Shell 1Q CCS Earnings Nearly Halved But Beat Consensus -- Earnings Review

April 30 2020 - 6:40AM

Dow Jones News

By Jaime Llinares Taboada

Royal Dutch Shell PLC on Thursday reported market-beating CCS

earnings for the first quarter of the year, but slashed its

dividend for the first time since World War II. Here's what you

need to know:

CCS EARNINGS: The Anglo-Dutch oil giant's adjusted earnings on a

current cost of supplies basis--a figure that is similar to the

net-profit figure U.S. oil companies use, but excludes one-off

items--fell 46% to $2.86 billion in the first quarter but remained

above the $2.25 billion consensus of 27 brokers compiled by Vara

Research.

UPSTREAM PROFIT: Shell's upstream earnings profit excluding

identified items plunged 82% to $291 million and was below the $468

million consensus.

WHAT WE WATCHED:

--IMPAIRMENTS: Shell said that it booked impairment charges of

$749 million mainly due to changes to the oil-price outlook for

2020. The group had warned in late March that it would include a

charge of between $400 million and $800 million in this regard.

--COST SAVING PROGRESS: Capital expenditure declined 11% to

$4.97 billion compared with the first quarter of 2019. Shell had

said it would reduce 2020 investments below $20 billion from the

original $25 billion plan. Including reductions to operating costs,

the company is seeking to save between $8 billion and $9 billion

this year.

--DIVIDEND: Shell cut the first quarter dividend to $0.16 a

share from last year's $0.47 to preserve its balance sheet and

"bolster" its resilience in these uncertain times. The brokers

included in Vara's consensus had not predicted the slash.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 30, 2020 06:25 ET (10:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

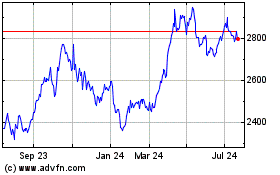

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

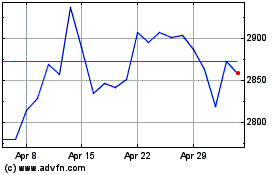

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024