,482 31,922 10,744

239,911 173,661 319,715 284,317

======== ======== ======== ========

The average credit period taken for trade payables at the end of

the year is 8 days (2017: 1 day).

22. Bank overdraft

Sport in Schools Limited has a bank overdraft facility secured

by a guarantee of up to GBP50,000 by Ultimate Sports Group Plc. The

overdraft is repayable on demand.

23. Deferred tax

The following are the deferred tax liabilities and assets

recognised by the group and movements during the current and

previous year:

Fair value Tax losses

Deferred tax liabilities gains offset Total

GBP GBP GBP

At 1 January 2017 (331) 331 -

Credited in the income statement 331 - 331

Charged directly to equity - (331) (331)

At 31 December 2018 and 31 December

2017 - - -

=========== =========== ======

24. Borrowings

There were no borrowings outstanding at 31 December 2018 (2017-

GBP2,000)

25. Issued and fully paid share capital

Number of Number of Number of

ordinary ordinary deferred

Ordinary shares 10p shares 1p shares 9p shares GBP

At 1 January 2017 20,486,638 - - 2,048,664

Shares issued in the year 2,325,000 - - 232,500

--------------- ----------- ------------

At 1 January 2018 22,811,638 - - 2,281,164

Subdivision of ordinary

shares (22,811,638) 22,811,638 22,811,638 -

New shares issued in the

year - 10,750,000 - 107,500

--------------- ----------- ------------

At 31 December 2018 - 33,561,638 22,811,638 2,388,664

=============== =========== ============ ==========

Following a capital reorganisation in March 2018 in which each

existing share of 10p each was subdivided into one new ordinary

share of 1p each and 1 deferred share of 9p each, the company

raised GBP537,500 before costs from a placing at a price of 5p per

share resulting in the issue of a further 10,750,000 ordinary

shares of 1p each.

Ordinary shares of 1p each:

Shareholders are entitled to receive dividends or distributions

in the event of a winding up with rights to attend and vote at

general meetings.

Deferred shares of 9p each:

Shareholders are entitled to receive 0.1p for each GBP999,999 of

dividends or other distributions in the event of a winding up with

no rights to attend and vote at general meetings.

At 31 December 2018 the company's issued shares carry no rights

to fixed income.

The market price of the company's shares at 31 December 2018 was

20.00p and the price range during the financial year was 8.50p and

20.88p.

26. Share warrants and options

Warrants

In March 2018, the company issued new warrants to subscribe for

shares. 750,000 A Warrants and 750,000 B Warrants were issued

exercisable at a price of 10p and 25p respectively per new ordinary

share.

Further details are given in note 30.

Options

In January 2011 the company adopted an unapproved share option

scheme details of which are given in note 30

To date the company has granted options to acquire 577,500

ordinary shares to key executives and employees engaged in the

development of the social network. At the year end and at the date

of this report there are options to acquire 307,500 ordinary shares

in issue.

27. Financial commitments

The group is committed to making the following future minimum

lease payments under non-cancellable operating leases which fall

due as follows:

2018 2017

GBP GBP

Within one year

Land and buildings 10,868 16,358

Other 5,636 -

Between two and five years

Land and buildings 43,472 47,193

Other 6,417 -

After five years

Land and buildings 24,453 35,321

---------------- ------------

90,846 98,872

---------------- ------------

28. Reserves

Retained earnings represent the cumulative retained profit or

loss of the group.

Share premium is the amount subscribed for share capital in

excess of nominal value and is a capital reserve required by UK

company law.

The merger reserve is a non-statutory reserve and represents the

difference between the fair value and nominal value of the shares

exchanged for shares on acquisition of Reverse Take-Over

Investments Plc which took place in 2003.

The fair value reserve represents the cumulative surplus and

deficits on recognition of available-for-sale investments at fair

value, less tax attributable to the net surplus.

29. Related parties

Details of the remuneration of directors is given in note 10. In

addition to the information given in that note, the following

provides further details of related party transactions involving

the company and its directors.

The directors are the key management personnel of the group.

Simmonds & Co

The group made payments of GBP26,500 (2017-GBP38,904) as

contributions towards office and secretarial costs to Simmonds

& Co, Chartered Accountants, a practice in which G Simmonds is

sole proprietor. No amounts were due at 31 December 2018 (2017 -

GBPNil).

In March 2017, G Simmonds was issued with 125,000 A Warrants and

125,000 B Warrants. Further details relating to these new warrants

are given in note 30.

R Owen

The company paid for office facilities to R Owen of GBP13,611

(2017- GBP 23,686). No amounts were due to R Owen at the 31

December 2018 (2017- Nil).

In March 2018, R Owen was issued with 125,000 A Warrants and

125,000 B Warrants. Further details relating to these new warrants

are given in note 30.

30. Share-based payment transactions

Warrants

In March 2018, the company issued new warrants to subscribe for

shares. 750,000 A Warrants and 750,000 B Warrants were issued

exercisable at a price of 10p and 25p respectively per new ordinary

share.

Warrants are valued using the Black-Scholes option pricing

model. The fair value per option granted and the assumptions used

in the calculation are as follows:

Grant date 13 March 2018 13 March 2018

Share price at grant 15p per share 15p per share

date

-------------- --------------

Exercise price 10p per share 25p per share

-------------- --------------

Shares under warrant 250,000 250,000

-------------- --------------

Expected volatility 100.0% 100.0%

-------------- --------------

Option life (years) 3 years 3 years

-------------- --------------

Expected life (years) 3 years 3 years

-------------- --------------

Risk-free interest rate 1.25% 1.25%

-------------- --------------

Fair value per option 3.15p 2.8p

-------------- --------------

In accordance with IFRS2, the fair value of the warrants issued

and recognised as a charge in the accounts for the year is

GBP10,800. In arriving at this amount, the expected volatility is

based on historical volatility, the expected life is the average

expected period to exercise and the risk-free rate of return is the

yield on a zero-coupon UK government bond for a term consistent

with the assumed option life.

30. Share-based payment transactions (continued).

Options

At the date of this report, options to acquire 577,500 ordinary

shares share have been granted to employees or key executives

involved in the group's trading operations. To date options over

270,000 shares have lapsed and there remain options over 307,500

shares that are exercisable.

Grant date 17 January 2011 6 March 2014 30 April 2014

Share price at grant 25p per share 27.5p per share 27.5p per share

date

---------------- ---------------- ----------------

Exercise price 25p per share 27.5p per share 27.5p per share

---------------- ---------------- ----------------

Shares under option 210,000 167,500 200,000

---------------- ---------------- ----------------

Expected volatility 17.0% 20.9% 20.9%

---------------- ---------------- ----------------

Option life (years) 10 years 7 Years 7 Years

---------------- ---------------- ----------------

Expected life (years) 10 Years 7 Years 7 Years

---------------- ---------------- ----------------

Risk-free interest rate 2.0% 2.0% 2.0%

---------------- ---------------- ----------------

Fair value per option 0.4p 0.07p 0.07p

---------------- ---------------- ----------------

In accordance with IFRS2, the fair value of the share options

issued and recognised as a charge in the accounts for the year is

GBPNil (2017 - GBPNil). In arriving at the amount, the expected

volatility is based on historical volatility, the expected life is

the average expected period to exercise and the risk-free rate of

return is the yield on a zero-coupon UK government bond for a term

consistent with the assumed option life.

31. Capital management and financial instruments

The group is solely equity funded which represents the group's

capital.

The group's objectives when maintaining capital are:

- To safeguard the entity's ability to continue as a going

concern, so that it can begin to provide returns for shareholders

and benefits for other stakeholders; and

- To provide an adequate return to shareholders by pricing

products and services commensurately with the level of risk.

The group sets the amounts of capital it requires in proportion

to risk. The group manages its capital structure and makes

adjustments to it in light of changes in economic conditions and

risk characteristics of the underlying assets. In order to maintain

or adjust the capital structure, the group may adjust the amount of

dividends paid to shareholders, return capital to shareholders,

issue new shares, or sell assets to reduce debt.

Capital for the group comprises all components of equity - share

capital of GBP2,388,664 (2017: GBP2,281,164), share premium of

GBP782,031 (2017: GBP393,454), other reserves of GBP325,584 (2017:

GBP325,584), the retained deficit of GBP2,979,116 (2017:

GBP2,840,795) and debts which comprises loans of GBPNil (2017:

GBP2,000).

During the year ended 31 December 2018 the group's strategy was

to preserve net cash resources by limiting cash absorbed from

losses and through good cash management.

Financial assets and financial liabilities are recognised in the

group's balance sheet when the group becomes a party to the

contractual provision of the instrument.

At 31 December 2018 and 31 December 2017, there were no material

differences between the fair value and the book value of the

group's financial assets and liabilities. All financial assets and

liabilities are measured at amortised cost. Relevant financial

assets and liabilities are set out below.

31. Capital management and financial instruments (continued).

Group Company

2018 2017 2018 2017

GBP GBP GBP GBP

Financial assets

Cash and cash equivalents 535,329 129,611 413,656 81,459

Due from subsidiary undertakings - - 347,102 318,053

Trade and other short- term receivables 70,395 32,571 - -

-------- -------- -------- --------

605,724 162,182 760,758 399,512

-------- -------- -------- --------

Financial liabilities (which are included at amortised cost)

Trade and other short- term payables 34,432 2,198 - -

Due to subsidiary undertakings - - 287,793 273,573

Loans - 2,000 - -

34,432 4,198 287,793 273,573

======== ======== ======== ========

The group's financial instruments comprise cash and cash

equivalents, receivables, payables, loan obligations that arise

directly from its operations

Amounts shown in trade and other short term receivables exclude

prepayments and deferred expenditure for the group of GBP8,311

(2017: GBP27,235) and VAT recoverable of GBP11,054 (2017: GBP9,175)

for the group and for the company GBP4,522 (2017: GBPNil) of short

term receivables and VAT recoverable of GBP10,166 (2017:

GBP7,430).

Trade and short- term payables exclude deferred income and

accruals of GBP106,020 (2017: GBP96,482), tax and social security

creditors of GBP99,459 (2017: GBP74,981). For the company - for tax

and accruals of GBP31,922 (2017: GBP10,744).

The group has not adopted a policy of using financial

derivatives and does not rely on the use of interest rate

hedges.

In common with other businesses, the group is exposed to risks

that arise from its use of financial instruments. There have been

no substantive changes to the group's response to financial

instrument risk and the methods used to measure them from previous

periods.

The main risks arising from the group's financial instruments

are market, credit and liquidity risks.

Market risk arises mainly from uncertainty about future prices

of available-for-sale investments held by the group. The board

monitors movements in the carrying value of its investments on a

regular basis. As there are no remaining investments there is no

longer any market risk attributable to investments.

Credit risk arises from trade receivables where the party fails

to discharge their obligation in relation to the instrument. To

minimise this risk, management have appropriate credit assessment

methods to establish credit worthiness of new customers and monitor

receivables by regularly reviewing aged receivable reports. There

is no concentration of credit risk other than in respect to cash

held on deposit at the company's bank as set out above.

The amount exposed to risk in respect of trade receivables at 31

December 2018 was GBP62,768 (2017: GBP24,371).

Liquidity risk arises in relation to the group's management of

working capital and the risk that the company or any of its

subsidiary undertakings will encounter difficulties in meeting

financial obligations as and when they fall due. To minimise this

risk the liquidity position and working capital requirements are

regularly reviewed by management.

The directors do not consider changes in interest rates have a

significant impact on the group's cost of finance or operating

performance.

As the group's operations are conducted in the United Kingdom,

risks associated with foreign currency fluctuations are not

relevant.

32. Notes to statement of cash flows

a) Analysis of net funds

At 1 January At 31 December

2018 Cash Flow 2018

GBP GBP GBP

Group

Cash and cash equivalents 129,611 405,718 535,329

Borrowings (2,000) 2,000 -

Net funds 127,611 407,718 535,329

============= ========== ===============

Company

Cash and cash equivalents 81,459 332,197 413,656

Net funds 81,459 332,197 413,636

============= ========== ===============

(b) Reconciliation of net cash flow to movement in net funds

Group Company

GBP GBP

Increase in cash and cash equivalents

in the year 405,718 332,197

Cash outflow on borrowings repaid in

the year 2,000 -

Movement in net funds 407,718 332,197

======== ========

(c) Statement of cash flows from discontinued activities

2018 2017

GBP GBP

Cash flow from discontinued activities

Profit/(loss) before tax - 53,567

Adjustments for:

Gain on disposal of trade - (82,600)

Movements in working capital

Increase in debtors - (914)

Decrease/(Increase) in creditors 13,865 (42,084)

Cash generated/absorbed from operations 13,865 (72,031)

--------- ---------

Investing activities

Net proceeds on disposal of trade - 82,600

Net cash used in investing activities - 82,600

--------- ---------

Financing activities

Repayment of borrowings - (2,000)

Net cash used in financing activities (2,000)

--------- ---------

Net cash increase in cash and cash

equivalents 13,865 8,569

Cash and cash equivalents at the beginning

of the year (13,865) (22,434)

Cash and cash equivalents at the end

of the year - (13,865)

========= =========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FRMFTMBMTBTL

(END) Dow Jones Newswires

June 28, 2019 02:00 ET (06:00 GMT)

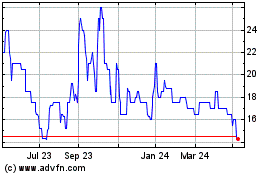

Insig Ai (LSE:INSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

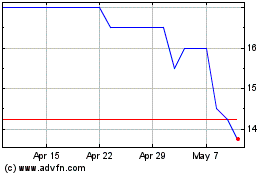

Insig Ai (LSE:INSG)

Historical Stock Chart

From Apr 2023 to Apr 2024