Standard Chartered Hopes No-Deal Brexit Planning Will Boost Growth

June 04 2019 - 10:08AM

Dow Jones News

By Nina Trentmann

Britain has twice delayed its split from the European Union and

the terms of the separation remain unclear, forcing financial

institutions to tackle a cardinal risk: the potential loss of the

ability to freely offer products and services across the EU.

Banks that used their operations in London as a base to serve

the rest of the EU, including Standard Chartered PLC, Lloyds

Banking Group PLC and Goldman Sachs Group Inc., have been making

major changes to prepare for Brexit. That includes expanding their

operations in one of the other 27 EU countries to ensure

uninterrupted service for European customers.

Such contingency plans increasingly look justified. Boris

Johnson, the front-runner to succeed Theresa May as British Prime

Minister when she steps down on Friday, said the U.K. should leave

the bloc on Oct. 31, with or without a deal. Mr. Johnson is one of

several would-be successors who are open to a no-deal Brexit.

"Firms in the finance industry have put contingency plans in

place to minimize disruption for their customers in a 'no deal'

scenario, but critical cliff-edge risks remain," said Stephen

Jones, chief executive of UK Finance, an industry association.

Standard Chartered chose to make its Brexit preparations on the

assumption that a no-deal Brexit would happen, a spokeswoman for

the bank said. The company hopes that the operational and

regulatory preparations it made as a result will prime it for

growth across the EU, as well as insulating it from disruption.

Standard Chartered received a full banking license from Germany,

turned its Frankfurt branch into a subsidiary, hired a local

management team including a finance chief, and increased the number

of employees based in Germany from around 100 to 200.

To meet stricter European liquidity and solvency requirements,

the company pumped additional capital into the German unit,

Standard Chartered Bank AG.

"It is important for German regulators that we are able to

survive without our English mother," said Alexander Engel, who

became chief financial officer of the subsidiary in March.

German regulators required more reporting and disclosure in

different formats, prompting Standard Chartered Bank AG to upgrade

its reporting software. "There are up to 400 reports on a regular

basis that we didn't have to file before," Mr. Engel said.

And the bank moved some of its compliance and control functions

from a shared service center in Chennai, India, to Frankfurt, the

main hub for the bank in continental Europe, to satisfy German

regulators. "German regulators have different views on what control

is," Mr. Engel said.

The effort has been worth it, he said. Brexit is an opportunity

for Standard Chartered to grow its footprint in Europe, according

to Mr. Engel.

The bank is seeking new customers, in particular large companies

with an international presence across industries. Mr. Engel said he

plans to use the bank's expanded setup in Germany to grow its

business. Among new offerings for European clients will be a

cash-management facility, alongside existing foreign exchange,

pooling and clearing services.

Standard Chartered already provides these services for corporate

clients in London, but many German companies would prefer to use a

bank based in the same jurisdiction as they are, Mr. Engel

said.

For banks and companies, more hard work is ahead as Brexit

nears. About GBP1 trillion ($1.27 trillion) in bank assets are

being transferred by London-based banks to continental Europe, and

up to 7,000 jobs could from the U.K. to Europe in response to

Brexit, according to Ernst & Young LLP.

Some of Standard Chartered's clients have moved deposits to the

new German entity and amended paperwork so that their continental

European business is no longer booked through London. "The vast

majority of clients have started the repapering process to be ready

when needed," Mr. Engel said.

Other customers are taking a wait-and-see approach, reflecting

doubts about when or whether Brexit will happen.

Banks have already spent an estimated GBP3 billion to GBP4

billion on getting Brexit-ready, a significant expense for an

industry that is one of the core pillars of the U.K. economy,

according to New Financial LLP, a think tank.

The changes that Standard Chartered made won't be rolled back

should Britain decide to stay in the EU, Mr. Engel said. "The point

of no-return has passed, independent of what happens on the

political side."

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

June 04, 2019 09:53 ET (13:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

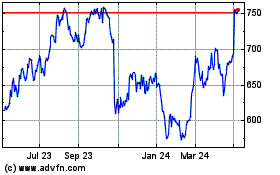

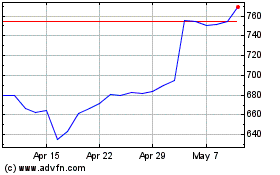

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024